Send this article to a friend:

August

30

2018

Send this article to a friend: August |

|

Making It in the United States: The Harsh Realities Americans Face

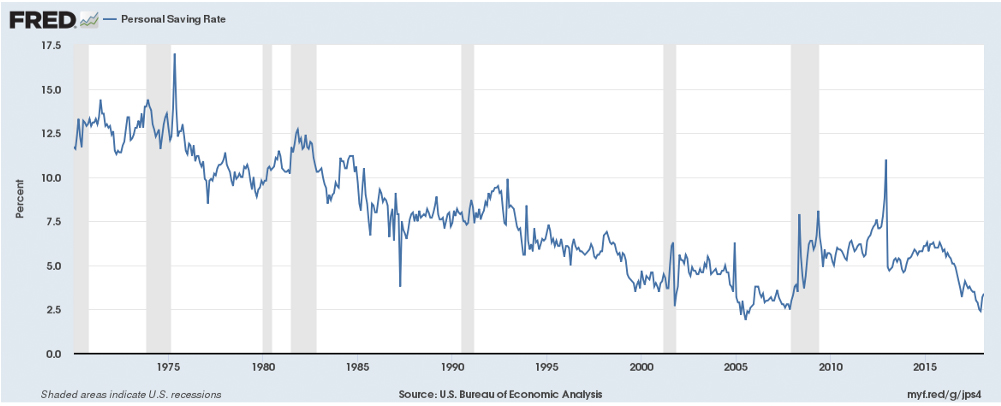

Only a handful of politicians and media members are talking about issues affecting the day-to-day lives of people. Americans care about things such as obtaining health insurance, earning a decent wage, buying a home, and sending their kids to college. On the surface, it seems like the United States has turned the corner. Unemployment has now fallen to 4.1% which is actually below what economists call the “natural rate of unemployment”. But beyond this number, Americans still face many challenges. The truth is that we are in for a world of hurt if another recession hits us and we could be due for one soon after almost nine years without one. The recent bipartisan deregulation of banks, Donald Trump’s trade war threats, increasing debt loads, and declining savings by households all point to a potential recession soon. Over 40 million Americans live in poverty. According to the U.S. Census Bureau in 2016, 12.7% of Americans live in poverty. That amounts to 43 million Americans. Similarly, 41 million Americans participate in the Supplemental Nutrition Assistance Program (SNAP) or in laymen’s terms — food stamps. Your response may be for these people to just get a job but here’s the reality. Many of them already do as NPR points out, And when it comes to families on SNAP with kids, a majority — 55 percent — are bringing home wages, according to USDA. The problem is, those wages aren’t enough to actually live on. This is the result when unions slowly lose power and minimum wage rates remain stuck. It’s so bad in some states like Louisiana and Mississippi that 20% of all residents there receive SNAP. 52% of fast-food employees in the United States enroll in at least one or more public assistance programs such as SNAP, Medicaid or the Children’s Health Insurance Program. In essence, taxpayers in the United States are subsidizing large companies that refuse to pay their workers living wages. Americans are taking on more debt and saving less. Those Americans lucky enough to earn enough to not qualify for help from various social programs are hurting as well. Since wages are still at the same levels since 1999, families have had to take on more debt to survive. At the same time, they are also saving less money. We’ve seen this story before — right before the crash in 2007. Student Loan Debt As of 2017, outstanding student loan debt in the United States topped $1.3 Trillion. Now the second-highest consumer debt, student loan payments are holding back millions of Americans from progressing. Many have decided to not take on extra debt to buy a house because they already make a monthly payment on student loans, sometimes equal to a mortgage payment. The average debt load of a student in 2016 was over $37,000.  College costs continue to skyrocket as median incomes have stalled. The rate of delinquency on student loans is now 11.2% and that is during good times with low unemployment. These loans will destroy your credit if you fall behind and they never disappear, even in the case of declaring bankruptcy. Kids have been told for years that going to college is a good investment, and in many cases it is. However, with costs continuing to rise every year, it is getting more difficult to make payments and pay off debt, in full. Currently, there is a bill going through Congress that will eliminate the income-based payment plan for student loans — a program I use myself. This will only exacerbate the problem. Debtors could owe hundreds more every month than what they pay now. Credit Card & Other Consumer Debt The picture isn’t much better for credit cards. In February, revolving credit which mostly consists of credit card debt reached a record $1.03 trillion. The average household carries an outstanding credit card balance of $8,600. In 2007, an $8,400 balance was deemed unsustainable. 30% of respondents to a survey conducted by CreditCards.com said they didn’t think they would ever get out of debt. That number rose to 35% when specifically referring to credit card debt. Why is this continuing to happen? Deborah Thorne, an associate professor of sociology at the University of Idaho explains: Essentially, our credit cards are our social safety net, I think one of the biggest factors why people continue to accrue debt is salaries are virtually what they were in the late 70s, and nothing else has held that stable. All together, Americans owe a combined $13 trillion in total household debt. This includes mortgages, credit cards, student and car loans. The personal debt to GDP ratio is still not back up to recession levels but still well above the post-war average. Household Savings are Non-Existent If you had an unplanned expense pop up, would you have the extra cash lying around to pay for it? Maybe your car needs a new part, or you have a medical emergency, or your furnace stops working. These unexpected events could derail your financial situation. According to a report from Bankrate, 61% of Americans don’t have the savings to respond to a $1000 emergency. 1 in 5 said that they would have to use a credit card to take care of the emergency. The current personal savings rate in the United States stands at 3.4%, a slight uptick from below 3% at the conclusion of 2017.  A recession followed after reaching these levels in 2007. How can we expect families and individuals to save any money in this environment we have created? Massive debt loads are taken to get an education, to drive a vehicle, and to own a house. Then, a couple of credit cards to make up for stagnant wages. And of course staggering health costs play a part as well. We spend more on health care for worse results.Maybe you haven’t heard, but there are still about 30 million (12.2%) residents in this country without health insurance and due to the sabotage of the ACA by Donald Trump and fellow Republicans, that number rose 3.2 million from 2016 to 2017. With the individual mandate set to expire next year, the uninsured rate will rise even farther.  It isn’t just about those who don’t have insurance. We, as a nation also spend more per capita on health care costs than any other developed country. Plus, those other countries guarantee universal health care to their residents. According to the OECD, the United States spends above 17% of their GDP on health care costs. The next closest is Switzerland at just over 12%. On average, the United States spends double per person on health than other wealthy countries. The Kaiser Family concludes:

