|

03.09.26- How to Play the Energy Spike

When Israel and the U.S. attacked Iran on February 28th, we knew there would be a response. Iran wasn’t going to sit idly by again. Military strategists knew what soft targets were vulnerable. And the Strait was an obvious target. Read More |

|

03.06.26- Micro wind turbine for home rooftops receives milestone certification

When it comes to harvesting energy from air currents, the big wind turbines usually get all the attention. For example, in 2023, the world's largest wind turbine, with a 260-meter (853-ft) diameter began operating in China, only to be outdone the following year by another monster windmill with a blade diameter of 310 m (1,107 ft). While these gargantuan commercial-grade wind turbines can supply an impressive amount of power to a large collection of homes, German company SkyWind has taken a different, and user-friendly, approach to harnessing wind energy. Read More |

|

03.04.26- A Huge “Problem”

|

|

03.02.26- The Oil Glut That Never Showed Up

|

|

02.27.26- Leaving water in batteries nearly doubles energy storage

Currently, there's really no beating lithium-ion batteries in terms of energy density and light-weight form factors. That's why they've found their way into everything from electric cars to cell phones. But there are certainly issues with the technology, including the fact that lithium itself is difficult, expensive, and environmentally damaging to mine. Lithium batteries are also prone to overheating, can occasionally burst into flames, and don't perform well in very low temperatures. Read More |

|

02.25.26- Oil Traders May Be Pricing Iran Risk Too Lightly

|

|

02.23.26- Space-Based Solar Power Will Be Economically Viable by 2040

|

|

02.20.26- Novel wave energy/desalination system gets trialled in Barbados

The government of Barbados, through its agency Export Barbados, has signed a Memorandum of Understanding (MoU) with Danish firm Wavepiston to launch a 50-MW commercial wave-energy pilot.Read More |

|

02.18.26- Why Molten Salt Nuclear Energy Will Change Society Forever

|

|

02.16.26- Big blimp uses blades to pull

|

|

02.13.26- China’s Clean Energy Boom Still Rests on Coal, Oil, and Gas

|

|

02.11.26- Economic Models Are Overlooking a Looming Diesel Crisis

|

|

02.09.26- The Rapid Rise of Humanoid Robots

|

|

02.06.26- U.S. Power Boom Triggers Global Gas Turbine Shortage

|

|

02.04.26- Texas Just Approved the Largest Gas Power Project in U.S. History

Pacifico Energy, a global, investor-owned infrastructure company, called its 7.65 gigawatt GW Ranch in Pecos County “the largest power project in the United States” in a press release this week. Read More |

|

02.02.26- World’s largest battery-electric ship enters harbor trials

|

|

01.30.26- China’s Edge in the AI Race

|

|

01.28.26- Global Energy Transition Threatened By Critical Transformer Shortages

|

|

01.26.26- Battery BREAKTHROUGHS will Finally Make Electric Vehicles NOT SUCK

|

|

01.23.26- U.S. Natural Gas Prices Surge 45% in Two Days Due to Arctic Cold

On Tuesday, the benchmark U.S. natural gas futures at Henry Hub soared by 23% amid the cold snap and short covering. Natural gas futures jumped by another 22% early on Wednesday, and were headed for their biggest weekly gain in 35 years. Read More |

|

01.21.26- Why Greenland Matters Even If Its Resources Don’t Pay

The Trump Administration’s reasons and intensified pressure on NATO allies aside, is Greenland really worth it? Read More |

|

01.19.26- Energy and Wealth:

From coal-fired Britain to oil-powered America to today’s renewable energy leaders, access to abundant, affordable energy has been the foundation of economic prosperity. This correlation isn’t coincidental — it’s mechanical. Energy powers industry, transportation, communication, and virtually every productive activity that generates wealth. Read More |

|

01.16.26- Drilling the deepest hole in history: Unlocking geothermal energy

The heat beneath our feetEveryone knows the Earth's core is hot, but maybe the scale of it still has the power to surprise. Temperatures in the iron center of the core are estimated to be around 5,200 °C (9,392 °F), generated by heat from radioactive elements decaying combining with heat that still remains from the very formation of the planet. Read More |

|

01.14.26- Markets Price Chaos as Oil Finds Its Footing

- Iran protests and the increasing probability that US President Trump would exploit that unrest for another series of strikes on Tehran have been dragging oil prices higher, boosting oil options trading in recent days. Read More |

|

01.12.26- New Year Starts With Fewer U.S. Oil and Gas Rigs

The number of active oil rigs fell by 3 in the reporting period, according to the data. Oil rigs are now at 409, which is 71 below this same time last year. The number of gas rigs fell by 1 to 124, which is 24 more than this time last year. The miscellaneous rig count rose by 2. Read More |

|

01.09.26- Aircraft carrier nuclear reactors could help solve AI's power problem

AI promises to be the biggest thing in information technology since the internet told people they had mail. The problem is that the data centers needed to support AI systems are so hungry for electricity that they will account for up to 40% of power-demand growth in the US alone by 2035. Read More |

|

01.07.26- Vistra Jumps After Buying 10 Nat Gas-Fired Power Plants For $4 Billion

Late on Monday, electricity supplier Vistra agreed to pay $4 billion for 10 natural gas-fired power plants in the US Northeast and Texas to expand the electricity supplier’s generation capacity in fast-growing energy markets. Read More |

|

01.05.26- The Renewable Energy That Trump Has Not Targeted

|

|

01.02.26- Trump's Gunboat Diplomacy Triggers Sharp Drop In Venezuelan Oil Output

|

|

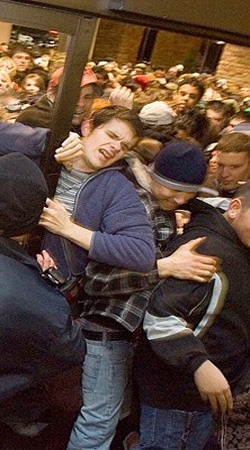

12.31.25- Holiday Markets Eye War Risks but Oil Refuses to Break Out

- Donald Trump’s maximum pressure strategy on Venezuela is finally starting to impact Venezuela’s oil production, with state oil company PDVSA beginning to shut down wells in the Orinoco Belt amidst swelling inventories and ongoing tanker seizures. Read More |

|

12.29.25- AI’s thirst for power

|

|

12.26.25- Ford’s Electric Vehicle

This was bad news for the U.S. EV market. Ford targeted electric trucks, to capitalize on its super popular F-150 model. However, the government killed the EV tax break. That curbed interest of U.S. car buyers on the higher end EV models like trucks. Read More |

|

12.24.25- A New Solar Material Is Pushing Efficiency Beyond Theoretical Limits

|

|

12.22.25- Nuclear startup raises mega cash in race to deliver portable reactors

The company has just raised US$300 million to scale its commercialization efforts ahead of laying the foundation for its reactor factory in Oak Ridge, Tennessee, in 2026. That facility is expected to roll 50 Kaleidos microreactors off its assembly lines each year, ahead of shipments to customers in 2028. Read More |

|

12.19.25- This startup raised millions to beam solar power from space after dark

Okay, it's not quite that common an occurrence, but there are indeed a number of firms giving this a go. The latest to join the fold is Overview Energy, a Northern Virginia-based startup that's raised US$20 million to try transmitting solar power from satellites down to solar panels on Earth, enabling a 24/7 supply. Read More |

|

12.17.25- Hydrogen Fuel Cell Market Poised to Nearly Double by 2030

|

|

12.15.25- Nuclear Reactors For Investors

|

|

12.12.25- Next-gen supersonic jet engine gets a much less glamorous job

|

|

12.10.25- Oil Prices Are Set to Fall

In 2026, both Brent Crude and WTI Crude are expected to slip from current levels of $63 per barrel and $60 a barrel, respectively, as the emerging oversupply will overwhelm the market, analysts say. Geopolitical factors will certainly play into the price of oil next year, and these will be centered on Venezuela, Russia, and Iran. Read More |

|

12.08.25- Electric Motor Market

According to a new analysis by Allied Market Research, the global electric motor market is projected to reach $373.9 billion by 2032, nearly tripling its 2020 valuation of $142.1 billion. Read More |

|

12.05.25- Beijing Backs EV Battery and Solar Giants for Worldwide Expansion

|

|

12.03.25- Tuneable perovskite: A breakthrough in low-cost solar and laser materials

|

|

11.28.25- How to Play the Nuclear Boom

The deal’s announcement sent Cameco’s shares soaring, as you can see here: Read More |

|

11.28.25- How to Play the Nuclear Boom

The deal’s announcement sent Cameco’s shares soaring, as you can see here: Read More |

|

11.26.25- New Monster Gas Wells Are Outperforming Legacy Haynesville Deposits

|

|

11.24.25- The World’s First Thorium

The Hong Kong-based South China Morning Post reports that the breakthrough, which took place at an experimental reactor out in the Gobi Desert, is “poised to reshape the future of clean sustainable nuclear energy.” Read More |

|

11.21.25- Three Mile Island Reactor Gets a $1 Billion Government Lifeline

|

|

11.19.25- The AI Boom Is Driving a Massive Geothermal Energy Revival

|

|

11.17.25- US Needs More Gas Infrastructure, Storage To Support Electric Grid: NARUC

