|

01.14.26- Is Silver About to Break Our Debt-Based Financial System?

For years, rumors have swirled that the CME and other futures exchanges were permitting too many silver contracts. Remember, a silver futures contract is supposed to be backed up by actual physical silver, meaning the investor has the option to “take delivery” of actual silver bullion if he or she chooses. Read More |

|

01.12.26- Silver Stackers Aim to ‘Screw the Bankers’

He’s known as a deeply Christian man and a big supporter of President Trump. And guess what? John’s a fellow silver bug, big time. Read More |

|

01.09.26- They Can’t Stop The Unstoppable Rise Of Silver Because They Are Losing Their Grip On The Entire Global Financial System

At the end of December, CME Group hiked margin requirements twice in a single week. Read More |

|

01.07 26- We Forecast Gold’s High

Regardless, per the above newly-enhanced Gold Scoreboard, we peg price as overvalued both by Fair Value (+11.5%) and BEGOS Market Value (+2.9%). In such respect, the notion of Gold thus opening on what would turn out to be its high for the entire year did have a modicum of plausibility. Read More |

|

01.05.26- Gold Didn’t “Spike,” It Was Repriced

Gold makes its 50th consecutive best move in 50 years, or somethingMost gold bugs probably didn't dare to expect gold leaping to $4,530 last week. As seen on Bloomberg, though, gold notched its best run since the 1970s. Read More |

|

|

|

12.31.25- JPMorgan Sees $5,000 Gold Coming Soon

|

|

12.29.25- Return of the Silver Standard?

|

|

12.26.25- A Better Silver Squeeze

The story of how it got there is full of intrigue and conspiracy. We’ll get to that. But first, a little background is in order. Monetary demand for silver had collapsed after the U.S. and other countries stopped using it in coins in 1965. Before that, America’s dimes and quarters were up to 90% silver. Other countries soon followed suit. Read More |

|

12.24.25- Silver Is the Big Story

He opens by flagging silver as the breakout story and explains why he expects more volatility and upside in the near term: Read More |

|

12.22.25- Gold and Silver Are Sending

Every 0.01% allocation to gold by U.S. investors would raise its price by $60 Read More |

|

12.19.25- Is An “Iceberg Order”

Let’s start with an excerpt: There’s a saying in the intelligence community: the loudest threats are rarely the most dangerous. It is the quiet ones you need to fear. In financial markets, we are conditioned to look for noise. We look for the massive green candle that shoots to the moon. We look for the violent red crash that signals panic. We look for volatility. But right now, if you look at the silver chart in the low 60s range, you see something strange. You see nothing. The price is stuck. It churns. It dips a few cents and then it bounces back. It rises a few cents and then it stops. Read More |

|

– JPM’s Move Coincided With the US Mint Announcing a Shortage of Silver coins Read More |

|

12.15.25- Industrial demand will drive SILVER beyond $100 in 2026

|

|

12.12.25- Gold Pushes Higher and Silver Sets a Record as Fed Cut Ignites Fresh Demand

Silver futures gained more traction, rising 2.2 percent to roughly 62.39 dollars after touching a record at 63.25 dollars. The move reflects a market that is leaning hard into the rate-sensitive metals complex despite the Fed declining to give clear guidance on how aggressive policy easing will be next year. Read More |

|

12.10.25- Planning Your Silver Bull Market

There will almost certainly be a peak and then a crash in silver. I don’t have a crystal ball, but I’ll go out on a limb and predict that the peak could be at just under $200 USD per Troy ounce. Read More |

|

12.08.25- The Decline of Developed Nations’

Today, we are living the decline of developed economies’ fiat currencies in real time. The global reserve system is slowly but decisively diversifying away from a pure fiat currency anchor towards a mixed regime where gold plays the dominant role, not fiat currencies. Read More |

|

12.05.25- Why Are Central Banks Escalating Their Gold Buying?

Gold’s December performance comes with a warning labelAccording to CNBC, gold has been inching higher, trading back around $4,130 as markets price in an 85% likelihood of a December interest-rate cut. Read More |

|

12.03.25- The Path to $200/oz Silver

|

|

12.01.25- $80 Silver Ahead?

As silver backwardation persists into a major delivery month, Andrew warns this could be a signal of a complete collapse in synthetic pricing structures. Read More |

|

11.28.25- Silver Crash or Shortage 2025; the Truth is Worse

|

|

11.26.25- Gold Is Under-Owned, Under-Supplied… and Overdue

A closer look at gold's market cap shows us how shockingly under-owned this asset is Read More |

|

11.24.25- Two Investing Titans Issue the Same Warning

|

|

11.21.25- U.S. Senator Introduces Comprehensive Gold Audit Legislation

Sponsored by Sen. Mike Lee (R-UT, the Gold Reserve Transparency Act would require a full assay, inventory, and audit of all United States gold holdings -- along with an upgrade in the purity of the gold so that it meets global market standards. Read More |

|

11.19.25- The Road To De-Civilization: Inflation

This deliberate inversion of language serves a political purpose: it shifts blame from those who create money to those who merely spend it, transforming an act of monetary fraud into a mere statistical “phenomenon.” Read More |

|

11.17.25- Copper, Silver and Uranium Join U.S. Critical Minerals Club

|

|

11.14.25- Buy the Golden Dip in Miners

That’s why we need to use this pullback to add to our gold portfolio. According to the Financial Times, gold bull markets commonly pull back up to 10% in bull markets. And none of the big financial institutions think gold’s run is over. Analysts at giant banks like Goldman Sachs and HSBC have price targets of $5,000 per ounce in 2026. Read More |

|

11.12.25- Silver Just Gained a Historic Advantage

The lone bear on gold leaves us with a pretty bullish picture Read More |

|

11.10.25- Who Will Survive (and Thrive)

Once upon a time in America, shopping malls were the royalty of retail locations, and the kings and queens of that select group of retail locations were multistory malls. Read More |

|

11.07.25- Gold Savers Will Win the Long Game, and Here’s Why

Your News to Know rounds up the most important stories about precious metals and the overall economy. Read More |

|

11.05.25- What Happens to Gold Miners If Trump Revalues Gold to $20K Per Ounce?

|

|

11.03.25- Silver Highest Nominal Monthly Price Close Ever

|

|

10.31.25- Investor Alert: the Trump Administration is Going Revalue Gold in 2026.

This is not conspiracy theory; the actual legislation is already in Congress as part of the Bitcoin Act. Specifically, Section 9 of the Act explicitly outlines that the Treasury is going to revalue the Fed’s gold holdings (currently valued at $11 billion at a price of $42.22 per ounce) to market rates ~$4,000 per ounce. Read More |

|

10.29.25- Gold SWOT: South African Gold Stocks Are on Track for the Best Year in Two Decades

|

|

10.27.25- India Unleashes Silver as Bank Collateral with 10:1 Gold-Silver Ratio,

|

|

10.24.25- Silver: London Calling

|

|

10.22.25- America’s Sixth Default Is Coming—What It Means for Gold and Your Wealth

|

|

10.20.25- The Great Gold Fever of the 2020s

The remark was recently made by 50-year-old Mike Hewlett, a welder from California. With gold now over $4,300 per ounce, he’s traded his hobbies of snowboarding, skiing, and dirt biking, for prospecting. He’s hoping to make big bucks. Read More |

|

10.17.25- Silver's Historic Rally Echoes 1980 Hunt Brothers Saga

It’s a monetary regime change – if market participants are trading anything it’s getting rid of a fiat currency (“it’s the denominator, stupid”) for a store of value – and we’re seeing it in spades with Bitcoin and gold: Read More |

|

10.15.25- Gold Breaks Another Record – But the Real Story Isn’t the Price

|

|

10.13.25- Getting the Gold Memo

|

|

10.10.25- The Untold Story Behind Silver’s 30x Move |

|

10.08.25- Are We There Yet? Over the past few weeks, I have received multiple inbounds asking what to do about our precious metals exposure. As of the start of Q3, gold (XAU) is up over 45% while gold miners (GDX) are up over 100%. Most charts bare the resemblance of a hockey stick. Understandably, some of you might be getting a little nervous. So, here’s my take. Read More |

|

10.06.25- Investors Have a Once in a Lifetime Opportunity Here

And by the look of things, this trend is nowhere near over. Read More |

|

10.03.25- The Case For $7,000 Gold

At the time, the “Nixon Shock,” as it came to be known, may have looked like a simple adjustment to the global monetary order. Read More |

|

10.01.25- Gold: Euphoria with Warning Signs on the Horizon

|

|

09.29.25- A Tsunami of Capital Is About

For decades, the dominant theme for portfolio composition was 60/40, meaning investors should allocate 60% of their portfolio to stocks and 40% to bonds. This was literally the gold standard for asset allocation used by Wall Street, financial advisors, and even hedge funds (Ray Dalio’s famed Bridgewater hedge fund was based on this structure). Read More |

