Platinum V.S. Palladium: Should You Invest?

David Haggith

When people think about investing in precious metals, they typically think gold and silver, but there are other elements in this group that may also deserve your consideration. Platinum and palladium are two, in particular, which have gained popularity as an investment option for precious metals enthusiasts. Both are classified as precious white metals due to their rarity in the earth’s crust. These white metals also have a striking appearance, are highly durable, and have strong industrial uses. When people think about investing in precious metals, they typically think gold and silver, but there are other elements in this group that may also deserve your consideration. Platinum and palladium are two, in particular, which have gained popularity as an investment option for precious metals enthusiasts. Both are classified as precious white metals due to their rarity in the earth’s crust. These white metals also have a striking appearance, are highly durable, and have strong industrial uses.

What is Platinum?

Platinum has been documented as far back as the 16th century, when Spanish conquistadors stumbled upon mines of platinum in South and Central America. Platinum derives its name from the Spanish word platina, which roughly translates to “little silver.” Originally considered a nuisance in the search for gold, it was later discovered that this new white metal was actually even rarer than the gold for which they were searching. Platinum is corrosion-resistant, extremely durable, and appealing from an aesthetic standpoint.

Platinum Use Cases:

The most common use for platinum is in the automotive industry, where it is used in catalytic converters for primarily diesel engines. It is also used in oxygen sensors and other electronic devices which require a hard, corrosion-resistant conductor. Platinum is also commonly used in jewelry. It is used commonly in the field of dentistry, as well, where its’ density and durability are ideal for tooth repair. In recent years, platinum has become increasingly popular as a bullion product for investment, garnering demand for platinum bars and rounds.

How Much Does Platinum Cost?

Platinum is one of the rarest metals on the planet. Although there is speculation that it may exist in more abundance on the moon and other planets in our solar system, it is currently one of the rarest metals on the planet. Per unit of mass, platinum far exceeds the price you’ll pay for silver, but has not yet surpassed gold as the most valued metal in the marketplace.

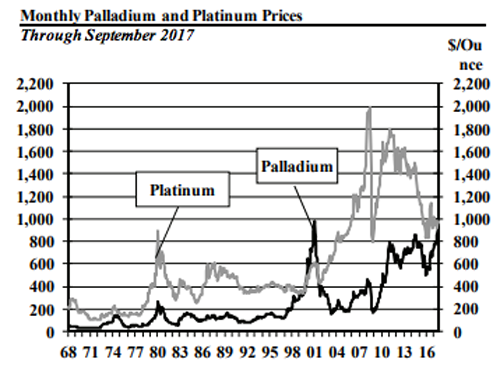

Price charts courtesy of CPM Group

What is Palladium?

Palladium was discovered in the early 1800’s. Its' name is derived from the asteroid Pallas. Similarly white like platinum, perhaps a shade darker, it shares many of the same properties. It is hard, durable, and resistant to corrosion. Although the exact quantity of palladium on the planet is unknown, we do know that it’s more abundant than platinum and gold.

Palladium Use Cases:

Somewhat of a poor man’s platinum, palladium is similarly used in the automotive industry in catalytic converters, in this case primarily for gasoline engines. It is also used as a corrosive-resistant conductor for electronics. Additionally, along with several other metals, it is commonly mixed with gold to create what is referred to in the jewelry industry as “white gold.

How much does Palladium cost?

Palladium is usually cheaper than platinum and gold, but still far more expensive than silver or copper.

Price charts courtesy of CPM Group

What’s the Difference Between Platinum and Palladium?

Nearly identical to the untrained eye, platinum and palladium are like peas in a pod. Platinum is far denser, less naturally abundant, and usually more costly. Palladium is more common in industrial uses due to the similarity to platinum at a normally lower price point. Both platinum and palladium are common in the jewelry industry due to the appealing white aesthetic. Both metals are hypoallergenic, meaning their non-porous surfaces are unlikely to collect bacteria or react poorly with human skin, making them ideal for wedding rings and other jewelry.

|

Platinum

|

Palladium

|

Symbol

|

Pt

|

Pd

|

Atomic Number

|

78

|

46

|

# of Protons

|

78

|

46

|

# of Neutrons

|

117

|

60

|

Atomic Mass

|

195.078 amu

|

106.42 amu

|

Melting Point

|

3,215° F / 1772° C

|

2,830.82° F / 1554.9° C

|

Boiling Point

|

6,917° F / 3827° C

|

5,365° F / 2963° C

|

Density

|

21.45 g/cm3

|

12 g/cm3

|

Should You Invest?