If we spend so much more money on health care, we should be have better health outcomes, right? Not so fast. The Commonwealth Fund reported worse results for America than their OECD counterparts. On several measures of population health, Americans had worse outcomes than their international peers. The U.S. had the lowest life expectancy at birth of the countries studied, at 78.8 years in 2013, compared with the OECD median of 81.2 years. Additionally, the U.S. had the highest infant mortality rate among the countries studied, at 6.1 deaths per 1,000 live births in 2011; the rate in the OECD median country was 3.5 deaths. The prevalence of chronic diseases also appeared to be higher in the U.S. The 2014 Commonwealth Fund International Health Policy Survey found that 68 percent of U.S. adults age 65 or older had at least two chronic conditions. In other countries, this figure ranged from 33 percent (U.K.) to 56 percent (Canada). The United States has increased rates of obesity, diabetes, and heart disease. One of the biggest contributors is higher stress levels from working longer hours, worrying about job insecurity, and crushing debt levels. Of course, the lack of preventative health care is a factor as well. Americans don’t see their primary doctor as much because of cost concerns. America is facing an obesity crisis. 36.5% of adults are obese and the number is still rising. Black American adults are quickly approaching the 50% mark for obesity. With obesity comes other health-related problems like heart disease and diabetes. This all leads to higher costs for everyone, especially with private insurance markets. So, not only do millions of Americans face difficult financial challenges, they also face more health concerns than other developed countries. It’s not a giant leap to recognize that these struggles go hand-in-hand. Someone who may have a lingering illness may put getting it checked out off because they can’t afford to see the doctor and they can’t miss work. Some may not purchase insurance on the ACA exchanges because it’s cheaper to pay the penalty to the government. Lucky for them, the penalty goes away next year. However, costs still need coverage if this person is injured and doesn’t have insurance. This economy isn’t sustainable. These problems laid out before us have built up over decades because of decisions our government has made.

