Demand in the Housing Market Just Got Even Worse, as Supply Piles Up

Wolf Richter

Waiting for lower prices, higher incomes, and lower rates. Waiting for lower prices, higher incomes, and lower rates.

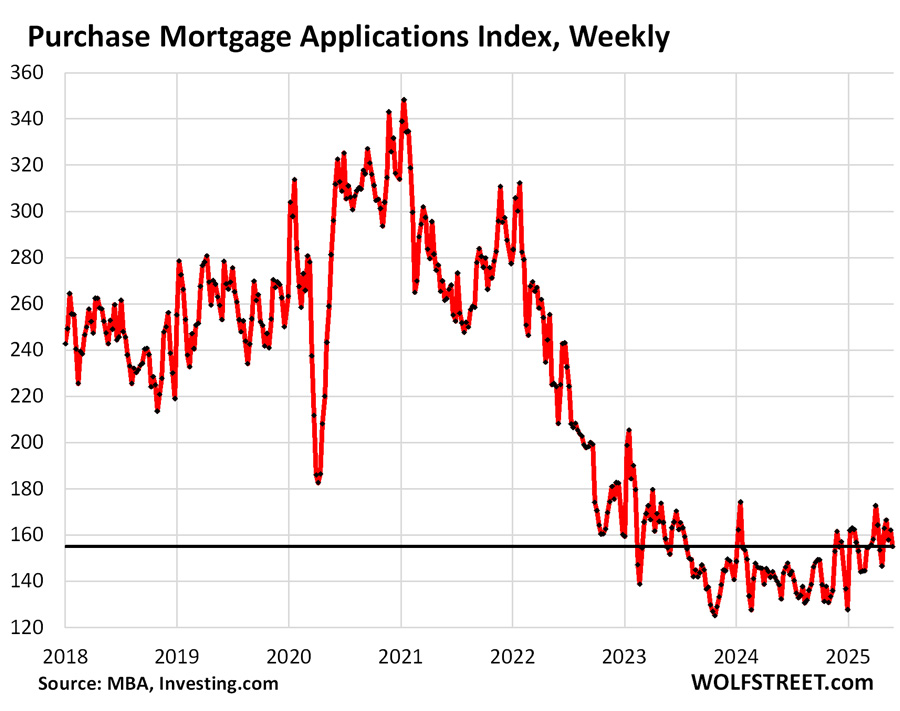

Applications for mortgages to purchase a home fell again in the latest reporting week, having collapsed by 39% from the same week in 2019, according to data by the Mortgage Bankers Association today. Mortgage applications are an early indicator of demand in the housing market, preceding “pending sales” and “closed sales” for this period.

This 39% plunge in purchase mortgage applications compared to 2019 documents the extent to which demand in the housing market has vanished, after prices spiked in just two years through mid-2022 by 50% and more – substantially more in many markets. Demand destruction sets in when prices are too high, a fundamental economic principle.

For two-and-a-half years, mortgage applications to purchase a home have been wobbling along above the record lows of November 2023 and February 2024 in the data going back to 1995.

