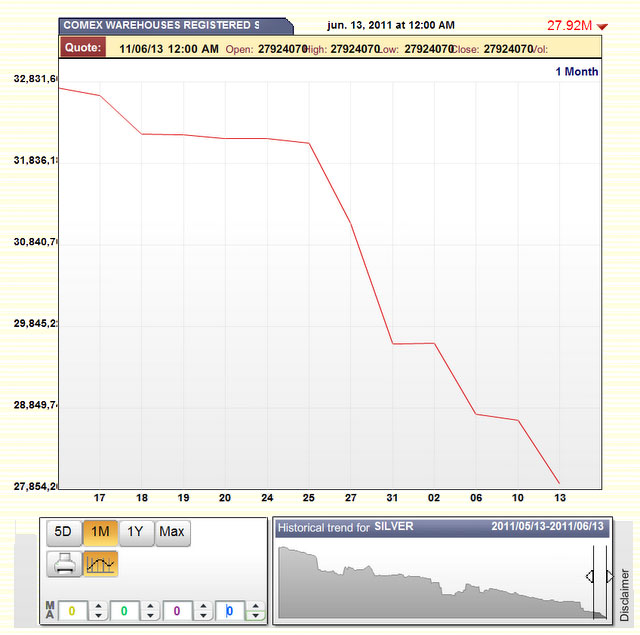

Comex Silver Continues to Fall to Historic Lows

Jesse's Café Américain

|

There were more large silver withdrawals from the Comex Deliverable Inventory with 773,018 ounces taken out of the Brinks depository. Additionally, there were withdrawals of 1,418,178 ounces of silver from the eligible (customer) inventory.

Comex will have to add to their deliverable inventory from some other sources in a tight market. Typically that implies higher prices.

Someone with credibility suggested to me yesterday that a panic liquidation in all assets is in the cards in the minds of the Wall Street banks and the monied class. When you cannot win the game, you kick over the card table and turn out the lights.

Since they are sitting in large pools of cash, thanks to the Fed, this would allow the monied interests to buy good assets up on the cheap, to fill the holes in their balance sheet as they write off their remaining fraudulent assets. A reset for them, and a misery for the rest.

I remain a little skeptical that this is their intent, but it would 'work' to their benefit. After all, 'first by inflation, then by deflation...'

More likely is a longish period of stagflation and continued kicking the can down the road. And a gradual exposure of more fraud in the financial markets, with fake paper assets undermining the real economy and genuine wealth.

And then it gets ugly.

jessescrossroadscafe.blogspot.com |