President Trump Was Right About the Fed Killing Growth... and About the Coming Economic Boom

Graham Summers

President Trump was right about the Federal Reserve being too hawkish with monetary policy in 2018. And he’s correct now to suggest the Fed should be easing more aggressively. President Trump was right about the Federal Reserve being too hawkish with monetary policy in 2018. And he’s correct now to suggest the Fed should be easing more aggressively.

To be clear, the Fed was correct to raise rates and attempt a balance sheet normalization, the pace of both operations was far too aggressive. As early as mid-2018 it was clear to me that the markets were signaling that Fed policies were killing growth.

Let me give you an example.

Due to its many industrial uses, copper is extremely sensitive to economic growth. When economic growth is accelerating, copper rises. When economic growth is slowing, copper falls.

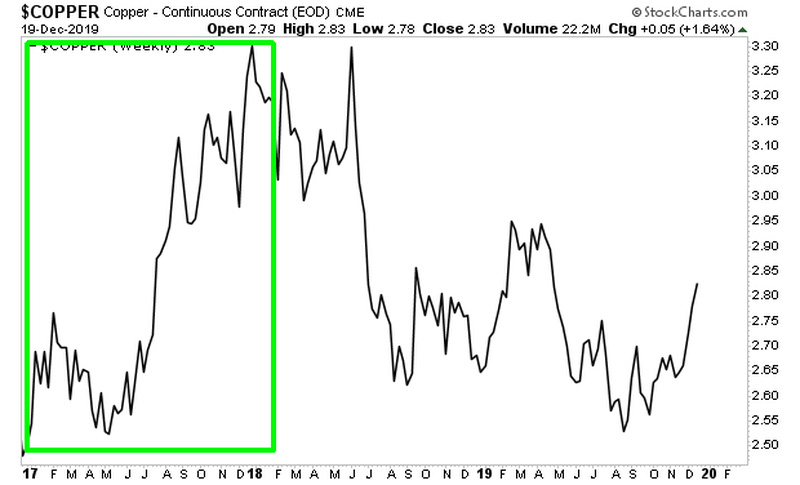

With that in mind, note in the chart below that copper initially rose quite a lot during the first year of the Trump Presidency (green box =2017). This signaled higher economic growth to market watchers such as myself.

However, once the Fed began its aggressive rate hike schedule along with its balance sheet normalization, copper entered a steep downtrend (red box=2018). As you can see, as early as June/ July 2018 it was clear the Fed was killing economic growth as copper entered a free-fall.

How the Fed failed to see this is beyond me as this kind of collapse was playing out in multiple sectors all linked to growth (copper, steel, industrials, etc.). I repeatedly commented on this, but to no avail.

Perhaps, had the Fed slowed the pace of the rate hikes and balance sheet normalization, we would not have had to experience that horrible stock market sell-off in late 2018.

Note also, it was only in early 2019 when the Fed reserved course with its policies and began talking about rate cuts and ending its balance sheet normalization that copper began to rally again. And as of late 2019, it has finally broken its downtrend (purple lines).

This tells me that growth is coming once again. The markets, as you know, are forward looking.

So once again, President Trump was right concerning the Fed killing growth. And by the look of things with copper today, we’re about to experience another economic boom, NOT a bust… which suggests President Trump winning a second term in a landslide.

Indeed, we’ve discovered a unique play on stocks… a single investment… that has already returned 1,300%. And we believe it’s poised to more than TRIPLE in the next 24 months as President Trump secures a second term in a landslide win.

Graham Summers, MBA is Chief Market Strategist for Phoenix Capital Research, an investment research firm based in the Washington DC-metro area.

Graham’s sterling track record and history of major predictions has made him one of the most sought after investment analysts in the world. He is one of only 20 experts in the world who are on record as predicting the 2008 Crash. Since then he has accurately predicted the EU Meltdown of 2011-2012 (locking in 73 consecutive winners during this period), Gold’s rise to $2,000 per ounce (and subsequent collapse), China’s market crash and more.

His views on business and investing has been featured in RollingStone magazine, The New York Post, CNN Money, Crain’s New York Business, the National Review, Thomson Reuters, the Fox Business, and more. His commentary is regularly featured on ZeroHedge and other online investment outlets.

gainspainscapital.com

|