Gold bull market in waiting

Justin Spittler

There are so many different incipient catalysts to unlocking upside for the gold price. While the sloe-eyed retail-investor cows continue to dutifully march to slaughter at this extremely late stage of the topped-out stock market, it’s time to place your bets as to how the coming precious metals bull market will play out. There are so many different incipient catalysts to unlocking upside for the gold price. While the sloe-eyed retail-investor cows continue to dutifully march to slaughter at this extremely late stage of the topped-out stock market, it’s time to place your bets as to how the coming precious metals bull market will play out.

Not that it particularly matters; if you own silver and gold, you will benefit, regardless.

Where is the gold bull market that we predicted would begin about now? Here is our broad-based overview. The financial markets continue to expect an aggressive Fed going forward with four—even five—rate hikes this year and a continuing shrinkage of its balance sheet (Quantitative Tightening). Given this, gold has held up pretty well, essentially range trading, but the gold stocks have suffered because they are leveraged calls on gold that only "work" with expectations of a rising gold price.

For gold to go higher, market psychology has to change. In particular, the stock and credit markets have to change their perceptions of the direction of Fed policy. What brings that about? There are any number of possible catalysts: A serious drop in the stock market; a sudden rise in interest rates as the bond market rebels against too much supply; a sudden widening of credit spreads reflecting an increased perception of risk; a sharp upward acceleration in price inflation which the Fed decides to ignore; credit chaos in the EU as the ECB tries to end QE; a credit crunch in China. There is strong evidence supporting each of these possibilities and it probably only takes one.

We are approaching a fork in the road, in our opinion.

Door #1: What if all the economic bulls are wrong and the economy weakens despite the tax cuts and the fiscal stimulus of a Federal budget gone wild? In that case, the Fed will pause and the massive short position at the front end of the Treasury curve will be seriously offside. Short rates will plummet. Negative real rates of interest will send gold flying.

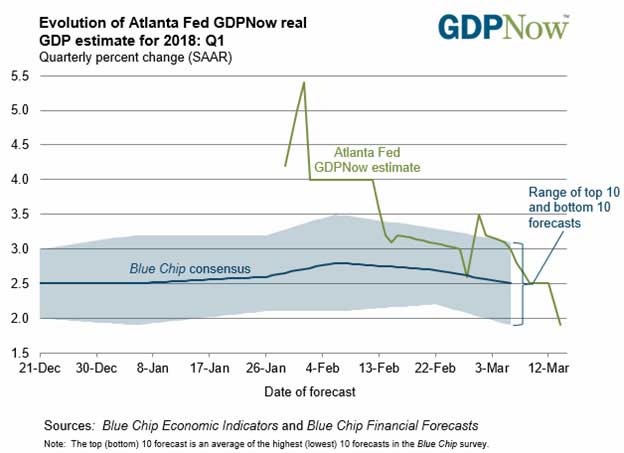

This may be happening now, before our very eyes. At the start of February, the Atlanta Fed's Q1 GDP expectation was an exuberant 5.4%. As of March 14, their outlook had collapsed to just 1.9% following a string of negative data on the U.S. economy over the past six weeks. We have seen this same pattern of disappointment repeatedly over the last eight quarters. The growth never meets expectations.

Here's the chart:

Door #2: If the economy does gain steam, we think Fed will lag in raising rates. We expect renewed growth would cause real yields to decline as inflation finally picks up. This would be good for gold, resembling the 1970s period where Fed Chairmen Arthur Burns and Bill Miller neglected to raise the Fed Funds rate as quickly as inflation.

In our view, the only scenario that really hurts gold going forward is a strengthening economy that has the Fed continuing to try to get ahead of inflation. This is essentially what markets now believe and have priced into gold. Just about anything different helps gold break out of its trading range and brings fresh money back into the gold stocks.

As previously stated, gold needs to break decisively above the 2016/17 high at $1370 to confirm that the bull is up and running. That's still our expectation for the first half of this year.

Rudi P. Fronk, chairman and chief executive officer of Seabridge Gold, has over 30 years of experience in the gold business, primarily as a senior officer and director of publicly traded companies. In 1999 Fronk co-founded Seabridge and has served as the company's CEO since that time. Prior to Seabridge, Fronk held senior management positions with Greenstone Resources, Columbia Resources, Behre Dolbear & Company, Riverside Associates, Phibro-Salomon, Amax and DRX. Fronk is a graduate of Columbia University from which he holds a Bachelor of Science in mining engineering and a Master of Science in mineral economics.

www.mining.com

|