"The Markets Could Be Disappointed": Here's What The Fed Will Say Today

Tyler Durden

Looking at today's FOMC decision at 2pm, and Powell press conference 30 minutes later, both of which will be the Fed's last public comments before the Nov 3 election (the next FOMC 2-day meeting takes place on Nov 4-5, right after the election) consensus is for a steady policy outcome after the Fed firmly took Yield Curve Control, enhanced forward guidance, and an extension in the QE maturity horizon off the table in its July 28 meeting. As BMO notes, the breadth of expectations run from "little change with an emphasis on the 2023 dots" to "extension of the weighted-average-maturity of QE with firmer forward guidance." That, however, could prove a disappointment to equities according to BMO's Ian Lyngen given the Fed’s uber-dovish efforts heretofore, although he lays out four considerations. Looking at today's FOMC decision at 2pm, and Powell press conference 30 minutes later, both of which will be the Fed's last public comments before the Nov 3 election (the next FOMC 2-day meeting takes place on Nov 4-5, right after the election) consensus is for a steady policy outcome after the Fed firmly took Yield Curve Control, enhanced forward guidance, and an extension in the QE maturity horizon off the table in its July 28 meeting. As BMO notes, the breadth of expectations run from "little change with an emphasis on the 2023 dots" to "extension of the weighted-average-maturity of QE with firmer forward guidance." That, however, could prove a disappointment to equities according to BMO's Ian Lyngen given the Fed’s uber-dovish efforts heretofore, although he lays out four considerations.

-

First, the Fed has erred on the side of delivering its biggest changes outside of the regularly scheduled FOMC meetings (Jackson Hole the latest example). This is, of course, a function of the emergency nature of the moves. That said, there certainly is logic in de-emphasizing the every six weeks cadence of policy changes as it enhances the Fed’s flexibility – a commodity the FOMC clearly prizes as evidenced by the lack of details around the new average inflation objective.

-

Second, those in the market forecasting action from the Fed this afternoon offer caveats such as "it would boost sentiment", "while not immediately additive to the real economy", "the probably won’t, but should", etc. – suggesting a collective sense that window-dressing is the most one should hope for at this point. To be fair, a great deal of accommodation has already been provided and the approaching Presidential election – while not so close as to limit the Committee’s actions today – does offer an incremental reason to keep the more dovish options of QE changes, hard forward guidance, or YCC securely in the toolbox and in reserve until a point when the economic outlook takes another material leg lower.

-

The disparate expectations imply that some subset of the market will be dissatisfied with any Fed action and implicitly caught offsides. This sets up the post-announcement response as potentially choppy, albeit within the confines of the existing trading range.

-

Fourth, the Fed has routinely demonstrated a bias to get ahead of the market’s expectations for greater accommodation – effectively out-doving the doves. This tendency on the part of Powell is the most compelling reason to anticipate a dovish surprise today ‘while not immediately additive to the real economy.’ See what we did there? This is unlikely to be accomplished simply by a series of SEP that shows policy rates at zero until at least 2024; which is consistent with Eurodollars note with no rates hikes expected until 2025.

With big picture that in mind, here is a detailed breakdown of what Wall Street expects today at 2pm EDT when the Fed publishes its rate decision and staff economic projections, and in the post-meeting press conference with Chair Powell which will commence at 230pm EDT, courtesy of NewsSquawk:

-

The Fed will keep rates unchanged at between 0.00-0.25%; its new policy framework is dovish, but unlikely to result in changes this week.

-

The Fed will likely avoid announcing enhanced forward guidance as it waits to see how the recovery plays out. Dovish signaling will stem from the Fed’s updated projections; while growth and unemployment forecasts will likely be nudged up and down respectively, the focus will be on the central bank’s forecasts for rates in 2023 (released for the first time) and on inflation to see if it still sees inflation running below target over its forecast horizon; if it does, the new policy framework implies it will be longer before the Fed begins thinking about lifting rates.

-

Some changes to QE maturities are a possibility, although not the base case for the September meeting.

-

Expect Powell to allude to yield curve targeting policies still remaining in its toolkit, following similar remarks from Vice Chair Clarida recently. If asked, Powell will likely again lean back on negative rates, though retain the optionality for the Fed to use them in the future if the situation demands.

AVERAGE INFLATION TARGETING: The Fed's new average inflation targeting framework is generally considered to be a dovish development for future policy, although it is unlikely to result in any major policy changes this month. Nevertheless, the Fed might reflect its new inflation regime within its statement. Specifically, the line which refers to the "symmetric 2 percent inflation objective" could be tweaked; Goldman Sachs thinks it will be changed to "inflation that averages 2% over time," while others think "over time’ might instead be ‘on a sustained basis."

