Debt Slavery

Gary Christianson

Breaking news: The DOW hit another all-time high at 28,004 on October 15. Breaking news: The DOW hit another all-time high at 28,004 on October 15.

From Sven Henrich: “The Day of Reckoning.”

“… once again giant inflows of artificial liquidity are dominating the price action in markets irrespective of what’s going on with earnings or growth.”

Debts: Currency and Digital Accounts:

Dollar bills: Dollars are Federal Reserve Notes—a debt of the Fed to you, the holder of the dollar bill. These currency units have no intrinsic value.

Bank balances—checking and savings: You deposited (loaned) currency units to the bank when you made a deposit into an account. Those currency units are now debts owed to you by the bank. The days where you deposited YOUR money (gold and silver) into the bank vault for safekeeping are long gone.

Debit Cards: These cards allow you to transfer dollars owed to you by a bank into another account. The transaction units are debts owed by the Federal Reserve. The bank extracts a slice from every transaction. It’s all debt…

Credit Cards: The credit card holder owes currency units measured in Federal Reserve (debt) Notes to the credit card bank. The bank extracts a slice from every transaction.

QE (and not QE): The Fed and commercial banks create currency units by computer entry, not by production or services rendered. QE is often used to buy Treasury debt—National Debt—which is also rolled over and never paid. However, interest on the debt is rolled over and added to total debt, which increases, as it has for many decades.

Most transactions are a transfer of liabilities—debts—from one party to another. The economy runs on debt and credit.

Exceptions:

- If two people swap fully owned real estate with each other, they used no credit. But a government entity may demand taxes paid in debt-based currency units.

- If you buy a used car with Morgan silver dollars, there is no credit transaction.

- If you buy a house with gold coins, no credit transaction occurs.

- If you lived in 1950 and paid for groceries with “Silver Certificates,” then no credit transaction occurred. The pieces of paper (dollars backed by silver) had no intrinsic value, but they were exchangeable for silver. Those days are gone.

CONSIDER:

- People work many years to discharge their debt to a mortgage company.

- Buy a small house with a big mortgage (debt). Make minimal payments and wait while the Fed devalues currency units. House prices rise as dollars buy less. Sell the house and buy a bigger house with a larger mortgage. Pay the mortgage company for many years beyond your retirement date. The banking cartel (probably) created the dollars for your mortgage loan, yet you converted blood, sweat and tears into mortgage payments for most of your life. Debt slavery.

- Buy a car with a seven-year loan. You replace the car every seven years with a more expensive car. Repeat process. Live with debt forever.

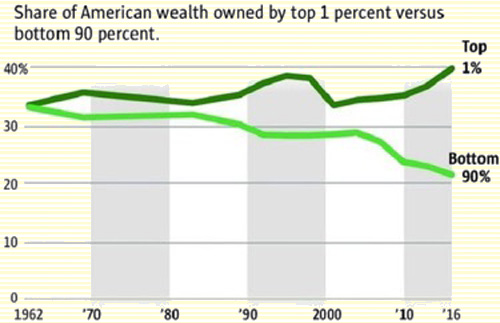

- Work, collect dollars, invest in the stock market, and own digital shares of stock, all measured in Federal Reserve Notes, which the Fed devalues in purchasing power. Most individuals don’t own enough stock to protect themselves from dollar devaluations and consumer price inflation. Banking cartel created currency units boost the stock market and wealth of the top 10%.

- Work and buy U.S. bonds with Federal Reserve Notes. The government promises to repay their bond debt to you with more debt from the Fed. The repaid dollars are (practically) guaranteed to buy less than when the bond was purchased.

QUESTIONS AND ANSWERS:

Q: If the Fed and our irresponsible congress continue borrowing and spending, the dollar will devalue further. Can devaluation continue forever?

A: Obviously not, but it can persist for decades. Argentina has lopped 13 zeros off their currency units since WWII and the country still functions. Inflate or die!

Q: If almost all transactions are credit based, what happens if banks don’t trust each other and credit collapses, as it did in 2008?

A: Bad news! The Fed will crank out another $10 – $50 trillion in “created from thin air” currency units and try to re-inflate the bubbles. Worse trauma will occur than in 2008.

Q: Do you believe we can fix an excessive debt problem with more debt?

A: The Fed does, and that’s all that matters.

Q: Should I work my entire life paying off debts to the banking cartel when I know they created those dollars from thin air?

A: Your call.

Q: If our economy is based on debt (it is), and debt must increase, and no system can expand forever, should I expect an implosion or reset?

A: Yes. International trade will use fewer dollars. Perhaps dollars will be replaced domestically (might take a long time). Expect central banks to replace dollars with central bank crypto currencies, “New Dollars,” IMF issued SDRs, or whatever. Maybe the Fed will monetize trillions in debts and make them “disappear.” MMT comes. If central banks are TRULY DESPERATE, they might consider gold backing to create confidence, but I doubt it.

