Brace for Impact: Silver is Firing the Engine!

Lior Gantz

[Ed. Note: This is a critical update from one of the best financial commentators I know, a good friend of ours, Mr. Lior Gantz, who runs WealthResearchGroup.com and we’re excited to share this one with you!]

Silver $30.12 – A No-Brainer

Officially, I’m more bullish on silver than any other asset class right now. I want to be absolutely sure that you comprehend what’s currently happening in the precious metals arena and with hard assets in general. Compared with gold, silver is the CHEAPEST it’s ever been in all of human history.

We don’t get to say that kind of sentence more than once in a person’s lifetime. You can go back to biblical times and observe periods where gold and silver traded at par with each other, on a 1:1 ratio. More historians quote the classical 12:1 and 16:1 ratios, but in the past 30-40 years, it has ranged between extremes of 30:1 and 80:1.

Today, with gold at $1,398 and silver at $14.98, the ratio is 93:1!

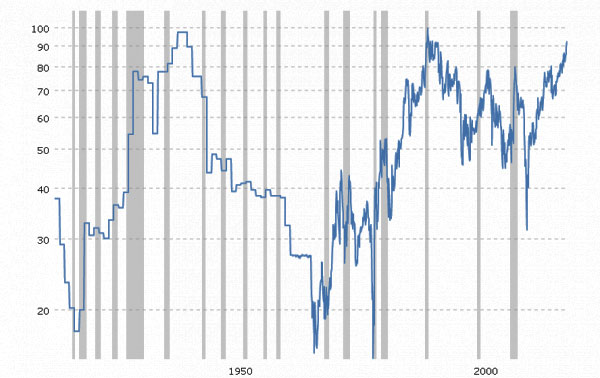

This chart goes all the way back to 1915 and shows 104 years of price history. Notice that apart from a brief period in 1991, when silver actually traded at a 99:1 ratio to gold, the risk/reward ratio in today’s environment is unbelievable.

I’ve just placed an order to purchase 4,000 ounces of silver eagles, but that’s only the beginning. I plan to use call options to bet on higher silver prices, invest in 4 “pure silver” plays, and go LONG in the physical trust fund.

I want to show you a stat that will shock you even more than realizing that silver now is the cheapest in its history. It will open your eyes that it isn’t only a bargain compared with gold, but relative to ALL asset classes and on ABSOLUTE terms as well!

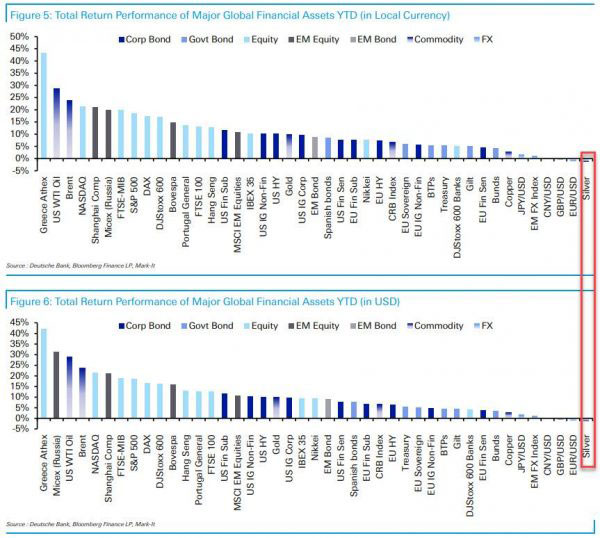

Courtesy: Zerohedge.com

In 2019, out of 38 major asset classes, 37 are GREEN for the year. Gold is one of them, yet silver is RED – it’s the only asset that’s down.

You’ll hear much more from me about this anomaly, but understand that I’m making higher silver prices my BIGGEST bet.

If the ratio would revert to 70:1 (which is still considered discounted for silver, with gold not budging an inch from its current price), silver would trade for $20.10, which is a 25% gain from here.

The mining stocks that directly mine silver are few and far between. They will SKYROCKET. As you know, apart from cryptocurrencies – which I find hard to believe we will ever replicate our profits with, with Bitcoin going up 4,872% since our alert and Ethereum topping off at 9,328% since our $12/coin alert – our largest profit was a silver miner, going from CAD$0.14 to CAD$1.21.

But, the last two things I will share with you are taken from the guidebook for precious metals bull markets:

- Trump is aggressively pushing for the inclusion of Judy Shelton on the Federal Reserve board. This banker is calling for a new “Bretton Woods” conference, the same one which in 1944 made every $35 dollars as good as an ounce of gold.

She’s also in favor of zero rates; in fact, if she ever gets to govern any monetary policy, gold could spike to $2,000 OVERNIGHT.

Going forward, she wants to make the dollar important for the global monetary system by backing it with gold.

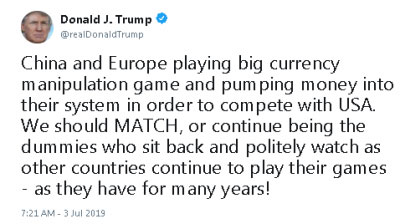

- Trump wants to openly devalue the dollar; he’s the 1st U.S. president to advocate for this.

Take a look at this, because it’s UNBELIEVABLE:

All I can say to that is, LET THE GAMES BEGIN!

Lior has been called a thrill-seeking entrepreneur by his team, and as such, he built and runs numerous successful businesses, and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience.

With Wealth Research Group, Lior allows readers access into the world of the few who beat the markets consistently for decades, thus leveling the playing field of the investment industry. With immense passion and full-force devotion to the readers, Lior’s purpose is to publish content that will have life-long value and allow readers to approach investing with methodic precision and a well-thought-out game plan.

Lior has been actively investing in the markets since the age of 16, and is now bringing the same proven strategies he has implemented himself, and advises people from high-net-worth individuals to subscribers and members. He is an advocate of meticulous risk management, balanced asset allocation, and proper position sizing.

His research is relentless and delivers a unique perspective to investors. As a deep-value investor, Lior loves researching businesses that are off the radar and completely unknown to most financial publications.

Readers can expect high-quality ideas on personal finance, timeless stock market wealth principles, and monthly stock suggestions fully vetted by Lior and his team.

www.wealthresearchgroup.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)