When Powell Does It, It’s Policy; When Traders Do It, It’s Criminality

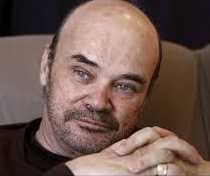

Martin Armstrong

Traders will use every trick in the book to try to gain an upper hand on their adversaries. It’s a cutthroat world, and one in which there is no winner without a commensurate loser; a true zero-sum game. Your gain is always someone else’s loss. Traders will use every trick in the book to try to gain an upper hand on their adversaries. It’s a cutthroat world, and one in which there is no winner without a commensurate loser; a true zero-sum game. Your gain is always someone else’s loss.

That said, even small-scale trader behavior and tactics can bleed over from “aggressive and creative” to illegal pretty easily by the letter of regulatory law. To see central banks loudly and proudly and openly boasting of their market manipulations, which have drastic impact on not just market participants but on all citizens (often while cloaking themselves in the fraudulent fabric of ‘public service’) is repugnant.

The government is criminally charging traders for manipulating interest rates, which is PRECISELY what they do all the time. Let us not forget Mario Draghi who when history is written about how the West fell, his name will rank very high on the list. It was Draghi who sought to push rates NEGATIVE to try to manipulate the economy to create inflation by punishing savers – which will include pension funds.

While traders go to prison for rigging spreads, front-running and trying to push trading levels to kick off stops, they have NOT put at risk the ENTIRE financial system. They have not even altered the trend of interest rates or markets.

Compared to the deliberate manipulations by central banks, what is at risk now is the entire pension system and European banks are still sitting on the edge of a cliff with no hope of recovery so Draghi simply postpones the accounting to that be that final push. Unfortunately, central banks do not share the same fate as traders

Armstrong Economics is an economic forecasting organization based on the cyclical models developed by Martin Armstrong. Our mission is to remove opinion from forecasting through the use of our advanced technical models while educating the public on the underlying trends within the economy.

We amassed the largest available monetary database to identify historic cyclical patterns in timing and price. Our system tracks international capital flows and looks for patterns in capital concentration that align with individual market cycles. Researching previous market behavior and identifying cyclical trends enables our models to project future trends with accuracy.

Our clients range from the average investor to professional traders who are interesting in implementing our models to manage investments. We offer a range of products and services to educate the public and provide tools for investors.

www.armstrongeconomics.com

|