Michael Burry Blasts Fed, SEC Over Most Speculative, Overvalued, Geopolitically-Challenged Market In Decades

Tyler Durden

Having taken aim at Elon Musk earlier in the week, Famous short seller Michael Burry of The Big Short game emerged once again from his latest self-imposed twitter exile to lambast The Fed (and The SEC) for fiddling while Rome burns.

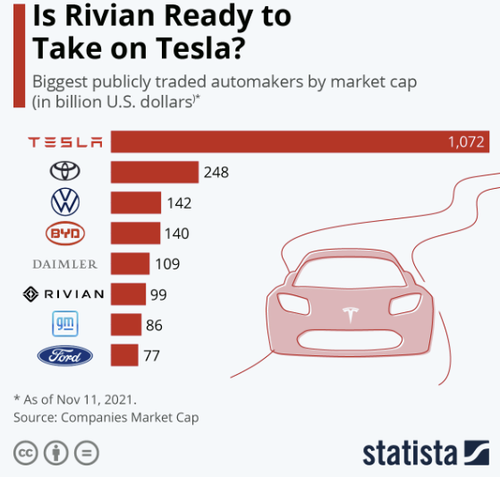

In one tweet, reflecting on the fact that Rivian - the newest entrant into the electric vehicle market - is now worth over $100 billion and larger than GM and Ford:

Burry summarizes the madness perfectly:

-

More speculation than the 1920s.

-

More overvaluation than the 1990s.

-

More geopolitical and economic strife than the 1970s.

And who is to blame as this shitshow continues:

"Players grabbing the barrel of Kyle Rittenhouse's rifle while The SEC and Federal Reserve nod approvingly."

The infamous housing bubble spotter was not done yet, taking aim at the bubbly nature of everything Wall Street, while Main Street suffers under the 'tax' of inflation:

"American real wages - adjusted for inflation - are down 2.2% since Jan 1.

Seems the ONLY truly meaningful thing that’s down this manic, manic year.

Inflation is a massively regressive tax. Never forget it."

Burry has been vocal about warning about our current stock market bubble.

"People say I didn't warn last time. I did, but no one listened. So I warn this time. And still, no one listens. But I will have proof I warned," he Tweeted about markets about a year ago.

He also commented on Tesla golden child Cathie Wood, earlier in the year, Tweeting:

"It is too early, she is too hot, and, today, short sellers are timid, but Wall Street will be ruthless in the end."

Burry, recall, revealed a huge Tesla short earlier in 2021 but as of one month ago he was no longer betting against Tesla and said that his position was just a trade.

Burry has also been vocal warning against a bitcoin bubble. Of course, if he was also short the crypto space in addition to TSLA, his losses in 2021 could be Jess Livermore-sized....

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|