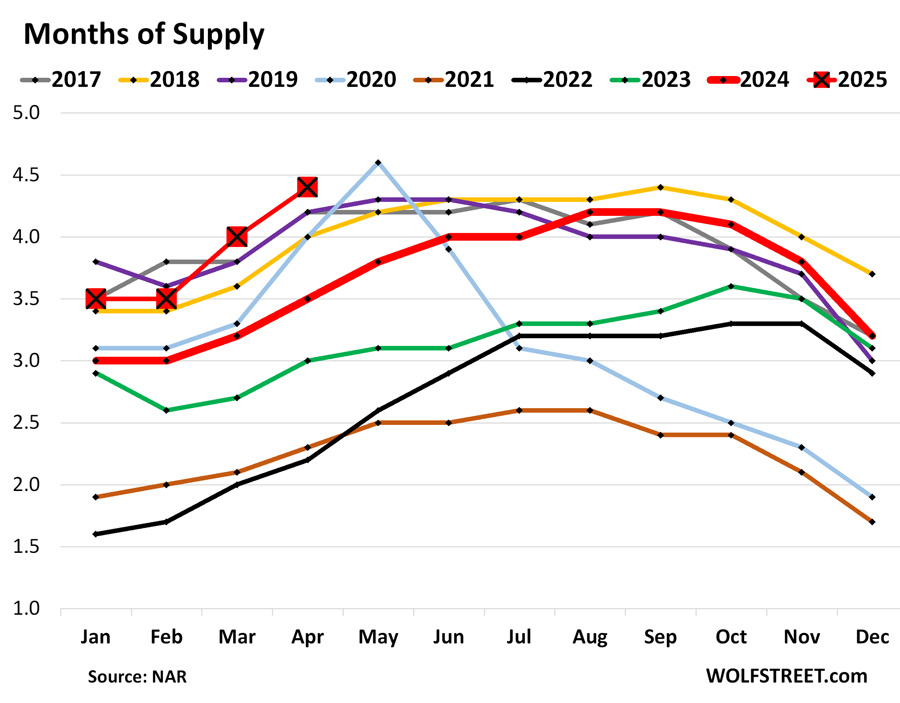

This lack of demand is now coinciding with, and is contributing to, the surge in supply, as listings sit longer and get stale. Supply of existing homes rose to 4.4 months in April, the highest for any April since 2016, according to data from the National Association of Realtors.

Back in 2022, they blamed the collapse in demand on the lack of inventory for sale. Inventory had dropped to very low levels as enough home buyers saw the historic price spike in progress and decided to ride it up all the way with their old home after they’d already moved into their new home, thereby taking one home off the market, and not putting their old home on the market. Now, those vacant homes are coming on the market, with impeccable timing after demand has vanished for price reasons:

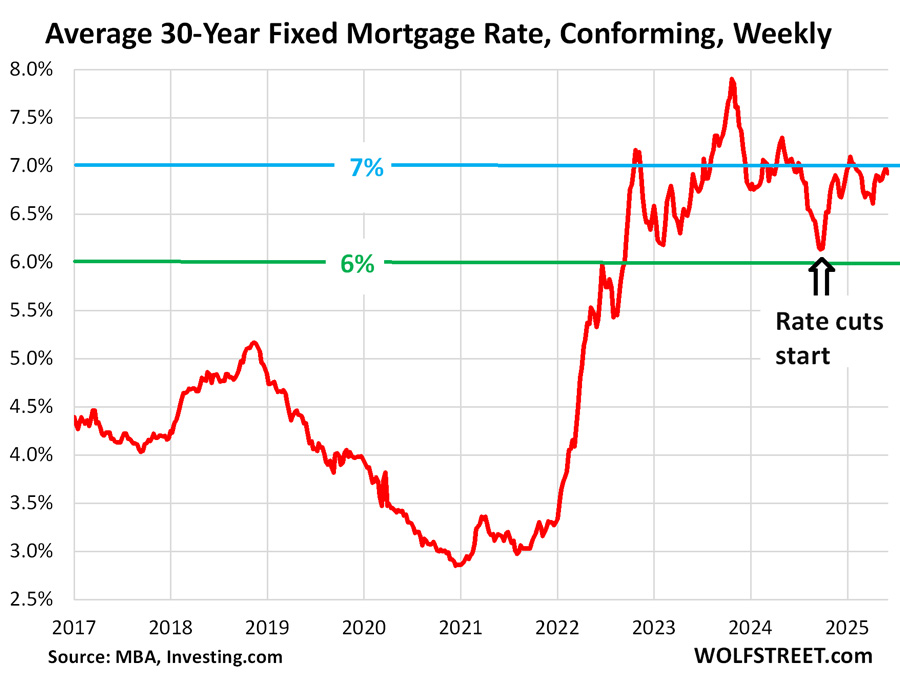

Mortgage rates have stabilized between 6.6% and 7.1% since October last year. In the latest week, the average conforming 30-year fixed mortgage rate ticked down to 6.92%, according to the MBA today, same as two weeks ago.

Mortgage rates in this range were normal to low in the pre-QE era before 2009. So that’s not the problem.

The problem is that home prices have exploded in a fantastical way during the Fed’s interest rate repression in 2020-2022 that generated the now infamous below-3% 30-year fixed-rate mortgages. That was a brief blip in history, but it did a lot of damage to the housing market by inflating home prices to absurd levels, the consequences of which are now here for all to see.

An event that taught the Fed a lesson was how mortgage rates re-spiked, along with long-term Treasury yields, from mid-September into January, as the Fed cut its short-term policy rates by 100 basis points, just as inflation had started to re-accelerate. This dovish move by the Fed, in face of rising inflation, spooked the long-term bond market. Inflation saps the purchasing power of long-term bonds, and investors want to be paid with higher yields for that expected loss in purchasing power, so long-term Treasury yields shot up, and mortgage rates along with them.

The MBA’s measure of the 30-year fixed mortgage rate surged by nearly 100 basis points, while the Fed cut 100 basis points.

