Why is the Fed Preparing the Public for NIRP, Permanent QE, and Worse?

Silver Bullion

T he next crisis will soon hit the financial system. he next crisis will soon hit the financial system.

If you don’t believe me, I have to ask… if this statement is false, why is the Fed desperately attempting to lay the groundwork for the next round of monetary easing at a time when the stock market is within 5% of its all time highs?

This has included:

1) The Fed stating it is DONE with rate hikes in 2019 when just three months ago it was talking about raising rates 3-4 times this year.

2) The Fed will taper its Quantitative Tightening (QT) program in May to $15 billion before ending it completely in September… when just three months ago the Fed stated it would keep QT at $50 billion per month all year.

3) The Fed floating the idea of making QE a REGULAR monetary policy (as opposed to one used exclusively during emergencies).

4) The Fed revealing it is already reviewing monetary policies so extreme that it opted NOT to use them during the Great Financial Crisis of 2008.

5) The head of the NY Fed stating that during the next downturn the Fed is considering using Negative Interest Rate Policy (NIRP).

6) Current Fed Chair Jerome Powell staging a sudden 60-Minutes interview with former Fed Chairs Ben Bernanke and Janet Yellen in which all three verbally intervened to calm the markets.

7) Former Fed Chair Janet Yellen publicly stating that the “Central Banks don’t have adequate crisis tools.”

This is absolutely astonishing.

At a time when the US economy is supposedly running at 3+%, unemployment is supposedly around 4%, and the stock market is a mere 5% of its all time highs… the Fed is talking about introducing NIRP, making QE a ROUTINE policy tool, and considering monetary policies so extreme that it chose NOT to introduce them during the 2008 crisis.

Why is the Fed doing this?

Because it knows the Everything Bubble has burst and the Fed is desperate to get the financial system back under control.

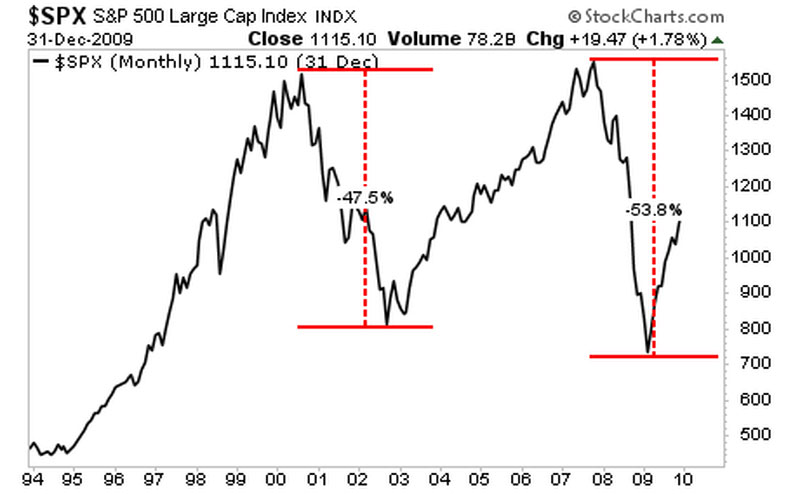

In chart terms, the Fed is seeing this:

Every time the stock market has broken its monthly bull market trendline in the last 30 years, it’s retraced roughly 50% of its gains via a crisis.

See for yourself.

Using today's market, this means the S&P 500 down near 1,500.

THIS is what the Fed is preparing for.

If you aren't actively taking steps to prepare for this, you need to start NOW.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusivelyto our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Graham Summers, MBA is Chief Market Strategist for Phoenix Capital Research, an investment research firm based in the Washington DC-metro area.

Graham’s sterling track record and history of major predictions has made him one of the most sought after investment analysts in the world. He is one of only 20 experts in the world who are on record as predicting the 2008 Crash. Since then he has accurately predicted the EU Meltdown of 2011-2012 (locking in 73 consecutive winners during this period), Gold’s rise to $2,000 per ounce (and subsequent collapse), China’s market crash and more.

His views on business and investing has been featured in RollingStone magazine, The New York Post, CNN Money, Crain’s New York Business, the National Review, Thomson Reuters, the Fox Business, and more. His commentary is regularly featured on ZeroHedge and other online investment outlets.

gainspainscapital.com

|