Send this article to a friend:

December

18

2021

Send this article to a friend: December |

|

Don't Be Fooled: Tapering & Rate Hikes Can, And Will, Crash Markets

I felt like I couldn’t write an article fast enough on Thursday when it appeared the Dow was going to open up over 200 points and Wednesday’s massive rally would continue. But, alas, I got sidetracked and had to temporarily settle for a Tweet to timestamp my thoughts. “Fading yesterday’s rally. At least for now, Powell is posturing like QE is over. While in the long term it’s probably not true, they’re gonna try it first & markets could puke as a result,” I wrote at about 10AM EST during Thursday's trading session. Then, of course, the market turned sour before rallying again on Friday. My prediction isn’t anything new: I think markets could be in for a pasting heading into 2022, with the NASDAQ leading the way, and I have been saying as much for months now. Volatility will continue heading into the new year, I’ve predicted. Here’s the bizarro world we woke up in yesterday:

Photo: CNBC yesterday I spent some time yesterday thinking about why markets would rally so hard after such news on Wednesday and it seemed to be a combination of things:

If you feel like you can keep down your breakfast in doing so, here’s Powell’s full news conference after this week’s rate decision:

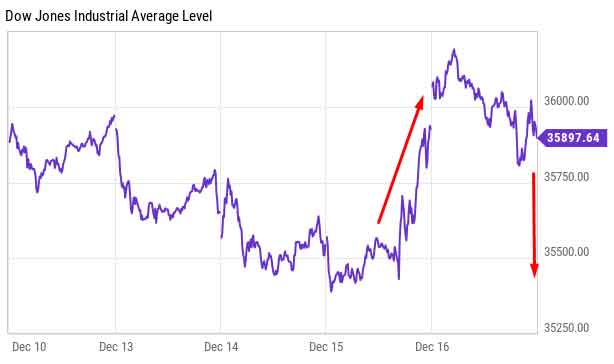

And here is Wednesday’s run higher and yesterday’s slight pullback. The second arrow shows the gap lower I think we have to fill back to the (correct) sentiment from Wednesday that markets should remain under pressure due to the Fed’s agenda. Regardless of what caused Wednesday’s spike, I see it as a bear market-rally-esque fake out to the upside.  And as I’ve noted above, I can’t figure out whether or not the market has actually been conditioned to believe that bad news is still good news, even when it clearly isn’t. Remember headlines like this one, from June of this year?  For the last couple years, any type of bad news always led traders to assume that the Fed would stimulate markets more, resulting in rallies on otherwise “bad news”. It happened over and over and over again: we would get a bad jobs number or we would get an ugly retail sales print, and the market would rocket higher. It was extraordinarily frustrating if you were short the market because it meant your underlying thesis that the economy was dogshit was correct, but that your judgement on the psychological tendencies of cowardly Central Bankers who do nothing but watch charts of S&P futures all day was skewed.

“There is an infinite amount of cash in the Federal Reserve. We will do whatever we need to do to make sure there’s enough cash in the banking system.” - Neel Kashkari, March 2020 And hey, why let markets slip 2 massive bps in the course of a month when we have the resources of “infinite cash” at our disposal anytime we want - right, Neel? I can’t help but wonder whether or not some of the “bad news is good news” attitude has become the standard and has carried over to news of an accelerated Fed taper, which is obviously simply directional vanilla negative for equity markets. Don’t believe me? Remember when Steve Mnuchin wet his pants in 2018 following rate hike plans?  Normally, the market would expect the Fed to respond to bad news, but this time, it’s the Fed’s own inaction that is the bad news. And so, I forsee a wake up call for those who have adopted this backwards ass strategy over the last decade. A taper is negative for markets whether we “expect” it or not. People are acting like because we “expected” this terrible news for equity markets, that we’re just going to be fine sitting atop of the largest bubble in U.S. stock market history. To me, there’s no doubt about it and no sugarcoating it. As Jon Najarian said in my exclusive recent interview with him: “a fast rise in rates will absolutely kneecap the economy and take the stock market with it.” I was encouraged by the reversal yesterday which I thought led credence to my assertions over the last month that markets still have a ways to fall.

This has been a free preview of paid content. We are one week closer to the holidays, which gives me one more chance to remind you that I am offering 20% off subscriptions to my blog, Fringe Finance, that last FOREVER if you use the link provided today: Get 20% off forever My Disclaimer: I have been trading in and out of all names I write about. I may add any name mentioned in any article and sell any name mentioned in any piece at any time. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

|

Send this article to a friend:

|

|

|