During Winter Storm Uri in February 2021, some Texas electric companies cut power to gas production and transportation facilities as part of their emergency conservation response. That reduced fuel supplies to gas-fired power plants, contributing to energy shortages and blackouts. Almost 250 people in Texas died in the storm. Read More |

|

11.14.25- Electricity Shortages Threaten to Pull the Plug on AI Expansion

Earlier this month, Nvidia’s chief executive warned that the West risks losing the AI race because electricity was too expensive. Yet the price of electricity is only one part of the problem that Big Tech faces with regard to its AI plans. Read More |

|

11.12.25- AI Energy Crunch: Hyperscalers Turn to Small Nuclear Reactors

|

|

11.10.25- Cheap Power Is The Secret To Winning The Global AI Race

|

|

11.07.25- Washington’s $80-Billion Nuclear Play Targets AI’s Energy Hunger

|

|

11.05.25- Rolls-Royce rolls out world's first 100% methanol marine engine

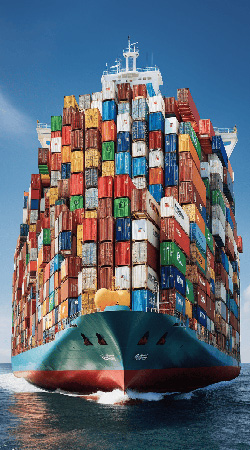

Maritime shipping makes up 90% of the world's commercial traffic, with almost 100% of it running on diesel fuel. Small wonder, therefore, that it accounts for a sizable percentage of global emissions, including 3% of greenhouse gases, 13% of sulfur oxides, and up to 30% of nitrogen oxides. While reducing these emissions would be a good thing, there are very practical obstacles to doing so. Read More |

|

11.03.25- Oil Stocks are Running on Fumes

|

|

10.31.25- 3D Solar towers boost electricity production by around 50%

Currently, most solar farms consist of flat panels laid out across the ground or on rooftops. But in much the same way that this is an inefficient way to house people, it's also not a great way to harvest the Sun's energy. Tall skyscrapers can hold significantly more people on a small footprint, so why not apply that thinking to solar panels as well? Read More |

|

10.29.25- U.S. Pump Prices Could Soon Spike After Fresh Sanctions On Russian Oil

|

|

10.27.25- Can U.S. Hydropower Compete in a New Energy Era?

|

|

10.24.25- What Ends the SMR Bubble?

|

|

10.22.25- Rare Earth Boom: Defense Heavyweight Joins Critical Mineral Effort

|

|

10.20.25- Nuclear Stocks Sell Off After U.S. Army Launches Microreactor Program

|

|

10.17.25- Why Energy Investors Are Doubling Down on Oil and Gas

Earlier this month, a top Shell executive warned that the Trump administration’s animosity toward offshore wind risks complicating investment decisions for oil and gas as well, pointing to a regulatory pendulum swing that has created a unpredictable environment.Read More |

|

10.15.25- Fusion device fires “super-lightning” pulses 12 times a minute

|

|

10.13.25- Is Space-Based Solar Power Finally Ready to Shine?

|

|

10.10.25- Data Centers Lit the Fuse |

|

10.08.25- Thorium Reactors: Why is this Technology Quite So Exciting

|

|

10.06.25- Wall Street Warns of Nuclear Tech Bubble

|

|

10.03.25- Deep Fission raises $30 million to build mile-deep nuclear reactor

|

|

10.01.25- AI Innovation Accelerates Geothermal Development

|

|

09.29.25- Giant Oil Trader Begins Physical Trading In Uranium

|

|

09.26.25- Why Iraq Wants Solar Despite Centuries of Oil Reserves

But Iraq is also OPEC’s second-largest oil producer. Worldometer ranks the country sixth in the world, producing 4.443 million barrels of oil a day. In terms of oil reserves, Iraq is fifth globally, with 143.069 billion barrels, accounting for 8.67% of world supply. At current consumption levels, Iraq has enough oil to last the next 457 years. Read More |

|

09.24.25- How Solar Canals Could Revolutionize the Water-Energy-Food Nexus

|

|

09.22.25- Resource Wealth Gushing Sky-High

In Texas in 1899, a company was formed to drill the Spindletop field, an area known for oil and gas seeping out of the ground. Read More |

|

09.19.25- AI Boom Fuels New Geothermal Investment

|

|

09.17.25- Natural Gas Becomes Core to Middle East Energy Mix

|

|

09.15.25- Shell promises 10-minute EV charging with its magical battery fluid

EVs can take hours to dozens of minutes to charge up that much, depending on the car's charging system, battery temperature, and the battery chemistry that's optimized for energy capacity, safe operation, and lifespan. Charging faster than we currently do presents challenges in these areas. Read More |

|

09.12.25- Why Innovation is Essential

|

|

09.10.25- Trump’s Clean Energy Law Sends Insurance Costs Soaring

|

|

09.08.25- Kevlar-like EV battery material dissolves after use to recycle itself

|

|

09.05.25- How Red Onion Dye Could Revolutionize Solar Panel Longevity

|

|

09.03.25- '80s science scandal may lead

In March 1989, electrochemists Martin Fleischmann and Stanley Pons stunned the world with the announcement that they had essentially achieved nuclear fusion in a jam jar. They claimed that by means of a simple glass container filled with heavy water into which were inserted a palladium cathode and a platinum anode, they were able, through electrolysis, to cause deuterium atoms to fuse within the palladium lattice. Read More |

|

09.01.25- US Oil Drilling Activity

The total rig count in the US slipped to 536, according to Baker Hughes, down 47 from this same time last year. The rig count is still near four-year lows. Read More |

|

08.29.25- The world's largest sand battery just went live in Finland

|

|

08.27.25- Cold War Plutonium Could Power Future U.S. Reactors

The U.S. does not use plutonium in nuclear power facilities. In the past, plutonium has been converted into fuel for commercial reactors in the United States only for short test runs. Read More |

|

08.25.25- Revolutionary ‘Breathing’ Crystal Could Transform the Clean Energy Industry

|

|

08.22.25- Uranium Stocks Remain Red Hot After Fundamentals Kick In

|

|

08.20.25- 'Breathing' crystals that release oxygen on demand could shape next-gen fuel cells

Solid oxide fuel cells (SOFC) can help extend the range of electric cars using a range of fuels, and run stationary power generators, with minimal emissions. The trouble is, these cells require awfully high temperatures to operate. Read More |

|

08.18.25- Trump Moves to Open 82% of Alaska’s Petroleum Reserve for Drilling

|

|

08.15.25- Solar Stocks Outshine Oil and Gas Benchmarks After Climate Credit Cuts

|

|

08.13.25- France runs fusion reactor

Achieving the dream of commercial fusion power is the Holy Grail of engineering and has been for 80 years. With a single gram of hydrogen isotopes yielding the energy equivalent of 11 tonnes of coal, a practical fusion reactor would hold the promise of unlimited, clean energy for humanity until the end of time. Read More |

|

08.11.25- How Dirt Batteries Could Power the Energy Transition

|

|

08.08.25- Global Energy Demand Outpaces Renewable Expansion

|

|

02.06.25- Breaking China’s Rare Earth Dominance

What the heck is samarium, you ask? It’s a rare earth element (REE) used to create magnets designed for high temperature applications. Read More |

|

08.05.25- Trump’s EPA to Make CO2 Great Again

Consider how, on June 5, 1947, Secretary of State George C. Marshall announced his eponymous Marshall Plan at the Harvard commencement ceremony, in Cambridge, Massachusetts. Read More |

|

08.04.25- The Race for Long-Term Energy Storage Is Heating Up

|

|

08.02.25- The Best Home Battery

|

|

08.01.25- The Great Geothermal Talent Shortage

|

|

07.31.25- Why Geothermal Energy Is Garnering So Much Attention

|

|

07.30.25- Google to deploy Energy Domes filled with CO2 to manage clean power

|

|

07.19.25- Green Agenda Fallout: Democrat-Led Northeast Now Has Highest Electricity Prices In Nation

|

|

07.15.25- World Energy Report Exposes Looming Resource Crises

|

|

07.14.25- DoE Authorizes Exxon To Tap SPR To Avert Refinery Disruptions

Bloomberg reports Exxon is borrowing up to 1 million barrels of crude from the SPR due to quality issues with Mars crude — a Gulf of America oil grade contaminated with high levels of zinc, which can damage refinery equipment. Read More |

|

07.12.25- Massive Rare Earths Elements Deposit Confirmed In Wyoming

|

|

07.11.25- Oil Prices Set to End the Week Flat Amid Conflicting Signals

At the time of writing, Brent crude was trading at $69.16 per barrel, with West Texas Intermediate at $67.16 per barrel, both slightly up from opening, after they shed about 2% on Thursday, pressured by the latest tariff announcements from the White House. Read More |

|

07.10.25- Can Geothermal Power Save Taiwan From Energy Catastrophe?

