Sell-Off Completed?

Alasdair Macleod

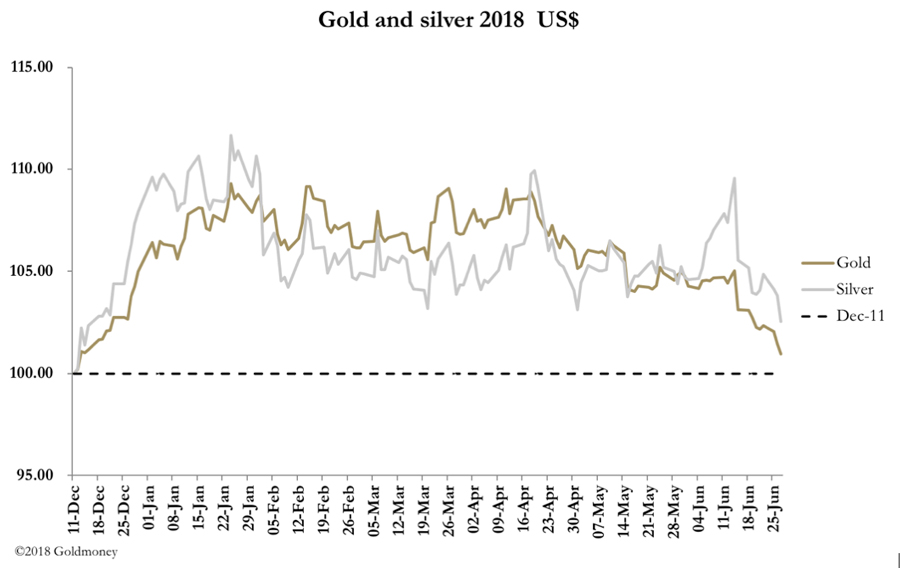

Gold and silver sold off last week, and as shown in our headline chart, have lost nearly all the gains made since the last major turning point on 11 December 2017. Gold and silver sold off last week, and as shown in our headline chart, have lost nearly all the gains made since the last major turning point on 11 December 2017.

Gold at its low yesterday was within $9 of that low, and silver 30 cents. By early European trade this morning (Friday), gold had fallen $19 from last Friday’s close to $1251 and silver by 25 cents to $16.09.

It often happens that gold and silver prices hit low points in June and December, before rallying sharply. The reason is not hard to understand: traders at the bullion banks close their books at the year and half-year ends and are almost certainly instructed by their superiors to reduce their trading positions to as low a level as possible. This is because the banks wish to report balance sheets that reflect low risk exposure for the purpose of making regulatory returns.

Bullion bank traders will also want to show profits, which given they are naturally net short on their positions, requires them to force prices as low as they can at the expense of the speculators. Comex is the ideal market to achieve these twin aims. The effect, which is reflected in the net exposure of the Managed Money category, is clearly demonstrated in the next chart.

The Managed Money category consists of hedge fund speculators, and when spooked by the professional traders at the bullion banks provide the means for them to square their books. Furthermore, hedge funds also have a desire to show “reasonable” exposure at the year-ends and half-year accounting dates, closing down loss-making positions. This creates the opportunity for bullion bank traders to smash market .

The up-arrows on the chart illustrate the low points in the Managed Money net exposure to gold futures contracts, and since gold bottomed in December 2016, note how they are always at or close to end-June and December. We will know last Tuesday’s figure after the markets close tonight, but it is a fair bet that the Managed Money category is now marginally net short, reflecting an extreme oversold position.

The other side of the traders’ coin is the dollar, and that has shown further strength this week, having had a decent rally from the earlier lows this year. However, persistent weakness in US Treasury yields, and the slowdown in money supply growth tells us that something, perhaps Trump’s trade tariff policies, is putting the brakes on the US economy. We are also seeing expectations of further interest rate increases soften, which should be negative for the dollar and positive for gold.

Therefore, the indications are that the conditions for a decent rally in the gold price lasting until September-October are now in place. And as it develops, one can see that the mixture of a stagnating economy and increasing price inflation (the CPI-U in May was at 2.8%, while oil prices are continuing to rise) could lead to markets reflecting ideal conditions for higher gold and silver prices.

Alasdair became a stockbroker in 1970 and a Member of the London Stock Exchange in 1974. His experience encompasses equity and bond markets, fund management, corporate finance and investment strategy. After 27 years in the City, Alasdair moved to Guernsey. He worked as a consultant at many offshore institutions and was an Executive Director at an offshore bank in Guernsey and Jersey.

www.goldmoney.com

|