Digital Dollar And Digital Wallet Bill Surfaces In The U.S. Senate

Jason Brett

It’s coming… It IS coming! …and so you begin to understand… It’s coming… It IS coming! …and so you begin to understand…

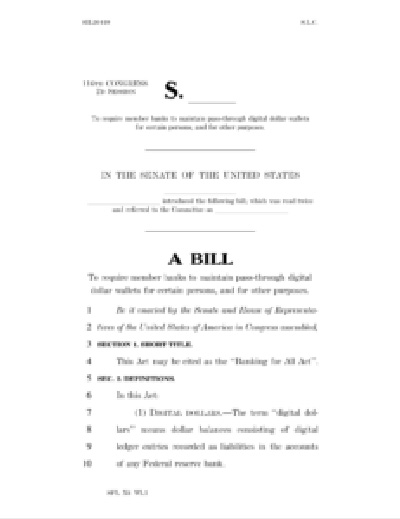

A bill has surfaced in the Senate called the ‘Banking For All Act’, sponsored by the Ranking Member of the Senate Banking Committee, U.S. Senator Sherrod Brown (D-OH).>

In the press release, Senator Brown lays out the details of his bill as well as how he looks forward to urging his colleagues to include it as part of the coronavirus economic stimulus package.

‘At the height of this pandemic we must do more to protect the financial wellbeing of hardworking Americans and consumers. They are on the front lines of this crisis and are already feeling the effects of the economic fallout. My legislation would allow every American to set up a free bank account so they don’t have to rely on expensive check cashiers to access their hard-earned money.’

This bill offers a definition for digital dollars as well as for a digital dollar wallet, and provides the provision for a pass-through digital dollar wallet with the mandate for all member banks to open and maintain digital dollar wallets for all persons, including those eligible to receive the stimulus.

Member Vs. Non-Member Banks In The United States

In the United States, the vast majority of banks, with the exception of the big banks such as Wells Fargo that are supervised by the OCC, have the option to be members of the Federal Reserve and to buy shares in the Reserve as a way of becoming a ‘member bank.’ These banks are then supervised and regulated by the Federal Reserve. A ‘non-member bank’ is a bank that chooses not to be a ‘member’ of the Federal Reserve and is regulated by the FDIC.

For large banks, there is a provision in the bill that online applications for pass-through digital wallets must be made available. The pass-through digital wallet contains consumer protection terms where it notes the wallet ‘shall not be subject to any account fees, minimum balances, or maximum balances and shall pay interest at a rate not below the greater of the rate of interest on required reserves and the rate of interest on excess reserves’

Federal Reserve Banks and the U.S. Postal ‘Banking’ Service

From one institution that likely most Americans have never even entered, the Federal Reserve, to the Post Office, where sometimes daily visits can be part of a person’s routine, this bill includes mandates for each agency to assist in the supply of digital dollar wallets for all. The Federal Reserve may maintain digital dollar wallets. And for low-income areas where the Federal Reserve may not be able to have a branch, the Fed will partner with postal retail facilities to carry out this mandate. For access to the digital cash, ATMs will be provided at U.S. Post Offices.

Now that both Chambers – the House and the Senate – have legislation introduced within both the Senate Banking Committee and the House Financial Services Committee, it does appear that the concept of digital dollars is one that Congress realizes reaches beyond the current coronavirus crisis, and may become a bi-partisan issue. With concerns over China and other countries developing a CBDC, the U.S. might be using this bill to introduce its own digital currency – and also be looking to solve one of the oldest policy issues of all in reaching out to offering banking services to the unbanked and underbanked.

I am a former U.S. Regulator with the FDIC, compliance examiner for the Making Home Affordable Program (HARP) with the Treasury, and have been active in bitcoin and blockchain since 2016. I served in in the FDIC’s Capital Markets and Finance Divisions during the Global Financial Crisis of 2008-2009 working on qualitative, quantitative issues covering IndyMac Bank, Washington Mutual, Wachovia, Lehman Brothers, AIG, Citigroup, Merrill Lynch and Bank of America. I supported the FDIC’s Board at IndyMac bank with deposit run analysis, researched and explained synthetic collateralized debt obligations, credit default swaps, compiled the exposure of net notional derivatives in the financial system, and analyzed new programs by the Federal Reserve Board to stabilize the economy. I became interested in the importance of trust in the financial system and how the U.S. government manages the concept of trust. With the introduction of bitcoin and blockchain technology by a colleague in 2016, I entered into the blockchain industry, first with the Chamber of Digital Commerce as Director of Operations for Policy and then as the Policy Ambassador for ConsenSys. I am currently the founding CEO and President of a new non-profit called the Value Technology Foundation, with the purpose to conduct exclusively educational and charitable activities with regard to digital assets, blockchain, distributed ledger technologies and other relevant “value” technologies for the public welfare and economic benefits of the citizens of the United States. I hold a degree from Cornell University in Government (BA, 1997) and the Kogod School of Business (MBA, 2009). I am a former U.S. Regulator with the FDIC, compliance examiner for the Making Home Affordable Program (HARP) with the Treasury, and have been active in bitcoin and blockchain since 2016. I served in in the FDIC’s Capital Markets and Finance Divisions during the Global Financial Crisis of 2008-2009 working on qualitative, quantitative issues covering IndyMac Bank, Washington Mutual, Wachovia, Lehman Brothers, AIG, Citigroup, Merrill Lynch and Bank of America. I supported the FDIC’s Board at IndyMac bank with deposit run analysis, researched and explained synthetic collateralized debt obligations, credit default swaps, compiled the exposure of net notional derivatives in the financial system, and analyzed new programs by the Federal Reserve Board to stabilize the economy. I became interested in the importance of trust in the financial system and how the U.S. government manages the concept of trust. With the introduction of bitcoin and blockchain technology by a colleague in 2016, I entered into the blockchain industry, first with the Chamber of Digital Commerce as Director of Operations for Policy and then as the Policy Ambassador for ConsenSys. I am currently the founding CEO and President of a new non-profit called the Value Technology Foundation, with the purpose to conduct exclusively educational and charitable activities with regard to digital assets, blockchain, distributed ledger technologies and other relevant “value” technologies for the public welfare and economic benefits of the citizens of the United States. I hold a degree from Cornell University in Government (BA, 1997) and the Kogod School of Business (MBA, 2009).

www.forbes.com

|