Here Is The Full Explanation Behind Today's Unprecedented Negative Oil Price

Roger Diwan

How did you end up with negative oil prices today? This happens when a physical futures contract find no buyers close to or at expiry. How did you end up with negative oil prices today? This happens when a physical futures contract find no buyers close to or at expiry.

Let me explain what that means:

A physical contract such as the NYMEX WTI has a delivery point at Cushing, OK, & date, in this occurrence May. So people who hold the contract at the end of the trading window have to take physical delivery of the oil they bought on the futures market. This is very rare.

It means that in the last few days of the futures trading cycle, (which is tomorrow for this one) speculative or paper futures positions start rolling over to the next contract. This is normally a pretty undramatic affair.

What is happening today is trades or speculators who had bought the contract are finding themselves unable to resell it, and have no storage booked to get delivered the crude in Cushing, OK, where the delivery is specified in the contract.

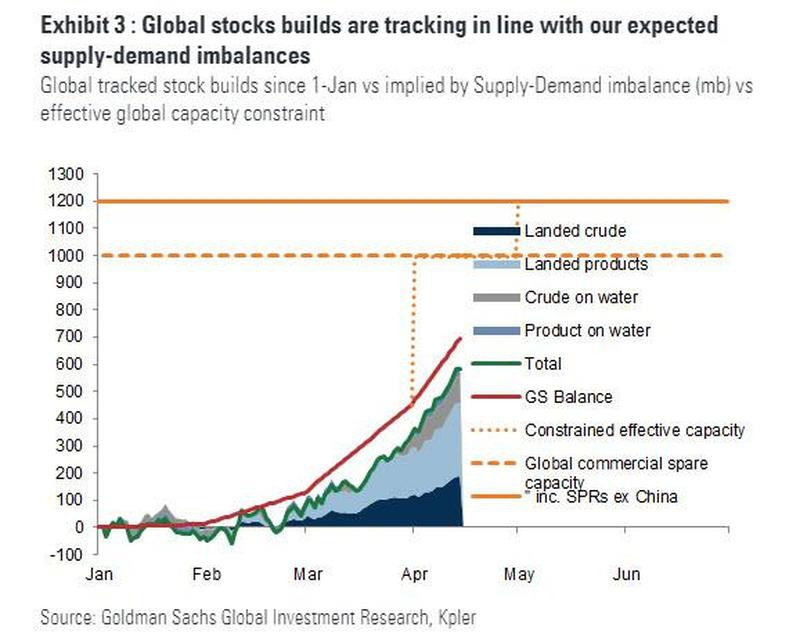

This means that all the storage in Cushing is booked, and there is no price they can pay to store it, or they are totally inexperienced in this game and are caught holding a contract they did not understand the full physical aspect of as the time clock expires.

The contract roll and liquidity crunch that made the extreme sell-off today possible but it DOESN’T necessarily represent futures market conditions: NYMEX June settled today at $21.13.

The June contract is not out of the woods either: today’s action indicate that physical oil markets at Cushing are not in good shape and that storage is getting very full.

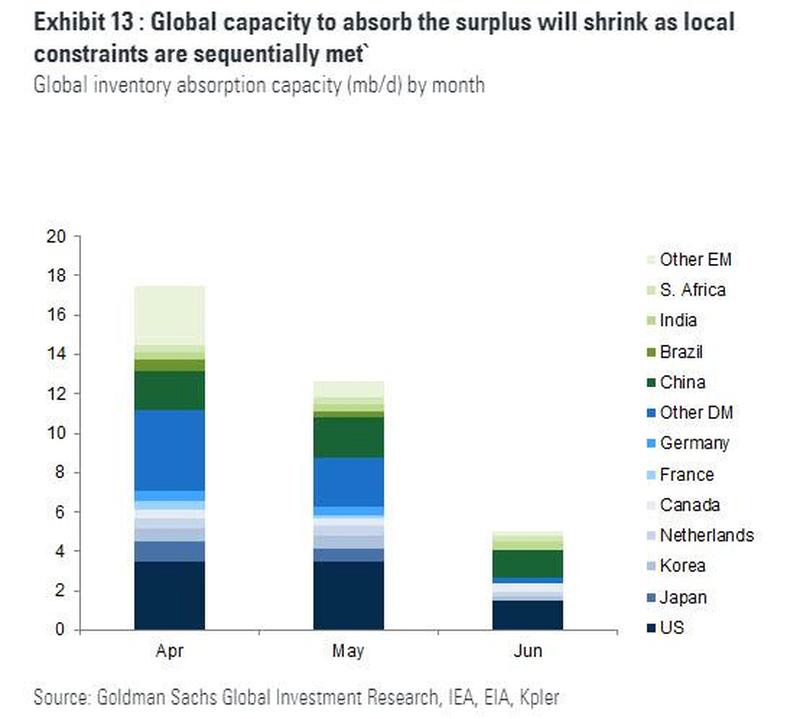

A decline of over 15% in the June contract price points to real worries that the physical stress will continue to reverberate, and will force a lot more production shutdowns during May than the ones announced so far.

So today negative prices are the reflection of dire market conditions for producers, with the hope that demand restart before the middle of May and that the June contract does not face the same fate.

Roger Diwan is a vice president for IHS Markit and heads a dedicated research team that provides integrated energy advisory to the financial sector. Roger Diwan is a vice president for IHS Markit and heads a dedicated research team that provides integrated energy advisory to the financial sector.

Mr. Diwan has more than 25 years of experience in advising governments, oil and gas companies, and financial institutions on oil markets, geopolitics of oil, and assessment of the strategic shifts of the global oil and gas industry. He leads a team of analysts and strategists to advise asset managers, hedge funds, private equity firms, and investment banks by providing customized analysis on the oil and gas industry. Recently, Mr. Diwan has been focusing on strategies that investors are implementing to capture value in the energy sector and the implications of the decapitalization of the oil and gas sector and capitalization of the energy transition. He still leads analysis on topics as varied as the global exploration outlook, the geopolitical impact of US shales, China's energy outlook, or the changing strategies of the Gulf national oil companies. Mr. Diwan holds a Bachelor of Arts from the Sorbonne University, France, and master's degrees from The Johns Hopkins University School of Advanced International Studies, United States, and the Institut d'Etudes Politiques of Paris, France.

ihsmarkit.com

|