Why Is The Fed Suddenly Holding An Unscheduled "Expedited, Closed" Board Meeting On Monday?

Tyler Durden

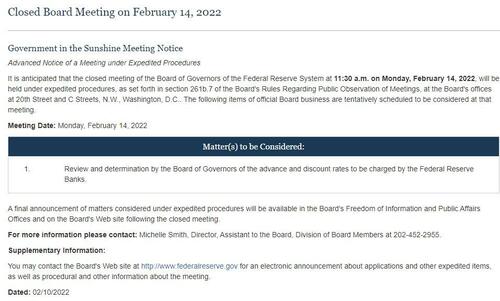

With Fed speakers and their media proxies scrambling to walk-back St.Louis Fed's Jim Bullard's calls for an inter-meeting liftoff and uber-hawkish rate-hike trajectory, it is notable that all of a sudden, The Fed has called for an "Expedited, Closed" Board Meeting on Monday Feb 14th (at 1130amET). With Fed speakers and their media proxies scrambling to walk-back St.Louis Fed's Jim Bullard's calls for an inter-meeting liftoff and uber-hawkish rate-hike trajectory, it is notable that all of a sudden, The Fed has called for an "Expedited, Closed" Board Meeting on Monday Feb 14th (at 1130amET).

The goal of the meeting is: "Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks."

We are sure this is 'probably nothing', right?

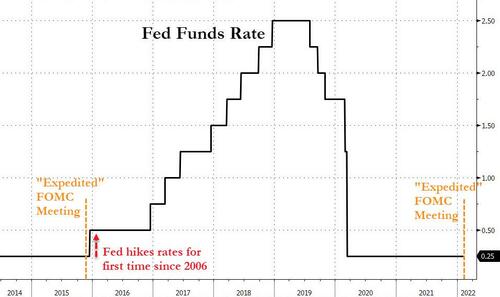

But it got us thinking about the last time The Fed held such a meeting...

In late November 2015, The Fed held an "expedited" meeting to "Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks. "

Shortly thereafter, this happened... (The Fed hiked rates for the first time since 2006)

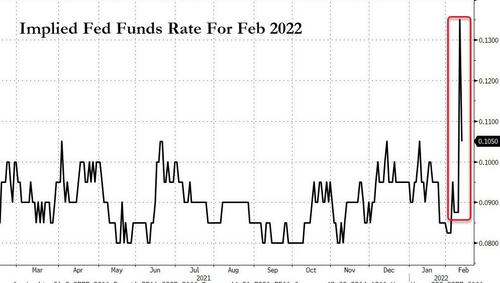

February rate-hike expectations have fallen today but remain elevated over recent norms...

So, will The Fed surprise the world on Monday?

Graham Summers, MBA is Chief Market Strategist for Phoenix Capital Research, an investment research firm based in the Washington DC-metro area.

Graham’s sterling track record and history of major predictions has made him one of the most sought after investment analysts in the world. He is one of only 20 experts in the world who are on record as predicting the 2008 Crash. Since then he has accurately predicted the EU Meltdown of 2011-2012 (locking in 73 consecutive winners during this period), Gold’s rise to $2,000 per ounce (and subsequent collapse), China’s market crash and more.

His views on business and investing has been featured in RollingStone magazine, The New York Post, CNN Money, Crain’s New York Business, the National Review, Thomson Reuters, the Fox Business, and more. His commentary is regularly featured on ZeroHedge and other online investment outlets.

gainspainscapital.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)