|

Dallas Fed Business Index Plunges to -35.8, Raw Material Prices +48.4

Mike Shedlock

I don’t usually cover regional Fed reports individually, but this one is wild. I don’t usually cover regional Fed reports individually, but this one is wild.

Today, the Federal Reserve Bank of Dallas released the Dallas Fed Manufacturing Report for April.

Texas factory activity continued to rise in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, was largely unchanged at 5.1, a reading indicative of modest growth.

Other measures of manufacturing activity signaled contraction, however. The new orders index plummeted 20 points to -20.0. The capacity utilization index edged down to -3.8, and the shipments index fell into negative territory for the first time this year, slipping to -5.5 from 6.1.

Labor market measures suggested a slight decrease in head counts and shorter workweeks this month. The employment index held fairly steady at -3.9, with 9 percent of firms noting net hiring and 13 percent noting net layoffs. The hours worked index slipped to -6.4 from -2.9.

Price pressures accelerated in April, while wage growth remained fairly stable. The raw materials prices index jumped 11 points to 48.4, its highest reading since mid-2022. The finished goods prices index rose nine points to 14.9, a reading well above average. Meanwhile, the wages and benefits index held mostly steady at 14.3, below its average reading.

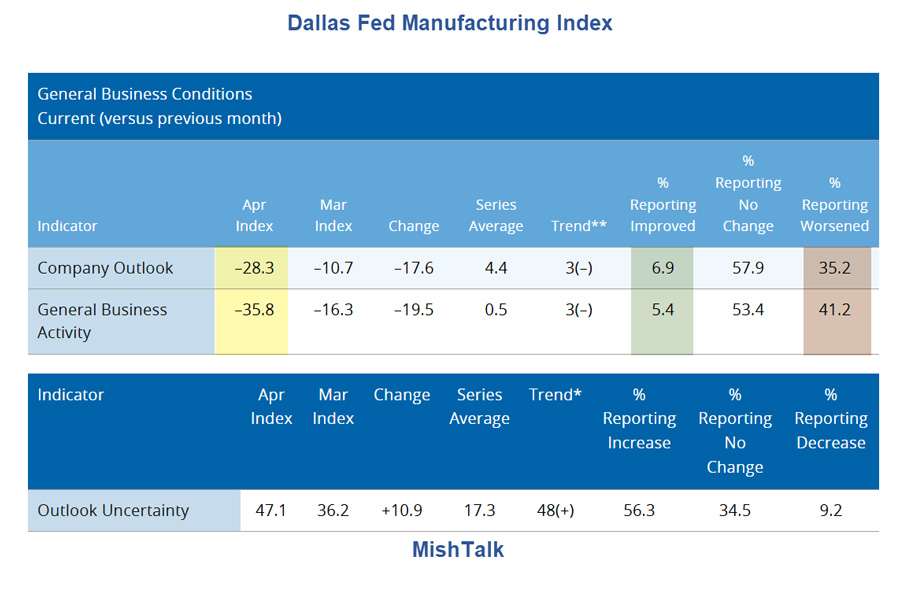

Key Index Items

- Business activity decreased to -35.8 in April from from -16.3 in March. This is the lowest since May 2020.

- Production was still positive at 5.1, down from 6.0, but new orders decreased to -20.0 from -0.1.

- Prices paid for raw materials jumped to 48.4 from 37.7. This is the 60th straight month of rising input prices.

- Employment is -3.9, the third month of declines.

The index numbers are the number of companies reporting an increase minus the number of companies reporting declines.

For example, 54.6 percent of companies reported increasing prices for raw materials while 6.2 reported declining prices.

Subscribe to MishTalk Email Alerts.

Subscribers get an email alert of each post as they happen. Read the ones you like and you can unsubscribe at any time.

Thanks for Tuning In!

Mish

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management.

Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

You are currently viewing my global economics blog which typically has commentary every day of the week.

mishtalk.com

|