|

09.26.25- Long Haul Gold

MarketWatch:

|

|

09.24.25- Why You Should Save in Hard Money

That’s 5 quarters, which at the time were made of 90% silver. There was 0.18 oz of silver in each coin. With silver priced at $44/oz today, the melt value of those 5 silver quarters is now $39. Read More |

|

09.22.25- From Bubbles to Breakdown — Why You Need Physical Assets Now

|

|

09.19.25- Gold's Surge Is an Economic Warning

Precious metals markets aren’t puzzling to well-informed investors Read More |

|

09.17.25- Dollar Debates & Gold’s

The Dollar’s Fate = Our FateThe “greenback” is much more than the subject of what often feels like overly theoretical debates on its (near and longer-term) direction in both absolute terms (i.e., inherent purchasing power) or in terms of its relative strength to other currencies. Read More |

|

09.15.25- The Real Reason Gold Is Surging (They Don't Want You to Know This)

|

|

09.12.25- Charting the Gold Story

First up, the performance of gold miners vs other sectors in 2025. Incredible outperformance. Gold mining stocks are finally getting the respect they deserve. With spot metal prices soaring, profitability in this sector is exploding. Read More |

|

09.10.25- The Fuse is Lit

Silver moved past $40 with gusto and is currently trading at $41.42/oz. Miners are churning out cash flow and starting to attract attention from the generalist investors. Read More |

|

09.08.25- Precious Metals Rally as Fed Signals Rate Cuts and Dollar Weakens

The latest episode of the Money Metals Midweek Memo, hosted by Mike Maharrey, explored why gold and silver are surging to historic highs, how inflationary pressures are building, and why central banks are moving away from the U.S. dollar. Maharrey also examined investor psychology, media bias, and even sensational claims about a massive gold discovery in Uganda. Read More |

|

09.05.25- 2 Reasons Gold Is

Gold passes $3,500 – what’s the next stop? A slew of headlines recently told us that the price of gold was held down positive economic data reports. Read More |

|

09.03.25- Silver Investment Demand Surges But U.S. Investors Still on the Sidelines

The increase in investment demand is reflected by a big jump in ETF silver holdings. Through the first six months of the year, 95 million ounces of silver flowed into silver-backed funds globally. That’s more than the silver inflows for the totality of 2024. Read More |

|

09.01.25- BREAKING: Silver Classified as a Critical Mineral

|

|

08.29.25- Tariffs & Gold Revaluation

For Piepenburg, the 50,000-foot macro assessment boils soberly down to this: The math and facts behind current headline policy-boldness smacks more of desperation than salvation. Read More |

|

08.27.25- "When Gold Is REVALUED, Silver Will Go ABSOLUTELY BALLISTIC!"

|

|

08.25.25- Jerome Powell Gives “All-Clear” Signal for Gold & Silver to Rally

It appears the Fed is now almost certain to resume its rate-cutting campaign in September. In reaction, the Federal Reserve note is moving down sharply in relation to other fiat currencies and precious metals are already buoyant. Read More |

|

08.22.25- Tale of the Gold Miner Tape

Yet strangely, investors in the fund have been selling aggressively. So far this year they’ve sold $3.5 billion worth of GDX shares on net. We can track this via ETF.com’s fund flows tool: Read More |

|

08.20.25- Gold is Signaling a Tectonic Shift in the Financial System

|

|

08.18.25- From “Retirement Dream” to Nightmare – Here’s How to Avoid the Trap

It never ceases to fascinate me how people have a tendency to only remember the things that they actually want to hear… Read More |

|

08.15.25- A World Of Fiat

Impossible ImbalancesThere has been a lot of discussion lately about America’s massive trade deficit and how President Trump’s tariff policies are intended to shrink it down while returning manufacturing to the USA. What isn’t often mentioned is how this massive trade deficit ever came about to the extent that it has to begin with. If the world still operated on a gold standard these mega imbalances would have been impossible. Read More |

|

08.13.25- Gold & Silver Drop as U.S.

After some back-and-forth over whether gold bullion imports into the United States would be hit with tariffs, the Trump administration confirmed yesterday that they will not be. In response, spot gold fell 1.62% and spot silver dropped 1.86%. Read More |

|

08.11.25- Marin Katusa on

Commodities analyst Marin Katusa just posted an analysis of the silver market which suggests a massive silver shortage — accompanied by much higher prices — in the coming decade. Here’s an excerpt: Read More |

|

08.08.25- The Calm Before the Storm: Why $4,000 Gold May Arrive Sooner Than You Think

If the Fed needs to cut rates, gold needs to go higher Read More |

|

08.06.25- Gold, Geopolitics & the Coming Commodity Clash

|

|

08.05.25- Silver: The Closer Metal

In the world of horse racing, many of the all-time greats have been closers. A closer is a horse that starts off slow, then surges on the back half. Many of the best racehorses of all time have been closers. Zenyatta, for example, is a mare that won a remarkable 19 of her 20 races. Read More |

|

08.04.25- Gold Doesn’t Need a Black Swan

Some see gold as insurance against disaster—financial crisis, currency collapse, geopolitical instability. Read More |

|

08.02.25- Gold And Silver Coin Premiums- How Low Can They Go?

|

|

08.01.25- Prepare for Historic Crash

In this candid and far-reaching conversation, Egon von Greyerz joins Lynette Zang to expose the uncomfortable realities behind fiat money, exponential debt, tokenisation, and the illusion of digital freedom. From the collapsing credibility of governments and central banks to the unstoppable rise of physical gold, they discuss why we’re facing the greatest wealth transfer in modern history – and what you can still do to protect yourself before the system breaks. Read More |

|

07.31.25- Central Bank Gold Buying Pushes Demand to Record Highs

Central bank survey prompts a deeper look at purchases of domestic gold Read More |

|

07.29.25- Is True Value in Crypto or Gold?

|

|

07.22.25- The Untold Story Behind

The story of how it got there is full of intrigue and conspiracy. We’ll get to that. But first, a little background is in order. Monetary demand for silver had collapsed after the U.S. and other countries stopped using it in coins in 1965. Before that, America’s dimes and quarters were 90% silver. Other countries soon followed suit. Read More |

|

07.15.25- Is A Silver "Deficit" The Same As A Shortage?

|

|

07.14.25- Why Sound Money is the Foundation

All of which should be exciting enough. Although underlying the price action, is what sound money represents, and allows us to do as a society. Read More |

|

07.12.25- Precious Metals: In Season, In Reason, and Now Even More Golden

|

|

07.11.25- The Pentagon’s Top Stock Pick

|

|

07.10.25- The Dirt on Gold Miners

The event is built for gold and silver bugs. There are around 1,000 of us here. Dozens of publicly-traded mining and royalty companies are represented as sponsors, speakers, and attendees. Read More |

|

07.09.25- America’s Broke. The Fed Will Print.

|

|

07.08.25- “Will Gold Hit $3460?” - Follow-up

|

|

07.07.25- Silver Price Forecast: Highest Level in 14 Years But No Sign of A Top

|

|

07.05.25- Silver’s Great Summer

|

|

|

|

07.03.25- The Last Time Gold Moved Like This Was 1929

In recent times, we have seen things compared often to infamous economic downturns, like the inflation and recession of the 1970s. We have also seen invocations of the Great Depression when the lockdowns happened, and gold accordingly leapt in massive bounds back then. Read More |

|

07.02.25- Silver Chartbook – Silver’s Breakout Rally Is Slowly Unfolding

|

|

07.01.25- This Chart Tells Us

|

|

06.30.25- This Is How Fiat Currencies Die - and What Will Replace it

|

|

06.28.25- Latest Calls on Iran, Ukraine

|

|

06.27.25- Despite Mainstream Pessimism, Gold Still Shines: Why the Bull Market Isn’t Over

Money Metals Midweek Memo host Mike Maharrey isn’t buying the recent bearish turn in gold forecasts from Wall Street. In this week’s podcast, he pushes back against the prevailing optimism in financial markets and lays out a compelling, data-backed case for why gold and silver still have room to run. Read More |

|

06.26.25- What History Says About

Gold has held up very well over the past few months, consolidating in a bullish manner. Read More |

|

06.25.25- Revolutionary Change = Revolutionary Mess & Rising Gold

|

|

06.24.25- Gold SWOT: The People's Bank of China Added 60,000 Ounces To Its Gold Reserves in May

|

|

06.23.25- The Earth Is Leaking Gold!

If your car tire is leaking, you’re probably going to end up stranded on the side of the road. If a pipe in your house is leaking, you’re probably going to end up with wet carpet. And if your team’s defense is leaky, well, it’s probably not going to win very many games. Read More |

|

06.21.25- Will The Silver Breakout Continue?

|

|

06.20.25- Understanding the Connection Between Gold Prices vs. Inflation

|

|

06.19.25-GOLD: The Global Financial System’s Lie Detector?

