An Emerging Markets "Doom Loop" Time Bomb Emerges,

And Inflation Could Set It Off

Tyler Durden

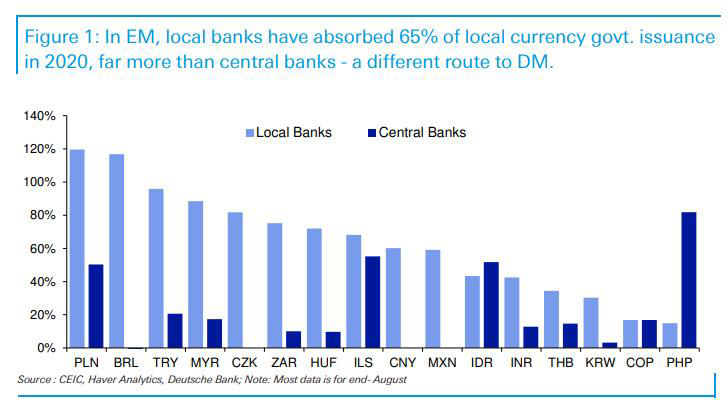

While both we - and most other analysts - have been focusing on soaring debt and QE since the covid pandemic, DB's Jim Reid correctly points out that this has been mostly in the context Developed Markets. But how have Emerging Markets funded themselves in the pandemic? The answer, as Reid writes in his Friday "Chart of the Day" note, is "via leveraging its banking system by a combination of moral suasion, liquidity provision from central banks, steep yield curves (encouraging carry trades), regulatory policies (reserve requirement cuts and easier accounting rules), and falling loan-to-deposit ratios (higher savings/weak demand) freeing up balance sheets." While both we - and most other analysts - have been focusing on soaring debt and QE since the covid pandemic, DB's Jim Reid correctly points out that this has been mostly in the context Developed Markets. But how have Emerging Markets funded themselves in the pandemic? The answer, as Reid writes in his Friday "Chart of the Day" note, is "via leveraging its banking system by a combination of moral suasion, liquidity provision from central banks, steep yield curves (encouraging carry trades), regulatory policies (reserve requirement cuts and easier accounting rules), and falling loan-to-deposit ratios (higher savings/weak demand) freeing up balance sheets."

This, according to some other analysts, is called "shadow" QE.

It's also a major problem: as the DB strategist explains, "if you’re looking for future potential crises this is another sovereign-bank nexus similar to that grappled with in the Euro sovereign crisis."

In other words, a Doom Loop for emerging markets.

Of course, an EM doom loop is just the start, as they are many more serious problems for emerging markets, with inflation the most likely one. As Reid explains, "a return [of inflation] could force central banks to sharply raise front-end rates, or to withdraw cheap liquidity. This would change the incentives for shadow QE which is inherently price sensitive, unlike the central bank QE mostly used in DM countries."

In a separately note by DB economists Mallika Sachdeva and Oli Harvey, the duo discuss the role that shadow QE has played across Asia, CEEMEA and Latam this year in helping governments to finance deficits and central banks to (mostly) avoid large official QE programs.

While CE3, Brazil & Mexico in Latam, and Malaysia in Asia stand out as countries where banks have played a particularly large role in absorbing issuance, a key condition of "shadow" QE has been muted inflation trends.

"If this changes, so could the calm in EM debt", Reid concludes adding that "increases in debt usually bring future crises so this is an interesting development to watch."

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com |