Inflation Has Eaten Up Nearly 100 Percent of Hourly Wage Gains Since 1973

Mish Shedlock

(Editor's Note: Inflation is theft. A little inflation is a little theft, and a lot of inflation is a lot of theft. There is nothing natural about inflation. The Federal Reserve is the only cause of inflation in the U.S.A., and a major cause of inflation throughout the world. Everyone involved with the Federal Reserve are thieves. The IRS is the collection agency for the Federal Reserve. They, too, are thieves. Not one in a hundred working there realizes it. But that hardly matters. We are talking about thousands upon thousands of thieves. No wonder we are in such a mess. - JSB) (Editor's Note: Inflation is theft. A little inflation is a little theft, and a lot of inflation is a lot of theft. There is nothing natural about inflation. The Federal Reserve is the only cause of inflation in the U.S.A., and a major cause of inflation throughout the world. Everyone involved with the Federal Reserve are thieves. The IRS is the collection agency for the Federal Reserve. They, too, are thieves. Not one in a hundred working there realizes it. But that hardly matters. We are talking about thousands upon thousands of thieves. No wonder we are in such a mess. - JSB)

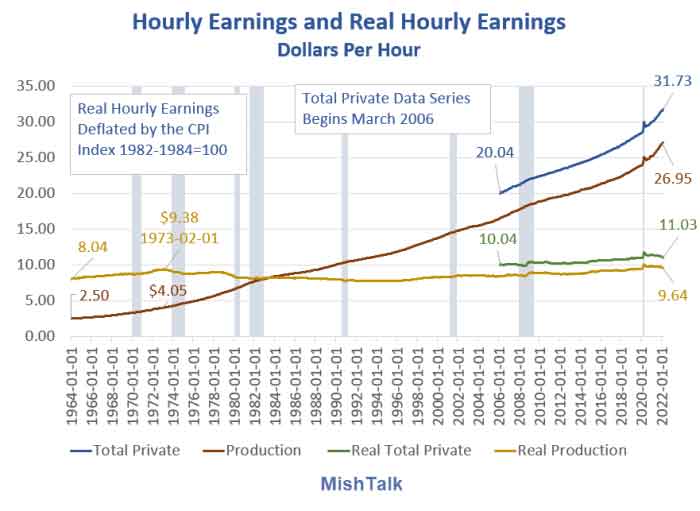

Accounting for CPI inflation, wages for production and nonsupervisory workers is nearly the same today as February of 1973.

Production and Nonsupervisory Wage Details

- Real (inflation-adjusted) wages for production and nonsupervisory workers increased from $8.04 in January of 1964 to $9.38 in February of 1973. That about a 16.7% gain but it was over 9 years.

- Nominal wages rose from $2.50 to $4.05 that’s a 62% gain over 9 years.

- In the next 50 years real wages rose from $9.38 to $9.64, about half-a-penny per year on average.

- In nominal terms, wages rose from $4.05 in February of 1973 to $26.95 in March of 2022 but inflation ate nearly 100% of those gains.

- The series is normalized to the 1982-1984 CPI.

Total Private Sector Wage Details

- The total private series only dates to March of 2006.

- Since March of 2006, nominal wages rose from $20.04 to $31.73.

- Normalized to the CPI Index for 1982-1984, real wages rose from $10.04 in March of 2006 to $11.03 in March of 2022.

Real Hourly Wages Dive Again in March, Negative for 13 of Last 15 Months

A soaring CPI had led to negative real earnings. The drop in purchasing power was steep in March of 2022.

For details and discussion of recent data, please see Real Hourly Wages Dive Again in March, Negative for 13 of Last 15 Months

For detailed discussion of the CPI, please see CPI Rips Higher to 8.5 Percent From a Year Ago, the Most Since 1981.

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management.

Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

You are currently viewing my global economics blog which typically has commentary every day of the week.

mishtalk.com

|