It was a “Go ahead, make my day!” message from the bond market to the Fed that had been considering further rate cuts. And the Fed has since then put rate cuts on ice and started talking tough on inflation, which calmed down the bond market, and mortgage rates.

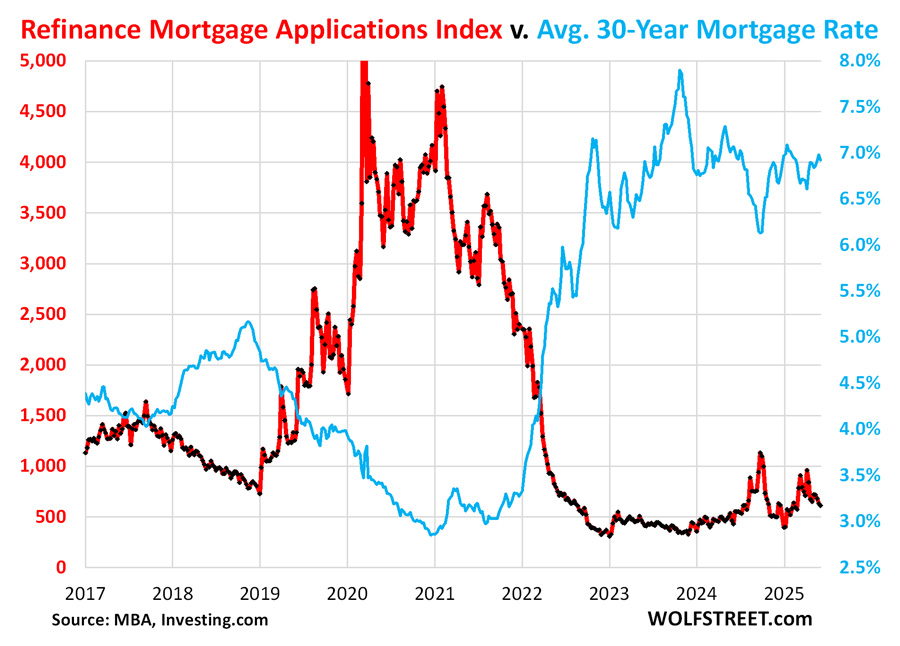

Mortgage applications to refinance a home fell further in the latest reporting week, and have been hobbling along collapsed levels compared to the 3%-mortgage era (-79% from 3 years ago).

But homeowners still want to refinance mortgages for various reasons, and they’re still happening despite the higher mortgage rates, but at a low volume. Mortgage refinance volume (red line) is inversely correlated to mortgage rates (blue).

The collapse in mortgage originations both to finance the purchase of a home and to refinance an existing mortgage has wreaked havoc in the mortgage lending industry, that responded quickly, starting in 2022, with mass-layoffs that have cut employment at nonbank real-estate lenders by 38%: Housing Bubble & Bust #1 and #2 as Seen through Employment at Mortgage Lenders: They Shed Jobs Again, 38% Gone

Many homebuyers remain on strike, now in its third year. They’re waiting for prices to come down, they’re waiting for their household incomes to rise, and they’re waiting for rates to come down. Household incomes have risen some, but not enough; and prices have come down only in some markets, but not enough (for example: The 10 Big Cities with the Biggest Price Declines of Single-Family Homes from their Peaks through April: -7% to -21%); and mortgage rates have stabilized in a range around 7%. And so the home resale market remains frozen.

With the extreme home-price distortions in many markets during the pandemic, it’s often a far better deal to rent an equivalent home, than to buy it, which gives lots of potential homebuyers some additional food for thought.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

Founder, Wolf Street Corp, publisher of WOLF STREET. Founder, Wolf Street Corp, publisher of WOLF STREET.

In his cynical, tongue-in-cheek manner, he muses on WOLF STREET about economic, business, and financial issues, Wall Street shenanigans, complex entanglements, and other things, debacles, and opportunities that catch his eye in the US, Europe, Japan, and occasionally China.

Wolf lives in San Francisco. He has over twenty years of C-level operations experience, including turnarounds and a VC-funded startup. He has a BA, MA, and MBA (UT at Austin).

In his prior life, he worked in Texas and Oklahoma, including a decade as General Manager and COO of a large Ford dealership and its subsidiaries. But one day, he quit and went to France for seven weeks to open himself up to new possibilities, which degenerated into a life-altering three-year journey across 100 countries on all continents, much of it overland, that almost swallowed him up.

wolfstreet.com

|