Yes, The Stock Market Is Just As ‘Stupid-Bat-$hit-Crazy Expensive’ Today As It Was

At The Peak Of The DotCom Mania

Jesse Felder

It was almost a year ago I wrote “What Were You Thinking?” referring to a quote from an interview with Sun Microsystems CEO, Scott McNeely, that he gave a year or two after the peak of the DotCom mania: It was almost a year ago I wrote “What Were You Thinking?” referring to a quote from an interview with Sun Microsystems CEO, Scott McNeely, that he gave a year or two after the peak of the DotCom mania:

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

More recently Kevin Muir of TheMacroTourist (whose work I greatly admire and highly recommend) referenced this same quote on twitter writing, “I hate to say it, but whenever you are feeling like today’s market is stupid-bat-s$hit-crazy expensive, take a gander at this gem from Scott McNealy about the DotCon bubble….” implying that stocks today aren’t nearly as expensive as they were back then. And I think most people currently believe this.

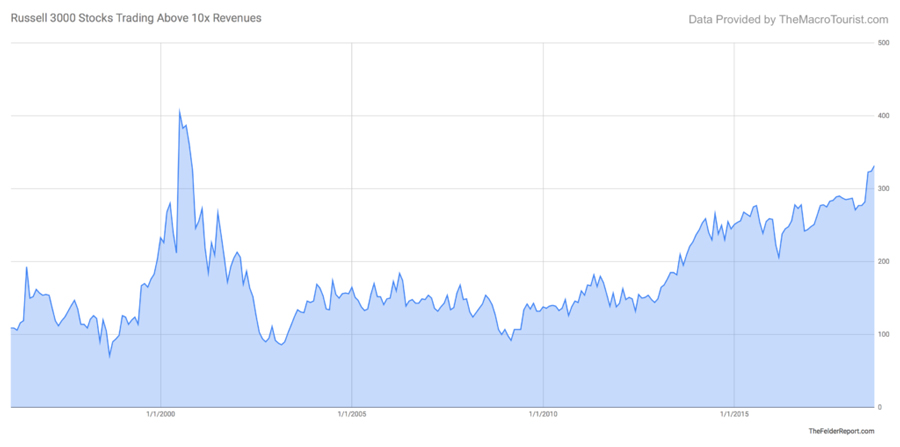

The truth, however, is that, according to the standard Mr. McNeely referenced, the stock market is exactly as “stupid-bat-s$hit-crazy expensive” as it was back then. In fact, according to Kevin’s data, fully 332 of the Russell 3000 components currently trade above 10x Revenues, 52 more than the 280 total seen in March of 2000, the month the Nasdaq put in its top.

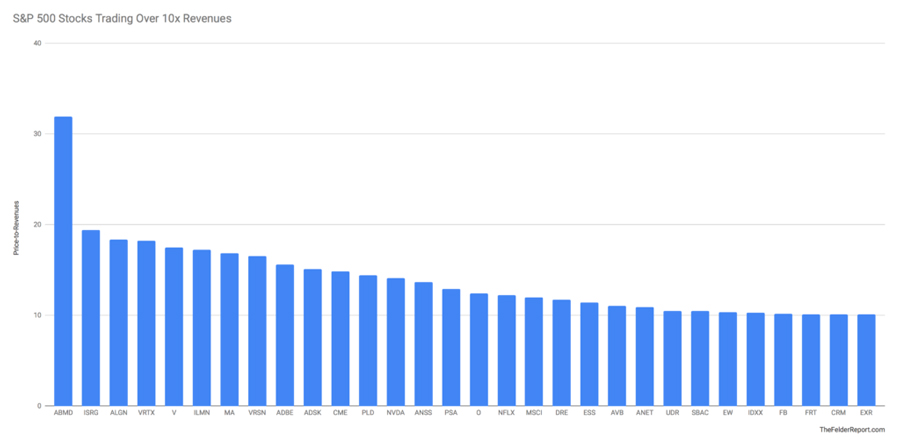

As noted in my last piece, Sun Microsystems saw its stock price fall from a peak of $64 to a low of just $5 in only a couple years’ time. So who will be the Sun Micro of the current cycle? Your guess is as good as mine but below is the list of the 30 stocks in the S&P 500 trading at more than 10x revenues. Let’s call it the short list of candidates to eventually inspire investors to ask themselves, ‘what was I thinking?’

Jesse has been managing money for over 20 years. He began his professional career at Bear, Stearns & Co. and later co-founded a multi-billion-dollar hedge fund firm headquartered in Santa Monica, California. Since founding The Felder Report in 2005 his writing has been featured in many major finance publications like The Wall Street Journal, Barron's, The Huffington Post, MarketWatch, Yahoo!Finance, Business Insider, Investing.com, Seeking Alpha and more. Jesse also hosts and produces the Superinvestors and the Art of Worldly Wisdom podcast. Today he lives in Bend, Oregon with his wife and two kids.

thefelderreport.com

|