Key Events This Week: All Eyes On Powell Again

Tyler Durden

Just in case you had an urgent craving of even more Fed talk, the US central bank will once again be under the spotlight this week with Powell due to testify before Congress on the US economy and monetary policy while a busy schedule of Fedspeakers is also scattered throughout the week. We’ll also get the latest FOMC meeting minutes and US CPI and PPI data. And days after a blistering payrolls report which slammed near-term rate cut odds, inflation data is also due to be out in Europe and China while the UK PM voting process begins. Just in case you had an urgent craving of even more Fed talk, the US central bank will once again be under the spotlight this week with Powell due to testify before Congress on the US economy and monetary policy while a busy schedule of Fedspeakers is also scattered throughout the week. We’ll also get the latest FOMC meeting minutes and US CPI and PPI data. And days after a blistering payrolls report which slammed near-term rate cut odds, inflation data is also due to be out in Europe and China while the UK PM voting process begins.

As DB's Craig Nicol notes, the main highlight for markets this week will be Fed Chair Powell’s testimony before the House Financial Services Committee on monetary policy and the state of the US economy on Wednesday. With markets cutting their odds for the Fed cut during the next meeting after the latest NFP report, the content of the speech has the potential to meaningfully impact market expectations. Powell will also testify before the Senate on Thursday though this will be a repeat of Wednesday’s speech.

It’s also a very busy week for Fedspeak: on Tuesday Bostic and Bullard address a conference in St Louis while Quarles will make a keynote address on stress testing with Powell due to make introductory remarks. On Wednesday we’re due to hear from Bullard again while on Thursday we’re expecting comments from Williams, Bostic, Barkin, Kashkari and Quarles.

Staying with the Fed, on Wednesday we’re due to get the FOMC meeting minutes from the June meeting. While rates were left unchanged at the meeting, the overall tone was decidedly dovish and it somewhat confirmed markets' aggressively pricing in an easing cycle. A reminder that the statement dropped the commitment for patience and the dots also swung in a similarly dovish direction. A reminder too that this meeting included a dissenting vote from Bullard.

As for politics, US trade negotiators are expected to return to Beijing next week. Meanwhile, in the UK Conservative Party Members will continue the postal vote process to choose between Boris Johnson and Jeremy Hunt to be the next UK PM. The candidate achieving more than 50% of the vote will be declared Leader of the Party, however the winner isn’t expected to be announced until July 22nd.

As for data, we should get to test the global inflation pulse next week. The June CPI report will be out in the US on Thursday followed by the June PPI report on Friday. The consensus for the former is a 0.0% mom headline reading and +0.2% core reading which should be enough to hold the annual rate at +2.0% yoy. We’ll also get June CPI and PPI data in China on Wednesday while in Europe we get final June CPI revisions for Germany and France on Thursday.

The remaining data in the US next week is fairly second tier with May consumer credit due on Monday, May JOLTS and June NFIB survey on Tuesday, May wholesale inventories due on Wednesday and jobless claims on Thursday. It’s a bit more interesting in Europe where May industrial production prints are due in Germany on Monday, the UK on Wednesday and euro area on Friday. In the UK we also get May GDP on Wednesday.

As for other central bank speak next week, on Monday the BoJ’s Kuroda is due to speak at a branch managers meeting. On Tuesday the ECB’s Visco speaks in the morning before Chief Economist Lane takes part at an event during the evening. On Wednesday the BoE’s Tenreyro speaks while on Thursday Carney speaks. Finally on Friday we’re due to hear from Carney again along with the BoE’s Vlieghe and ECB’s Visco.

Finally, other events to keep an eye on include the euro area finance ministers due to gather in Brussels

for a two-day meeting on Monday. On Wednesday we’ve got the BoC meeting while on Thursday we get the ECB minutes from the June policy meeting and the BoE’s financial stability report.

