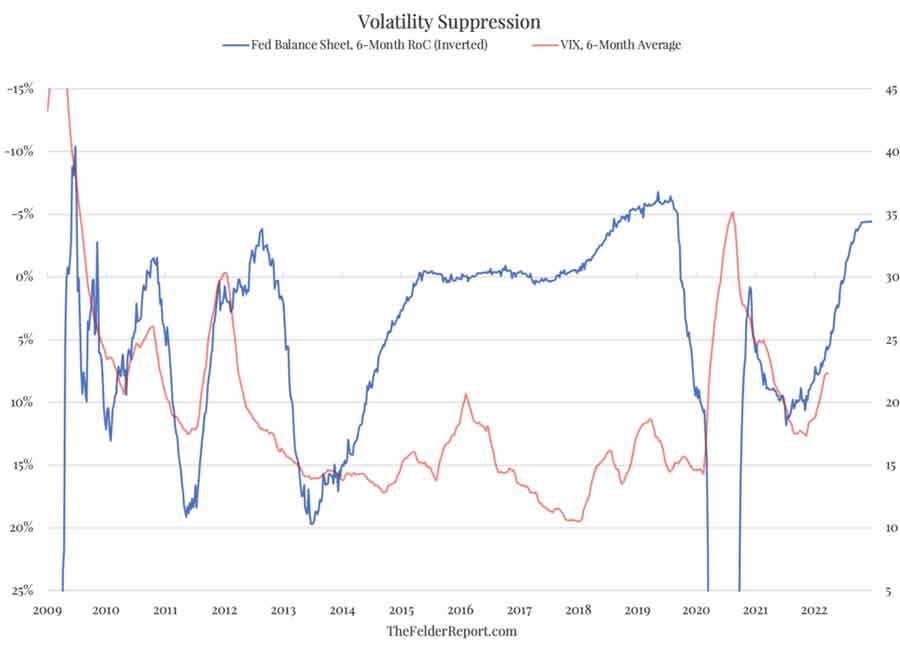

The Fed Just Disengaged Its Volatility Suppression Machine

Jesse Felder

The Fed minutes released today reveal the central bank intends to start reducing its balance sheet by as much as $95 billion per month beginning in May. Investors ought to pay very close attention to this development because, for a very long time now, the Fed has effectively used its asset purchase program to suppress volatility across a variety of markets including the equity market. When the Fed has removed this volatility dampening system in the past, it has regularly led to a series of rolling ructions in the broad stock market. The most recent of these was the 2018-2020 period which began with the Volmageddon episode and ended with the Covid crash upon which the Fed reengaged its volatility suppression program in a massive way. The Fed minutes released today reveal the central bank intends to start reducing its balance sheet by as much as $95 billion per month beginning in May. Investors ought to pay very close attention to this development because, for a very long time now, the Fed has effectively used its asset purchase program to suppress volatility across a variety of markets including the equity market. When the Fed has removed this volatility dampening system in the past, it has regularly led to a series of rolling ructions in the broad stock market. The most recent of these was the 2018-2020 period which began with the Volmageddon episode and ended with the Covid crash upon which the Fed reengaged its volatility suppression program in a massive way.

Considering the fact that the magnitude of these ructions has grown with every subsequent removal and/or reversal of the asset purchase program, it only stands to reason that the greatest volatility explosion could still lie ahead of us. As Christopher Cole has put it, “Risk cannot be destroyed, it can only be shifted through time and redistributed in form.” It’s possible that Fed policy over the past decade, rather than destroy risk, has only managed to shift risks into the future. Now that rapidly rising inflation makes the continuation of the program untenable, those risks could now finally materialize in a way we haven’t seen as of yet. At the very least, it could mean that volatility in the stock market could be elevated for the foreseeable future.

Jesse has been managing money for over 20 years. He began his professional career at Bear, Stearns & Co. and later co-founded a multi-billion-dollar hedge fund firm headquartered in Santa Monica, California. Since founding The Felder Report in 2005 his writing has been featured in many major finance publications like The Wall Street Journal, Barron's, The Huffington Post, MarketWatch, Yahoo!Finance, Business Insider, Investing.com, Seeking Alpha and more. Jesse also hosts and produces the Superinvestors and the Art of Worldly Wisdom podcast. Today he lives in Bend, Oregon with his wife and two kids.

thefelderreport.com

|