The Fed Should Hike Interest Rates, Not Cut Them

Scott Minerd

In the runup to the Federal Reserve’s Open Market Committee meetings on July 30 and July 31, policy makers are debating the value of what would normally be considered unorthodox policy actions. The consequences of the Fed’s actions in the next week - the U.S. central bank is expected to cut interest rates by a quarter of a percentage point - could be with us for much longer than we think, culminating in the next recession and increasing the risk to financial stability. In the runup to the Federal Reserve’s Open Market Committee meetings on July 30 and July 31, policy makers are debating the value of what would normally be considered unorthodox policy actions. The consequences of the Fed’s actions in the next week - the U.S. central bank is expected to cut interest rates by a quarter of a percentage point - could be with us for much longer than we think, culminating in the next recession and increasing the risk to financial stability.

In the meantime, the Fed could be delivering yet another sugar high to the economy that doesn’t address underlying structural problems created by powerful demographic forces that are constraining output and depressing prices.

By almost every measure, policy makers should be considering another rate hike, not a rate cut, in anticipation of potential economic overheating from looming limitations on output. Instead, debate has been focused on the need to take preemptive action to avoid a potential slowdown.

An abrupt shift in thinking was set in motion last December when, after raising overnight rates by a quarter of a percentage point, Fed Chairman Jerome Powell signaled more hikes would come and that balance-sheet reduction was on “autopilot.” Alarmed by the market tantrum that ensued, Fed policy makers began a mop-up campaign that included the Fed’s now-famous “pivot” to patience.

While the Fed has more than succeeded in stabilizing markets, the ensuing liquidity-driven rally in various markets has boosted asset prices, including stocks, bonds, precious metals, energy, and even cryptocurrencies.

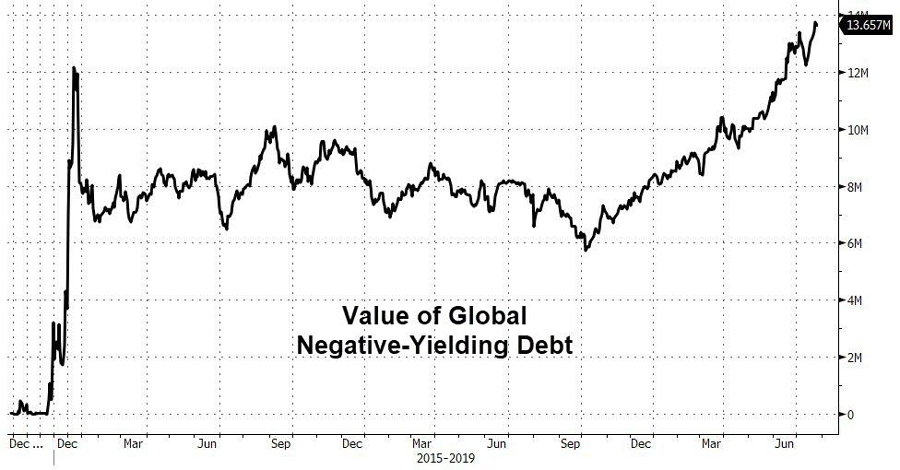

As Europe faces prospects that negative rates might become a long-term fixture in the euro region, concerns are mounting in the U.S. that a global slide toward negative yields could infect the market for Treasury securities, should the U.S. slip into a recession. These concerns are well founded.

In the postwar era, the Fed has reduced short-term interest rates by an average of 5.5 percentage points during easing cycles associated with recession. The required stimulus in the next recession could necessitate large-scale asset purchases of nearly $5 trillion to overcome the monetary limitations of the zero bound. Such a policy action could result in negative Treasury yields.

To immunize against the global contagion of negative rates, the Fed is intentionally overheating the U.S. economy in the hope of pushing inflation above its 2% target rate. Once inflation approaches some undefined rate, perhaps 2.5%, the Fed likely will reverse course and lift rates above today’s levels, creating another set of risks.

Additional accommodation this late in the business cycle is likely to push asset prices higher, just as in 1998, when the Fed cut rates by 75 basis points (a basis point is one-hundredth of a percentage point) during the Asian crisis, only to reverse course nine months later by raising short-term rates to the cycle high. Just as Fed accommodation inflated the internet bubble then, asset inflation associated with stimulative policy at this point in the cycle is likely to have a similar impact.

Chairman Powell has been clear that the Fed will go for broke, doing whatever is necessary to keep the expansion going. Most likely, a quarter point next week will be followed by another half percentage point before year end.

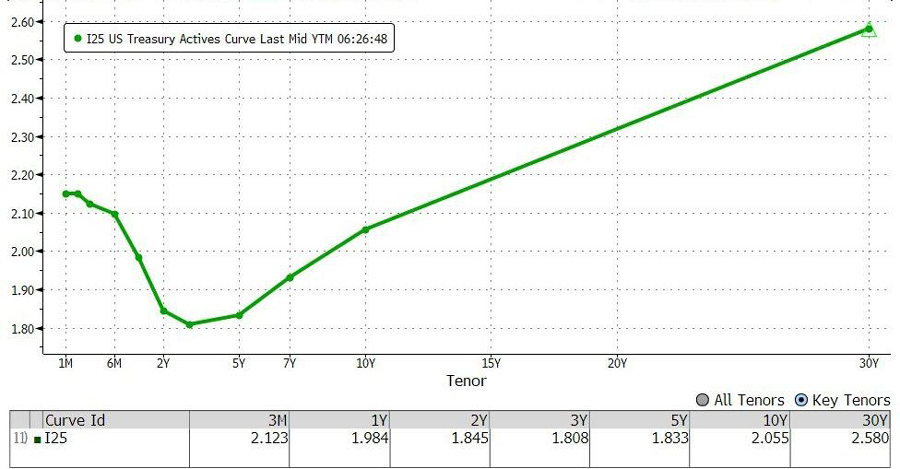

The real problem leading to the depressed yield curve can’t be solved by the Fed, short of the remote possibility of an overt policy to increase inflation well above 2%. This problem is the product of structural changes within the economy that have reduced growth potential relative to the past 50 years.

Demographics play an important role. Not only is an aging population creating an acute labor shortage, but the opioid crisis and failures in education and job training are limiting the supply of skilled labor.

Without growth in supply-side contributors including labor, capital, and other forms of investment, and increased demand associated with a faster-growing, younger demographic, the real neutral rate—or the Fed’s sweet spot to maintain economic output—is likely to remain low and may even fall into negative territory. The depressed neutral rate is limiting the power of policy makers to stimulate demand without risking significantly higher inflation and financial instability.

The simplest way to avoid recession and the associated negative rates would be a rapid increase in the supply of labor, aided by education, job training, and solutions to address the blight of opioids. A rational immigration initiative could quickly offset the risks of a slowing economy by providing more workers to fill open jobs. Two million new workers could raise output potential by 2% or more. This would push the neutral rate higher by stimulating economic growth while increasing tax revenue due to the rapid growth in personal income.

The Fed’s current policy of anticipatory and preemptive rate cuts likely will lead to unsustainably high asset prices and increased financial instability. This can only make the next downturn worse. If the U.S. continues down the current policy path, we will find out that the Fed’s cure for avoiding a near-term recession and negative interest rates may ultimately make the disease worse.

* * *

Scott Minerd is co-founder and global chief investment officer of Guggenheim Partners, and a member of the Board of Overseers of the Hoover Institution.

www.barrons.com

|