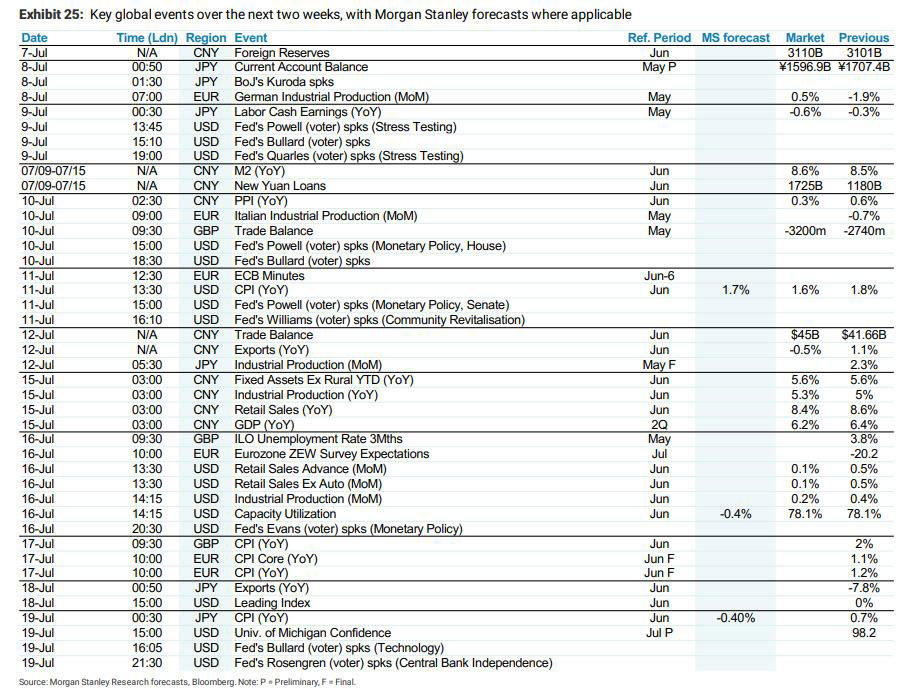

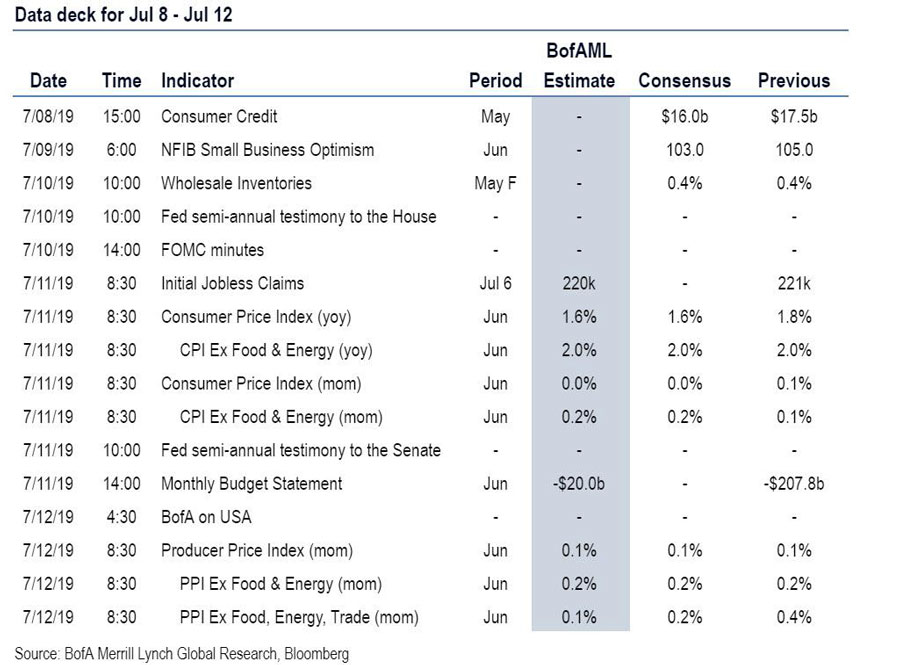

Summary of key events in the week ahead courtesy of DB's Craig Nicol:

- Monday: Data releases include May core machine orders in Japan, May industrial production and trade data in Germany, June Bank of France industrial sentiment, July Sentix investor confidence reading for the Euro Area and May consumer credit in the US. Away from that the BoJ’s Kuroda is due to speak while euro area finance ministers gather in Brussels.

- Tuesday: The focus will likely be on the Fedspeak with Bullard and Bostic due to speak, while Quarles is due to make the keynote address on stress testing at a conference. Powell will also make introductory comments at said conference. Away from that the only data of note is the June NFIB small business optimism reading and May JOLTS report in the US. Elsewhere, the ECB’s Visco and Lane are due to speak. Euro area finance ministers will continue their meetings in Brussels.

- Wednesday: The big focus will be Fed Chair Powell’s testimony before the House Financial Services Committee on monetary policy and the state of the US economy. Late evening we’ll also get the FOMC minutes from the June meeting. As for data, June CPI and PPI in China will be out early morning while the highlights in Europe include May industrial production readings from France and the UK along with May GDP and trade data in the latter. May wholesale inventories data in the US is also due to be released. Other events to note include a speech from the BoE’s Tenreyro and the BoC monetary policy meeting.

- Thursday: Fed Chair Powell will testify to the Senate Banking Committee while other scheduled Fed speakers include Williams, Bostic, Barkin, Quarles and Kashkari. The data highlight is the June CPI report in the US while final June CPI revisions will be made in Germany and France. Jobless claims data will also be out in the US. Meanwhile, the BoE will publish the latest financial stability report, ECB will release the latest meeting minutes and the OPEC oil market report will be released.