One Big…Lie? Earlier this year, I was asked to give my most “heretic” opinion about the global financial system. This was an unusual yet bold question, and after a brief pause, I answered that the entire system was…, well: “A lie.” Read More |

|

06.18.25- Why Investors Can't Trust the System—and Should Trust Gold

The conversation centered on growing sovereign debt, entitlement reform avoidance, shifting macroeconomic dynamics, and the critical role of gold and silver in a volatile financial system. Read More |

|

06.17.25- Gold, Silver, & Gold Stocks Since 2011 - Gold Kills It!

The chart below shows monthly closing prices for gold, silver, and gold stocks since their respective price peaks in August 2011. The prices are "normalized" to illustrate percentage changes and direction. All three items are indexed to a starting value of 100. The respective origin prices are $1825/Gold, $41.76/ Silver, 601/Gold Stocks-HUI; closing prices as of May 30, 2025 are $3288/Gold, $32.95/Silver, 398/Gold Stocks-HUI... Read More |

|

06.16.25- Implications Of The Impending Failure Of London’s Platinum Market

That was followed this past week by former metals trader and precious metals analyst Robb Gottlieb reporting that the 1-month London OTC platinum lease rate had increased to 24.5%. Figure 1 shows a mark-up (in yellow) of Bloomberg’s platinum lease graph showing the scale of Gottlieb’s reported spike in the London platinum lease rate. Read More |

|

06.14.25- Silver Fuelled for Blast Off!

|

|

06.13.25- Gold Forecast: Red Hot Sentiment – Even More Confirmations

And right now, it looks like everyone didn’t just move to one side of the boat, but they invited everyone they knew to join them. At least, that is how it looks like when looking at the charts featuring silver stock ETFs: SIL (senior silver miners) and SILJ (junior and mid-tier silver miners). Read More |

|

06.12.25- Silver Overbought Doesn’t Mean Over

Tops do form. Corrections do come. But here’s the part I learned staring at those screens and studying history’s data sets on restless nights: overbought doesn’t mean over, the correction might happen way down the road, and even then, it could just be a couple of percentage points.. Read More |

|

06.11.25- Is Gold Peaking, or Just Warming up?

According to several mainstream economists, we are indeed. But, they’re DEAD wrong and today I’ll show you why. Their argument relies on the inflation-adjusted price of gold. Read More |

|

Gold: The U.S. Dollar and Delusions of Growth

The dollar is the currency of the realm. There is, however, a real problem with using it as a benchmark. Read More |

|

06.09.25- What Is The Gold Standard?

In order to provide sufficient context so that the definition provides meaning to readers, it is necessary to explore several, tangential subjects. As such, this discussion will contain: Read More |

|

06.07.25- Gold Shines as Private

And what does this have to do with gold? In fact, the answers are becoming harder to ignore. Understanding gold’s rise in the context of macro-economic forces—i.e., historically unprecedented debt levels, oversupplied and under-demanded USTs and the consequent rise in yields/credit costs – helps us place a range of other asset classes, including private equity, into sober perspective. Read More |

|

06.06.25- Silver: Money, Markets, & The Metal's Role In The Coming Chaos

Doug Casey: Let’s look at the definition of what makes a good money. There are basically six characteristics. A good money has to be durable, divisible, convenient, consistent, have use value, and some limit on supply. Using those six key characteristics, gold ranks first, silver second, and copper third. That’s why those three metals have been preferred money throughout history. They were superior to seashells, salt, cows, paper, and other commodities. In today’s world it makes sense to bring Bitcoin, which also satisfies those six characteristics into the mix. Read More |

|

06.05.25- The Next Gold Confiscation: What It Could Look Like... And How To Avoid It

The decree forced Americans to sell their gold to the government at an artificially low “official price.” If they refused, they faced harsh penalties: a $10,000 fine (over $200,000 in today’s debased dollars) and/or up to 10 years in prison. Read More |

|

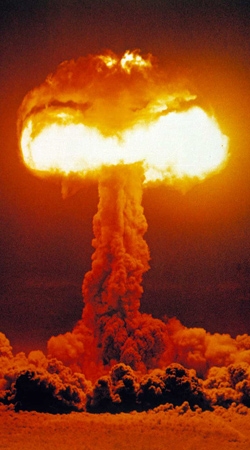

06.04.25- Gold Soars When Sh*t Hits the Fan

Silver stood out, popping nearly 5%, with the largest silver miner ETF (SIL) rising more than 6%. Spot gold rose mildly, but gold miners jumped by about 5%. Read More |

|

06.03.25- Chaos on Top of Chaos: Why Uncertainty Is Our Only Certainty

The current state of the U.S. economy can be summed up in one word: chaos. Read More |

|

06.02.25- Bank of America Eyeballs

Last October, the big bank projected $3,000 in 2025. BoA analysts said trade-induced geopolitical uncertainty would continue to support the metals, with growing concern about the U.S. government’s fiscal situation possibly catalyzing the next leg up. Read More |

|

05.31.25- Basel III -

|

|

05.30.25- Rickards On Gold Leasing:

Two months ago, Jim was featured on Daniela Cambone’s Youtube show. This was a gem, and luckily a reader alerted us to it. Read More |

|

05.29.25- Gold & Silver Prices Set to EXPLODE in 2025! Why Central Banks Are Terrified!

|

|

05.28.25- Believe It or Not, Gold is Still Out of Favor

After the past year’s epic run, you’d think gold would have displaced at least some other assets in mainstream investors’ portfolios. But apparently not. These two charts have been making the rounds on X, showing that during the previous decade’s gold bull market, gold-related ETFs saw their share of “implied allocations” rise dramatically. Read More |

|

05.27.25- “Buy America”, Keep Gold

The about-to-be-hiked tariffs for the EU were delayed by a month (precisely: to at least July 9), and it looks like we’re getting the same kind of story as we’ve seen recently. First, a threat, then, escalation, which is followed by delay, putting pressure on the other side. Read More |

|

05.26.25- Could Platinum Be Setting Up to Break Out?

Over the last four years, platinum has traded in a range between $900 and $1,100 an ounce. On Friday morning, the metal was just a tick above that $1,100 resistance level. Platinum is more than twenty times rarer than gold. All the platinum ever mined could fit into a room measuring 25 feet by 25 feet. Read More |

|

05.24.25- Gold’s Jagged Ascent

If you think this is going to be quick? If you think this is going to be easy? Think again. If you think Trump cares about Wall Street? Read More |

|

05.23.25- A Review of Gold & Silver: The Greatest Bull Market has Begun

|

|

05.22.25- $6,000 Gold Forecasts? The Experts Are Finally Catching Up

|

|

05.21.25- Global Debt Trap = Golden Era

Although both have a long history and understanding of precious metal investing, von Greyerz and Macleod discuss how the golden era for physical gold is just starting, despite a clear historical arc in its favoured direction. Macleod thinks back to the debt and credit woes of the 90s and central bank manipulation of rates, in which the gold cycle bottomed around 300 before Egon began making his first core gold investments. Since then, the price has grown by 10x. Read More |

|

05.20.25- Big Money Is Turning To Gold – Here’s Why You Should Pay Attention

For the average person, what organizations with large amounts of money do isn’t usually relevant to their day-to-day lives. Read More |

|

05.19.25- Could Basel III Endgame

|

|

05.17.25- Singapore Gold Launch Could Threaten London & NY Dominance

Abaxx Exchange recently launched a physical 1-kilo gold contract. It will be denominated in dollars and deliverable in Singapore. It will be the first and only physical gold futures contract in Asia. Singapore Bullion Market Association head Albert Cheng told the Financial Times that the country has the potential to compete with London. Read More |

|

05.16.25- Gold Goes Full Reserve Asset As Basel III Elevates It To Tier 1 Status

As of July 1, 2025, gold will officially be classified as a Tier 1, high-quality liquid asset (HQLA) under the Basel III banking regulations. That means U.S. banks can count physical gold, at 100% of its market value, toward their core capital reserves. No longer will it be marked down by 50% as a “Tier 3” asset, as it was under the old rules.Read More |

|

05.15.25- Gold Never Settles (But It Should)

Blythe Masters, former head of world's biggest bullion dealer JPMorgan's Global Commodities Group, once famously said, “Gold never settles.” Read More |

|

05.14.25- "$300 Silver Is ENTIRELY POSSIBLE"

|

|

05.13.25- Central Banks, De-Dollarization, and the Bull Market in Gold

Dr. Nomi Prins kicked off the discussion by framing today’s gold rally as just the beginning of a much larger trend. She forecasted gold reaching $3,000 by the end of 2024, $4,000 in 2025, and $5,000 by 2026. Read More |

|

05.12.25- Seismic Changes in the Global Currency & Precious Metal Markets

|

|

05.10.25- The Great Gold Repricing: $6,000 to $55,000 Forecasts?

|

|

05.09.25- Gold’s Strange Behavior

I know that’s about the most dangerous phrase in all of investing, and virtually everyone who has ever uttered it was ultimately made a fool by the markets. There’s no denying that this gold bull market is unprecedented for a number of reasons. Read More |

|

05.08.25- Why $4,000 Gold Might Be the New Floor (Not the Ceiling)

Your News to Know rounds up the most important stories about precious metals and the overall economy. Read More |

|

005.07.25- How Much Is My Scrap Gold Worth?

