The Fed Has No Way Out

Peter Schiff

We have argued that the Federal Reserve has no exit strategy from this extraordinary monetary policy. In fact, it never could extricate itself from the extraordinary monetary policy it launched during the Great Recession. Today, we’re merely witnessing the same policy on hyperdrive. And there is still no way out. We have argued that the Federal Reserve has no exit strategy from this extraordinary monetary policy. In fact, it never could extricate itself from the extraordinary monetary policy it launched during the Great Recession. Today, we’re merely witnessing the same policy on hyperdrive. And there is still no way out.

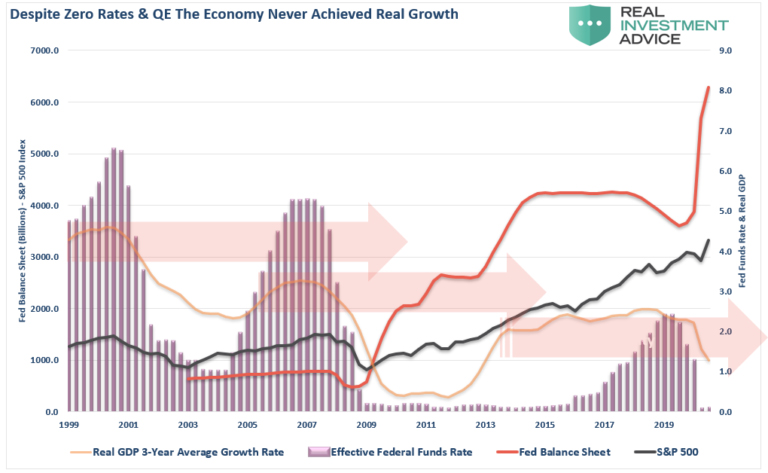

After blowing up its balance sheet to over $4 trillion during the Great Recession, the Fed tried to pull back. Through quantitative tightening, the Fed managed to get it down to just over $3.7 trillion before the stock market tanked in late 2018 and the central bank abandoned its plans to normalize monetary policy. At that point, it ended balance sheet reduction and dropped interest rates three times the following year. Not only that, it relaunched quantitative easing, although the central bankers kept insisting it wasn’t QE.

Most people assume the Fed started growing its balance sheet again as an emergency measure in response to the COVID-19 pandemic. But the balance sheet was already back over $4 trillion before coronavirus even reared its ugly head. The pandemic pressed the easy-money accelerator to the floor and today the Fed balance sheet is over $7 trillion

Since 2008, the Federal Reserve and the US government have pumped more than $36 trillion into the US economy. But they have “bought” very little in terms of economic growth with all that massive “investment.” The Fed has pumped in roughly $12 of liquidity for every $1 of economic growth.

You see this cycle more clearly if you go back to 1999 at the height of the dot-com bubble. Each boom created by the Fed’s monetary intervention has failed to attain the level of economic growth seen in the previous. In other words, as the level of money printing rises during each crisis, the level of growth in the preceding boom falls. Just like the addict suffers diminishing returns and needs more and more of his drug to get him high, the economy needs more and more stimulus simply to maintain the currently tepid level of economic growth.

And now that we’re in this cycle, there is really no way out. As economist Mohammed El-Erian put it, “They are increasingly on what I call a no-exit paradigm.”

Easy money leads to an increased level of debt. The US national debt has ballooned to over $27 trillion. Meanwhile, the Federal Reserve recently issued a warning about growing levels of business debt.

Former Fed Governor Randall Kroszner recently summed it up this way.

The big debts that governments are racking up are going to make it difficult for central banks to raise rates when they feel the need to do so because that will increase borrowing costs.”

Rising interest rates would be the final nail in the coffin for an economy built on piles of debt. It has to continue forcing interest rates low to keep the debt bubble from popping.

Meanwhile, the markets are totally dependent on the Fed. El-Erian said that central banks have “conditioned” the markets to the point that every time the Fed tries to “step back” and normalize monetary policy, the market “forces them back in by selling off and tightening financial conditions.”

This is exactly what happened in late 2018. The stock market threw a tantrum as the Fed nudged rates up and shrank its balance sheet. Powel immediately reversed course, as already noted.

So here’s the $64,000 question: if the Fed couldn’t exit then, how is it going to now with another $3 trillion on its balance sheet (and rising)?

In a nutshell, the Fed is stuck with forever stimulus. As an article at Real Investment Advice put it:

The trap the Federal Reserve has stumbled into is that it continues to require more interventions to sustain lower rates of economic growth. Whenever the Fed withdraws interventions, economic growth collapses.”

So the Fed is stuck between the proverbial rock and a hard place. It can’t withdraw the “emergency” monetary policy. But continuing it forever comes with its own risks, as Bloomberg recently noted.

If the Fed and other central banks are constrained from scaling back emergency stimulus, the continued flood of liquidity could spur asset bubbles and even too-rapid inflation.”

So the Fed is damned if it does and damned if it doesn’t. It truly looks like there is no way out.

Peter is an economic forecaster and investment advisor influenced by the free-market Austrian School of economics. He is one of the few forecasters who accurately and publicly predicted the 2007 housing market collapse and subsequent 2008 financial crisis. His latest best-selling book, The Real Crash: America’s Coming Bankruptcy – How to Save Yourself and Your Country, warns that the 2008 crisis was just the prelude to a larger sovereign debt crisis in the United States that may lead to a collapse of the US dollar. Peter recommends long-term investment in foreign markets with sound fiscal policies, as well as global commodities including buying gold, silver and other physical precious metals.

Peter Schiff’s investment career began with Shearson Lehman Brothers in the early 1990s. In 1996, he and a partner started Euro Pacific Capital in Los Angeles, later moving the headquarters to Connecticut. The firm has since expanded, with offices in Scottsdale, Arizona, Boca Raton, Florida, Newport Beach, California, Los Angeles and New York City. Euro Pacific Capital’s investment strategy focuses on long-term wealth savings in the face of a declining US dollar with an emphasis on emerging market and commodity-focused investments.

Peter is best known for accurately forecasting the 2008 financial crisis. During a Fox News debate in December 2006, Schiff said, “What’s going to happen in 2007 is that real estate prices are going to come crashing back down to Earth.” Business news journals reported that Schiff accurately predicted the crisis, while “nearly all [macroeconomists] failed to foresee the recession despite plenty of warning signs.”

Peter has also worked in the political arena, first serving as an economic advisor for Ron Paul’s 2008 presidential campaign and later running for United States Senate in Connecticut in 2010 as a Republican. Politically, he leans Libertarian, with an emphasis on fiscal conservatism.

Peter started SchiffGold in 2010 after recommending for decades that investors allocate 10-20% of their portfolios to physical precious metals. Peter became concerned that some of his Euro Pacific Capital clients were being misled into purchasing overpriced “numismatic” gold and silver products from gold dealers with unsavory business practices. Peter started SchiffGold to provide a trustworthy alternative that would sell only the most liquid physical bullion products at the lowest possible prices. SchiffGold is backed by Peter Schiff’s Guarantee that it will only sell the most liquid physical bullion products at the lowest possible prices.

Peter’s expertise on money, economic theory, and international investing makes him a highly sought after as a speaker and analyst. He has been quoted and interviewed hundreds of times by media outlets around the world, including The Wall Street Journal, Barron’s, Die Zeit, Tokyo Shinbun, South China Morning Post, Investor’s Business Daily, The Financial Times, The New York Times, The Los Angeles Times, and The Washington Post. He regularly appears on CNBC, CNN, CBC, Al Jazeera, Fox News, and Fox Business Network.

www.europac.com

|