- Friday: Data highlights include June trade data in China and June PPI in the US. We’ll also get May industrial production for the euro area and May industrial production in Japan. The ECB’s Visco is also due to speak while over at the BoE Carney and Vlieghe are due to speak.

Finally, here is Goldman's preview of just the US, where the key economic data release this week is the CPI report on Thursday. Minutes from the June FOMC meeting will be released on Wednesday. There are several scheduled speaking engagements from Fed officials this week, including Chair Powell’s semiannual testimony to Congress on Wednesday and Thursday.

Monday, July 8

- No scheduled major economic data releases.

Tuesday, July 9

- 06:00 AM NFIB small business optimism, June (consensus 103.3, last 105.0)

- 10:00 AM JOLTS Job Openings, May (consensus 7,458, last 7,449k)

- 10:10 AM St. Louis Fed President James Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will make welcoming remarks at the Official Monetary and Financial Institutions Forum at Washington University in St. Louis. Prepared text is expected.

- 2:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak at the Official Monetary and Financial Institutions Forum at Washington University in St. Louis.

Wednesday, July 10

- Federal Reserve Chair Jerome Powell will appear before the House Financial Services Committee to deliver the Fed’s semi-annual Monetary Policy Report to Congress and answer questions from lawmakers. Prepared text is expected.

- 10:00 AM Wholesale inventories, May (consensus +0.4%, last +0.4%)

- 1:30 PM St. Louis Fed President James Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will speak at the Official Monetary and Financial Institutions Forum Conference at Washington University in St. Louis. A moderated Q&A and audience and press Q&A are expected.

- 2:00 PM Minutes from the June 18-19 FOMC meeting: At its June meeting, the FOMC left the target range for the policy rate unchanged at 2.25-2.50%, but delivered a dovish message stating that the FOMC “will act as appropriate,” and with seven of 17 participants projecting 50bp of easing this year. In the minutes, we will look for further discussion of the path of the policy rate and the growth and inflation outlook.

Thursday, July 11

- 08:30 AM CPI (mom), June (GS +0.09%, consensus flat, last +0.1%); Core CPI (mom), June (GS +0.21%, consensus +0.2%, last +0.1%); CPI (yoy), June (GS +1.68%, consensus +1.6%, last +1.8%); Core CPI (yoy), June (GS +2.04%, consensus +2.0%, last +2.0%): We estimate a 0.21% increase in June core CPI (mom sa), which would leave the year-over-year rate unchanged on a rounded basis (at +2.0%). Our monthly core inflation forecast reflects a boost from tariffs of around 0.05pp (step-up from 10% to 25% rate on $200bn of Chinese imports), which we expect to manifest in the household furnishings, auto parts, and personal care categories. We also expect a rebound in used car prices, reflecting higher auction prices and residual seasonality. We estimate a flat reading in the apparel category following methodological changes earlier this year, and we look for a sequential reacceleration in shelter inflation. On the negative side, we look for a pullback in airfares. We estimate a 0.09% increase in headline CPI (mom sa), reflecting a drag from lower gasoline prices.

- 08:30 AM Initial jobless claims, week ended July 6 (GS 230k, consensus 221k, last 221k); Continuing jobless claims, week ended June 29 (consensus 1,682k, last 1,686k): We estimate jobless claims increased by 9k to 230k in the week ended July 6, after declining by 8k in the prior week, as there were several more auto plant shutdowns.

- 10:00 AM Fed Chairman Powell appears before the Senate Banking Committee; Federal Reserve Chairman Jerome Powell will appear before the Senate Banking Committee to deliver the Fed’s semi-annual Monetary Policy Report to Congress and answer questions from lawmakers. Prepared text is expected.

- 11:10 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak on community revitalization in Albany, New York.

- 12:15 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on monetary policy at the Volcker Alliance State Fiscal Conference hosted by the Atlanta Fed. Prepared text and audience and media Q&A are expected.

- 12:30 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will speak at the Rocky Mountain Economic Summit in Victor, Idaho.

- 5:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will speak in a town hall Q&A in Aberdeen, South Dakota.

Friday, July 12

- 08:30 AM PPI final demand, June (GS flat, consensus +0.1%, last +0.1%); PPI ex-food and energy, June (GS +0.2%, consensus +0.2%, last +0.2%); PPI ex-food, energy, and trade, June (GS +0.2%, consensus + 0.2%, last +0.4%): We estimate a flat reading in headline PPI in June, reflecting relatively firm core prices but weaker energy prices. We expect a 0.2% increase in the core measure excluding food and energy, and also a 0.2% increase in the core measure excluding food, energy, and trade.

- 5:00 PM Chicago Fed President Charles Evans (FOMC voter) speaks: Chicago Fed President Charles Evans will speak on “Trade and the Heartland: From Agriculture to Manufacturing” in Chicago.

Source: Deutsche Bank, BofA, Goldman

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|