Investing in platinum and palladium can be a great way to diversify your investment portfolio. They are both tangible, finite substances that should hold their value well over time. Notably, platinum and palladium were not confiscated during the nationalization of gold and silver by President Roosevelt. However, we believe that for most investors, gold and silver offer a better opportunity for investment. If you are looking to invest in platinum and/or palladium, send us a note. We love to hear from our investors, and if there are specific products you’d like to see in our catalog, we’re open to increasing our offerings.

Michael Maloney is the founder and owner of GoldSilver.com, a global leader in gold and silver sales and one of the world's most highly regarded investment education companies since 2005. He is author of the best selling precious metals investment book of all time, Guide to Investing in Gold and Silver, published in 2008. Michael Maloney is the founder and owner of GoldSilver.com, a global leader in gold and silver sales and one of the world's most highly regarded investment education companies since 2005. He is author of the best selling precious metals investment book of all time, Guide to Investing in Gold and Silver, published in 2008.

Mike Maloney was born in Willamette, Oregon, and spent most of his youth in the Los Angeles area. He is a life-long inventor and entrepreneur. At age 17 he traveled all over the U.S. selling mini-bikes and go-karts.

By age 23, Mike founded the sales firm of Michael Maloney & Associates, growing it to five employees and two branch offices. He became a designer and manufacturer of high-end stereo equipment that won several engineering and industry awards. In 1992 his designs were selected as one of five permanent exhibits for display at the opening of the 20th century design wing of the royal Victoria & Albert museum in London, the world's greatest design museum. "That's about the time I had my first up close and personal encounter with economic cycles," Mike says.

In 1992, the U.S. economy was in recession, and the market for luxury audio equipment quickly dried up. To make matters worse, a real estate bubble had burst, and the home Mike then owned dropped 60 percent in value. Still he managed to stay in business and in 1998 launched a trade show for his industry, which grew to become a successful business.

In 2000, Mike was given the responsibility of managing his family's estate. He decided to trust a professional financial planner to manage the investments. The results were disastrous, and for two years Mike watched the value of his family's investment portfolio plummet. So he fired the planner and began to educate himself.

"I soaked up the information like a sponge," he recalls. "I studied every evening for five or six hours, and all day long on weekends." Delving into financial markets, U.S. and global economics, Mike discovered a passion for monetary history, devouring dozens of books and thousands of web pages. He discovered that the same economic patterns, or cycles, kept repeating over and over throughout history, from ancient times to modern day.

One recurring cycle, the inflation and subsequent crash of currencies, always ended the same way with the return to the safe haven of gold and silver. From his years of studying, it became apparent to Mike that the global currency system was at a point where it was about to happen again only at an intensity that would be magnitudes greater, due to the size of our modern global economy.

With that newfound understanding, Mike invested his family's wealth 100% in gold and silver, and remains 100% invested in them today.

Several years ago, Mike met financial educator Robert Kiyosaki, author of the "Rich Dad, Poor Dad" series, and was invited to speak at one of Kiyosaki's seminars. That experience inspired Mike to share his understanding of economic history and recurring "wealth cycles" with others, so that they, too, would have the ability to secure their wealth and their families' futures against the certain future crash of the global currency system. He began speaking at investment seminars all over the world. After founding GoldSilver.com in 2007, he began work on his book, Guide to Investing in Gold and Silver. In 2010 he launched WealthCycles.com as another forum with which to help educate and empower others to benefit from history's greatest wealth transfer.

"For 2,400 years as people have lost faith in fiat currencies, they have turned to 'real money,' gold and silver," Mike says. "Today the stage is set for a world-wide 'gold rush' to the safe haven of precious metals just when supplies of those metals are precariously low. The opportunity for those who position themselves in precious metals ahead of the crowd is like none we will see again in our lifetimes."

goldsilver.com

|