|

|

07.09.25- World's first long-life sodium-ion power bank launched

On the outside, the affectionately named DE-C55L-9000 looks similar to the vast majority of power banks on the market, with a rounded brick shape housing its 9,000-mAh battery, a 45-W USB Type-C and an 18-W Type-A port, and charging indicator LEDs. Read More |

|

07.08.25- Creaky Grid Will Get Creakier

|

|

07.07.25- China builds world's first massive 500-MW impulse turbines

Each one is rated at 500 MW – a world-first, but they are yet to be put to real-world use. These massive impulse turbines will be installed at the Datang Zala Hydropower Station on the Yuqu River – a smaller tributary of the Nu River in eastern Tibet. Read More |

|

07.05.25- How Traders Capitalized on Oil's Extreme Price Swings

U.S. trade policies, OPEC+ production policies, and the on-and-off war premium have all influenced market movements and traders’ behavior and strategies at some point over the past six months. Read More |

|

07.04.25- Smart Money Buys the Solar Dip

|

|

07.03.25- Underwater tidal turbines get a 6-year reliability boost

|

|

07.02.25- There's A Lot Of Honest Pain Out There

The commenter challenged me, not to just oppose Mamdani’s ideology, but to think about why his message resonates at all. Here's what they said: Read More |

|

07.01.25- Burning Trash for Energy, People and Planet

|

|

06.30.25- Extreme Heat Exposes

|

|

06.28.25- Billy Bob vs. ‘Stop Oil’ Lunatics

It’s well worth watching, as long as you don’t mind graphic content. Despite its cruder moments, the show is entertaining. Plus, it’s rare to see the oil business portrayed in a major TV show, let alone in a balanced manner. Read More |

|

06.27.25- China Records Hydropower Boom Amid Power Storage Push

|

|

06.26.25- Why Wind and Solar Alone Can't Meet Rising Energy Needs

|

|

06.25.25- Trump Policy Threatens Residential Solar Industry

|

|

06.24.25- Turning plastic into gasoline: Backyard alchemy or TikTok hype?

|

|

06.23.25- Supertankers U-Turn In Hormuz As World Braces For Iranian Retaliation

The Coswisdom Lake and South Loyalty both entered the waterway and abruptly changed course on Sunday, according to vessel tracking data compiled by Bloomberg. The first of the two carriers then did a second U-turn and is now going back through Hormuz. The other one remains outside of the Persian Gulf, according to its signals on Monday. -Bloomberg Read More |

|

06.21.25- From 8,000 experiments to 28: AI does the dirty work for clean ammonia

You might be most familiar with ammonia as a kitchen cleaning product, but outside of the home, ammonia is a big deal, ranking as the second most industrially produced chemical in the world, after sulfuric acid. About 80% of ammonia is used as fertilizer, so it's a key part of global food production. It also finds its way into other industries and lately, it's being looked at as an alternative fuel source. Read More |

|

06.20.25- Kazakhstan, China Forge Uranium Partnership as U.S. Falls Behind

|

|

06.19.25- Israel-Iran War Packs Major Oil Blow

Having written that this war is not WWIII, that doesn’t mean I think it will be inconsequential or harmless to the US or to Israel. All wars can be and usually are very harmful. What I meant is that it is not inherently going to be the long-feared pan-Arab-Israeli war that people believed any war between Israel and Iran would quickly turn into. As I laid out, Iran has no allies left with the stamina to take on such a fight or with the desire to support Iran in such a conflict against Israel. It’s already clear that you don’t see Islamic nations rushing to Iran’s defense. There is a stunning silence, instead. Read More |

|

06.18.25- New Policies Spark Optimism for Uranium Market Revival

But there is new cause for optimism. A new federal push to modernize and expand nuclear energy is breathing fresh life into the long-dormant uranium sector. And that could have important implications for investors looking to position ahead of what might become a structural shift in American energy policy. Read More |

|

06.17.25- Uranium Enrichment: What It Is and Why It Matters

|

|

06.16.25- New AI Technology Aims to Revolutionize Battery Recycling

|

|

06.14.25- New Plasma Patent Rings a Bell

|

|

06.13.25- Saudi Arabia’s Giant Hydrogen Project Reaches 80% Completion

|

|

06.12.25- Iran Declared in Breach of

|

|

06.11.25- MIT Turns Soda Cans and Sea Water Into Green Hydrogen

|

|

To be sure, the share of coal in India’s power output remains above 70%, but at 70.7% in May, it was the lowest in three years, according to data from federal power grid regulator Grid India reviewed by Reuters. Read More |

|

06.09.25- Wood Pellets: America’s Underrated Power Play

These compact cylinders aren’t flashy or trend on social media. For the uninitiated, they are carriers of renewable carbon and energy, sourced from responsibly managed forests; a real, scalable, domestic resource that delivers energy security, climate value, and rural jobs while sustaining and growing forests. Wood pellets are emerging as one of the smartest plays in America’s energy and climate portfolio. Read More |

|

06.07.25- Is A New Oil Price War Between The West And OPEC About To Break Out?

|

|

06.06.25- These 3 Nuclear Stocks Should Be on Your Energy Radar

|

|

06.05.25- Oil Industry Profitability

|

|

06.04.25- Hydrogen’s Chicken-and-Egg Problem Persists as Buyers Hesitate

While the hoped-for future trade between Europe and the Middle East and North Africa (MENA) remained in focus, a shift in emphasis appeared. While national goals look increasingly dubious, progress is occurring in specific industry sectors guided by international agreements. Meanwhile, MENA countries confront the imperative to develop domestic markets for their clean hydrogen. Read More |

|

06.03.25- Sodium-air fuel cells may soon be electrifying airliners

Created by Prof. Yet-Ming Chiang and colleagues at MIT, the current prototype device consists of two chambers linked by a solid ceramic electrolyte material. The fuel, namely liquid sodium metal, is in one of the chambers, while the other is filled with humid air. Read More |

|

06.02.25- The Battery Tech

|

|

05.31.25- Executive Orders Ignite

|

|

05.30.25- Lightweight plastic mirrors drop cost of solar thermal energy by 40%

That could be huge for agriculture and industrial facilities which need large amounts of heat for large-scale processes at temperatures between 212 - 754 °F (100 - 400 °C). That addresses food production, drying crops, grain and pulse drying, sterilizing soil and treating wastewater on farms; industrial applications include producing chemicals, making paper, desalinating water, and dyeing textiles. Read More |

|

05.29.25- LNG Slowdown in Asia Masks a Bigger Surge Ahead

|

|

05.28.25- U.S. Battery Production Set To Decline 75% Under Trump’s ‘Big Bill’

|

|

05.27.25- The Permian Is Not Done Yet

|

|

05.26.25- Exploring the Untapped Power of Marine Current Turbines

|

|

05.24.25- Nuclear Stocks Surge on Trump Reactor Approval Plans

Four sources familiar with the matter told Reuters that the forthcoming orders aim to simplify the regulatory process for approving new nuclear reactors and to strengthen nuclear fuel supply chains amid mounting concerns over U.S. dependence on foreign suppliers. Read More |

|

05.23.25- Green Hydrogen Faces Reality Check

|

|

05.22.25- Is Freight Decarbonisation Viable?

|

|

05.21.25- Uncuffing Iran Could Backfire

|

|

05.20.25- Nuclear Lobby Fights Back as GOP Slashes Clean Energy Incentives

|

|

05.19.25- How giant concrete balls on ocean floors could store renewable energy

Since 2011, the StEnSea (Stored Energy in the Sea) project has been exploring the possibilities of using the pressure in deep water to store energy in the short-to-medium term, in giant hollow concrete spheres sunken into seabeds, hundreds of feet below the surface. Read More |

|

05.17.15- Will Nuclear Fusion Soon Be The "Norm?"

