Inmates of The Hotel Eccles QE Rehab Facility

Gary Christenson

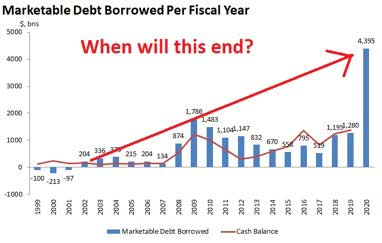

Chairman Bernanke promised the Fed would unwind Fed purchases from the 2008 crisis. Now we know they can’t and won’t. The Fed balance sheet of created QE currency units will expand until a reset occurs. Chairman Bernanke promised the Fed would unwind Fed purchases from the 2008 crisis. Now we know they can’t and won’t. The Fed balance sheet of created QE currency units will expand until a reset occurs.

When will increasing debt and the QE nonsense stop? Perhaps…

a) When a snowstorm devastates South Texas in August.

b) When the Fed begs forgiveness for its monumental sins.

c) When the US government balances its budget.

d) When global fiat Ponzi Schemes collapse.

e) When a huge financial reset occurs.

BOTTOM LINE:

Like the Eagles said in 1977:

“Welcome to the Hotel California… Relax, said the night man. We are programmed to receive. You can check out any time you like but you can never leave.”

The 2020 post COVID-19 pandemic version could be:

“Welcome to the Hotel Eccles… Relax, said the chairman. We are programmed to deceive. You can check out any time you like but you can never leave.”We have become inmates in the Hotel Eccles QE Rehab Facility because:

- National debt and money supply must grow. Inflate or Die!

- U.S. National Debt of $25 trillion can never be paid in today’s dollars. It must be defaulted or devalued. Expect a reset.

- Government and the banking cartel want dollar devaluation, consumer price inflation and more debt. They will sacrifice the dollar to support the bond and stock markets.

- The U.S. economy runs on debt and credit. Dollars are debts of the Federal Reserve. The U.S. government spends $ trillions over its revenues each year, so national debt must increase. In the absence of foreign and domestic buyers at artificially low interest rates, the Fed must monetize. QE4ever!

- Dishonest dollars created from nothing spend like existing dollars, but they make existing dollars worth less, until they become worthless. Countries who pursued similar policies are Zimbabwe, Argentina, and Venezuela, bad precedents.

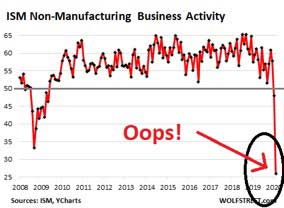

- Oops! The consequences of monetizing $ trillions will be catastrophic, but we must not focus on those consequences in an election year.

From the Eagles: “This could be heaven, or this could be hell.”

Post COVID-19 Pandemic version: This will be heaven and hell. It will be (for a while) heaven for the political and financial elite and hell for the lower 90%. See below.

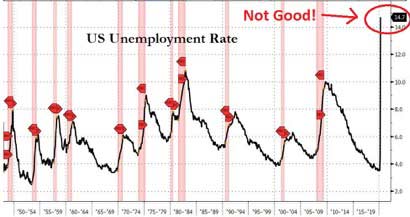

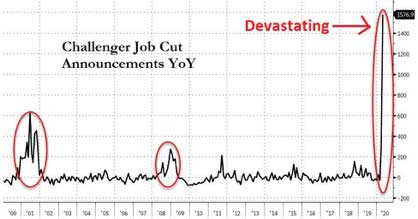

But we were told in January the economy was doing great. Now that claim is heard less than before the COVID-19 shutdown. Examples of the shutdown created mini reset from early 2020:

Summary: the US economy is not doing well. The stock market has been levitated by “easy money,” not fundamentals. Desperation, bankruptcies, and bailouts are prevalent. Employment and GDP are in free fall. The Fed monetizes debt because they must. “Helicopter money” floats down upon people, and most need more. Repo madness bailed out hedge funds. QE bails out Wall Street.

What About National debt?

Sept. 30, 2000 $5,674 billion

Sept. 30, 2005 $7,933 billion

Sept. 30, 2010 $13,562 billion

Sept. 30, 2015 $18,151 billion

May 6, 2020 $25,142 billion

Does this debt trend reassure anyone that “everything is good?” Does “well managed” describe our debt disaster? Which plan to control expenses, repay the debt, and strengthen the economy is best? Oops, the Fed and the US government have NO PLAN to control expenses or manage debt. Government will spend during 2020 (an election year) to support the economy, buy votes, levitate the stock market, and perpetuate a failing status quo.

- Addressing an excessive debt problem with more debt is not a workable plan.

