Send this article to a friend:

June

27

2020

Send this article to a friend: June |

|

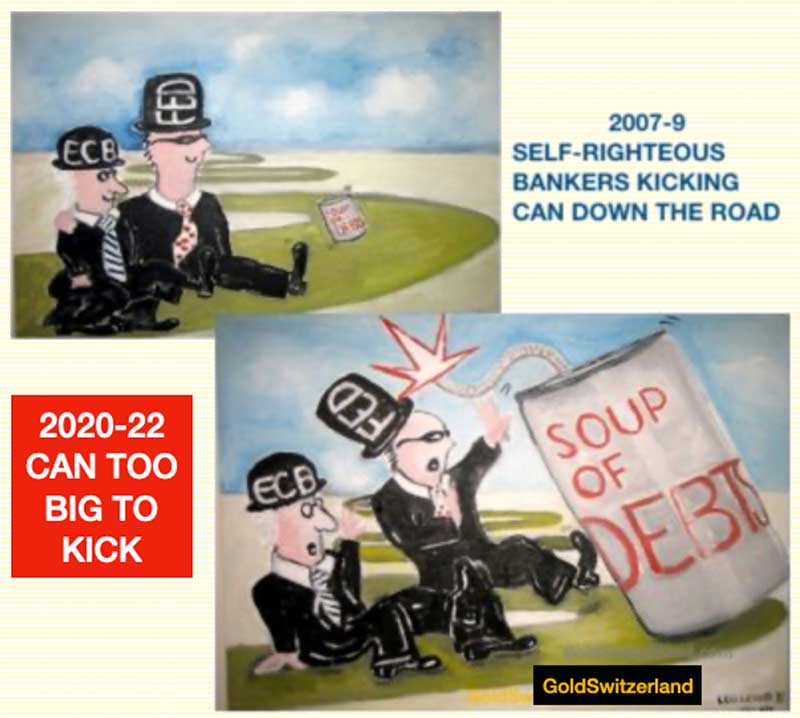

A Can Too Big For The Fed And ECB To Kick

There are lies, damned lies, and economists. Whether these economists work for the government or a bank, they spend all their time on the computer extrapolating current trends with minor adjustments. If you want to understand the future, don’t spend your life preparing and constantly revising an Excel sheet with masses of economic data. Collective human behaviour is extremely predictable. But not by spreadsheet analysis but by studying history. HISTORY IS A BETTER FORECASTER THAN ECONOMISTSThere just is nothing new under the sun. So why is there so much time and money wasted around the world to make economic forecasts that are no better than a random job by a few chimps? Instead, give some lateral thinkers a few history books and let them study the rise and decline of the major empires in history. That will tell them more about long term economic forecasts than any spreadsheet. After a 50 year decline of the US economy and the dollar, we still hear about the V-shaped recovery being imminent. On what planet do these people live who believe that a world on the cusp of an economic and social collapse is going to see a miraculous recovery out of the blue. This is the problem with a system that is totally fake and dependant on constant flow of stimulus even though it has zero value. Most people are fooled and believe it is for real. ALL EMPIRES END WITH COLLAPSING CURRENCY AND SURGING DEBTS We are now in the final stages of the end game. The end of the end could be extended affairs or they could be extremely quick. Most declines of major cycles are drawn out and this one has lasted half a century. During that time the dollar is down 50% against the DM/Euro and 78% vs the Swiss franc. And US debt has gone up 65x since 1971 from $400B to $26T. A collapsing currency and surging debts are how all empires end. But the end of the end has also been drawn out and started in 2006 with the Great Financial Crisis. The financial system was on the verge of collapse in 2008 but was miraculously rescued with tens of trillions of dollars in printed money and guarantees. Central banks have since then frenetically kept the party going by manufacturing worthless paper money. The music should have stopped in 2008 but the participants are still dancing on the grave of a system that is about to succumb.  The degree of the coming disintegration of the world economy will only be known with certainty by future historians. What is clear though is that we are seeing the end of a major cycle. What we will experience next is not just the fall of one nation but of most nations on earth, both advanced and developing countries. Debt is a global problem that virtually every country is seriously affected by. When the financial system crumbles so will world trade. WHAT WILL HAPPEN NEXT? Asset Bubbles can only end in one of two ways: Either they Implode or they Explode The principal bubbles we are here talking about is the financial system, stock markets, bond markets, and property. So in principle, we are looking at two options for this era to end. The net result is always the same although the Explosion finale will be the more violent and lead to a quicker massacre than the Implosion. Explosion The risk of an Explosive end is very high. That would most probably involve acute problems in the banking system leading to a major bank defaulting, say Deutsche Bank. This would spread throughout the whole banking system like wildfire and obviously also affect the derivatives bubble of $1.5+ quadrillion. It would happen so quickly that central banks wouldn’t be able to print money fast enough to stop it. In any case, the whole financial world would know at that point that any freshly printed money would have ZERO value and therefore ZERO effect. An Explosive outcome of this 100-year bubble-era would clearly be cataclysmic for the world. It would lead to a global deflationary depression of a magnitude never seen before. It would also take life back to a level of devastation and deprivation that would be unimaginable today. Implosion The only difference with an Implosive outcome is that it would take longer and therefore involve both hope and pain as desperate central banks create trillions and quadrillions of worthless dollars, euros etc to temporarily keep the balloon inflated. Even though this process would be more drawn out, it would also fail in the end. First, there would be a brief period, maybe a couple of years, of hyperinflation before it would end in a deflationary collapse. So these are the two options. There is absolutely nothing that can stop it. Well, we always have Deus ex Machina of course. Yes, miracles can always happen and the world would certainly need one this time. But sadly the odds are not in favour of these kinds of wonders. WHAT WE KNOW

The 6 biggest money manufactures are:

The above list of problems is just an example of the global pressures on states, companies, and individuals that either are bankrupt or will collapse under the weight of their own debt in the next few years. WHAT THE EFFECTS WILL BE

WHAT WE SHOULD DO Most people sadly cannot plan for what is coming. They don’t have any savings and might have problems affording to stay in their house or apartment.  For the ones with small savings, even if it is only a few hundred dollars, take it out of the bank and buy some silver or gold bars or coins. One gramme of gold costs $60-70. One gramme of silver costs 70 cents and an ounce of silver costs $20. Many people can afford that and what today looks like small investments could save your life in a few years. Just ask the Venezuelans. For bigger investors, get out of stocks, except for gold and silver stocks, and get out of bonds and investment properties. On your own home, pay down the mortgage if you can. And obviously, buy as much physical gold and silver that you can afford and store it outside the banking system. Gold and silver will work effectively as wealth protection both in inflation and deflation. In a period of crisis, your best asset and support system is a close circle of friends and family. This is what will keep you going physically, mentally, and morally. MARKETSStocksThe secular bull market in stocks ended in February 2020. We have now entered a secular and devastating bear market. The first leg down finished in mid-March and we are just finishing the suckers’ rally that makes retail investors uber-optimistic. The next leg down is imminent. It will shock the world. There could be a vicious catalyst. Gold & SilverThe move up to $1,950 – $2,100 has started. We could see an acceleration starting soon. Once gold clears $2,000 much higher values are coming. For most people who know and follow me, I hardly need to repeat that you mustn’t focus on the price of gold or silver measured in soon worthless paper currencies. Just own physical precious metals for insurance and wealth preservation. Measured in overvalued paper money, gold and silver are absurdly cheap. Egon von Greyerz

|

Send this article to a friend:

|

|

|