For at least the same time frame, humanity has sought comfort through technology. While primitive heat producers like coal and wood are still used today, the discovery that petroleum, natural gas, and even moving water could generate a newly discovered phenomenon known as “electricity” transformed the industrial revolution into the modern era. Read More |

|

05.16.25- Why First Solar Has Surged More Than 40% in One Month

According to J.P. Morgan, the revealed portions of the budget reconciliation bill are bullish for solar, wind and geothermal power providers, noting that production and investment tax credits were truncated from their current definitions, but were left unchanged through 2028, after which they will be gradually phased down until 2032. Read More |

|

05.15.25- Oil Prices Sink 4% on Hints

In Asian and early European trade on Thursday, the U.S. oil benchmark, WTI Crude, was down by 4.12% at $60.58 a barrel, while the international benchmark, Brent Crude, was falling by 3.80% on the day and traded at $63.52 per barrel. Read More |

|

05.14.25- Big Oil Goes Bionic

Digitalization is not new to the energy sector—oil producers and utilities have been using and perfecting it for years. But AI and its rapid advancements and capabilities are the latest hype, and it seems everyone is using it, and doing a very good job at it, at least companies say so. Read More |

|

05.13.25- Europe’s $2 Trillion

Renewable energy proponents have been touting for years the record-breaking solar and wind capacity additions in Europe and elsewhere, calling at the same time for more investments in grids. With headline-grabbing record renewable installations and reduction of dependence on fossil fuels, the need for trillions of dollars worth of investment in grids may have been overlooked. Until it was too late and Spain’s grid buckled on April 28, leaving the country, most of Portugal, and, for shorter periods of time, parts of France, without electricity and basically ruining an entire Monday for millions of people. Read More |

|

05.12.25- Breakthrough shrinks fusion power plant and expands practicality

Practical fusion power has been touted as only 25 years in the future ever since 1945, but there are some bright spots on the horizon that suggest that it could come to pass as soon as the next decade. Read More |

|

05.10.25- Should We Be Worried About Solar Storms?

|

|

05.09.25- OPEC+ Overproducer Kazakhstan Will Not Cut Oil Output in May

Kazakhstan, one of the biggest overproducers under the agreement alongside OPEC’s second-largest producer, Iraq, plans to keep its crude oil and condensate production levels in May the same as in April and slightly higher than in March, Kazakhstan’s energy ministry told Bloomberg via email. Read More |

|

Big Oil Isn’t Backing Down at $60 Oil

|

|

05.07.25- ‘Cold’ Manufacturing Could Be The Breakthrough Point for Solid-State Batteries

However, like any other technology out there, Li-ion batteries come with a suite of drawbacks, including the ability to deliver peak charge deteriorating over time; they generate a lot of heat, necessitating weighty cooling systems and also come with a risk of explosion or catching fire if damaged in an accident. Read More |

|

Following our report earlier that Saudi Arabia has declared a new price war on OPEC+ quota-busters such as Kazakhstan, and non OPEC+ members such as US shale producers, today after the close Diamondback Energy, the largest independent oil producer in the Permian Basin, made a historic pronouncement today when it said that production has likely peaked in America’s prolific shale fields (something we also mentioned earlier in the day) and will decline in the months and years ahead after crude prices plummeted. Read More |

|

05.05.25- The Global Race for White Hydrogen

|

|

05.03.25- Next Generation Solar Panels Are Revolutionizing Clean Energy

|

|

05.02.25- Europe’s Grid Buckles

On Monday midday, a sudden massive outage hit the electricity transmission systems of Spain and Portugal, and briefly parts of France, in a very rare blackout in Europe, whose causes are yet to be determined. Read More |

|

05.01.25- Raindrops Power New Renewable Energy Breakthrough

|

|

04.30.25- White Hydrogen Hype Heats Up as Green Dreams Fade

Grey hydrogen produced from fossil fuels and blue hydrogen produced from natural gas with accompanying carbon capture and storage (CCS) are by no means clean energy sources. Read More |

|

04.29.25- Renewables Emerge as Key to Meet AI-Driven Energy Demand

NextEra Energy – whose 72 gigawatts (GW) operating portfolio consists of 55% renewables, 36% gas, and 8% nuclear power generation – says that America will need all forms of energy to meet the expected surge in demand. And wind, solar, and battery storage can act as the “bridge” energy source until new natural gas and nuclear capacity comes online. Read More |

|

04.28.25- Oil priced in gold is near all-time lows

|

|

04.26.25- Shale Slowdown? Halliburton Sounds the Alarm

“Looking forward, many of our customers are in the midst of evaluating their activity scenarios and plans for 2025,” Halliburton’s chairman, president, and CEO, Jeff Miller, said on the first-quarter earnings call this week. Read More |

|

04.25.25- Whatever Happened To The

While people who had a grounding in economic thought found this new initiative to be naïve at best and destructive at worst, nonetheless it has energized American progressives and other environmental true believers. Read More |

|

Vision 2030 Fuels Saudi Shift to Natural Gas

|

|

04.23.25- Drill, Baby, Drill... But for Water

|

|

04.22.25- China Unveils World’s 1st ‘Meltdown Proof’ Thorium Reactor

|

|

04.21.25- Firms Cancel $8 Billion in Renewables Investment on Trump Policies

In a dramatic surge in cancellations of projects amid the chilling effects of the Trump Administration’s trade policy and attempts to repeal part of the green energy incentives, companies have withdrawn $7.9 billion in investments since January, clean energy business group E2 said in a monthly update this week. Read More |

|

04.19.25- Middle East Eyes Clean Energy Trade, But Markets Lag Behind

What appeared was a region ready to think about leveraging its growing array of renewable energy resources to maintain its role as a leading energy exporter. Exports of power from the Gulf’s thriving renewables sector, to countries needing more clean power to meet climate goals, could become an important driver of the region’s economic growth. Read More |

|

04.18.25- Iran Faces Tough Decisions in Nuclear Negotiations

|

|

04.17.25- Electricity from rainwater: New method shows promise

When it comes to generating clean energy from water, hydroelectric would certainly be the first thing to come to mind. But the issue with utility-level turbines is that they need large flows of water to operate, so their installation locations are limited. Wave energy is steadily coming on board as well, but again, that type of power generation is very site specific. Read More |

|

04.16.25- New fuel switches US nuclear reactor from Regular to Premium

Nuclear fuel is one of those things that we tend to pretty much take for granted. You have a nuclear reactor, it needs fuel, you put fuel in. QED. The general assumption is that filling a reactor with uranium and plutonium is like shoveling coal into a boiler furnace – a straightforward operation that, in the case of nuclear, is just a bit more involved. Read More |

|

04.15.25- Space solar startup preps

The billionaire co-founder of financial services app Robinhood has a new startup called Aetherflux focused purely on beaming solar power from satellites to receivers on Earth. Having announced it last year, Bhatt has now raised US$50 million in Series A funding from a clutch of Silicon Valley investors, and aims to launch a test next year. Read More |

|

04.14.25- Geothermal Energy Poised for Significant Growth in the US

|

|

04.12.25- The largest hydroelectric dam in the world has been approved

The project is slated to be built on the Yarlung Zangbo River in Tibet near the border of India at a cost of US$137 billion. It's part of China's 14th "Five-Year Plan," which includes environmental goals to accelerate renewable energy and fight pollution. The location of the proposed dam looks to take advantage of the river's steep geography to harness more hydropower than ever before: 300 billion kilowatt-hours per year. Read More |

|

04.11.25- Nuclear’s Back—

Therefore, efforts must begin immediately to secure the supply of the key nuclear fuel, the OECD Nuclear Energy Agency (NEA) and the International Atomic Energy Agency (IAEA) said in their Red Book report prepared jointly every two years. Read More |

|

04.10.25- Oil Prices Drop to Lowest Level Since Pandemic as Trade War Accelerates

At the time of writing, Brent crude was trading at $60.36 per barrel, with West Texas Intermediate at $57.04 per barrel, both down by close to 4% from Tuesday’s close. Since the start of the year, the benchmarks have shed lover $10 per barrel and most analysts expect the rout to deepen as tariffs would sap oil demand. Read More |

|

04.09.25- Renewable energy now handles 40% of our global electricity needs

The finding comes from data and estimates culled from 215 countries. The 118-page Global Electricity Review 2025 analyzes trends underlying the changes and the likely implications for energy sources and power sector emissions in the near future. Read More |

|

04.08.25- US Uranium Production Hits Highest Level In 6 Years

|

|

04.07.25- Demand for Lithium Strains Water Resources

|

|

04.05.25- U.S. Natural Gas Prices Drop 6% as WTI Oil Craters by Nearly 9%

The benchmark price for U.S. natural gas delivered at Henry Hub was plunging by 6.26% to $3.877 per million British thermal units (MMBtu) as of 10:35 a.m. EDT. At the same time, the WTI Crude futures were tumbling by as much as 8.59% to $61.14. Read More |

|

04.04.25- Oil Executives Voice Concern Over Trump Energy Policies as Prices Plummet

