"We Now See The Fed Moving Toward An Attempted Controlled Unwind Position"

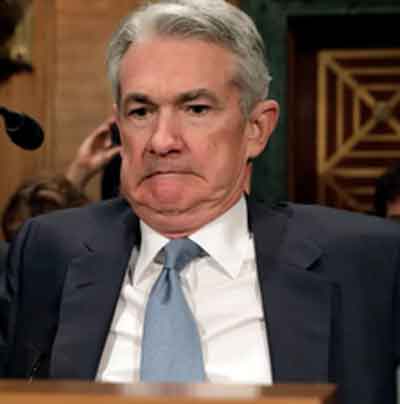

Larry McDonald

Never forget – NOT allowing price discovery for a long period of time - then forcing the process onto markets with a “bayonet in the back” - at an ever-accelerating rate - is a virgin-central bank experiment. It comes at a high price. Never happened before. Never forget – NOT allowing price discovery for a long period of time - then forcing the process onto markets with a “bayonet in the back” - at an ever-accelerating rate - is a virgin-central bank experiment. It comes at a high price. Never happened before.

Inflation is forcing central bankers to allow price discovery. There was always price discovery before Lehman – but for much of the last 12 years markets have been in a Fed zombie trance. We mean a real - free market - "cost of capital."

Light on this process is emerging through the cobwebs of "Pandora's Box." After leaving it closed for far too long. Indeed, the Fed ripped open the box with panicked shaking fingers. As academics - they cannot possibly measure the risk in what they are doing. They are focused on backward-looking economic data - NOT the thousands of NEW risk metrics flying out of the crypt.

Financial conditions are tightening, at the fastest since Lehman. And even when central bankers do see the new emerging risk - they certainly will NOT tell us until the beast inside the market forces them to.

That said, much like our weekend notes delivered near March 14 (QQQ counter trend rally +17%) and May 20 (QQQ counter-trend rally +12%), buy signals are mounting yet again.

Central bankers are NOT idiots – they clearly see the emerging risks we see but have to stick to the stale script and bleed out the truth -- one drop at a time. BUT colossal market pressures and fast economic deterioration will force them to acknowledge the new risk landscape. The greater the systemic risk pressure, the faster the clowns will react.

It ́s all about the rate of change of information. In a bull market, under normal conditions – central bankers do NOT have to get out of their cozy recliner – for years they are conditioned to sit back and relax.

As the bear ́s claws arrive – fresh tracks can be seen on the trail staking Powell and Co. The fierce shift in the rate of change of both economic and systemic risk data presents fresh wounds to the reputations of our brain trusts.

For months – their pawns (sell side banks and journalists) have been talking up a 4-5% Fed funds rate – pure lunacy on today ́s stage. The beast will NOT have it.

We love the gold and silver miners here – and see the Fed moving toward an “attempted” controlled unwind position. They have acknowledged their inflation fight, now they must come clean on the financial stability - recession front.

Larry McDonald is a New York Times bestselling author, CNBC contributor, and Political Risk Expert. He is also the creator of The Bear Traps Report, a weekly independent Macro Research Platform focusing on global political and systemic risk with actionable trade ideas.

Thought-provoking Larry McDonald presents his captivating views on the Trump Administration, U.S. Financial Crisis, European Sovereign Debt, and China’s Economic Meltdown - spiced with actionable risk indicators, risk management lessons, and sprinkled with humor.

In 2016, Larry McDonald joined ACG Analytics in Washington D.C., as a partner with a unique skill set, as one of today’s leading political policy risk consultants and strategists. From 2011 – 2016, he was Managing Director and Head of U.S. Macro Strategy at Société Générale.

www.thebeartrapsreport.com

|