Silver and Sanity

Gary Christenson

Silver is real money, not a debt-based fiat currency that will eventually fail. Silver bullion production requires capital and effort to mine and refine. We use it for solar panels, iPhones, cruise missiles and thousands of other items. Silver is monetary sanity. Silver is real money, not a debt-based fiat currency that will eventually fail. Silver bullion production requires capital and effort to mine and refine. We use it for solar panels, iPhones, cruise missiles and thousands of other items. Silver is monetary sanity.

Prices for silver rise as currency units are devalued. Silver sold for $1.29 in the 1960s. Today’s price is around $18.00 because dollars buy less. The continual devaluation benefits the political and financial elite who own most paper assets – stocks and bonds. The bottom 90% pay higher prices for necessities plus interest on their debts. Savings in silver coins will offset devaluation and loss of purchasing power.

Why do dollars buy less? The banking cartel borrows and “prints” too many of them into existence. More debt means more dollars in circulation.

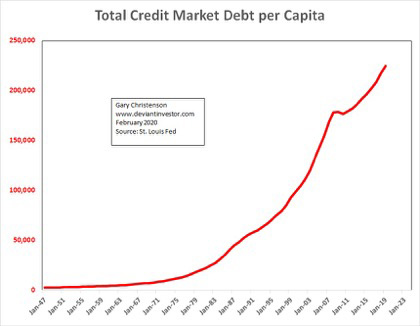

How much debt have our bankers created? The St. Louis Fed tracks total credit market debt. Current US debt is about $74 trillion, over half a million fiat dollars per US worker. Insanity! The debt will be extinguished via default or hyperinflation.

Total debt increases rapidly. But one might think the debt increases because population rises every year. To prove otherwise, divide total credit market debt by US population and see the rapid rise in population adjusted debt.

Population adjusted credit market debt increases, and dollars buy less every year. See the Chapwood Index.

Do you remember?

- A cup of restaurant coffee cost ten cents in the 1960s. Today a coffee costs two bucks.

- A pack of Marlboros cost twenty-five cents in the 1960s. Today that pack of cigs will cost $6 – $12 depending on taxes.

- A new truck in the 1960s cost $2,000. Today a new truck costs $50,000 to $80,000. It may be a better truck per government statisticians, but you still pay $50,000 to $80,000 in devalued debt-based dollars.

WHAT ABOUT SILVER?

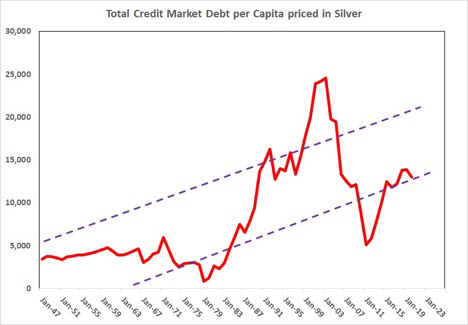

Take the above population adjusted total credit market debt and price it in silver ounces. Use the average of daily closing prices for each year to create an annual price. Debt increases faster than the price of silver, which is no surprise. The world runs on credit and debt, and currencies are debts (Federal Reserve Notes are debts of the Fed to you, the holder). The banking cartel creates billions in new debt every day. Silver prices, except in the 1970s, have not kept pace with debt creation. That will change.

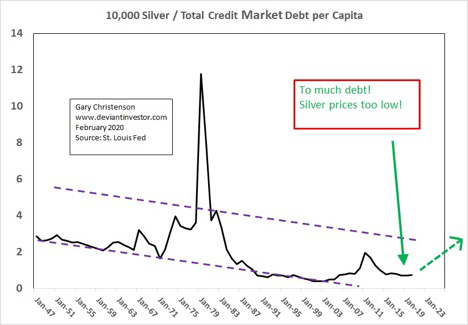

Take the same data and plot it as silver price (annual average times 10,000) divided by population adjusted debt.

CONCLUSIONS FROM ABOVE:

- Debt, adjusted for population, increases faster than silver prices. Fake money (debt-based currency) has prevailed since 1980 versus real money—silver.

- Silver prices will “catch up” someday, perhaps soon, when fake money is recognized for what it isn’t. Investors and savers will scramble to buy a tiny supply of real silver and bid prices far higher.

- Silver prices have increased since last May. Silver’s low price in May was under $14.50. Closing price on Feb. 21 was $18.53.

- Palladium prices spiked higher, defying expectations. Perhaps the parabolic palladium price increases foreshadow silver prices in the next one—five years.

BUT LET’S BE CONSERVATIVE IN OUR EXPECTATIONS:

- Population will slowly increase. Use the past ten years as a guide.

- Debt will increase, unless you think bankers will change their behavior, governments will balance budgets, congress will become fiscally responsible, and Pentagon spending will diminish as peace descends upon the world.

- The silver to population adjusted debt ratio will rise to the upper trend channel. However, the ratio could move far above the trend channel.

- We need not assume a total financial reset or hyperinflation. Silver prices must rise in a debt-based fiat currency world.

- Assume the ratio will rise from 0.77 to 3.0 by 2025.

Using these mild and reasonable assumptions, the average price of silver (annual average of daily closes) could rise to $85 by 2025. Since price spikes can be three times larger than the annual average price (as in January 1980) the spike price of silver could be $250 without assuming global war, hyperinflation, global pandemic, central banks fighting recession with QE4ever, electing a tax and spend socialist in 2020, Universal Basic Income, MMT, negative interest rates for most of a decade, and other insane fiscal and monetary policies.

