What Would Happen If the Fed Ceased to Exist?

Charles Hugh Smith

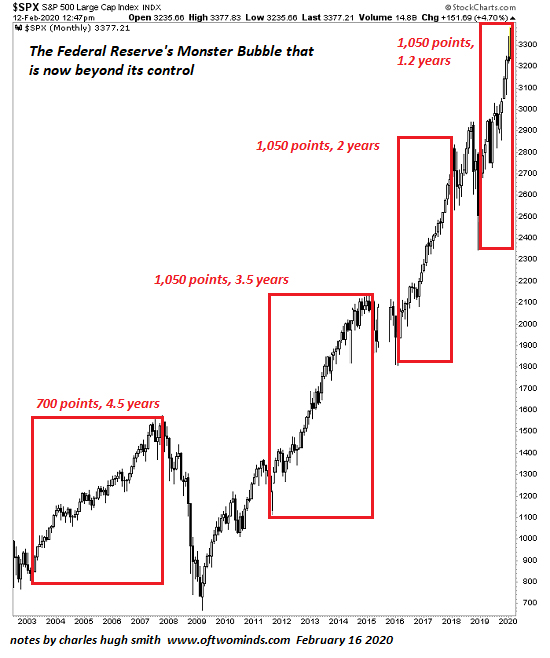

Extremes get more extreme until risk breaks out; then the reversal will be as extreme as the bubble expansion. Extremes get more extreme until risk breaks out; then the reversal will be as extreme as the bubble expansion.

What would happen if the Federal Reserve ceased to exist?

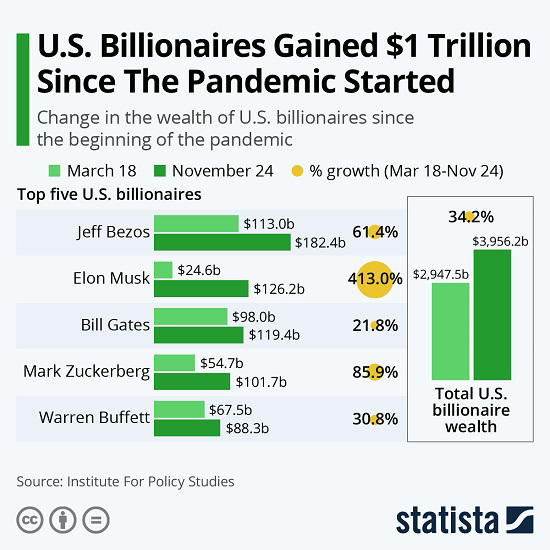

We all know the answer: global markets would instantly collapse and the global financial system, now entirely dependent on Fed stimulus, intervention, manipulation, free money for financiers and endless printing of trillions of dollars out of thin air, would crash, leaving nothing but a steaming, fetid pile of corruption infested by the cockroaches scurrying around gobbling up the few crumbs left.

What would happen if the Federal Reserve ceased to exist?

The Treasury would sell its bonds on the open market, where buyers and sellers would set the yield on the bonds. Private banks would take deposits and lend money at rates set by supply and demand.

We all know what would happen: yields and interest rates would explode higher in response to risk having to be priced in

And every flimsy, worm-eaten enterprise that depended on zero-interest rates would collapse in a heap and every putrid, staggering zombie corporation would crumble to dust, and its phantom assets, illusions generated solely by the artificial spew of the Fed, would fall to their real value, i.e. near zero.

Let's modify the question slightly: what would happen if the Fed's policies stopped working?

In other words, what if the Fed's spew no longer created the illusion of risk-free gambling in bubble-valuation assets? What if risk raised its Gorgon-like head despite every intervention, every manipulation, and every foul burp of propaganda from the Fed?

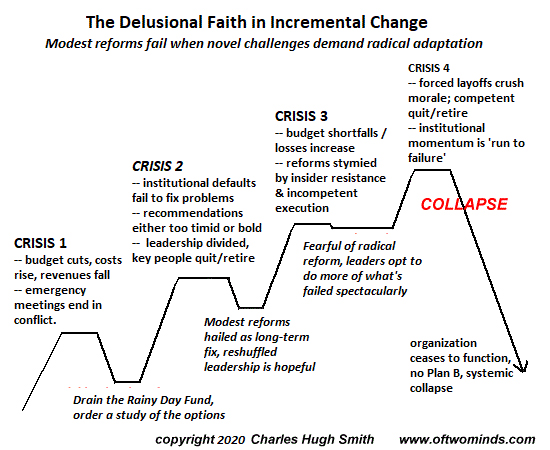

Please glance at this chart of the delusional faith in incremental change

The faith in the Fed's omnipotence that magically reduces the perception of risk to zero is ultimately a faith in incremental change: the Fed tweaks the dials of bond purchases and its spew of free money for financiers, and voila, risk is banished and risk assets get another rocket booster.

Alas, risk cannot be banished, it can only be transferred to others

The Fed's endless spew and its constant tinkering with incremental adjustments have created a delusional faith that these tweaks will work forever and ever.

All that's actually happened is the Fed's spew has transferred the skyrocketing risks generated by its policies to the entire economy

The economy has been capacious enough to absorb the astronomical risks generated by Fed policies, but the economy has been stuffed to the gills with Fed-generated risk, and now the bursting of the risk bubble is upon us.

Put another way, there's no closets left to hide the risk in

Now the risk will escape the Fed's rusting, hubris-soaked chains and decimate the financial sector, which is now the dominant force in the economy. Once the delusions of no-risk gambling and phantom valuations implode, the real economy with undergo a devastating cold turkey withdrawal from the Fed's malevolent spew of free money for financiers masquerading as "stimulus."

Extremes get more extreme until risk breaks out; then the reversal will be as extreme as the bubble expansion

Delusions, illusions, phantoms of value: these are not real. Want to know what's real? Risk.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My new book is available! A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now available$17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

Parallels of the Great Fire of Rome 64 AD to Today (with host Richard Bonugli) (31:40)

AxisOfEasy Salon #34: Reclaiming Capital and Agency

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Become a $1/month patron of my work via patreon.com.

At readers' request, I've prepared a biography. I am not confident this is the right length or has the desired information; the whole project veers uncomfortably close to PR. On the other hand, who wants to read a boring bio? I am reminded of the "Peanuts" comic character Lucy, who once issued this terse biographical summary: "A man was born, he lived, he died." All undoubtedly true, but somewhat lacking in narrative.

I was raised in southern California as a rootless cosmopolitan: born in Santa Monica, and then towed by an upwardly mobile family to Van Nuys, Tarzana, Los Feliz and San Marino, where the penultimate conclusion of upward mobility, divorce and a shattered family, sent us to Big Bear Lake in the San Bernadino mountains.

charleshughsmith.blogspot.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)