|

|

04.03.25- U.S. Uranium Market Goes Radio Silent on Tariff Shock

Bloomberg reported this week that uranium purchases by U.S. power utilities had dropped by 50% ahead of the 10% import tariff that Trump imposed on Canadian energy exports. The publication noted that those power utilities source more than a quarter of their uranium from Canada, which makes the potential impact of the tariffs rather palpable. If the tariffs do come into effect as scheduled and stay in place long enough, U.S. power utilities may have to replace their top source of nuclear fuel if they are to take full advantage of what many have called a nuclear Renaissance.Read More |

|

04.02.25- Sodium-iron battery startup to challenge Li-ion for extended storage

|

|

04.01.25- Peak Permian? Geology and Water Say We’re Close

Top executives at major shale firms have already expressed opinions that Permian oil production could hit its peak as early as the end of this decade. Read More |

|

03.31.25- BP, Shell, and Exxon Signal One Thing: Oil Isn’t Going Anywhere

|

|

03.29.25- Future of Biofuels Hinges on Industry Agreement

|

|

03.28.25- Palisades Nuclear Plant Revival Sparks Industry Interest

|

|

Tiny nuclear battery could power devices for decades

Called a dye-sensitized betavoltaic cell, this battery uses beta particles, which are just high-energy electrons. The magic in this battery is the material carbon-14, a radioactive isotope that emits beta particles. These particles strike a titanium dioxide semiconductor coated with a ruthenium-based dye, which knocks electrons loose in the dye, generating an electrical current. Read More |

|

03.26.25- And Now, for Something Entirely Different:This looks like a divorce. And it’s going to be a messy one

The administration was discussing if, when, and how to strike against the Houthi rebel group in Yemen, which has been menacing commercial ships in the Red Sea since late 2023. Read More |

|

03.25.25- AI, Crypto Data Could Soon Use Over 10% of All U.S. Electricity

|

|

03.24.25- Hedge Funds Struggle as

Bloomberg wrote this week that a lot of money managers were scrambling to strike the right balance between investors who were still insistent that emission-cutting commitments were priority number one and those who are accepting energy reality for what it is and seeking to replace those commitments with profits. Read More |

|

03.22.25- Big Oil Shrugs at $50 Crude

|

|

03.21.25- Report Shows Geothermal Can Meet 64% of AI Energy Demand Boom

|

|

03.20.25- World's first long-life sodium-ion power bank launched

On the outside, the affectionately named DE-C55L-9000 looks similar to the vast majority of power banks on the market, with a rounded brick shape housing its 9,000-mAh battery, a 45-W USB Type-C and an 18-W Type-A port, and charging indicator LEDs. Read More |

|

03.19.25- Harold Hamm: ‘Drill, Baby, Drill’

American producers, especially those pumping crude outside the Tier 1 inventory in the best Permian locations, would need an oil price of around $80 per barrel to cover the cost of drilling wells. Read More |

|

03.17.25- Nuclear Fusion Race Intensifies With Chinese Breakthrough

|

|

03.15.25- Reality Check: Towns And States Don't Want Green Energy

|

|

03.14.25- Green steel plant glugs out first ton of molten metal

|

|

03.13.25- EV-Critical Battery Metal Cobalt Soars As Congo's Export Ban Disrupts Supply Chains

New Fastmarkets data shows that a pound of cobalt hydroxide—the main product exported from the DRC, the world's top producer—has surged 84% since the DRC suspended exports last month to counter a market glut that had pressured prices to multi-year lows. Prices reached $10.50 per pound on Tuesday, the highest level since July 2023. The price of cobalt metal has also soared 43% Read More |

|

03.12.25- Trade Wars Spark Uncertainty

US Energy Secretary Chris Wright announced that he plans to work with the Congress to cancel the mandated sales of 100 million barrels of strategic petroleum reserves in 2026-2031 to refill SPR stock. Read More |

|

03.11.25- Record Nuclear Power Production

|

|

03.10.25- Ultra-fast thermal mats could power homes, or radically reduce energy

How does the IsoMat achieve these goals? Essentially by moving heat from one place to another in a radically quick and efficient fashion. Read More |

|

03.08.25- PA Faces "Looming Power Crisis" After Gov. Shapiro's Electricity Tax

|

|

03.07.25- Italy Overturns 40-Year Nuclear Ban

|

|

03.06.25- U.S. Crude Stockpiles Climb as Oil Prices Tumble Below $70

Crude oil prices were down prior to the crude data release by the U.S. Energy Information Administration, even after the American Petroleum Institute (API) reported on Tuesday a dip of 1.455 million barrels in U.S. crude oil inventories. The market-moving force, rather, was OPEC+’s decision to begin unwinding its production cuts starting in April. The Brent benchmarkwas trading down 2.13% at 9:47 a.m. ET at $69.53, marking three days of consecutive losses. The WTI benchmark, meanwhile, was trading down 2.64% at $66.46. Read More |

|

03.05.25- Solar film you can stick anywhere to generate energy is nearly here

Power Roll has been focusing on embossing 'microgroove structures' into a plastic substrate, similar to a "hologram" on a credit card. A single square meter has 500,000 microgroove structures, and these are coated with conductive materials and photo-active ink. Layers of encapsulation film keep the printed rolls stable and enhance their durability. Read More |

|

03.04.25- Penn Undergraduate Solves Century-Old Wind Energy Problem

|

|

03.03.25- Is Trump Breaking the Wind Industry?

On Trump's first day back in office, he took an axe to federal wind policies, pausing leasing and permitting for new projects and leaving developers in limbo. Offshore and onshore wind giants—Shell, TotalEnergies, and Orsted among them, according to the WSJ—are suddenly staring at billion-dollar write-downs and wondering if their investments just got sucked into a policy tornado. Read More |

|

03.01.25- Fusion Technology to Revolutionize Geothermal Power

|

|

02.28.25- Helion eyes Washington site for 2028 fusion reactor build

Local media outlet Wenatchee World reported that Helion made an announcement at a press conference on Thursday, laying out its plans to lease a site in Malaga. The prospective project is located within Chelan County, and near the Rock Island Dam on the Columbia river. The land is owned by Chelan County Public Utility District. Read More |

|

Without the shale revolution, global oil production would likely have peaked in the early 2010s, and current output would be at least 10 million barrels per day lower than it is today. Read More |

|

02.26.25- Iran Turns to Solar to Address Electricity Shortage

The Middle Eastern country is one of the richest in energy resources, holding the second-largest natural gas reserves behind Russia, at 17 percent, and 9.4 percent of global oil reserves. It is a founding member of OPEC and the Gas Exporting Countries Forum (GECF). Read More |

|

02.25.25- BYD to build the 'world's largest' battery storage projects

|

|

02.24.25- Drilling the deepest hole in history: Unlocking geothermal energy

|

|

02.22.25- AI Data Centers Bet on Next-Gen Nuclear

Many start-ups in the United States and Europe are vying to become the first to not only design but also put into commercial operation the next generation of advanced nuclear reactors. Read More |

|

02.21.25- Floating nuclear power plants to be mass produced for US coastline |

|

02.20.25- The Economics of Solar Power

|

|

02.19.25- France runs fusion reactor for record 22 minutes

|

|

02.18.25- Coal Consumption Remains High in the United States

|

|

02.17.25- Trump's Energy Secretary Is Betting Big on Nuclear Power

|

|

02.15.25- Britain's Energy Future Hinges on Small Modular Reactors

Last month was the hottest January on record globally. It was unexpected because the natural weather phenomena known as ‘La Niña’ should have produced a cooling effect. That suggests that La Niña might be losing its ability to keep global warming in check – a terrifying reminder of the escalating climate crisis. Read More |

|

02.14.25- What Happened to the

|

|

02.13.25- America's War On Coal Power-Plants

|

|

02.12.25- Net Zero Dreams Meet Energy

The surge in energy prices, especially in Europe, has forced governments to address immediate concerns about the cost of living and high energy prices rather than gain more support for net-zero goals and policies. Read More |

|

02.11.25-International Collaboration Driving Advancements in Geothermal Technology

|

|

02.10.25- Trump's Energy Policies Cast Shadow Over U.S. Wind Industry

|

|

02.08.25- Flying figure-eights

In 2023, wind energy accounted for roughly 7.8% of all electricity created around the world. There are a few countries that have really topped the list of wind-energy generation: Fifty-eight percent of Denmark's total electricity generation was wind. Uruguay saw 43%. Ireland 35%. Read More |

|

02.07.25- Drought Dims Hydropower's Promise

|

|

02.06.25- The Trump Administration Could Throw A Lifeline To The Uranium Sector

|

|

02.05.25- China Hits Clean Energy Goal Six Years Ahead of Schedule

China, the world’s biggest emissions polluter, set in 2020 a goal to have at least 1,200 gigawatts (GW) of solar and wind capacity by 2030. Read More |

|

02.04.25- 28-ton, 1.2-megawatt tidal kite is now exporting power to the grid

Solar energy is the bedrock of most renewable energy grid plans – but lunar energy is even more predictable, and a number of different companies are working to commercialize energy generated from the regular inflows and outflows of the tides. Read More |

|

02.03.25- Energy and Nuclear Stocks Recover After DeepSeek Selloff

|

|

01.31.25- Green Hydrogen Hype Fizzles as Implementation Lags

|

|

01.31.25- The Small Nuclear Reactor Revolution Is Underway

SMRs are advanced nuclear reactors with a power capacity of up to 300 MW(e) per unit, equivalent to about one-third the generating capacity of a conventional nuclear reactor. SMRs are much smaller than traditional reactors and are modular, making it easier to assemble them in factories and transport them to the site. Because of their smaller size, SMRs can be installed on sites that are not suitable for conventional reactors. They are also significantly cheaper and faster to build than traditional nuclear reactors and can be constructed incrementally to meet the growing energy demand of a site. Read More |

|

01.30.25- Chevron And GE Vernova Teaming Up To Build Nat Gas Plants To Power Data Centers