Something has to give. Soon, we could be back in the same predicament we were in just a short decade ago. And it could be worse. All of these developments in the U.S. economy has led to massive wealth and income inequality. The last time we saw inequality this high was just before the Great Depression. As of 2015, the top 1% of wage earners took home 22% of total income in America. Compare this with just before 1980 where the top 1% only took home 8.9% of total income — a much fairer distribution.   Wealth inequality is also rising again, approaching pre-depression levels. The top 10% of households hold over 90% of the wealth in stocks and mutual funds. Meanwhile, the bottom 90% percent of households hold about three-quarters of all debt. One in five households actually have a negative net worth (Assets-Debt). The Washington Post reports that, The 400 richest Americans control more wealth than the poorest 80 million households, and as the richest citizens continue to capture the lion’s share of new wealth — the top 5 percent has captured 74 percent of the wealth created in this country since 1982 — the situation is only growing more extreme. The thirst for more and more wealth among the nation’s elite is only going to end in disaster as it did in 1929. The middle class in America is not progressing or moving up. All the gains this economy makes goes to the top. There are no perfect solutions but we must try something different. It’s obvious that what has taken place for over three decades isn’t working for most Americans. We’ve witnessed the costs of essentials like education, health care, and housing rise year after year as wages have remained stagnant. What can we do to alter this trend? To the chagrin of many, the answer is probably through government action, specifically the federal government. We need to lay out our priorities in our budget and through public policy. We don’t necessarily need a larger federal government, but we need a government that is working on behalf of working Americans rather than big corporations and wealthy individuals. To combat rising health costs and lack of insurance, we should move toward a single payer system or adding an Medicare Extra For All option as a part of the ACA. This would not only reduce costs on employees who receive coverage through work but many companies would be freed from the hassle of having to offer health plans creating more costs for the business. Americans can’t afford to go to college anymore. We need a broad investment in students. We can create a program to allow free public college, with some restrictions. Even if students still need to take some loans to cover books and/or living expenses, the magnitude of debt will be much smaller. The state of New York has already moved to do this. They put income restrictions on who the program is available to and required students to say in-state for five years after graduation. The federal government can do something similar like ensuring students complete school or risk having to pay the grants back. We should also find a way to cut some of $1.3 trillion in student loan debt currently outstanding. For the same price tag to the deficit, the federal government could have wiped out all student debt instead of cutting taxes late last year, which would have a much greater impact on the American economy by freeing millions to go out and spend their newly found excess savings. To tackle the issue of inequality and stagnant wages even farther, we need a multi-faceted approach. A revamped tax system that closes loopholes and raise income and capital gains taxes on the highest earners. Simultaneously, we need to raise the minimum wages for workers, Study after study shows that this has little to no effect on the unemployment rate. Some states are still holding their minimum wage at the federal level of $7.25/hour. We could even look into either a federal job guarantee or a basic income program. Labor also needs to recapture the voice they once had to negotiate better wages for not only union members, but all workers. Of course, investment in infrastructure, family leave and earlier education are vital as well. Better transportation systems brings lower costs and more opportunity to low-income Americans. Starting to build around families is a good approach. Guaranteeing family leave to parents who have recently had a child is good first step and then we need to commit to providing the best education possible to the child in our public schools. These aren’t radical ideas Most of the proposals are already being done by other countries all over the globe and almost all of them are succeeding. When you create a baseline safety net for all people, the result is a healthier, happier, more secure society. We can ensure everyone’s basic needs are met and Americans are then free to chase whatever dream they so desire without worrying whether they’ll go bankrupt from a health incident or be in financial hell because they want to better themselves by going to college. We can’t continue the path we’re on and things are only going to deteriorate further under the current administration. But we need to elect politicians that are willing reverse course and push for a better government and economy for working and middle-class Americans. Frankly, there is no other option. The United States can’t survive when most of us are struggling to just get by.

|

Send this article to a friend:

|

|

|