Stocks Puke As TINA Unwind Accelerates

Tyler Durden

Remember the rally yesterday and how great that felt... "is the bottom in?" etc... yadadadada... Well... it's gone... Remember the rally yesterday and how great that felt... "is the bottom in?" etc... yadadadada... Well... it's gone...

US equity futures are tanking after the cash markets open, taking out yesterday's lows...

As Nomura's Charlie McElligott notes, it appears this is the potential unwind of the "TINA" phenomenon, as, thanks to the repricing of the risk-free rate - then pushing into yields on spread-product - "there is an alternative" to equities once again.

And this aligns with something that has increasingly come up in conversation with Multi-Asset investors into said potential for an “economic cycle downshift,” but one that does not see a “systemic” shock increase in default cycle, as Corporate balance sheets have been cleaned-up - which is the relative attractiveness of IG Credit in particular, which now has handsome Yield again, but of course too is “up” in capital structure versus Equities

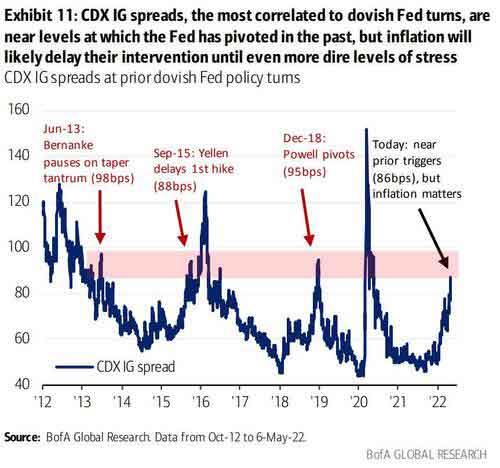

And as the chart above shows, IG spreads are at a somewhat critical level too - The Fed has typically folded like deck-chair at around this level of risk.

However, as McElligott notes, there was a clear “hawkish” directional tilt and even another “signal” from Jay Powell yesterday, acknowledging increased likelihood of “hard-landing” risk

-

On over-interpreting / “cherry-picking” inflation data for signs of progress, or the potential for “pause” when the hit they perceived ‘neutral’ rate: “Truthfully, this is not a time for tremendously nuanced reads of inflation. We need to see inflation coming down in a convincing way. That is what we need to see. Until we see that, we are going to keep going.”

-

On running “restrictive”: “What we need to see is inflation coming down in a clear and convincing way, and we’re going to keep pushing until we see that. If that involves moving past broadly understood levels of ‘neutral,’ we won’t hesitate at all to do that.”

-

Notable that this was the second-consecutive interview where he noted that that this is going to tough-sledding: “There could be some pain involved in restoring price stability.”

-

Further: in order to get inflation down to 2% target, “..we have to slow growth to do that...(but) we don’t have precision tools.”

So maybe it's different this time for Powell's Fed and he will let financial conditions tighten deeper and for longer than anyone since Volcker? We suspect a lot will depend on Biden's polls... and we know which direction that is heading.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|