America’s Largest Insurer Just Sounded the Alarm on Retirement Health Costs

Peter Reagan

Retirement dreams are fading fast as America’s largest insurer sounds the alarm. Between soaring medical bills, Medicare cuts, and rising drug prices, can your savings handle what’s coming next? Retirement dreams are fading fast as America’s largest insurer sounds the alarm. Between soaring medical bills, Medicare cuts, and rising drug prices, can your savings handle what’s coming next?

Retirement: The dream of many Americans is to be able to travel, do what you want, and enjoy life after working most of your life (usually for someone else).

It’s a beautiful dream – the freedom to sleep in, see friends on your schedule, and finally enjoy the good life you’ve worked decades to earn.

Except for most Americans that isn’t a reality that they’ll be able to enjoy.

They would still like to be able to live the good life. They just won’t be able to.

This isn’t cynicism. It’s realism – and we’re overdue for a clear-eyed look at the facts.

You and I both know that most people don’t pay attention to the bigger picture of what is going on. They don’t make plans with that bigger picture in mind, and even with that bigger picture and with plans, they don’t work towards making the best of the situation.

And if you think that it’s going to get easier by the time that you and I retire, I have bad news for you (and I really wish that I didn’t have to be the bearer of bad news).

But let’s step back and talk about why I’ve said what I’ve said here. To start, let’s look at…

What health insurance companies are telling us

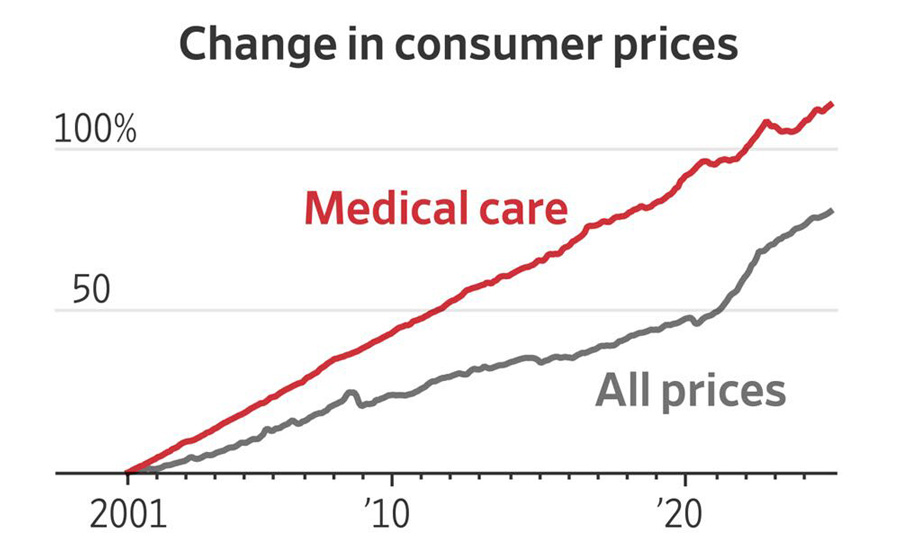

You might have noticed that healthcare costs have risen faster than prices generally. It's not your imagination.

Chart via The Wall Street Journal

Healthcare industry bellwether UnitedHealthcare is a giant company. In fact, it is the U.S.’s largest insurance provider, and executives in its parent company had some alarming things to say recently:

[UnitedHealth Group] said health-care expenses during the quarter went up much faster than what it charged in premiums.

Now, if the largest insurance company in America is saying that their earnings have been hurt by how rapidly the cost of medical care has increased, you can bet that we’re going to start feeling that increased medical cost in our pocketbooks, too.

And who gets hit the hardest by increased medical care costs? Answer: those who need medical care the most.

And who needs medical care the most? Statistically, as we age, we tend to need more medical care, so retirees are going to be one of the groups that feel that pinch in the pocketbook more than your average 20 year old.

But something else could also make these expenses much worse for retirees

Yes, healthcare costs, overall, are up. It looks even worse for retirees, though, when you consider this:

On top of that, Medicare funding cuts also made things worse.

Now, according to Alena Hall with Forbes, "In 2022, 18.7% of the U.S. population was enrolled in Medicare."

That’s 67.3 million Americans – nearly 1 in 5 – relying on Medicare. And nearly 90% of them are 65 or older. So those Medicare cuts could affect up to one-sixth of the U.S. population.

And if you are planning on Medicare to keep up with the increasing costs of medical care, you may want to reconsider that thinking.

If I’m going to give you a realistic idea of this entire situation, though, I’m going to have to pile it on a little more. Not because I love bad news! Rather, because I think you really need to understand the situation so you can make the necessary decisions for yourself and your family.

And medical care is just the beginning.

Everyday costs are climbing, too

Now, for this next subject, beyond food and shelter, is there something else that nearly every person in their retirement years needs?

I’m not talking about what they want (so the answer isn’t cable television or ESPN).

The answer: their medications.

Yes, the costs for medications are expected to rise, too. Tina Reed with Axios writes:

The trade deal between the U.S. and the European Union could hit the pharmaceutical industry with billions in new costs and ultimately drive up prices and limit access.

Why it matters: Drugmakers have been heavily reliant on foreign countries' manufacturing and raw materials, most of it duty-free. Those free-trade policies are on the way out as the U.S. prepares to impose a 15% tariff on U.S.-bound imports of branded drugs from Europe.

Driving the news: Wall Street analysts estimated the tariff deal could cost the industry between $13 billion and $19 billion, Reuters reported on Monday.

"The big picture is: The cost of imported drugs is about to become more expensive for all Americans," Joe Brusuelas, principal and chief economist for RSM US, told Axios.

That’s right, the prescription drugs that nearly all older folks take are likely to become more expensive. And it’s not just prescriptions. Everyday essentials – soap, toothpaste, cleaning supplies – are about to get pricier, too.

One of the biggest consumer products companies in the world, Proctor & Gamble, made an announcement that you and I won’t like:

CFO Andre Schulten said during a media call that there will be mid-single-digit price increases affecting about a quarter of P&G’s items during the first quarter of fiscal 2026 due to tariffs and innovation.

It’s a perfect storm of unpleasant factors, all of which will hit retirees in a time when most of them have fixed budgets to work with to pay those higher costs.

Securing your purchasing power is your #1 priority

Unless you’re already living on a fixed income, you can insulate your purchasing power from cost of living increases and economic volatility.

See, there are inflation-resistant stores of wealth that historically have held their ground over decades and even centuries. No matter what else is going on in the economy. As you might have guessed, I’m talking about physical precious metals.

In times of economic uncertainty, banks, governments and the wealthy diversify with precious metals as a hedge, protection, from economic instability. The prudent do the same, even during the good times.

You can make that same smart move for your personal economy and your retirement planning, too, and you can start your due diligence by learning about the benefits of investing in precious metals. Also be sure to request your free Precious Metals Information Kit.

Peter Reagan is a seasoned financial market strategist at Birch Gold Group with over 15 years of experience in the precious metals industry. He has been featured in several leading publications, including Newsmax and Zerohedge. At Birch Gold Group, Peter leverages his deep market insights to help educate customers on how they can diversify their savings into gold and other precious metals. His commitment to education has made him a trusted thought leader in the field. In addition to the Birch Gold website, you can follow Peter on LinkedIn.

www.birchgold.com

|