Silver’s Biggest Weekly Gain in 40 Years

Frank Holmes

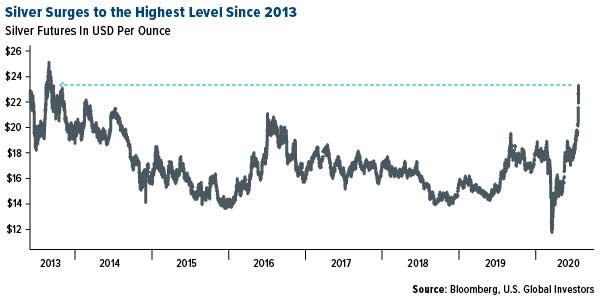

The best performing precious metal for the week was silver, up 17.79 percent. Silver had its biggest weekly gain in nearly 40 years and could keep soaring. The metal hit its highest level since 2013. Mike McGlone, commodity strategist at Bloomberg Intelligence says the white metal could eventually climb to $30 an ounce amid a broad-based bull market for precious metals.

McGlone predicts the metal will stay between $20 and $25 for an extended period before moving higher. The Global X Silver Miners ETF had a ninth straight day of inflows and the iShares Silver Trust saw five consecutive days of money flows.

Gold has rallied an amazing 24 percent so far this year and rose above $1,900 an ounce for the first time since 2011. Investments in U.S.-listed commodity ETFs rose last week for the fifth straight week of inflows, according to Bloomberg data. Precious metals funds saw investment inflows of $3.8 billion in the week ending July 22, which is the second largest weekly inflows ever, according to Bank of American strategists citing EPFR Global data.

Veteran investor Mark Mobius says that investors should buy gold now and keep buying it as political tensions and worries over global growth fuel the bullion rally. Mobius said in a Bloomberg TV interview this week that “I would be buying now and continue to buy. When interest rates are zero or near zero, then gold is an attractive medium to have because you don’t have to worry about not getting interest on your gold.”

Weaknesses

The worst performing precious metal for the week was gold, still up an incredible 5.06 percent. With gold positive 24 percent for the year, investors are broadening their exposure across the precious metals space with palladium and platinum both with nearly double digit gains this week too.

Teck Resources Ltd reported an 82 percent drop in second quarter adjusted profit as the Covid-19 pandemic hurt demand for its products and squeezed prices, reports Kitco News. Miners globally have been faced with challenges in the commodities market, forced mine closures and production cuts. Teck largely produces copper and zinc and suspended its 2020 outlook in April.

Pan American Silver announced this week that it is moving two of its operations in Peru into care and maintenance after several works at the mines recently tested positive for Covid-19.

Opportunities

Platinum could rise higher along with gold, according to UBS Group AG. “Our near-term bullish view on gold implies higher platinum prices this year,” said analyst Giovanni Staunovo in a note this week. The bank raised its platinum forecast to $975 an ounce at the end up September, up from $850 an ounce. U.S. imports of platinum from Switzerland more than tripled in June from a month earlier to 3.4 tons – the highest level since October 2006.

According to Deutsche Bank AG, the close correlation between gold and the Japanese yen has broken down in the new macro environment. A risk-averse environment that leads to easy monetary policy, which in turn triggers a rebound in risky assets, is among the most constructive for a long-gold and short-yen position, writes strategist Alan Ruskin. “Gold then remains the easier long” versus the dollar or yen.

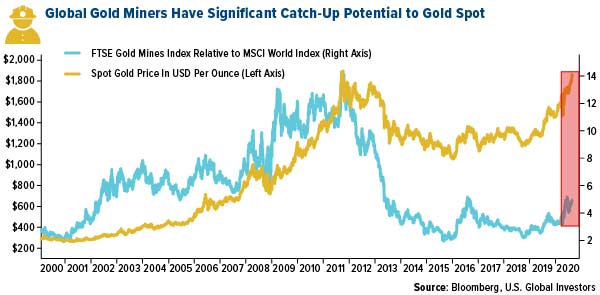

Gold miners have room to catch up with spot gold. The performance of gold miners relative to the MSCI World Index has widened a gap with spot prices in recent years, signaling plenty of catch-up potential. According to Societe Generale strategist Sophie Huynh, “both fundamentals and positioning look aligned for gold miners to shoot higher.”

Threats

Gold’s meteoric rise is flashing a warning signal that faith in central banks has disappeared. Bloomberg’s Eddie van der Walt comments: The risk is that top central bankers’ “clay feet are exposed by asset price bubbles and the fear of stagflation. In particular, I’m starting to hear the question: ‘If these people really knew what they’re doing, why is gold going gangbusters?’ The assumption being that there should be no reason to own the metal if growth is steady and inflation is benign.”

Frank Holmes is the CEO and chief investment officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal, and in 2011 he was named a U.S. Metals and Mining "TopGun" by Brendan Wood International. In 2016, Mr. Holmes and portfolio manager Ralph Aldis received the award for Best Americas Based Fund Manager from the Mining Journal. He is also the co-author of The Goldwatcher: Demystifying Gold Investing. More than 30,000 subscribers follow his weekly commentary in the award-winning Investor Alert newsletter which is read in over 180 countries.

Under his guidance, the company’s mutual funds have received recognition from Lipper and Morningstar, two trusted independent financial authorities. In 2015, Mr. Holmes led the company into the exchange-traded fund (ETF) business with the launch of the U.S. Global Jets ETF, which invests in the global airline sector. In 2017, U.S. Global Investors made a strategic investment in HIVE Blockchain Technologies, listed in Toronto, and Mr. Holmes was appointed non-executive Chairman of the Board.

Mr. Holmes was awarded the Huron Medal of Distinction from Huron University College in 2013, his alma mater for the class of 1978. This award recognizes individuals whose life achievements set an example of excellence and reflect Huron’s arts and social sciences missions.

Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association.

Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He has spoken at the Investing in African Mining Indaba conference, the Denver Gold Group’s European Gold Forum and numerous Money Show events, sat on panels with prominent industry leaders including the editor of Barron’s and continues to be invited as a keynote speaker at conferences throughout the U.S., Canada and overseas.

Mr. Holmes is a regular commentator on the financial television networks CNBC, Bloomberg, BNN and Fox Business, and has been profiled by Fortune as well as The Financial Times. His thoughts on gold are captured each week on a program called Gold Game Film in collaboration with Kitco News and TheStreet.com. Mr. Holmes was also the feature spread in Barron’s during the commodity rally at the start of 2004. He is a regular contributor to Forbes, Business Insider, Seeking Alpha and Wall Street Journal’s Experts Corner.

Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE, directly and indirectly. This interview should not be considered a solicitation or offering of any investment product.

www.usfunds.com

|