The Fed's "Inflation Bubble"

Joe Carson

The Federal Reserve continues to argue that the US is experiencing an "inflation bubble." Even though the uptick in consumer prices has run hotter and longer than policymakers expected, the "inflation bubble" will deflate at some point. Policymakers offer no timeline for the moderation but continue to promote the view that inflation will drift back to the 2% mark, implying that the economy has a preset ceiling of inflation and nothing more. The Federal Reserve continues to argue that the US is experiencing an "inflation bubble." Even though the uptick in consumer prices has run hotter and longer than policymakers expected, the "inflation bubble" will deflate at some point. Policymakers offer no timeline for the moderation but continue to promote the view that inflation will drift back to the 2% mark, implying that the economy has a preset ceiling of inflation and nothing more.

The Fed's inflation story is paradoxical. It comes from an institution that has long argued inflation is a monetary phenomenon. The current policy stance is the most accommodative monetary stance in history, so expectations of more inflation, not a reversal, should be expected. Also, the Federal Reserve, which has long argued that it's impossible to identify an asset bubble beforehand, can now suddenly see an "inflation bubble" and also predict its end.

Investors need to be aware that inflation cycles do not die on their own. But die when there is a sustained tightening of monetary policy. Also, inflation cycles have bad endings for the simple reason they create liquidity on the way up, and a sharp reversal in liquidity occurs, negatively impacting the economy and finance once the cycle ends.

Transitory Inflation No More

The June reports on consumer and producer price inflation struck a significant blow to the "transitory" inflation argument. Both showed substantial and broad-based gains, resulting in the highest rates of inflation in decades.

In June, consumer prices rose increased 0.9%, the most significant monthly gain of the year and the largest since 2008. Core consumer prices posted a similar increase of 0.9%. That matches the April 2021 gain, and both represent the most significant increases since 1982.

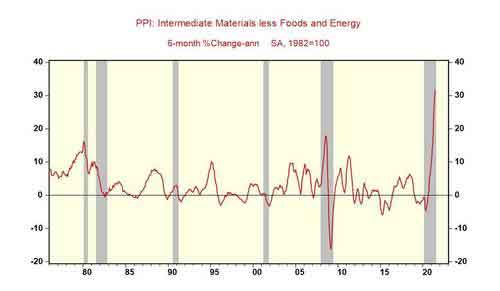

Pipeline inflation pressures remain intense. Core producer prices for intermediate materials and supplies increased 2.3% in June. Since the start of 2021, these prices have increased at an annualized rate of 32%. That surge is the largest in nearly 50 years and is a harbinger of more consumer price inflation in the months ahead.

The Indefensible Defense of Current Stance of Monetary Policy

Policymakers' defense of their current monetary policy stance is no longer credible. In 2020, policymakers moved quickly and aggressively when the economy plunged, and consumer prices dropped for three consecutive months in a row. Just the rebound in the consumer prices, up for thirteen successive months, climbing 5.4%, nearly three times the Fed's target of 2%, makes the case that the policy of stance for 2020 is no longer appropriate in mid-2021.

It's necessary to point out that a record surge in housing prices is not part of the current inflation readings. Failure to include housing prices in the reported inflation readings makes inflation appear less problematic than in the 1970s. But in reality, it is similar to the 1970s. That's because the economy (people and businesses) responds to actual or experienced inflation and not reported inflation.

Using the measurement practices of owners' housing costs of the 1970s would push the current consumer price inflation readings close to the double-digit gains last seen in the 1970s. That means the US is experiencing a more significant "inflation bubble" than is being reported or recognized by everyone. Investors forewarned.

I have spent over 40 years researching in the field of economics, focusing mainly on financial markets and policy analysis. For 16 years I served as the Chief Economist & Director of Global Economic Research for Alliance Bernstein, an investment management firm, where I was responsible for economic and interesting rate forecasting, while also being a member of investment policy committees in fixed income and the equity divisions. Prior to that, I held Chief Economist positions on the sell side of Wall Street - Chemical Bank (which is now part of JP Morgan), Dean Witter (now part of Morgan Stanley), Deutsche Bank, and UBS. I started my professional career as a staff economist at the Department of Commerce, and later worked as an industry analyst at the General Motors Corporation. I have spent over 40 years researching in the field of economics, focusing mainly on financial markets and policy analysis. For 16 years I served as the Chief Economist & Director of Global Economic Research for Alliance Bernstein, an investment management firm, where I was responsible for economic and interesting rate forecasting, while also being a member of investment policy committees in fixed income and the equity divisions. Prior to that, I held Chief Economist positions on the sell side of Wall Street - Chemical Bank (which is now part of JP Morgan), Dean Witter (now part of Morgan Stanley), Deutsche Bank, and UBS. I started my professional career as a staff economist at the Department of Commerce, and later worked as an industry analyst at the General Motors Corporation.

Given my experience on the buy and sell-sides of Wall Street, government, and private industry, I have a unique background to offer my opinion and analysis on a wide range of topics involving the economy, markets and public policy. I have decided to share my research and opinion on this blog; please feel free to contact me if you want to discuss any of my research discussed on this platform

www.thecarsonreport.com

|