Send this article to a friend:

October

09

2020

Send this article to a friend: October |

|

We No Longer Have Markets – Only Interventions

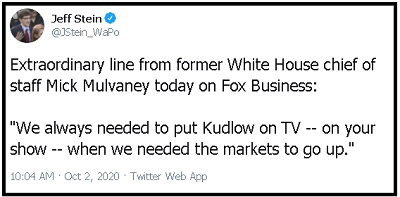

The actual quote is: “There are no markets anymore, just interventions – GATA.” The only people who deny that Central Banks and Governments prop up the financial markets are those who are completely ignorant of the facts, tragically naive or those who stand to benefit from some way from the market manipulation. Et tu, Bill Fleckenstein? Of course, a populace which enables and allows the head Central Banker to stand in public and convince everyone that creating inflation is good for the economy – when in fact price inflation of necessities is running around 10% across the country (Chapwood Index), far out-pacing income growth, can probably be convinced of anything. Rather than trust hearsay from me or GATA, how about from the horse’s mouth – the former White House Chief of Staff just 5 days ago:  It’s hard to label those who make an effort to expose the truth as “conspiracy theorists” when in fact those “conspiracies” are confirmed to be “conspiracy truths” by those who are involved with the activity being labeled a “conspiracy.” The entire economic, financial and political system in the U.S. (and in most of the rest of the world) is skating on thin ice. I said 17 years ago that the corporate, billionaire and political elitists who are pulling the strings on our system will print money and manipulate the markets until they’ve wiped every last crumb of middle class wealth off the table. And then they’ll let the Comex default and the dollar collapse. The money printing by the Fed enables these people to prop up the market s AND transfer wealth from your pocket to their’s. That the purpose of a fiat currency based system and that’s what is happening now. It’s also why I convert a meaningful percentage of my earnings into physical gold and silver (emphatically not GLD or SLV). The devaluative effect of the money printing on the dollar is the reason gold has risen in price from $35 to $1900 since 1971, with the majority of that rise in the value of gold occurring after 2000. That end game is growing closer.

investmentresearchdynamics.com

|

Send this article to a friend:

|

|

|