Selling gold tucked away in a jewelry box or gathering dust on a shelf can certainly put extra cash in your wallet, but you should manage your expectations. How much you’ll get for your gold will vary wildly depending on its purity. Read More |

|

05.06.25- When To Sell Gold

Economic conditions varied widely, but gold held up better in tough times as well as during periods of growth. In all likelihood, no one who held gold through the past couple of decades regrets it. Why has gold done so well, and when will that change? Read More |

|

05.05.25- Where House Prices May Melt

|

|

05.03.25- The Dollar Falters as Gold Remains Stable

|

|

05.02.25- First Quarter Gold Demand at Highest Level Since 2016

The LBMA gold price hit multiple record highs in Q1, with the average price coming in at $2,860 an ounce. That was a 38 percent year-on-year increase. The gold price was driven by multiple factors, including the specter of a trade war, geopolitical turmoil in the Middle East and Ukraine, stock market volatility, and dollar weakness. Read More |

|

05.01.25- The Dollar and Gold Are Building Energy for a Major Move

|

|

04.30.25- Can Gold Reach $16,000?

Comparing the current bull run to the previous two points to a gold run as high as $16,000 per ounce. I typically analyze the gold price through a framework of how gold relates to "credit assets" (national currencies, debt securities, equity, etc.). Simplified, trends in the ratio between gold and credit assets tell us where we are in a debt cycle, and where we are in a debt cycle reveals in what direction the gold price is heading. Read More |

|

04.29.25- Gold Fortunes Are Changing Hands

|

|

04.28.25- Silver Remains the Undeniable Achilles Heel of Wall Street

|

|

04.26.25- Gold: The Everything Hedge

|

|

Crazy-Overbought Gold!

|

|

04.24.25- The

Patriotic and Moral Imperative for Owning Gold and Silver

|

|

04.23.25- A Stagflation Survival Guide

The United States from 1972-1982 is the textbook case. Inflation raged as high as 14%, real economic growth was practically non-existent, and unemployment reached 9.7%. Read More |

|

$10,000 Gold This Year? Monetary Reset Breadcrumbs In Plain Sight

|

|

04.21.25- The Global Safe Haven Is Slowly Breaking: Why Central Banks Are Turning To Gold

On April 1st, I wrote: “The erosion of trust: the times are changing.” That warning has since become a headline. Read More |

|

04.19.25- The “Too Crowded” Gold Trade

This marks the first time in 2 years that the Magnificent 7 tech stocks did not top the “overcrowded” survey. Read More |

|

04.18.25- Gold On Fire

It began last night, as the price of gold began to take off in overseas trading. The chatter on X alerted those of us trying to get away from the markets for a few hours to what was going on. I took a moment from my BBQ to check the price. It was up about $40, no news. Read More |

|

04.17.25- Gold Surges Past $3,300 –

|

|

04.16.25- Tech Bros vs. Gold Bugs

Symptoms include buying stocks at 50x revenue, chasing a handful of big names to ridiculous prices, and believing the bull market can last forever. This particular strain of tech mania has been here for centuries: Read More |

|

04.15.25- Gold Once Again Proves Its

Spot gold opened the week just below $3,040 an ounce. During Monday’s stock rout, the yellow metal plunged below $3,000 and tested $2,950. That was as low as gold would go. Read More |

|

04.14.25- As Global Tariffs Escalate, The Elites Are Buying Gold & Silver

|

|

04.12.25- Bonds Break, Bullion Breaks Out

No, what we’re seeing in the markets is not “normal.” Instead, this is the:

|

|

04.11.25- “Liberation Day” or Financial Shockwave? What Trump's New Tariffs Really Mean for You

|

|

04.10.25- Tariff Needle + Debt Balloon = Era-Ending Liquidity Crisis

Navigating such market stress, historical debt realities, the role of gold and the absolutely critical importance – and meaning – of a liquidity crisis requires a far more balanced assessment than “blame it all on the tariffs.” Read More |

|

04.09.25- Silver: A Rare Buying Opportunity

However, what is interesting this time is that silver has failed to grab any of the spotlight, which presents a truly rare opportunity for shrewd investors with a long-term vision. Read More |

|

04.08.25- President Trump’s Metal Tariffs Morass

|

|

04.07.25- Silver Supply Gap, Tariffs, Gold to Silver Ratio, & Ask Me Anything

|

|

04.05.25- Bathwater, Baby, and Silver

The S&P is down 4% and the Dow and tech-heavy Nasdaq aren’t far behind. Your screen is a sea of red. Maybe your palms are sweating. Maybe you’re frozen, just staring at the numbers, thinking about your portfolio and 401k.Read More |

|

04.04.25- Gold price retreats from record as it joins market selloff triggered by tariffs

Spot gold was down 0.5% to $3,118.75 per ounce by 10:30 a.m. ET after scaling a record of $3,167.57 earlier. US gold futures fell 0.8% to $3,140.20 an ounce in New York. Read More |

|

04.03.25- Gold SWOT: Gold-Backed ETFs Added the Most Assets in More Than Three Years

|

|

04.02.25- Gold Reset On The Horizon

|

|

04.01.25- Coming Soon: Silver’s Mania Phase

I experienced my first and only silver mania from 2009-2011. There’s nothing quite like it in the investment world. Simultaneously thrilling, nauseating, and lucrative. Silver is tiny compared to gold and other commodities, so bull markets tend to be almost violent in nature. Once generalist investors get involved, things can quickly get out of hand, in the best kind of way.Read More |

|

03.31.25- You’ll Be Amazed How Much Higher

|

|

03.29.25- Bonfire Of The Paper Asset Vanities & The Rebirth Of Gold

The picture to the right shows the Bonfire of the Vanities (Falò delle Vanità)in 1497 in Florence. Objects of sin like art, books, cosmetics etc were burnt. Tom Wolfe wrote an excellent book with the same title in 1987. Some time ago, I wrote an article with the title: THE MOST IMPORTANT ARTICLE I HAVE PENNED. Read More |

|

03.28.25- As Gold Breaks Out Why Is Platinum Watching From the Sidelines?

What is causing this divergence? Over the last two years, platinum has shown a moderate correlation with gold (+0.47), however, the yellow metal has recently left its cousin in the dust. Read More |

|

03.27.25- Silver’s 3x Upside

|

|

03.26.25- Who’s Got the Gold?

I was a young man at the time and had previously bought gold, albeit on a very small scale, but I recall looking into the face of this delusional man and thinking, “This is not good.” Read More |

|

The Price of Gold: A Woefully Outmoded Law Needs Updating

|

|

03.24.25- Price vs Value – Will Gold Hit $3460?

|

|

03.22.25- Why Is Gold Soaring?

After a dizzying run to $3,000 that has stunned even the most ardent gold bulls, the yellow metal has continued to climb. Count me among the dumbfounded bulls. I stood in awe at how easily gold had achieved the latest millennium number, even as it was hesitating at $3,000. But since then, the run has continued, punctuated by a $34 jump yesterday even as other asset classes were diving. Read More |

|

03.21.25- Gold vs Toxic Brews of Financial Repression & Capital Controls

And this, by the way, always results in more centralization from on high and more pain for the man on the street. Every. Time. Read More |

|

03.20.25- Gold Discussion: Chatting with A Dead Economist: Charles Rist

Gold, that most divisive of metals, has been much talked about of late as its market price surges, a strange thing to witness considering that it was long ago banished from the monetary system and condemned as a “barbaric relic.” It’s even stranger considering that, in our time, to talk respectfully about gold usually requires seeking out someone dead to do it with, and one such someone is the French economist, Charles Rist. A reading of his History of Monetary and Credit Theory (published in 1938) not only delivers on what its title promises but also includes a strident defense of the gold standard. Read More |

|

03.19.25- Gold vs. Nvidia

But first, before we get into gold let’s discuss a high tech darling, beloved by the stock market, namely chipmaker Nvidia. Because, as my Paradigm Press colleague Enrique Abeyta predicted at the end of last year, “Sometime in 2025, Nvidia will lose a trillion dollars of market cap.” Read More |

|

03.18.25- Gold’s Warning Signal

At least $4.6 trillion was pumped into the economy in the form of stimulus checks, forgivable loans, tax breaks, and healthcare spending. Read More |

|

03.17.25- Gold Breaks $3,000, But Here’s Why Silver Could Steal the Show…

|

|

03.15.25- Why Bitcoin Is NOT Equal to Gold

Cryptocurrency enthusiasts often refer to Bitcoin as “digital gold” and consider both as equal forms of sound money. In reality, gold and Bitcoin are quite different in asset quality and in terms of their hierarchy as sound money. Read More |

|

03.14.25- Fort Knox, Government Secrecy, and the True Role of Gold

Yet, despite this public stance, the US government still holds one of the world’s largest gold reserves. Read More |

|

There’s Only 0.04% of USA's GOLD Left. Can Trump Buy it Back For $42?