- Because government and the Fed have no practical plan, INDIVIDUALS MUST HAVE A PLAN:

FACTS:

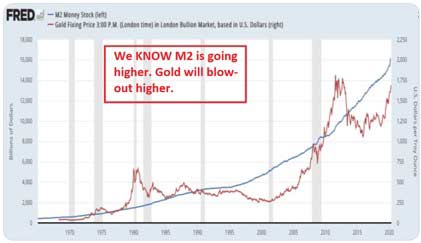

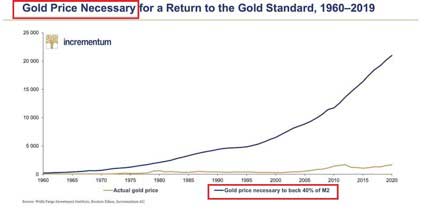

As M2 rises, gold and stocks become more expensive, because each dollar is worth less.

The stock market is over-valued, has corrected, and will probably fall more, even supported by QE induced levitation.

Stocks are too high. Gold and silver peaked in 2011 and have been rising for the past four years. Given that QE4ever is the “plan”, gold and silver must rally further. They have been money for millennia, retain their value, are trusted globally, are hated by central banks, despised by bankers, and discouraged by politicians.

BACKING CURRENCY UNITS WITH GOLD:

- One alternative is to back dollars with gold, which will not happen soon. It’s possible the ruble or yuan will be backed by gold.

- Pretend the US has the 261 million ounces of gold reserves as claimed. (Fort Knox and other locations.)

- Assume the US backs M2 by gold at 40%. The price of gold would be around $20,000.

THOUGHTS:

- David Schectman: “Hyperinflation is a currency event.”

- Spend with fiat units, save with stacked gold and silver.

- The Fed has stated that QE is unlimited. Swell…

- The Fed is not supporting the economy. It is supporting the debt bubble.

- Chairman Powell: “Now is not the time to worry about debt.”

- The “shutdown” is a small reset. A larger reset is coming.

- Credit cards, auto loans and student loans each exceed $1 trillion in debt. What could go wrong?

- QE is like heroin. It feels good for a while, and then kills the addict.

- Fiat currencies failed in the past. Why will they be different this time?

- The Fed “prints” dollars by the trillions. The Fed can’t print gold. Which will increase in value during the next four years?

CONCLUSIONS:

- Unemployment is high and getting worse. This recession/depression/reset creates more governmental expenses, less tax revenue, and cranky citizens.

- The US government has addressed the economic shutdown with bailouts for businesses, checks for individuals, proposed infrastructure spending, more bailouts, social services, and… the list is long. These bailouts increased debt since governments have no savings.

- Over $25 trillion in national debt and $75 trillion in total US debt will never be paid in 2020 dollars. Defaults and huge devaluations are coming. Got gold?

- The Federal Reserve enables most of the debt increase via QE4ever— “printing” dollars and increasing their balance sheet. Yup, the plan is creating debt to fix our excessive debt catastrophe.

- The Fed’s balance sheet will increase by many $ trillions in the next several years. Those new trillions will boost consumer prices, including food prices. Food shortages will make it worse.

- Pensions are underfunded. The shutdown has damaged state and local budgets. The cries for expanded federal bailouts will intensify. More debt and QE are a tidal wave rushing toward us. We can never leave the Fed created QE Rehab Facility.

- MMT—Magic Money Tree—policies will add trillions to debt. Gold prices will rise to $5,000 or $10,000 or $14,000 per ounce. When gold sells for $10,000 per ounce, what will a month’s food cost?

- Maybe a larger reset will occur before gold prices reach five digits. Maybe a snowstorm will blanket South Texas next August. Maybe the Fed cares about the lower 90% of the US and will pursue policies to help them. However, a stack of gold and silver coins will be necessary if the Fed is more interested in bailing out Wall Street.

- The Fed might do “the right thing” and back dollars with gold. But their history suggests they will exhaust ALL alternatives first. Crushing deflation and/or hyper-inflation, a “new dollar” worth a fraction of the 2020 dollar in purchasing power, wealth confiscations, and more are possible. Got gold?

Review the data on unemployment, gold prices paralleling M2, and increasing national debt. Are your savings and retirements protected from inflation and deflation, from devaluation and Fed policies, from bailouts and bail-ins from politicians and central bankers? Got gold?

Gold is expensive now. It will be more expensive after hyper-inflation or an economic reset.

Miles Franklin sells gold and silver. Call them at 1-800-822-8080. Silver is inexpensive in May 2020 compared to the price of gold, total debt, the price of the S&P 500 Index and more. Gold provides safety during stressful times. These stressful times are likely to become worse during the rest of 2020.

Protect your savings and retirements with gold and silver.

Gary Christenson

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of several books, including “Fort Knox Down!” and “Gold Value and Gold Prices 1971 – 2021.” He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy, and central banking. His articles are published on Deviant Investor as well as other popular sites such as 321gold.com, peakprosperity.com, goldseek.com, dollarcollapse.com, brotherjohnf.com, and many others.

deviantinvestor.com

|