Send this article to a friend:

May

22

2021

Send this article to a friend: May |

|

Surging Inflation Might Be the Rumblings of an Economic Tsunami

Gasoline prices pushing $5 per gallon are concerning bad, and will strain family budgets across the country following on the heels of the COVID-19 pandemic. The 400% increase in lumber prices isn’t helping either, and as Business Insider reports: “Certain food items, household products, appliances, cars, and homes are all seeing prices surge” thanks to supply chain issues. So the economic situation is already pretty dicey. But what if the situation is much worse? What if the Fed has played such a good “shell game” with inflation that something bigger is actually brewing? Former Treasury Secretary Larry Summers is worried because of how fast inflation is heating up:

And this fast-rising inflation still seems to be flying under the Fed’s radar. Robert Wenzel didn’t mince any words, calling Chairman Jerome Powell’s Federal Reserve “clueless.” Based on Powell’s previous track record, Wenzel’s comment might be reasonable. That Powell seemed to be “ignoring” parts of the entire story behind inflation last year further supports Wenzel’s argument, and adds uncertainty. Inflation surging and the Fed failing to even acknowledge it, let alone live up to their inflation-control mandate? This is a recipe for a frightening situation. Bloomberg spotlighted one fact that raises at least one serious question:

The question this fact raises is fairly simple: How did Powell’s Fed miss by so much? Regardless of that answer, how did all the forecasters get it so wrong, as well? (We’ve reported on “real” inflation several timesbefore, so it’s safe to conclude they aren’t regular readers…) Thinking about the answers adds more weight to how serious (and frightening) this inflation situation really is. “A Tsunami Warning Has Been Issued” The Daily Reckoning, in addition to claiming an economic “tsunami warning” needs to be issued, revealed a few more insights that should at least give you pause:

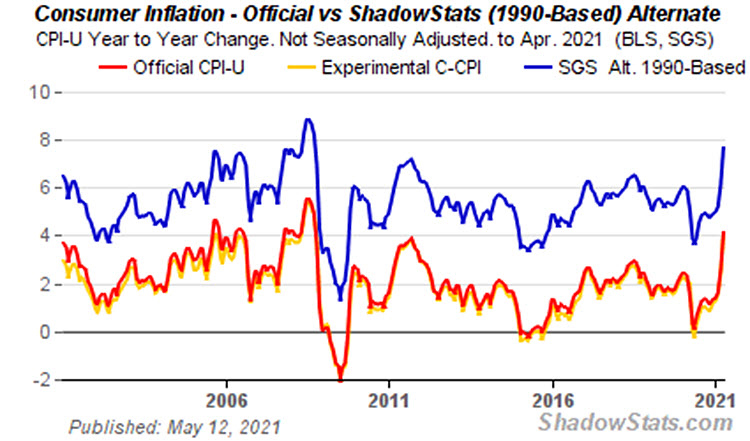

A look at ShadowStats latest update reveals an eye-popping 8% inflation. This rate is calculated using a 1990 methodology that took a consumer’s “standard of living” into account (along with food and energy inflation). Don’t make the mistake of dismissing ShadowStats based on its name. Their logic and methodology for their calculations isn’t a secret. According to the same measure of inflation the U.S. officially used in 1990, he latest rate is almost double the CPI reported by official sources (both shown on the chart below):

Via ShadowStats The 1990 methodology for calculating inflation was “swept under the rug” 30 years ago to make way for an artificial cost-of-living adjustment for Federal programs. (Or as John Williams of ShadowStats puts it, “real-world experience and public perceptions versus academic theories and political gimmicks.) If “real-world experience” inflation is really 8%, and not 4.2% as officially reported, then it is already spinning out of control. What’s worse, inflation isn’t some light switch that can be turned off instantly, and the ripple effects could last for years. The last time inflation got really bad in the U.S., Paul Volcker was finally able to rein it in. This wasn’t pretty. Here’s how the former president and CEO of the St. Lous Fed William Poole described Volcker’s cure:

To make matters worse, Nouriel Roubini thinks stagflation could be possible:

High unemployment, high inflation, and a “slowing” economy are the main ingredients of stagflation. Unemployment rose to 6.1%, inflation is rising fast, and the anemic annual GDP growth rate of .40% still hasn’t come near pre-pandemic levels. So unless GDP dramatically changes or unemployment returns to pre-pandemic levels, Roubini (known as “Dr. Doom”) could be right. Maybe an economic “tsunami warning” is necessary. When the sirens sound, it will already be too late When a tsunami alarm goes off, you need to already be prepared. Things get dangerous fast if you aren’t, and the opportunity to prepare has long passed. Are you hearing the economic sirens right now? With a tsunami of inflation rising offshore, poised to cause horrific carnage and financial devastation? Because once you see the ocean rising up and not even the most skeptical can deny what’s happening, it’s far too late to brace yourself. Hope, or pray that you’ll be one of the lucky few survivors. If you’re reading this right now, you still have a chance to make a plan. Precious metals like gold and silver have had inherent value for thousands of years. They have proven to be an excellent hedge against inflation and a globally-recognized store of value. Don’t wait to consider adding some to your tsunami survival kit.

|

Send this article to a friend:

|

|

|