|

|

03.12.25- Silver as a Hedge Against Market Chaos

|

|

'The Jig is Up' -

|

|

03.10.25- Silver is the New Gold

|

|

03.08.25- The Current Monetary System

In this patient deep dive, Piepenburg gives his blunt insights on the macroeconomic setting, carefully addressing all the core themes affecting our lives and finances, from global debt markets, geopolitical brinksmanship, the bubble danger in risk asset markets, and the growing tide of fiat money debasement to the rise of gold pricing/interest and the ever-evolving but ever-controversial “gold vs. BTC” saga. Read More |

|

03.07.25- Here’s How

|

|

03.06.25- Why Verifying Fort Knox Gold

|

|

03.05.25- The Revenge of the Gold Bugs

The people who spent all of their time marginalizing gold bugs as nutjobs and conspiracy theorists are starting to find themselves out on the fringe. Read More |

|

03.04.25- And Now, for Something Entirely Different: The Deeper Dive, Recession

|

|

03.03.25- Forget Fort Knox - the greater MISSING GOLD question should focus

|

|

03.01.25- Gold’s Historic Rally

Since the U.S. dollar is also near interim highs based on leading indices, gold’s performance when measured in euros, sterling or Swiss francs is even stronger. We expect this trend to continue and to push gold solidly above the $3,000 per ounce level on its way to even higher levels in the months ahead. Read More |

|

02.28.25- Even The NYT Is Saying, "Buy Gold"

But money printing and sustained artificially-low interest rates are why inflation keeps resurging. Read More |

|

02.27.25- The Value of the Dollar Does Not Depend on the Size of the US Gold Stockpile

Virtually everything the US government owns is stolen, whether it’s stolen from Americans or from foreign institutions. Read More |

|

02.26.25- ETF Inflows Indicate North American Investors Jumping on Gold Bandwagon

Last week, 48.8 tonnes of gold flowed into North American-based gold-backed funds. The last time we saw weekly flows at that level was April 2020 as governments were locking down economies during the COVID-19 pandemic. Read More |

|

02.25.25- Impulse Power: How to Spot Gold's Next Breakout

|

|

02.24.25- Wild Times in Precious Metals

You’d think that gold would have gotten more attention after such an impressive run. But until recently, this has remained a largely neglected asset class. But Now…DamnIn just the past few weeks, the news surrounding gold has gotten both strange and frantic. Here are a few of the events/trends that are making gold interesting for the generalist investor masses. Read More |

|

02.22.25- The Politics of Gold: Why Gold's Price is Rising so Much

|

|

02.21.25- Death of the Penny and What this Means for Gold

|

|

02.20.25- Whose Gold, if anyone’s, Is in Ft. Knox

Many bullion dealers believe that any gold in Ft. Knox is not ours. Over the decades the gold was “leased” to bullion dealers who sold it into the gold market, thereby protecting the value of the dollar by holding down the gold price. “Leasing” the gold means that the US can still claim to own the gold. A sale has to be recorded, but not a “lease.” Read More |

|

02.19.25- A Problem So Big Not Even 8,000 Tons of Gold Can Fix It

|

|

02.18.25- Gold Revaluation: Solution or Desperation?

And things like politics can be, well… emotional at best or divisive at worst. Shared Concern Among So Much Division? Read More |

|

02.17.25- "Let's Do It": Rand Paul Supports Fort Knox Physical Audit After ZeroHedge Suggestion Goes Viral

What we do know is that the last 'audit' of America's gold stash was conducted on Sept. 23, 1974, when the US Treasury opened just one of its 15 vaults at Fort Knox so politicians and reporters could swarm the site for a two-hour photo-op with roughly 6% of the alleged amount held. Read More |

|

02.15.25- Missing Metals: The Big Gold Squeeze

Much of the bullion is coming from London, where the Bank of England (BoE) is having some… issues delivering its customers’ gold. BoE is a major gold depository which claims to hold more than 5,000 metric tonnes of gold in its underground vaults. The precious metal is held for both central banks and commercial groups. Read More |

|

02.14.25- How To Cash In On Golden Lottery Tickets

One year ago, an ounce of gold could be bought for about $2,000 per ounce. Since then, the price of an ounce of gold has increased about 46 percent. But is gold really 46 percent more valuable than it was just one year ago? Read More |

|

02.13.25- Gold Outlook: Murky For the Metal, Bright For the Miners

It’s another great day for gold, with $2,800 in the rearview mirror and $3,000 in traders’ crosshairs. This means it’s time to take a deep breath and consider gold’s — and the miners’ —near-term prospects. Read More |

|

02.12.25- Gold Miners or NVIDIA? You Choose…

You can either own Stock A that’s down 10% on the year amid negative headlines. Or you can own Stock B trading at record highs with a 17% return year-to-date. Perhaps it seems like a no-brainer. I prefer to buy strength and sell weakness, so I know I would take Stock B any day. Read More |

|

02.11.25- The Silver Squeeze: Market Manipulation and the Coming Storm

|

|

02.10.25- Why a Chinese Gold Mania

The current gold bull market began in the spring of 2024, fueled in large part by aggressive Chinese futures traders on the Shanghai Futures Exchange (SHFE), while Western investors remained largely on the sidelines. In just six weeks between March and April, these traders propelled gold prices up by $400, or 23%—an extraordinary surge for the yellow metal. Since then, their activity has quieted, but I’ve anticipated their return, expecting them to push gold to truly staggering levels. Read More |

|

02.07.25- Gold Price Explodes - What It’s REALLY Telling Us

|

|

02.06.25- SILVER ALERT! Musk Calls Out US Mint! Conspiracy at the US Mint is Being EXPOSED!!

|

|

02.05.25- Gold Helps Protect Australians Against Depreciating Aussie Dollar

We know that gold set records in dollar terms, but, how did it perform in other countries? In most currencies, it did even better. Read More |

|

02.04.25- How Silver Could Rise to $100/oz

But we haven’t really seen that yet this cycle. Today we’re going to explore why this is the case, and what it means going forward. Over the past year, gold is up 39%, and silver is up 37%. Don’t get me wrong, both are doing very well. Read More |

|

02.03.25- CENTRAL BANKS to Invest in SILVER? Silver Prices Set to EXPLODE! Here's Why!

|

|

02.01.25- Silver’s Role in

US Debt Crisis and the Yield Curve Warning The US debt burden continues to rise, with debt service costs now exceeding the country’s entire military budget. Treasury Secretary Scott Bessent has ruled out a default, but maintaining obligations requires significant currency expansion. Read More |

|

01.31.25- ALERT! Silver Breaks Higher Over 100DMA! Everybody Knows the Game! $600/oz Silver Coming!

|

|

01.30.2025: On the Brink of the Biggest Oil Shock in History

It’s the world’s single most important energy corridor, and there’s no alternative route. Five of the world’s top 10 oil-producing countries—Saudi Arabia, Iran, Iraq, United Arab Emirates, and Kuwait—border the Persian Gulf, as does Qatar, the world’s largest liquefied natural gas (LNG) exporter. The Strait of Hormuz is their only sea route to the open ocean… and world markets. Read More |

|

01.29.25- We are Witnessing A Prelude to the Biggest, Baddest Silver Squeeze

|

|

01.28.25- David Morgan: Gold, Silver, and Surviving the Trump Economy

David Morgan’s book, The Silver Manifesto, was recently listed among the top 5 books on sound money for 2025. The conversation spanned a variety of topics, including the impact of the current political climate on precious metals markets, tariffs, economic challenges, and strategies for investing in metals. Read More |

|

01.27.25- BTC: Desperate Times Require Centralized Measures

Fast-forward to today, and the Trump administration is promising a BTC “strategic reserve” stockpile while Fink (who has since launched a $50B+ BTC spot ETF) is at Davos front-running a 700,000 price target due to BTC’s critical role in a world of currency devaluation. Read More |

|

01.25.25- Gold Miners’ Best Quarter Ever

|

|

01.24.25- Gold Investors: A Time To Rejoice

|

|

01.23.25- Buying Gold Bullion: What to Know

Buying gold bullion remains an appealing option for Americans who are growing increasingly wary of a volatile economy and other instabilities. If you are looking to protect your own savings and lifestyle, then it may be time to consider investing in precious metals. Read More |

|

01.22.25- How High Will Silver Go With These Potential Tariffs? $45 Silver Maples Incoming?

