Send this article to a friend:

January

03

2023

Send this article to a friend: January |

The Fed needs to jack rates up by 10% right now

This is nuts, we thought there was a crash? If you thought that the Federal Reserve’s interest rate hikes and the Nasdaq’s subsequent 33 per cent puke in 2022 were enough to finally kill the tragicomically engorged late-stage private market tech bubble . . .From CNBC overnight:

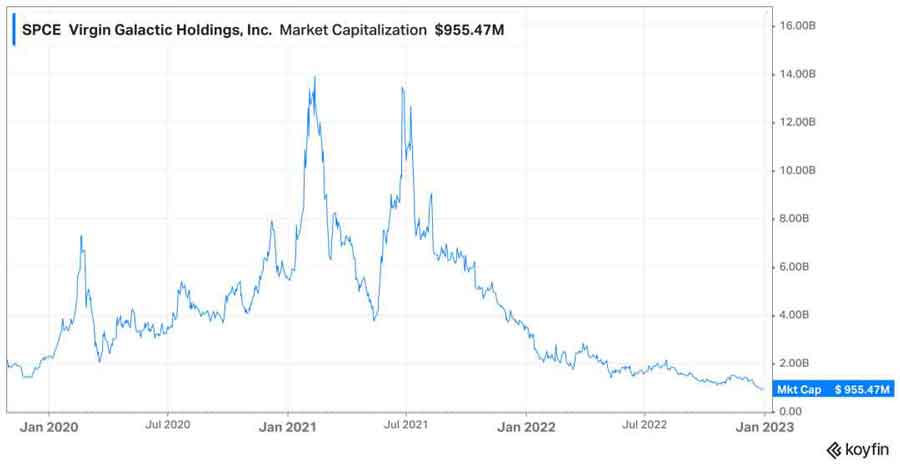

$137 yards! That’s a valuation greater than Salesforce, Netflix, AT&T, Unilever, IBM, HSBC, Caterpillar and Lockheed Martin. For an apparently unprofitable company with thus-far modest revenues and growth trajectory (Jefferies estimated sales at $2bn in 2018 and this industry analyst put it at about $3.2bn in 2022). And judging from SpaceX’s prodigious fundraising (now about $10bn) it seems to be burning through roughly $1bn a year? For reference, here’s the market capitalisation of Virgin Galactic, another space company that went public through a Spac in late 2019.  Basically, it’s a good day for Matt Levine’s Elon Markets Hypothesis. But we’re sure that the good folk at Andreessen Horowitz, Sequoia and Founders Fund have done exhaustive due diligence and been disciplined in their capital allocation.

|

Send this article to a friend:

|

|

|