The latest example? Chevron, Engine No. 1, and GE Vernova are teaming up to build natural gas power plants in the U.S., co-located with data centers to meet growing electricity demands driven by AI development, according to Yahoo Finance. Read More |

|

01.29.25- Helion has $1 billion and 3 years to figure out fusion-powered energy

Washington-based fusion energy company Helion just raised US$425 million in fresh funding for its bid to be the first to produce usable electricity through nuclear fusion. The firm's latest Series F round brings the total investment into Helion over the $1 billion line, and it's aiming to begin delivering power from a single fusion 50-MW plant to Microsoft by 2028. Read More |

|

01.28.25- Can Geothermal Become a Major US Energy Source Under Trump?

Yet for various reasons — including logistics, economics, and permitting issues — geothermal has not come close to reaching its potential. That could be changing, with Donald Trump’s surprising embrace of the deep-seated renewable energy source. Read More |

|

01.27.25- China sets new fusion endurance record of over a thousand seconds

For 80 years, there has been a concerted effort to turn the incredible destructive power of the hydrogen bomb into a practical source of power. In part, this has been a matter of pure science. In part, it's been a major technical challenge. And, in part, it's been a legacy of Cold War rivalries. Read More |

|

01.25.25- MIT's zero-energy technique shows how to brew ammonia underground

Currently, ammonia is the second-most produced chemical in the world, where about 80% of it is used as agricultural fertilizer. However, current ammonia-production methods chew up about 2% of the world's fossil fuel energy and release about 1% of worldwide manmade greenhouse gas emissions. Put another way, for each ton of ammonia produced, about 2.4 tons of carbon dioxide are released. Read More |

|

01.24.25- UK Government Pledges Record Investment in Nuclear Fusion

|

|

01.23.25- World's largest solar energy plant begins to take shape in Abu Dhabi

That's part of a gigascale project set to be built in the capital of the United Arab Emirates by Abu Dhabi Future Energy Company aka Masdar, and Emirates Water and Electricity Company. The firms note it'll be the world's first '24/7' solar photovolatic plant coupled with a Battery Energy Storage System (BESS) to match. Read More |

|

01.22.25- Permian Basin Oil and Gas Output Faces Disruption Due to Freezing Temperatures

According to the National Weather Service, snow is forecasted to begin in Houston on Monday evening and accumulate to upwards of 4 inches by Tuesday. After the snow, frigid temperatures are expected to sweep in, bringing dangerously cold conditions that could jeopardize the power grid and energy infrastructure. Read More |

|

01.21.25- Indonesia Bets on Solar Manufacturing Amid US-China Trade Row

China, Cambodia, Malaysia, Thailand, and Vietnam face U.S. tariffs and restrictions in exporting their solar products, including panels and other equipment, as the United States has determined that they have been engaged in dumping practices. Read More |

|

01.20.25- 3D-printed battery made from fungi feeds on sugars

|

|

01.18.25- Nuclear Waste: The Dark Side

|

|

01.17.25- Molten salt nuclear reactor in Wyoming hits key milestone

In Kemmerer, Wyoming, the Naughton Power Plant has been burning coal to provide electricity since the 1960s. But in September 2019, it was announced that the plant would be shut down by 2025 due to issues with operating efficiency and compliance with environmental regulations. Yet unlike other towns where coal plants get shuttered, Kemmerer won't simply fade from the map. Instead, it is the site where Natrium, America's first coal-to-nuclear project, is taking place. Read More |

|

01.16.25- A Coordinated Strategy To Bring American Energy Dominance Back Again!

One area where Trump made significant headway in his first term was in making America energy independent. Indeed, Trump’s policies began a domestic energy renaissance, making the U.S. energy dominant, becoming a net exporting country for the first time in 75 years. Read More |

|

01.15.25- 2024 Registrations Of New Electric Cars Plummet 27.5% In Germany…”Petrol Dominates”

Firstly, Germany has been in recession for almost 2 years now – thanks mostly to the policies of Economics Minster Robert Habeck (Green Party), who incidentally has no education in economics, business or finance. The guy just doesn’t know what he’s doing. Read More |

|

01.14.25- Trudeau's Exit Sparks Oil Industry Optimism in Canada

|

|

01.13.25- US Oil Growth Slows as

There have already been signs that the oil and gas industry itself is not really on board with a rerun of the “Drill, baby, drill” movie that the shale revolution made. The industry seems to have advanced to the stage of financial discipline and shareholder returns and is not going back to the stage where the ultimate goal was to see just how much oil and gas they could get out of the ground. Then there are the oil and gas themselves. Read More |

|

01.11.25- Can the World Break Its Reliance on Chinese Clean Energy Tech?

|

|

01.10.25- Is U.S. Nuclear Power at Risk? Russia's Uranium Restrictions Explained

This graphic, via Visual Capitalist's Bruno Venditti, illustrates the top sources of enriched uranium for U.S. civilian nuclear power reactors in 2023, based on data from the U.S. Energy Information Administration. Read More |

|

01.09.25- Get Ready for a Major Solar Showdown

|

|

01.08.25- NYC is set to get a $3 billion,

|

|

01.07.25- Nuclear Renaissance

|

|

01.06.25- Could Texas Become a Geothermal Energy Hub?

|

|

01.04.25- The largest hydroelectric dam in the world has been approved

The project is slated to be built on the Yarlung Zangbo River in Tibet near the border of India at a cost of US$137 billion. It's part of China's 14th "Five-Year Plan," which includes environmental goals to accelerate renewable energy and fight pollution. The location of the proposed dam looks to take advantage of the river's steep geography to harness more hydropower than ever before: 300 billion kilowatt-hours per year. Read More |

|

01.03.25- Make Lithium Great Again: Peer-Reviewed Study Reveals Whole-Body Benefits Of Supplementation

|

|

01.02.24- The Factors That Will Drive Oil Prices in 2025

Brent crude and West Texas Intermediate appear set to end the year at nearly the same levels that they started. WTI started 2024 at a little over $70 per barrel and is about to end a little below that. Brent crude looks like it will post a little more noticeable loss, starting the year at $77 per barrel and ending at a bit over $74 time of writing. Read More |

|

01.01.25- Residential Battery Energy Storage Systems Industry Growth Opportunities - Distributed Solar, Battery Cost Declines, Incentives, and Supportive Regulations Sustain Double-Digit Growth

Dublin, Dec. 13, 2024 (GLOBE NEWSWIRE) -- The "Growth Opportunities in the Residential Battery Energy Storage Systems Industry" report has been added to ResearchAndMarkets.com's offering. Read More |

|

12.31.24- U.S. Natural Gas Futures Soar Ahead of Historic Cold Front

|

|

12.30.24- 3 Clean Energy Stocks That Could Thrive Under Trump

|

|

12.28.24- World's first 30MW pure hydrogen electrical generator

The Jupiter One is the most powerful and largest pure hydrogen generator on the planet. It was developed in collaboration with Mingyang Smart Energy, known for colossal wind turbines, and Mingyang Hydrogen Energy along with several research teams and smaller enterprises. Read More |

|

12.27.24- Oil Market 2024 in Review: A Year of Surprises and Shifting Demand

|

|

12.26.24- Geothermal Energy: Big Tech's Answer to AI's Growing Energy Consumption

|

|

12.25.24- Hydrogen Fuel Cells: A Promising Green Alternative to Battery Electric Vehicles

|

|

12.24.24- Green Hydrogen Costs Set to Stay Too High For Too Long

BNEF’s new report on hydrogen prices finds that green hydrogen, the one produced via electrolysis using renewable energy, will fail to reach price parity with gray hydrogen by the middle of the century, as costs have more than tripled from last year’s forecast. Read More |

|

12.23.24- Virginia's fusion power plant: A step toward infinite energy

After over 100 locations around the world were scouted, CFS chose a 100-acre (40.5-ha) plot of land in Chesterfield County in Virginia for the ARC – an acronym for "Affordable, Robust, Compact" – to be built. This fusion power plant aims to produce a continuous 400 megawatts of clean, virtually limitless energy by the early 2030s. Read More |

|

12.21.24- Tanker Ships Set Sail for Greener Future with Wind-Powered Technology

That's because the Sohar Max, a 400,000-deadweight-ton vessel, was just retrofitted with five 35-meter rotor sails at China's COSCO Zhoushan shipyard, according to Bloomberg. The purpose is to reduce fuel use by 6% and cut annual carbon emissions by 3,000 tons. Read More |

|

12.20.24- This Major Perovskite Breakthrough Could Change Solar

|

|

12.19.24- Can Coal Ash Solve the Rare Earth Supply Chain Crisis?