|

|

01.21.25- Gold In 2025: After The Rally

|

|

01.20.25- Gold's Entering Its

While this recent pause has tested the patience of many investors, I've consistently maintained that it was a healthy consolidation phase, paving the way for even greater gains. Now, as I'll demonstrate with numerous charts, gold is breaking out of its post-election trading range across nearly every major currency, reaffirming its bullish momentum. Read More |

|

01.18.25- Gold Defied Spent Dollar

|

|

01.17.25- Roosevelt Also

QUESTION: I made a bet that a friend was wrong that Roosevelt also confiscated silver. I never heard of that, only gold. He said I should write to you and you will decide who wins.Thanks. ANSWER: Sorry, you lose. He must have been at one of my conferences when we discussed that if he told you to ask me. Most people have never heard that Roosevelt also confiscated silver – not just gold. On August 9th, 1934, U.S. President Franklin D. Roosevelt implemented the seizure of all silver situated in the continental United States with Executive Order 6814 – requiring the Delivery of All Silver to the United States for Coinage. This was the same abuse of executive power as Executive Order 6102, which FDR signed on April 5th, 1933, “forbidding the Hoarding of Gold Coin, Gold Bullion, and Gold Certificates within the continental United States” with some differences. Read More |

|

01.16.25- Why Gold & Silver EFP Premiums Are Blowing Out Again

I’ve referenced several of Bob Coleman’s comments about the situation (Bob is a bullion dealer and fund manager), and today I was able to catch up with him and interview him about what’s going on.Read More |

|

01.15.25- Goldman Sachs Forecasts Huge Shift in Gold Prices

|

|

01.14.25- My Favorite Way to Play Gold’s Rise

Both have ripped higher together. Historically, these two are often inversely correlated, meaning when the bond yields are high, gold is weak. And vice versa. But no longer. The chart below shows the price of gold vs. U.S. real interest rates (10y bond yield minus inflation expectations): Read More |

|

01.13.25- Massive Silver Flows, Potential Short Squeeze from Trump Tariff Threat

As of Friday midday recording, gold is trading at $2,709, its highest mark in a month and up 2.1% for the week. Silver meanwhile is coming in at $30.65 which is a gain of just over 80 cents or 3% since last Friday’s close.Read More |

|

01.11.25- Jobs Moving Gold Shifting

|

|

01.10.25- The World's First 1/3 oz Gold Britannia Coin

If you’ve heard me speak on Steve Bannon’s War Room or The Ben Shapiro Show, you may have guessed that I’m not a native of the U.S. Actually, I grew up in London – and even though I became an American citizen in 2021, I admit I still have a soft spot for a few British things.Read More |

|

01.09.25- And Now, for Something Entirely Different: Stop Believing

|

|

01.07.25- What Is Gold Whispering?

This commentary is an update and review of a commentary that we published in December 2023. The updated charts are once again very useful. Read More |

|

01.07.25- The Three Biggest Gold Stories of 2024

|

|

01.06.25- 2025: The Year of $3K Gold

Long-time readers will know that I’ve been bullish on gold for a while. Many investors have been flocking to gold in the last few years — and for good reason. It’s a great diversifier, it protects against inflation, and it’s a safe-haven asset when things go awry. Read More |

|

01.04.25- How Has Russia Used Gold to Support Its Wartime Economy?

Central banks around the world have bought thousands of tons of gold over the last several years. The pace of buying picked up after the U.S. and its allies froze Russian dollar assets and locked the country out of the SWIFT payment system. Read More |

|

01.03.25- Gold 2025 Outlook: More Room to Run

|

|

01.02.25- A Toast to 50 Years of Legalized Gold

Gold enthusiasts can celebrate a golden anniversary on New Year’s Eve and simultaneously mark a market manipulation milestone. Read More |

|

01.01.25- History Shows Gold Could Repeat

Gold doesn’t succumb to fly-by-night momentum rallies, but price trends that can sustain themselves over time. As Citi analysts data noted in the Wall Street Journal, gold futures that have risen by at least 20% tend to rise again the following year. This occurred in five of the last six years where futures averaged at least a 15% gain. The only time this didn’t occur was in 2021 where the precious metal fell 3.6% after rising 25% the previous year. Read More |

|

12.31.24- Experts Are Predicting Continued Growth for Gold in 2025

|

|

12.30.24- Gold prices slip

At 15:09 ET (20:09 GMT), spot gold fell 0.3% to $2,646.06 an ounce, while gold futuresexpiring in February slipped 0.3% to $2,662.44 an ounce. Read More |

|

12.28.24- Why Robert Kiyosaki Says Buy Silver ASAP ‘Even If You Have Very Little Money’

Silver is notable in this regard, as U.S. News & World Report indicated , as its industrial uses — particularly concerning electronics and healthcare applications — are widespread and growing in scope. Read More |

|

12.27.24- Here's Why I'm Afraid Of $10,000 Gold

|

|

12.26.24- China Secretly Snaps Up More Gold, Positions for Its Greater Global Role

And while cross-border trade statistics from the U.K. for November have yet to be released, I foresee another purchase of a similar magnitude. Read More |

|

12.25.24- India Gold Imports at Record Levels in November

India ranks as the second-largest gold market in the world. Read More |

|

12.24.24- Christmas ISN’T Canceled

Buyers are melting down following Wednesday’s Powell presser, crushing the hopes and dreams of a market melt-up into the holidays. This week’s rate cut didn’t register on most folk’s radar. After all, a 25 basis point cut was a sure thing. What the market clearly wasn’t expecting were Powell’s comments that the FOMC wasn’t planning on as many cuts in 2025 as advertised. Read More |

|

12.23.24- Will there be a Santa Rally this year?

Take the “sell in May and go away” theory, for example. It suggests markets tend to underperform or become more volatile between May and October due to reduced summer trading volumes. Read More |

|

12.21.24- Inflation Bites: The $38 Million Man

Federal Reserve Chairman Jerome Powell acknowledged the pain of price inflation during his press conference at the close of the December FOMC meeting.

|

|

12.20.24- The Real Reason Food Prices Keep Going Up

The good news is that, thankfully, we still have ample food. Food security – in other words, hunger – just isn’t something most Americans have to worry about. In fact, it might come as a shock to you that 13.5% of U.S. households don’t have that privilege. They don’t always have enough food for a healthy, active life. Read More |

|

12.19.24- Head of Largest Russian Oil Producer Says Gold Could Rival the Dollar

Russian policymakers have a vested interest in undermining the dollar, so their rhetoric should be taken with a grain of salt, but it’s worth paying attention to what they say. Others around the world undoubtedly sympathize with the Russian viewpoint thanks to America’s weaponization of the dollar. Read More |

|

12.18.24- China May Buy More Gold As Trump Returns To Office

Not surprisingly, the price of gold rallied after PBOC revealed its purchases. The bank added 160,000 ounces to its reserves, which have grown to 72.96 million ounces. Read More |

|

12.17.24- Is Selling Gold Right Now a Mistake?

With inflation worries mounting, investors sold gold. Wait. People sold an inflation hedge with increasing signs of inflation? Yes. You read that correctly. Read More |

|

12.16.24- Gold & Silver Bull Has More Time Left Than You Think

However, as we wrote last week, a new secular bull market in the entire precious metals sector cannot begin until Gold breaks out against the conventional 60/40 investment portfolio. Read More |

|

12.14.24- Gold Stocks Big Bargains

|

|

12.13.24- And Now, for Something Entirely Different: A Personal Announcement

|

|

12.12.24- The Secret Connection Between Bitcoin and Gold Prices

Your News to Know rounds up the most important stories about precious metals and the overall economy. Read More |

|

12.11.24- Trump Tariffs will Trigger Global Trade War, with Gold and Silver Set to Benefit

In the space of less than two weeks, Trump has lost no time in firing off import tariff threats against China, Canada, Mexico, and all nine member countries of BRICS (a grouping which represents 45% of the world’s population). In doing so, Trump is rekindling fears of global trade wars and creating global economic uncertainty. Read More |

|

12.10.24- Gold And Silver Take Off

That was my first thought on seeing gold up about $45...and silver jumping 4%...this morning while other markets weren’t confirming the moves. The Dollar Index was down, but not much. Treasury yields were actually higher. And the stock market was flat (and has since turned lower). Read More |

|

12.09.24- 2025 Gold Price Predictions: Off to the Races

|

|

12.07.24- Trump’s Tariffs Are Coming – How Will They Affect Your Finances?