SILVER PRICED AT $80 – $250 PER OUNCE: Total Insanity?

Probably not! In our crazy world, insane prices are likely. Consider:

a. Tesla stock closed at $917 on February 19, 2020. That price made Tesla market capitalization larger than the sum of Ford, GM, and Fiat Chrysler plus annual global silver production.

b. The Fed added over $400 billion to its balance sheet in six months, created from “thin air”. Total annual production of silver is less than $20 billion.

c. The Fed is monetizing US government debt, as did Weimar Germany, Zimbabwe, Argentina and banana republics. When will central bankers learn?

d. If health departments don’t test for Covid-19 (coronavirus) they can legitimately report no confirmed cases. (Hmmm, no worries, nothing to see, move on.)

e. China has closed many businesses because of Covid-19. Chinese debts and cash flow requirements are huge. But they have assured us that economic and pandemic consequences will be minimal. Really?

f. Per a politician: “… the world is gonna end in twelve years if we don’t address climate change.” The world survived ice ages, two world wars, black death, communism, pandemics, Y2K, hydrogen bombs, the great depression, $250 trillion in global debt, and eight years under several presidents. The world will survive an increase in carbon dioxide. Plants need carbon dioxide, and humanity needs plants. Yes, serious problems exist with insects, oceans, pollution and soil, but the world will not end in twelve years.

g. Tesla stock was $179 on June 3, 2019 and $917 on February 19, 2020. Amazing! Amazon stock was $300 in January 2015 and $2,170 in February 2020. The NASDAQ 100 Index was 4,800 in March 2000 but fell to 830 by September 2002. What goes too high can crash.

CRAZY AND INSANE ARE A MATTER OF PERSPECTIVE.

- Tesla stock at $917 is crazier than silver at $100 in 2025. Buy silver and avoid over-valued tech stocks.

- In 1919 gold sold for 10 German marks. In 1923 gold sold for one trillion German marks. Hyperinflation and QE4ever are bad policies.

- The Swiss Central Bank created billions of francs from nothing, sold them for dollars and bought Apple and other tech stocks. Counterfeiting is legal for central banks, but not individuals.

- Since 1945, the Argentine peso has been devalued against the (falling) US dollar by 10 trillion to one. Insane or just bad management?

- Global debt exceeds $250 trillion. Can the global economy support interest payments of 5% on $250 trillion? What about only 1% interest? Are near zero interest rates necessary to avoid insolvency? Global central banks will be forced to print how many trillions of debt-based currency units to keep interest rates near zero? Keynesian craziness? Gold and silver prices will rise.

Read: “On Leaving The Golden State.”

Read: “US Woefully Unprepared for Coronavirus.”

Read: “With Half of China Locked Down, Car Sales Plunge 92%.”

Watch: “Urgent Silver Information. Important!

From Alasdair Macleod: “Will COVID-19 Lead to a Gold Standard?”

“Even before the coronavirus sprang upon an unprepared China the credit cycle was tipping the world into recession. The coronavirus makes an existing situation immeasurably worse, shutting down China and disrupting supply chains to the point where large swathes of global production simply cease.”

From Sven Henrich: “The Big Dodge”

“They [The Fed] caused another bubble and now they are in denial mode again. Why? Because they can never admit that the Fed is behind the financial asset bubbles that benefit the few and hurts the most when the bubbles pop.”

“The top 10% keep reaping all the wealth benefits associated with artificially propped up asset prices while the bottom 90% gets settled [saddled] with all the debt that will hang like a chain around everybody’s neck when the bubble pops.”

CONCLUSIONS:

- Global central banks are part of the problem, not part of the solution. Fed policies help the financial and political elite, but few others. Don’t expect easy or quick change. The banking cartel “owns” the politicians.

- Balance and sanity should return to government and financial markets—eventually. Expect traumatic “potholes” on the return highway.

- Dollars are debts issued by the Fed, a compromised private corporation. Silver and gold are real money. However, only a tiny percentage of people trust gold and silver more than fiat dollars. Insane!

- The Fed created over $400 billion from nothing in six months. Annual production of gold (at current prices) is less than $200 billion. Annual production of silver is less than $20 billion. Expect real money prices to rise as central banks devalue their currencies to fight their self-created monetary disasters.

- Gold sells at all-time highs in over 70 global currencies. It closed at a seven-year high in US dollars. A new all-time US dollar high is coming.

- Tech stocks are priced too high. Silver is priced too low. Both will reset to prices that are more sensible given global political and financial conditions.

Miles Franklin can’t prevent a pandemic, will not trade Tesla stock, does not create debt-based currency units from nothing and is not represented at Fed meetings.

They will recycle fiat dollars into real money, silver and gold bullion and coins.

Call Miles Franklin at 1 -800-822-8080.

Gary Christenson

The Deviant Investor

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of several books, including “Fort Knox Down!” and “Gold Value and Gold Prices 1971 – 2021.” He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy, and central banking. His articles are published on Deviant Investor as well as other popular sites such as 321gold.com, peakprosperity.com, goldseek.com, dollarcollapse.com, brotherjohnf.com, and many others.

deviantinvestor.com

|