|

|

12.18.24- AI and Chip Manufacturing Drive Japan's Nuclear Energy Expansion

Japan's long-delayed restart of the 820 MW No. 2 reactor at the Shimane plant, shut down since January 2012, raises the number of operational reactors to 14, with a total capacity of 13,253 MW, according to Reuters. Read More |

|

12.17.24- New retrofit lets micro-turbines burn both hydrogen and natural gas

|

|

12.16.24- Enhanced Geothermal: A Game Changer for Renewable Energy

The beauty of this technology, which extracts thermal energy from deep beneath the surface, is that it is widely applicable, and may be of particular interest in regions where they face limitations. Read More |

|

12.14.24- Uranium Wars

Enriched uranium is used to fuel nuclear reactors. The degree of enrichment is not high. Natural uranium (sometimes called yellowcake) has about 0.7% U-235 isotope. This is enriched to 3% to 5% for use in most reactors (called low-enriched uranium or LEU). Some specialized reactors require uranium enriched to 20% U-235 isotope, but those are rare. Read More |

|

12.13.24- Collapse of the $5 Trillion

However, even with that astronomical financial support, the world still depends on hydrocarbons for 84% of its energy needs—down only 2% since governments started binge spending on renewables 20 years ago. What is really going on here? Read More |

|

12.12.24- China Looks To Build The Largest Human-Made Object in Space

The startup notes that space solar power can revolutionize energy distribution, especially where delivering power is expensive, challenging, or dangerous. Powering hard-to-reach places like remote military bases, islands, or areas hit by disasters unlocks new capabilities and advantages for our country. Read More |

|

12.11.24- Nuclear Stocks Were Super Hot Just A Month Ago. What’s Changed?

|

|

12.10.24- Emerging Trends from Electrification to Energy Management

Society is undergoing a scientific renaissance driven by the timely convergence of technological advancements and investments in energy. Read More |

|

12.09.24- AI's Energy Appetite Sparks Global Power Grid Concerns

|

|

12.07.24- Solar Panel Importers Face

Companies have until December 3rd to install the panels, and U.S. Customs and Border Protection has pledged strict enforcement to prevent stockpiling, potentially exposing importers to audits, inspections, and billions in backdated tariff costs. Read More |

|

12.06.24- Small Nuclear Reactors Are Gaining Traction Around the Globe

|

|

12.05.24- Texas Looks to Capitalize on Big Tech’s Nuclear Power Push

These mines are the leading edge of what government and industry leaders in Texas hope will be a nuclear renaissance, as America's latent nuclear sector begins to stir again. Read More |

|

12.04.24- Why No One Wants California’s Orphaned Oil Wells

Last year, California sought to prevent a rise in the already high number of so-called orphan oil wells. The state also looked to keep from passing off to taxpayers the liability for plugging and abandoning oil wells should operators not have sufficient funds to plug and decommission non-producing wells and clean up the sites. Read More |

|

12.03.24- The Next Four Years Will BeAll

|

|

12.02.24- Why Europe’s Hydrogen Economy Dreams Remain Just That

|

|

11.30.24- The Secret Metal That Helped Win WWII is Back, And Prices Are Soaring

A German U-boat lurking in the cold Atlantic waters fired a torpedo and the ship went down, sinking to the ocean floor along with its mysterious cargo. Read More |

|

11.29.24- American Oil Rigs Continue Their Steady Decline

The total rig count fell by a single rig for the third week in a row, landing at 582 total rigs, according to Baker Hughes, 43 years fewer than a year ago. Read More |

|

"Competitive markets — not the dictates of far-flung asset managers — should determine the price Americans pay for electricity," wrote Texas Attorney General Ken Paxton in the complaint. Read More |

|

11.27.24- Trump's Nightmare: The Critical Resource Biden Couldn't Secure

The metal is not gold, silver, or uranium. It’s not the lithium used for EV batteries. It’s not the copper that is essential for electrification. It’s not even the rare earth elements that are crucial for everything from smartphones to wind turbines. Read More |

|

11.26.24- Fast-charging lithium-sulfur battery for eVTOLs nears production |

|

11.25.24- Government Funding Fuels

|

|

11.23.24- Sodium-Ion Batteries: A Promising Rival to Lithium?

|

|

11.22.24- China's Solar Dominance Fuels Asia's Green Energy Shift

Southeast Asia’s demand for renewable energy is rising, driven by tech manufacturing and data center growth, according to Nikkei. Solarvest, the region's leading renewable energy provider, plans to capitalize on this boom by increasing imports from China, according to a local manager. Read More |

|

11.21.24- Small modular nuclear reactors get a reality check in new report Small modular nuclear reactors (SMR) are generally defined as nuclear plants that have capacity that tops out at about 300 megawatts, enough to run about 30,000 US homes. According to the Institute for Energy Economics and Financial Analysis (IEEFA), which prepared the report, there are about 80 SMR concepts currently in various stages of development around the world. Read More |

|

11.20.24- Why Big Oil Is Scaling Back Renewables Investment

First came the ambitions to become major players in the renewables sector and goals to reduce oil and gas production by the end of the decade. That was in 2019 and early 2020 when Big Oil firms were racing to announce major shifts in strategy toward conventional and green energy. Read More |

|

11.19.24- First onshore wave energy project in the US gets official nod

The idea behind the setup is to mount a number of floaters on coastal infrastructure, which rise and fall to the motion of waves. This drives hydraulic pistons to move fluid to an accumulator, which is then released to produce electricity via a generator. Read More |

|

11.18.24- Bourbon distilleries: A new source of renewable energy

At the end of the bourbon distilling process, producers are left with a substance known as stillage. This material consists of the grains used to feed the yeast that created the bourbon as well as dead yeast cells and other fermentation products. It is a high protein material and is most commonly used to feed cattle and other livestock. In Kentucky alone, 127.2 million gallons of bourbon were produced when the last comprehensive count was done in 2020 and for each gallon of spirits made, there is 10 times as much stillage produced. Read More |

|

11.16.24- Shale Industry Wants Liberty CEO Wright as U.S. Energy Secretary

Wright, who advocates for “better human lives by expanding access to abundant, affordable, and reliable energy,” does not have political experience, but is being endorsed by his peer executives to be the next U.S. Secretary of Energy. Read More |

|

11.15.24- Electrochemical reactor grabs 97.5% of lithium from geothermal sources

It's hard to pick up any rechargeable device these days that doesn't have a lithium-ion battery inside. While there have been alternatives floated, such as those based on potassium or sodium, lithium is currently where it's at in the contemporary battery market. That's primarily because, despite occasionally bursting into flames, Li-ion batteries have an excellent energy density that lets them hold a lot of charge in a relatively small size. Read More |

|

11.14.24- Three Key Energy Moves Trump Plans for His First 100 Days

|

|

11.13.24- The Future of Nuclear Power is Wrought with Challenges

As I analyze the situation, however, the problems associated with nuclear electricity generation are more complex and immediate than most people perceive. My analysis shows that the world is already dealing with “not enough uranium from mines to go around.” In particular, US production of uranium “peaked”about 1980. Read More |

|

The End of Globalism: Navigating the Transition to a Sustainable World

Latour made the case that Trump's perplexing popularity could be traced to his ability to give voice to the anger and fear generated by the effects of Globalism. In fact, Latour noticed that the anger and fear were actually widespread and reflected in Great Britain's exit from European Union and the many right-wing movements in European countries that now are all too familiar eight years later. Read More |

|

11.11.24- Here's Why These Geopolitical And Financial Chokepoints Need Your Attention...

|

|

11.09.24- Three Mile Island's Clean Energy Comeback Fueled by Tech Giant Demand

|

|

11.08.24- And Now, for Someting Entirely Different: Ivy Day Thoughts

|

|

11.07.24- Solar And Wind Won't Replace Natural Gas For Decades: They Will Depend On It