Trump has made it clear that tariffs will be one of his primary tools in his new administration. One opinion piece observed (or complained?) that tariffs “are becoming Trump’s silver-bullet solution to everything.” Read More |

|

12.06.24- Silver Alert! Silver Ready to Explode Higher as Theta Prepares to Change the world!!

|

|

12.05.24- Eastern European Countries Loading Up on Gold as Chaos Hedge

Poland, Hungary, and the Czech Republic have been among the top gold buyers this year, with Poland leading the way. As a Bloomberg report put it, “Striving for a sense of security is a powerful motive in a region that’s been ravaged by Europe’s wars of the past — and that now finds itself next door to the continent’s deadliest conflict since World War II.” Read More |

|

12.04.24- Gold Should Be At $5000 Based Exploding National Debt

|

|

12.03.24- Gold & Silver Are Stabilizing

Last week saw relatively quiet, low-volume trading across gold, silver, and other financial markets, largely due to the Thanksgiving holiday in the United States. The week began with gold and silver pulling back, partly on news of hedge fund manager Scott Bessent—who happens to be a gold bug—being nominated by President-elect Donald Trump for Treasury Secretary. Read More |

|

12.02.24- 3 signs a gold revaluation is coming

|

|

11.30.24- Silver Buying Opportunity

So 8.6x more silver is mined annually than gold. Yet gold trades at about 86x the price of silver today ($2,633/oz for gold and $30.60/oz for silver). What explains this disconnect? The primary differentiator is the fact that central banks buy and hold large quantities of gold. Global central banks and governments hold approximately 36,700 tons, or roughly 17% of all gold ever mined. Read More |

|

11.29.24- Gold’s Fundamentals Are Intact, With One “Great” Exception

Pay no attention to the fact that he is going to use well worn and unsuccessful tricks of trade wars past, that he is going to increase the already incalculable national debt, and try to stimulate the appearance of “America great again” for the average Joe. It’s not going to work. You know it. I know it, and anyone with a modicum of economic sophistication knows it. Read More |

|

11.28.24- Gold Will Rise By Multiples

As Eastern and Southern Central Banks substantially increase their gold holdings, Western Central Banks will most probably have little physical gold in their coffers. Total global gold reserves allegedly held by central banks (37,000 tonnes) are valued at $3.1 trillion at the current market price of $2,700. That value is absurd when one US company – Microsoft – has the same valuation. Just think about it: Microsoft is as big as the gold backing of the global financial system. Read More |

|

11.27.24- The Latest Gold Survey Found Something Very Interesting

It's good to see articles like this that fully acknowledge the recent slump in the price of gold provided a great buying opportunity for latecomers. Some prospective buyers have been waiting a year or more, since $2,100/oz. to buy gold. It’s been a long wait. Even then, at $2,600 an ounce, gold was hardly the bargain some were hoping for. Read More |

|

11.26.24- We Are in a Government

At the start of the year, the US zipped past $34-TRILLION in debt. In July, we zoomed past $35-TRILLION. And now, in even less time, we screamed past $36-TRILLION. The mileposts to financial doom are flying by so fast they are just a blur now, and the rate at which they are going by is rapidly accelerating.. Read More |

|

11.25.24- Gold & Silver Still Near Ground Floor Opportunity

Silver broke out from 4-year resistance and recently reached an 11-year high, touching $35/oz. However, the ongoing secular bull market in US Stocks and the emerging bubble in cryptocurrency have stolen its shine. Read More |

|

11.23.24- And Now, for Something Entirely Different: The Choice

Daycare for Adults Sometimes things must get worse before they get better. Reducing deficit spending and eliminating government waste, for example, will initially have a negative impact on GDP and employment. Though, this is exactly what is needed to restore America’s economic health. Read More |

|

11.22.24- Could the Rapid Growth of AI Boost Gold Demand?

According to a report by the World Gold Council, the answer is yes. Gold's excellent conductivity and its malleability make it an important component in the manufacture of electronic devices. Gold can be formed into extremely thin wires, making the metal ideal for use in small computer chips. Read More |

|

11.21.24- Connecting Dots: Fort Knox,

Years ago, a floor broker with deep ties to major bullion banks made a startling statement: Fort Knox holds "nothing but moths and half-eaten IOUs." We all laughed back then. But as time passed, I realized he was right. Recently, something Egon von Greyerz said brought that old memory rushing back: Read More |

|

11.20.24- Gold & Silver Are Rebounding

The question remains whether the bull market is back in force over the short term or whether this is merely a technical bounce. Read More |

|

11.19.24- Gold SWOT: The Global Silver Market Is Set to Record a Physical Deficit in 2024

|

|

11.18.24- Gold In a Trump Era:

A Revolution Coming? Needless to say, Donald Trump recently won the US election, and as JFK Jr. said of this “impolitic” figure, a “revolution” is coming. Depending on one’s politics, such a “revolution” is either music to one’s ears or the potential for “fascism American style.” Good grief… Read More |

|

11.16.24- Trading Gold is unlike

Dear readers! Gold has its own laws in trading. The most emotional of all financial assets is traded unlike anything else. Unlike any other commodity, every ounce newly mined adds to the existing stock of Gold. It moves from vault to vault, in various forms. Occasionally it is melted down and given a new form as jewelry, ingots, coins or something else. It is thus not consumed and is not lost. Every year, around 3,500 tons of new Gold are mined, which are added to the existing stock. Read More |

|

11.15.24- The Sell-Off in the Precious Metals Sector May Be Winding Down

|

|

11.14.24- Gold Is Back—And So Is Judy Shelton

Earlier this year, the precious metal soared past $2500 an ounce to all-time price highs, making it one of the best-performing assets of 2024, following a price gain of 13 percent in 2023—the result of persistent economic as well as geopolitical uncertainties. Read More |

|

11.13.24- Gold Demand in Tech and Industry

Gold is fundamentally money, but there is demand for the yellow metal in industry and technology. Industrial and tech demand accounted for 83 tons of gold in the third quarter, a 7 percent year-on-year increase. It was a 2-ton increase quarter to quarter. So far, in 2024, about 245 tons of gold have been consumed in industrial and technical applications. Read More |

|

11.12.24- Europe Is Finalizing Preparations for a Gold Standard

To prepare for a monetary system based on gold, they are buying gold to equalize their reserves to the eurozone average. This balancing of gold reserves in Europe is a key topic. Read More |

|

11.11.24- Researchers Continue to Find New Uses for Silver That Seem Like Science Fiction

Some of these innovations sound like they come straight out of a science fiction movie. According to the Silver Institute, industrial demand is expected to rise by 4 percent to a record 690 million ounces in 2024. Photovoltaics (PV) and automotive industries are the key drivers. Specifically, new, higher-efficiency N-type solar cells being phased in require more silver than older solar panel technology. Read More |

|

11.09.24- "People Have NO IDEA What's Coming In 2025...": Gold and Silver Price 2024

|

|

11.08.24- Election Results Are In: Gold and Silver are the Real Winners of 2024

Despite the usual hype of each election cycle being “the most important,” Maharrey offers a different perspective, suggesting that regardless of the outcome, Americans are likely to see the same trends continue—big government, increasing debt, and ongoing monetary policy impacts. Read More |

|

11.07.24- Gold and Bitcoin Will Jump Under ‘Debasement Trade’ Rule: JPMorgan

|

|

11.06.24- The Silver Short Squeeze: A Historic Market Battle in the Making

|

|

11.05.24- Why Global Gold Demand Has Never Been Higher

|

|

11.04.24- Gold Is on the Ballot

That one’s easy. Kamala Harris. A President Harris administration would preserve and strengthen the status quo. To start with, we’d see a continued bonanza of bad regulation, spending and taxes. Add in poor capital allocation and misaligned incentives, and we have a recipe for stagflation and reckless monetary policy. Read More |

|

11.02.24- Silver Short Squeeze Coming?