Q: Are you comfortable trusting The Federal Reserve, The NY Fed, The Treasury Department and congress to manage the value of the dollar?

A: Your call, but based on ten decades of history, lean toward NO! Inflate or die!

THOUGHTS:

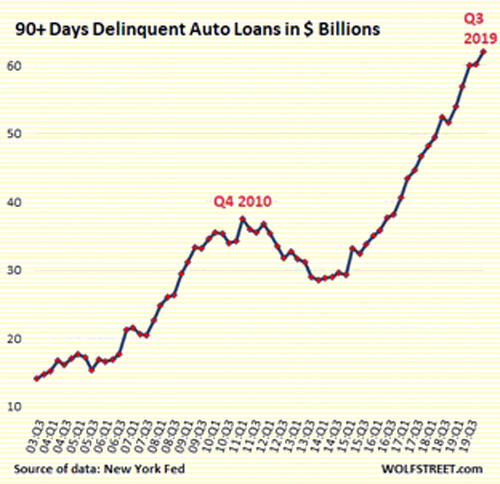

Auto loan delinquencies are increasing, especially in the sub-prime group. Debt slavery via auto loans has become a problem during a strong economy. What happens to auto loans (and to all debts) when the recession crushes “the everything” bubble?

John Mauldin: “The Road to Default:”

“Nothing is forever, not even debt. Every borrower eventually either repays what they owe, or defaults. Lenders may or may not have remedies. But one way or another, the debt goes away.”

President Putin in a text: “U.S. dollar will collapse soon.”

Fed Chair Powell:

“The federal budget is on an unsustainable path with high and rising debt.”

Charles Hugh Smith:

“As long as central banks create and distribute trillions in conscience-free credit to conscience-free financiers and corporations, the incentives for sociopathy only increase, and the incentives for everyone else to opt out increase proportionally.”

“Neoliberal global capitalism has one unstated law: credit must always expand or the system dies.” [Increase debt so interest plus past debt can be rolled over.]

“Neoliberal capitalism is in crisis for one fundamental reason: the central bank and state have played “the fixer” with monetary and fiscal policy in the belief that risk could be suppressed or even massaged away by spreading it over the entire system.” [Didn’t work in 2008 and won’t work in 2020.]

DEBT BASED ECONOMY REVIEW:

Year Official National Debt

1971 $0.40 trillion

1981 $1.0 trillion

2019 $23 trillion 1971-2019 compound rate = 8.9%

2029 $50 trillion at 8.9% per year

2039 $100 trillion Why Not?

2050 $200 trillion Really?

MARKETS:

1971 Gold $40.00 (too low)

1971 S&P 500 100

2019 Gold $1,500 (too low)

2019 S&P 500 3,100 (too high)

20?? Gold $10,000 (inevitable)

20?? S&P 500 10,000 (measured in mini dollars)

CONCLUSIONS:

- In our debt-based economy, debt must increase forever.

- Fed actions encourage wealth and income inequality that benefit the political and financial elite. If the elite derived no benefit from Fed actions, the elite would change Fed actions.

- President Trump will not reduce spending nor balance the budget.

- President Trump will not reduce inequality of wealth or income.

- The president elected in 2020, Trump or other, will expand spending, deficits, debt and monetary nonsense.

- Congress is irresponsible, but their payoffs from the political and financial elite will continue. Do not expect positive change.

- Is working your entire life to escape debt slavery attractive?

- Gold is real money, not debts owed by the Fed to the holders of paper and digital currency units. Is working for real money that has intrinsic value better than working for (fake money) debts created by the Fed?

- Our monetary and economic systems will not change easily, but individuals can improve their lives. Debt slavery is ugly, yet most westerners will be mired in debt slavery their entire lives.

- Mortgages, car loans, student loans, credit cards, payday loans, medical loans, corporate debts, unfunded liabilities, QE, “not QE,” Federal Reserve swaps, futures contracts, money markets, stocks, and bonds dominate our lives. Debt, taxes and death… escape is difficult.

- We won’t fix the credit and debt system, but we can reduce debt and increase real assets—gold and silver that have no counter-party risk and can’t be printed by central banks.

Final Thoughts:

- You can’t win.

- You can’t break even.

- You must play the game.

- Debt slavery destroys individuals and nations.

- Real money is… your call.

Miles Franklin will help you play the game with less debt and more real money. Call 1-800-822-8080 and discuss a transfer of debts issued by the Federal Reserve into real money.

Gary Christenson

The Deviant Investor

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of the book, “Gold Value and Gold Prices 1971 – 2021.” He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy and central banking.

www.milesfranklin.com

|