Send this article to a friend:

July

24

2020

Send this article to a friend: July |

|

It's All Downhill from Here: U.S. Oil Production Peak Already In The Rear-view Mirror

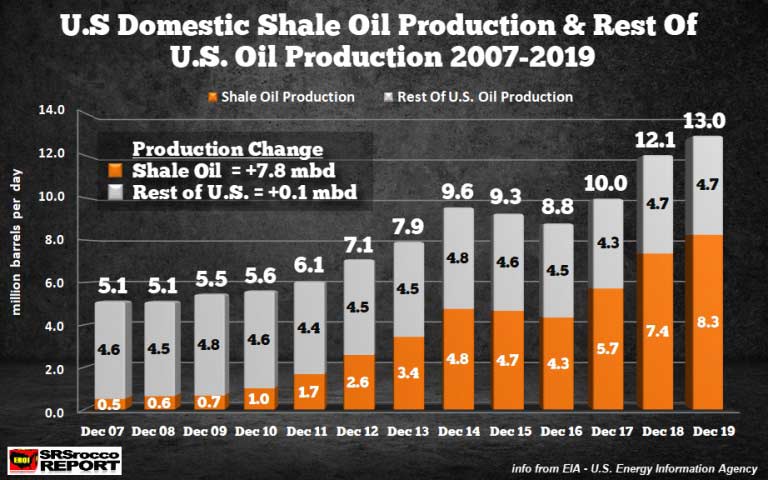

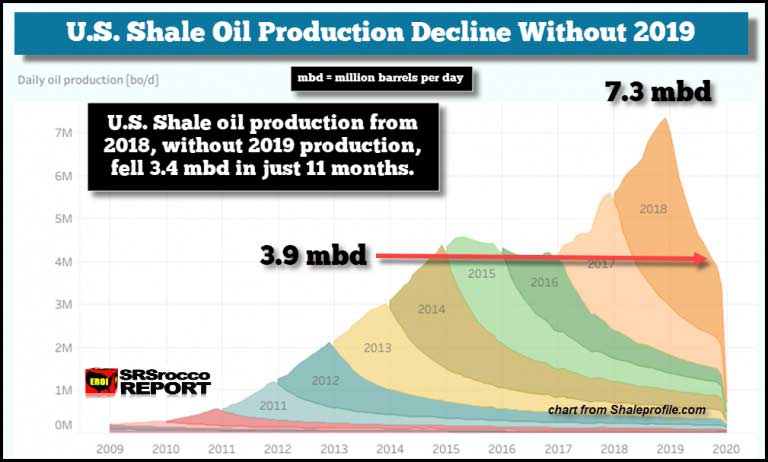

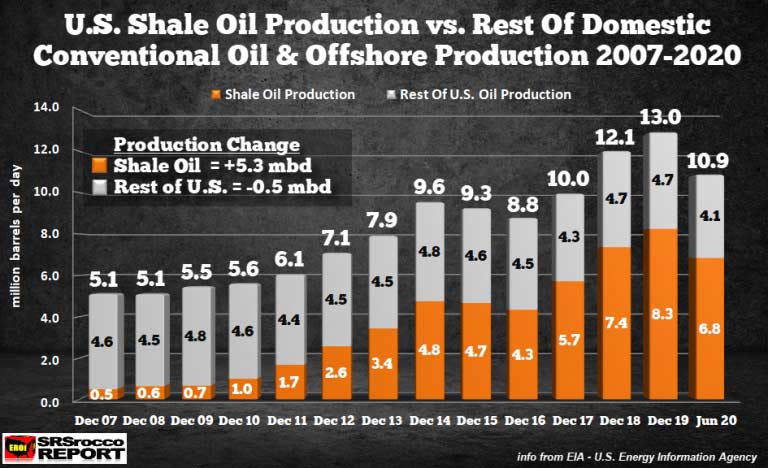

It’s a shame that the drive for U.S Energy Independence only lasted for about a year. Even worse, U.S. Shale Oil Industry responsible for the country’s energy independence is now in serious trouble as the companies have cut drilling by 75% while they are drowning in debt up to the eyeballs. This is a “No-Win” scenario. So, watch over the next 3-6 months as the mighty U.S. Shale Industry begins to implode in glorious 3D-Technicolor. Amazingly, if it weren’t for the 135,000 shale wells drilled since 2007, U.S. oil production would have remained virtually flat. Yes, that’s correct. Just about all the U.S. domestic oil production growth from 2007 to 2019 came from shale oil (tight oil). Even though there was oil production growth offshore in the Gulf of Mexico, it offset the declines in the states. According to the EIA, U.S. Energy Information Agency, U.S. shale oil production increased from 500,000 barrels per day (bd) in December 2007 to 8.3 million barrels per day (mbd) in December 2019:  As we can see, the Rest of the U.S. net production only increased by 0.1 mbd since 2007 while shale oil increased 7.8 mbd. Unfortunately, with the U.S. shale oil industry annual decline rate at nearly 50% per year, at some point, the DRILLING HAMSTERS were going to run out of reserves. While this may have been 1-2 years away, the global pandemic pulled the rug from underneath the U.S. Shale Industry.  While I commend that tens of thousands of workers that helped bring on this much-needed oil production, a 50% annual decline rate is not a long-term sustainable business model. Well, unless the Federal Reserve can print more oil reserves. That I would like to see. So, if we look at the current situation as of June 2020, U.S. total oil production declined 2.1 mbd, mostly from the temporary curtailment of shale oil and offshore wells in the Gulf of Mexico:  While we may see an increase in overall U.S. oil production, with a 75% collapse in the oil drilling rig count, there is no way the shale companies will be able to offset the declines coming in the next 3-6 months. With the EIA’s latest weekly release, total U.S. oil production has increased to 11.1 mbd. I believe the ultimate peak in U.S. oil production will be 13.1 mbd as of March 13th, 2020… the week before the Whitehouse announcing shutdowns of economic activity all across the country. Investors need to realize, without oil production growth, there is no GDP growth. And, without GDP Growth, the largest Global Financial Ponzi Scheme in history has lost the ability to be PROPPED UP. Just like with any typical Ponzi scheme, a source of new investor funds are necessary to keep it going. With oil being the main driver of the Global Economy and U.S. shale oil production accounting for 75% of global oil production growth since 2008, the death of the Global Ponzi Scheme has begun. Got physical gold and silver? IMPORTANT NOTE: If you are new to the SRSrocco Report, please consider subscribing to my: SRSrocco Report Youtube Channel. HOW TO SUPPORT THE SRSROCCO REPORT SITE: My goal is to reach 500 PATRON SUPPORTERS. Currently, the SRSrocco Report has 155 Patrons now! Thank you very much for those who became new members and new Patrons of the SRSrocco Report site. So please consider supporting my work on Patron by clicking the image below: Or you can go to my new Membership page by clicking the image below: Check back for new articles and updates at the SRSrocco Report. You can also follow us on Twitter, Facebook, and Youtube below:

|

Send this article to a friend:

|

|

|