Gold’s rally, which started in mid-February, has been underpinned by increased geopolitical risks, the upcoming US election, central bank buying, and slowing ETF sales. It last traded at $2,744 an ounce, up 37% so far in 2024. Read More |

|

11.01.24- Third Quarter Gold Demand Breaks Record

Including over-the-counter (OTC) sales, gold demand came in at 1,313 tons in Q3, a 5 percent year-on-year increase. Read More |

|

10.31.24- Your Mag 7 Earnings Guide

TSLA posted its best trading day in over a decade when management announced it topped Q3 profit estimates and improved automotive gross margins. Just two days later, the shorts banked losses of $4.2 billion closing out bets against the stock during its historic rally, according to data from S3 Partners. Read More |

|

10.30.24- How Chinese Traders Will Help Drive Gold to $3,000+

|

|

10.29.24- The Golden Rule Is Real

The use of gold as money existed from antiquity until gold backing broke down entirely in 1971. Still, central banks and finance ministries hold over 37,000 metric tonnes of gold in reserve. Read More |

|

10.28.24- Silver Price Forecast:

|

|

10.26.24- This Points To Significantly Higher Silver Prices

The Dow/Silver ratio needs to rise above the double blue line in order to reach parity with the Dow since the creation of the Federal Reserve. In current prices, that would mean silver’s price needs to be above $340. Read More |

|

10.25.24- JP Morgan: “Debasement Trade” Is Increasing the Gold Price

Your News to Know rounds up the most important stories about precious metals and the overall economy. Read More |

|

10.24.24- Silver, the A-Bomb, and Russia

They had figured out a way to enrich uranium using electromagnets, but it was a highly resource-intensive process. Read More |

|

10.23.24- Record High Gold Price Signals "Fragmenting Global System"; El-Erian Warns

In setting one record level after the other, it seems to have decoupled from its traditional historical influencers, such as interest rates, inflation and the dollar. Moreover, the consistency of its rise stands in contrast to fluctuations in geopolitical situations. Read More |

|

10.22.24- Gold Fever

|

|

10.21.2- In a Rare Candid Moment, Three Central Bankers Talk Up Gold

Three central bank officials went off script at the London Bullion Market Association conference in Miami. Reserve managers from the central banks of Mexico, Mongolia, and the Czech Republic sat together on a panel at the conference, and all three indicated their countries plan to add even more gold to their reserves in the near future as tensions increase and global interest rates decline, creating more inflationary pressure. Read More |

|

10.19.24- Russia’s Silver Pivot: A Historic Shift That Could Reshape Global Finance

In a development that has received surprisingly little mainstream media attention, well not that surprising hunh?, Russia is set to make a move that could fundamentally alter the global precious metals landscape. Read More |

|

10.18.24- 30 Sec To Midnight: "Stock Insiders Are Selling, I'm Buying SILVER"

|

|

10.17.24- Jim Willie: "They're Selling A Lot Of Treasuries & Buying Gold"

Although fortunately to dig into the latest events, including the series of hurricanes that have caused great damage to the affected areas, and FEMA's response, as well as Jerome Powell's aggressive rate cut while he simultaneously claimed that he doesn't see any weakness in the economy, Dr. Jim Willie of The Hat Trick Letter joins me on the show to discuss all of that and more. Read More |

|

10.16.24- These 3 Conditions Must Be Met Before Silver Surges Like Gold

|

|

10.15.24- Gold Forecast: Physical Gold Is No Longer Cheap – But Gold In The Ground Is

|

|

10.14.24- Indicators Show Increasing Global Silver Shortage

“If you can’t take a small loss, sooner or later you will take the mother of all losses.” Ed Seykota Silver shortage is kryptonite to the system of setting silver’s price with leveraged cash/spot promissory notes in London’s cash silver market – the world’s largest cash physical silver trading market by volume. A promissory note is no substitute for a silver bar when the market encounters physical shortage. Read More |

|

10.12.24- Bottom in Gold & Silver

Bottom in Gold & Silver Prices: What's Next? Despite the slightly higher than expected CPI numbers across the board, a rate cut of 25 bp on Nov. 7 has a probability of 84-87%, a virtual certainty according to interest rate futures. Read More |

|

10.11.24- 5 Gold Charts Battling Breakout Resistance

|

|

10.10.24- The Gold Bull Cycle Has Just Begun

Every day is a circadian cycle for us all. Our bodies move through phases based on our exposure to light or darkness. Markets are also remarkably cyclical, responding to the environment around them. Interest rates, regulation, monetary policy and investor psychology all play important roles. Read More |

|

10.09.24- Iran vs Israel: Game, Set, Match Iran

|

|

10.08.24- Today's Geopolitical Forces Driving Gold Higher

Your News to Know rounds up the most important stories about precious metals and the overall economy. Read More |

|

10.07.24- How About James Bond as a Central Banker? ‘Goldfinger’ Emerges

Growing protectionism and what it portends for global economic growth — not to mention geopolitical stability — induces somber references to the year 1944. The “rules-based” Bretton Woods agreement hammered out by the Allies in July that year, while World War II still raged, puts into sharp relief the consequences of trade and currency wars. Read More |

|

10.05.24- Commodity Outlook: Gold and silver continue to shine bright |

|

10.04.24- Silver: So Much Bigger Than 2011

We had already experienced two rounds of money printing (QE) by then, and the bank bailouts were still fresh on everyone’s mind. Silver prices shot up from $9.40 per ounce in October 2008 to over $49 in April 2011. It was a beautiful run, but ended much too quickly for my liking. Silver stayed above $30 for almost two more years, but as the economy improved, investors lost interest for a time. Read More |

|

10.03.24- Unlike The Great Financial Crisis

They were able to avoid collapse, but the underlying problem (an extremely debased currency) obviously did not go away simply because the solution further debased the currency. Read More |

|

10.02.24- Silver price on the rise

The silver price has increased significantly since the beginning of this year and has now surpassed $31 per ounce. Read More |

|

10.01.24- A Golden Week for Gold

|

|

09.30.24- Triple Digit Silver is in Our Future

|

|

09.28.24- Iran's Gold Imports Surge Sixfold as Part of Sanctions Workaround

This significant uptick in gold acquisition highlights the Islamic Republic's strategic move to circumvent international sanctions and stabilize its economy amidst ongoing geopolitical tensions. Read More |

|

09.27.24- Gold Rising? No — the Dollar’s Falling

The last data point for the net long position for hedge funds was 17 September (COT report) due to be updated on Friday. Since then, open interest has increased by 28,256 contracts on preliminary figures for yesterday (Tuesday). That implies that this category of trader (managed money) is net long of about 240,000 contracts and therefore highly vulnerable to a bear raid by the swaps (bullion bank traders and market makers). And note how the rise in their net position is in lockstep with the price. But there is other evidence which we cannot ignore and is a new factor in the market. Read More |

|

09.26.24- Gold Repatriation Shifting From North To South

Perhaps no other country (except maybe Zimbabwe) understands the value of bullion as a store of value than Germany. Hyperinflation during the Weimar Republic of the 1920s had citizens piling near-worthless Deutsche marks into wheelbarrows just to buy bare necessities. During the Second World War Nazi Germany looted about 4 tonnes of gold and stored it in the Reichsbank. But in 1948 the allies recovered it and gave it back to its rightful owners, leaving Germany’s bullion vaults bare. Read More |

|

09.25.24- Is World War III looming? Experts debate the impact on gold and Bitcoin markets

Roughly 100 years ago, ‘rhyming’ circumstances were setting the stage for the Great Depression and a Second World War, and if we aren’t careful, there is the potential for the global economy to sink into a deep recession/depression while chatter about the potential for World War 3 is also on the rise. Read More |

|

09.24.24- Did the Fed just send gold over $2,600/oz?

|

|

09.23.24- Metal Mania Starts Soon

Interestingly, I’ve never had a driver, or a barber for that matter, pitch me on gold and silver. Despite gold regularly breaking out to new highs, we really haven’t yet seen any signs of a typical retail mania. Read More |

|

09.21.24- Gold Lackluster After Fed

|

|

09.20.24- Hedge Fund Billionaire Says He'd Pull Money from Market and Go to Gold

The Paulson and Co. founder and CEO has been called “one of the most prominent names in high finance.” He’s best known for making billions by betting against the subprime mortgage lending market in 2007. Read More |

|

09.19.24- An Unprecedented Monetary Destruction Is Coming

Additionally, global debt surged by over $15 trillion in 2023, reaching a new record high of $313 trillion. Around 55% of this rise came from developed economies, mainly the U.S., France, and Germany. Unfunded liabilities in the United States amount to $72 trillion, almost 300% of GDP. This may seem high until you look at Spain with 500% of GDP, France with close to 400%, or Germany with close to 350% of GDP. Read More |

|

09.18.24- The 2 Powerful Forces Behind Gold’s Latest All-Time High

Gold hits a new all-time high Read More |

|

09.17.24- It's Starting in October! Shocking Predictions for Gold & Silver!

|

|

09.16.24- Despite Emerging Challenges PV Silver Demand Set To Hit New High In 2024

|

|

09.14.24- ING Bank: This Gold Rally Is Just Getting Started

The Dutch financial group cites the prospect of a Federal Reserve rate-cutting cycle, geopolitical risks, and uncertainty going into the presidential election as potential catalysts to drive gold to new record highs. The report also noted several bullish trends supporting the gold price. Read More |

|

09.13.24- Why Chinese Traders May Soon

|

|

09.12.24- How To Instantly Know the True State of the Economy

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Federal Reserve finally signals rate cuts, Russia is buying gold like it's 2015 and silver price’s growing disconnect from reality. Read More |

|

09.11.24- How to Hedge Anti-Heroes?