Today, solar and wind are relatively low cost, and prices will likely fall further. But they are not like fossil fuels—they are what’s known as variable renewable energy (VRE)—meaning they only produce electricity when the sun shines or the wind blows. Read More |

|

Republicans have taken back control of the Senate, while Trump is due to return to the White House after winning the crucial battleground of Pennsylvania. Trump declared victory in a speech in Florida after having earlier won the key swing states of North Carolina and Georgia. The win was officially called by media outlets later in the morning. Read More |

|

11.05.24- Looming Oil Glut to Reshape Global Energy Landscape

"Next year, the global oil supply is expected to exceed demand by an average of 1.2 million barrels per day," World Bank stated in its latest Commodity Markets Outlook report. The scale of this oversupply is difficult to overstate; these numbers have only been exceeded twice in history, in 1998 and 2020. As a result, a barrel of oil could cost less than $60 within the next six years. Read More |

|

11.04.24- China sets launch date for world’s first thorium molten salt nuclear power station

|

|

11.02.24- USGS Finds Enough Lithium to Meet Annual Demand Nine Times Over

|

|

11.01.24- New Survey Shows Grim Outlook For Oil Markets

|

|

10.31.24- The Race for Nuclear Fusion

|

|

10.30.24- Small Nuclear Reactors to Power Czech Republic's Green Energy Shift

The Derby-headquartered giant has handed a 20 per cent share in Rolls-Royce SMR in a deal worth hundreds of millions of pounds. CEZ plans to build the first small modular reactor at the existing Temelin nuclear plant in the first half of the 2030s. Read More |

|

10.29.24- It's not a tiny home. It's actually a nuclear microreactor powerplant

With backing from Sam Altman, the CEO of OpenAI and makers of ChatGPT, Oklo Inc. – a company that recycles nuclear fuel and uses it in its nuclear fission microreactor dubbed Aurora – says this will be possible. Not only possible, but in Oklo's plans. Read More |

|

10.28.24- The Green New Scam Is Dying

Whether this preference is based on ignorance of the science, ideological zeal, a willful desire to hurt American growth or simple greed because of their investments in Green New Scam infrastructure varies case by case. Read More |

|

10.26.24- Big Tech's Nuclear Gamble Could Change The Course of the Energy Transition

|

|

10.25.24- Oxford Claims to Have Produced Mater-Antimatter Plasma

|

|

10.24.24- Planet's largest wind turbine record broken again at 26-MW

The nacelle hub height sits at 607 ft (185 m), while the blade diameter is a whopping 1,107 ft (310 m). It has a blade swept area of 812,424 square feet (75,477 sq m). Do you know what else has about that much wingspan? Twelve Boeing 747s. You'd need an area the size of 14 NFL football fields, or a decent city block, to lay it down. It's a bit big. Read More |

|

10.23.24- Why Is Smart Money Betting Against Renewable Energy

|

|

10.22.24- Wave-resistant PV platform explores offshore solar potential

|

|

10.21.24- Scientists To Drill Volcano In Search Of Unlimited Super-Hot Energy

Apart from gaining better insights into the processes taking place under the surface of the Earth, the researchers plan, via a testbed under the Krafla volcano, to look into the potential of super-hot geothermal energy. Read More |

|

10.19.24- Controversial Study Claims LNG is Dirtier Than Coal

Howarth’s peer-reviewed paper, published in Energy Science and Engineering, claims that LNG has a 33% larger emissions footprint than coal over a 20-year period, challenging the oil and gas industry’s assertion that LNG is a cleaner alternative. Read More |

|

10.18.24- Ultra-deep fracking for limitless geothermal power is possible: EPFL

|

|

Google goes nuclear in world-first small reactor agreement

In terms of developing cleaner, carbon-free energy, Google is certainly putting its money where its mouth is. Just last year the company switched on an advanced geothermal plant in Nevada that has already made impressive gains in developing its technology for using heat from beneath the Earth's surface to generate power. Read More |

|

|

|

10.15.24- Billionaire Robinhood Co-Founder Eyes Solar from Space

|

|

|

|

10.11.24- Solar power project hits the rails with between-track panel pilot

Despite many household and business rooftops rocking solar panels, and dedicated "farms" also soaking up the Sun's energy, there's still huge potential for harvesting much more. Read More |

|

10.10.24- Declining North Sea Oil Patch Could Make Way For Geothermal Boom

|

|

10.09.24- Nuclear Power Likely To Grow By Getting Smaller

For many in the nuclear power industry, one way to address these issues is to become smaller. Read More |

|

10.08.24- And Now, for Something Entirely Different: Traitors to America Should be

|

|

10.07.24- Is Nuclear Power the Future of Green Energy for Big Tech?

|

|

10.05.24- Will EU's EV Tariffs Ignite a Global Trade War?

The European Commission, the bloc's executive arm, recently concluded its anti-subsidy investigation into Chinese imports of battery electric vehicles. The findings supported the Commission's move to implement the duties, which would last for five years. Read More |

|

10.04.24- Oil Stocks To Watch As Middle East Conflict Intensifies

|

|

10.03.24- Robots are Making Nuclear Energy Safer and More Efficient

|

|

10.02.24- U.S. Port Strike Could Trigger New Wave of Inflation

|

|

10.01.24- 3 Stocks To Play The Nuclear Renaissance

|

|

09.30.24- eVinci nuclear microreactor moves towards commercialization

In the wake of climate change concerns, nuclear energy is experiencing a resurgence. With its zero-emissions principle and ability to generate large amounts of power, it can address many of the challenges facing the energy sector. However, the nuclear industry must overcome issues related to safety (perceived or otherwise), availability, and cost, while also significantly speeding up the construction process, which traditionally takes years. Read More |

|

09.28.24- An Electric Investment!

Among the forests, fields, farms, housing and office park developments, I see many solar panel arrays. But there’s something else as well, and a lot of it. I’m talking about data centers. They’re especially common in northern Virginia, outside D.C. Northern Virginia is home to 70% of the world’s data centers. Read More |

|

09.27.24- How China Could Win The Nuclear Fusion Race

|

|

09.26.24- Thermoelectric generator pulls energy from room temperature heat

Thermoelectric devices are designed to tap into a simple law of physics: heat energy moves from hotter regions to colder ones. In these devices, electrons move from the warmer surface to the cooler one, which produces an electric current. In theory, thermoelectric generators, materials and paints could produce electricitytemperature differences in engines, power plants, even body heat. Read More |

|

09.25.24- Coal's Resurgence Challenges Global Energy Transition

In this graphic, Visual Capitalist's Bruno Venditti shows global coal consumption by region from 1965 to 2023, based on data from the Energy Institute. Read More |

|

09.24.24- Three Mile Island Nuke to Reopen with Microsoft Contract

|

|

09.23.24- U.S. Solar Energy Soars Despite Chinese Competition

|

|

09.21.24- Gazprom Accelerates Pipeline Gas Transports To China

|

|

09.20.24- Glowing crystal-powered nuclear battery boasts 8,000x efficiency boost

|

|

09.19.24- Oil Net Short For First Time in History

|

|

09.18.24- Sunlight turns CO2 and methane into valuable gases for fuel and industry

Researchers from McGill University have developed a novel process known as photo-driven oxygen-atom-grafting, which uses gold, palladium and gallium nitride as a catalyst to chemically transform carbon dioxide and methane into carbon monoxide and green methanol when exposed to sunlight. Read More |

|

09.17.24- Solar Pumps Poised to Revolutionize Global Water Access

|

|

09.16.24- New grid battery packs record energy density into a shipping container

|

|

09.14.24- Next-Gen Nuclear Power: Oracle's Solution for Energy-Hungry AI

During an earnings call, Ellison said the company is designing a data center that will need over a gigawatt of electricity, which would be supplied by three small nuclear reactors, according to CNBC. Read More |

|

09.13.24- Russia's Nuclear Ambitions in Central Asia

|

|

09.12.24- California Launches America’s First Hydrogen-Powered Passenger Train

Dubbed Zemu for Zero-Emission Multiple Unit, the $20 million train uses a hybrid hydrogen fuel cell and battery system to power the lightweight vehicle capable of ferrying 108-seated passengers on a 9-mile line known as the Arrow Corridor. San Bernardino is notorious for its poor air quality thanks to a high concentration of freeways, rail yards and industrial facilities. Read More |

|

09.11.24- Watch: Giant multibody wave energy converter flaps its way toward launch

Developed by the University of Western Australia's Marine Energy Research Australia knowledge hub, the device is called the Moored MultiMode Multibody (M4) Wave Energy Demonstration Project. Read More |

|

09.10.24- And Now, for Something Entirely Different: The Mediocrity Downspiral

How do whole agencies, companies, and cultures that were once high function succumb to mediocrity and then collapse into incompetence and nepotism? It seems like poison or like plan, but mostly, i suspect it’s not. it’s just self-assembling self-disassembly. Read More |

|

09.09.24- Motionless turbines deliver super-efficient wind energy to BMW's factory

|

|

09.07.24- Why Has the Green Hydrogen Hype Faded?

|

|