Send this article to a friend:

July

07

2020

Send this article to a friend: July |

|

A Long and Perilous Journey

What Long Journey? Most unbacked fiat currencies issued by governments and central banks have failed and ended in tears, inflation, abuse, and corruption. Governments collapsed, devalued currencies to minimal or zero value, and people lost jobs, savings, retirements, and homes. Dollars, euros, yen, and pounds have been over-printed and devalued but have not yet failed. Knowing the many historical examples of failed currencies, and knowing that every major currency is backed by nothing in 2020, and knowing that central banks have created, from “thin air,” over $20 trillion in new currency units, the dollar’s perilous journey should concern us. The world is traveling a long and perilous journey toward failed currencies. The implications are staggering. Unless the following are true, expect many fiat currencies to fail, probably this decade:

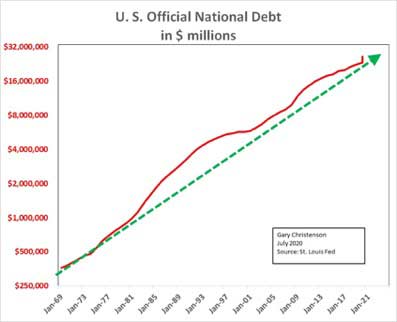

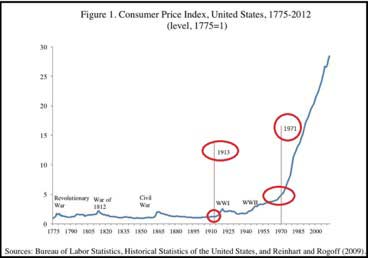

It is obvious that the above are false. Central banks manage economies to benefit their wealthy cronies. U.S. government spending is out-of-control and growing worse every year. Official consumer price inflation (CPI) is supposedly low, but everyone knows better. U.S government spending has exceeded revenues every year for decades. Official national debt has reached $26 trillion. Fractional reserve banking and QE4ever create trillions of currency units every year. Many state, city, and corporate pension plans are insolvent, limping along, and waiting for federal bailouts. Over 40 million newly unemployed workers have filed for benefits since March, stressing budgets and creating a wave of bankruptcies. We are traveling a long and perilous journey toward currency failure and insolvency. Federal Reserve actions look like a runaway train barreling down the tracks toward a barrier at the end of the line.  Does anyone see any serious political effort to reverse our doomed trajectory? Will fiscal and monetary sanity return in an election year marred by an ugly recession, massive unemployment, and a coming wave of bankruptcies? Probably not. Expect more debt. WHAT ARE THE CONSEQUENCES? QE4ever, MMT (Magic Money Tree) economics, “Inflate or Die,” fiscal stimulus, helicopter money, and central bank purchases of stocks and bonds lead to market distortions, inappropriate risks, inflated stock and bond markets, crashes, recessions, and depressions. And yet we persist in disastrous actions… Along this journey we know the dollar’s purchasing power will plummet, much higher prices are inevitable, hyperinflation is possible, and many asset prices will deflate before spiking higher during an inflationary disaster. How much inflation, how deep a recession, and whether deflation comes before or after inflation will be determined by actions of The Fed and U.S. government. BUY GOLD AND SILVER TO PROTECT YOUR ASSETS AND SAVINGS. HISTORICAL PERSPECTIVE: As the dollar is devalued (down 98% to 99% since 1913) prices rise. Cigarettes cost twenty-five cents in the 1960s. Now they are $5 to $10 per pack. Thousands of other examples exist at the grocery store, doctor’s office, hospital, and college tuition office. As the dollar buys less, houses, the S&P 500 Index, gold, and hundreds of other necessities rise in nominal prices. Do you remember paying a dime for restaurant coffee? Examine the graphs of M2 (a measure of money supply) and gold prices.

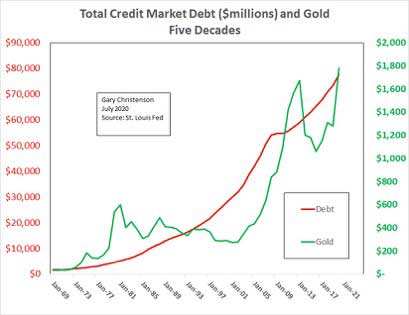

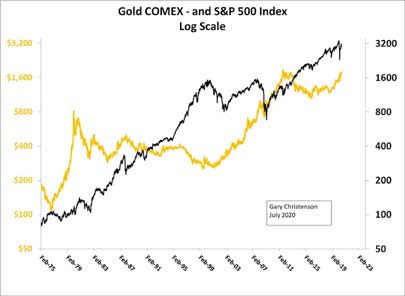

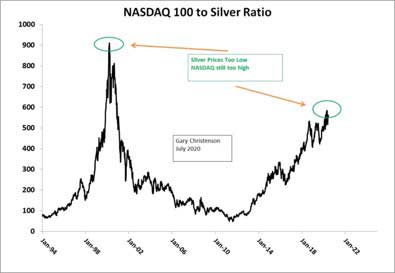

As too many dollars are created by the banking cartel, M2 rises more rapidly than the economy grows. Prices rise. We don’t need an academic discussion, complete with integrals and partial differential equations, to understand this concept. Total credit market debt per the St. Louis Fed tells the same story. More debt forces gold prices higher.  The S&P and gold rise as dollars buy less.  National debt shows the same relationship. Government creates excessive debt, and higher gold prices and a weaker dollar follow. We know that national debt will increase by multiple trillions every year, regardless of which political party is mismanaging the economy, regardless of which Fed Chairman is facilitating the transfer of assets from the many to the few, regardless of which tech company is censoring news, and regardless of pandemics, infection rates, and distracting stories of impending doom. Politicians will spend currency units they don’t have by borrowing, and borrowing, and borrowing…  M2, total debt, the stock market, national debt, and gold prices will rise as the “Powers-That-Be” devalue dollars and transfer wealth to the financial and political elite. This devaluation process has been ongoing since 1913, and more aggressive since 1971 when President Nixon “temporarily” abandoned gold backing for the dollar and allowed the quantity of debt and dollars to skyrocket. Read: What Went Wrong in 1971.  This perilous journey began in 1913, accelerated after 1971, and will eventually create a crash or reset with dire consequences for everyone, except the political and financial elite. This year and 2021-2025 will be difficult. WHAT IS EXPENSIVE in July 2020? Tesla stock closed at $1,208 on July 2. Sounds expensive, considering it sold for less than $180 thirteen months ago. The NASDAQ closed at 10,207. Expensive! Silver (COMEX) closed at $18.32. Cheap!

Examine the ratio of the NASDAQ to Silver.  Silver is inexpensive compared to the NASDAQ! That will reverse. WHAT SHOULD WE EXPECT?

Read: We are on borrowed time. CONCLUSIONS:

Silver prices are almost as low, relative to debt and the stock market, as they were in 2001 when they bottomed at $4.01. Food for thought… Miles Franklin sells gold and silver coins and bullion. Insurance may reduce your risk during a perilous journey. Gold and silver are insurance against government and central bank currency devaluations, corruption, and dangerous policies. Call Miles Franklin at 1-800-822-8080. Gary Christenson

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of the book, “Gold Value and Gold Prices 1971 – 2021.” He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy and central banking.

|

Send this article to a friend:

|

|

|