ENHANCED FORWARD GUIDANCE: Officials seek more clarity on how the recovery is playing out before implementing specific forward guidance, which implies a September unveiling is unlikely. For now, statement tweaks may do much of the heavy lifting for the Fed. Chair Powell will likely still face questions on the theme, particularly since ‘a number’ of officials want rate guidance to be tightened. The general expectation is that the Fed will make these sorts of changes before the end of the year, perhaps in November. Officials appear to be leaning towards an outcome-based version, rather than a calendar-based version.

STAFF ECONOMIC PROJECTIONS: In the absence of other policy changes, the Fed’s dovish signal – that it will keep rates at current levels and keep policy accommodative – will come from the projections. These projections will need to walk a line of reflecting the US economy’s resilience, as well as telegraph the challenges that the economy still faces, and the level of support that is still needed. The Fed will still be keen to impress that the recovery will continue to be protracted, and risks to both growth and inflation are to the downside. Some officials have sounded more upbeat on the labour market than June’s 9.3% end-2020 forecast implies; Robert Kaplan, for instance, said he sees the unemployment rate ending the year around 8%. And on growth, Chair Powell recently said that three-months ago, there was a possibility of a much slower recovery, and of the recovery not going very well at all, but that has not happened; that puts the Fed’s current -6.5% GDP projection in line for an upward revision. The Fed’s June forecasts do not see inflation rising to 2% during its forecast horizon that runs through the end of 2022 (we will start getting 2023 forecasts at the upcoming meeting); if the Fed continues to see sub-2% inflation, the market will take that as another signal that rates will remain at present low levels for an extended period, given its new inflation framework. Finally, with regards to the notorious ‘dots’, the Fed sees no movement in rates through its forecasts, and that is unlikely to change this week. That would be in line with money market pricing (which, incidentally, prices a non-zero probability that rates could be cut into negative territory before 2023; if Powell is asked about negative rates, expect him to be cool on them, while retaining the optionality to keep them in the toolbox for the future).

QE MATURITIES: The Fed’s current QE program is heavily weighted towards shorter-dated maturities, with over half of its current Treasury buying focused on the maturities up to 5-years. Some analysts therefore have made the case that the Fed might extend its maturity horizon. While the general expectation is that the Fed will hold off any major changes, UBS argues that there are costs to waiting, as large amounts of front-end buying intensify future leverage ratio constraints for some banks. UBS says that USD 50bln of purchases in the 5-year+ sector would stimulate more than USD 80bln across the curve. And it argues that the Fed could extract more duration even with a smaller headline purchase amount. Finally, on asset purchases, we will be paying attention whether the Fed enshrines the rate of purchases in its statement (currently around USD 80bln per month, but that is not explicitly stated within its statement); some have suggested that this is something more likely to be seen when the Fed eventually raises the rate of its bond buys.

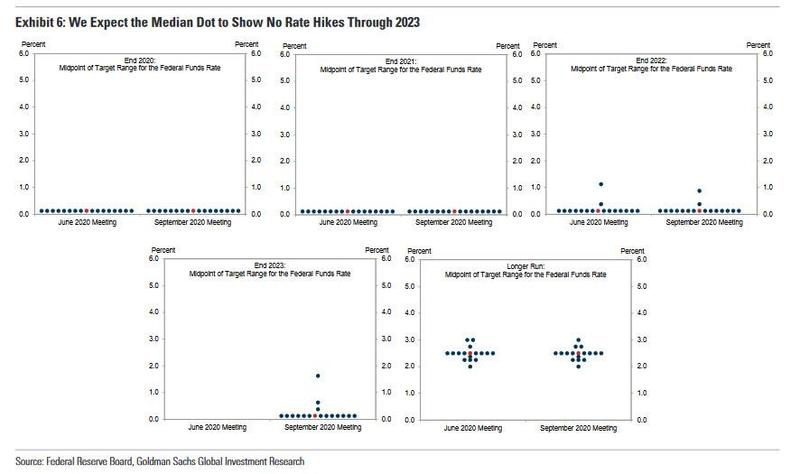

DOTS: The dot plot is likely to continue to show a baseline of no rate hikes through the end of the forecast horizon, which now extends to 2023. Two participants showed hikes by 2022 in the June projections, so Goldman expects three to show hikes by 2023 in the September projections. While the recovery now looks likely to be quicker than expected in June, the formal adoption of the new framework likely raises the bar a bit for showing rate hikes over the next few years. The neutral rate dots have been quite stable recently, and some expect further convergence toward the 2.5% median.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)