Uranium Stocks Are Glowing Hot As Global Nuclear Ambitions Grow

Alex Kimani

For decades, the nuclear energy sector has been regarded as the black sheep of the alternative energy market family thanks to massive cost-overruns, poor public perception as well as a series of high-profile disasters such as Chernobyl, Fukushima and Three Miles Island. However, last year, the sector received a much-needed shot in the arm after the Trump administration sought a $1.5B bailout in a bid to create sufficient federal uranium stockpiles for national security purposes. For decades, the nuclear energy sector has been regarded as the black sheep of the alternative energy market family thanks to massive cost-overruns, poor public perception as well as a series of high-profile disasters such as Chernobyl, Fukushima and Three Miles Island. However, last year, the sector received a much-needed shot in the arm after the Trump administration sought a $1.5B bailout in a bid to create sufficient federal uranium stockpiles for national security purposes.

And, suddenly, the out-of-favor industry has been receiving support from numerous quarters.

"Unless susceptible to extreme natural disasters, nuclear power plants should not be shut down," Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk tweeted last month.

Twitter Inc.(NASDAQ:TWTR) co-founder and Block Inc.(NASDAQ:SQ) CEO Jack Dorsey has also lent support for nuclear power:

"Generating more energy, not less, increases quality of life for all," Dorsey tweeted last week.

The U.S. Secretary of Energy has expressed similar positive sentiment:

"The United States views nuclear energy as a pivotal technology in the global effort to lower emissions, expand economic opportunity and ultimately combat climate change," Secretary Jennifer Granholm has said.

Meanwhile, skyrocketing fuel prices have led to massive protests in Kazakhstan, leading to multiple deaths and hundreds of injuries as well as soaring uranium prices. Kazakhstan makes up around 43% of global uranium production, making it the world's largest uranium producer.

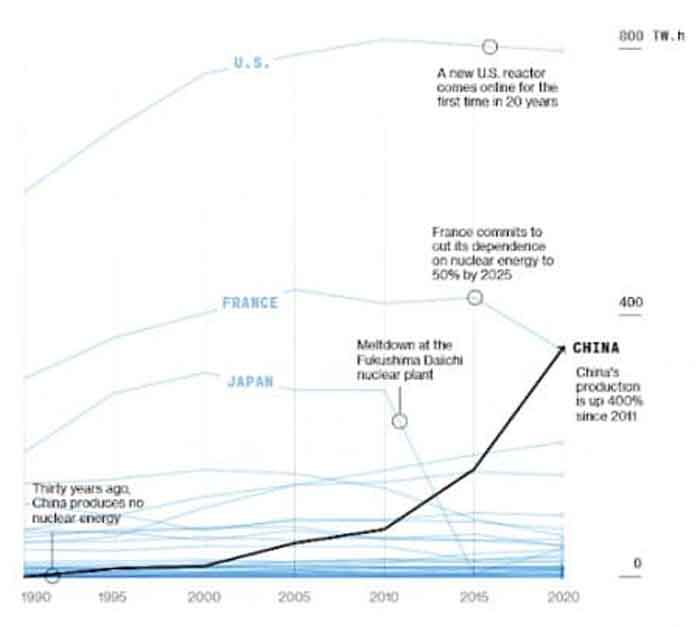

But now, the nuclear industry has managed to snag its biggest ally yet: China.

Back in November, Bloomberg reported that Beijing has plans to build 150 nuclear reactors at a staggering cost of $440B over the next 15 years as the country looks to become carbon neutral by 2060.

China's nuclear intentions resonate well with a cross-section of leaders and the investment community considering the global energy crisis and the calls for action coming out of the COP26 Climate Summit. That many reactors is more than what the entire planet has built in the past 35 years, representing a third of the current global fleet of 440 reactors.

Where investors should be looking now is uranium, which is basking in the limelight.

Shares of uranium producers have also been surging after Bank of America touted the growing acceptance of nuclear as an alternative power source in decarbonizing the economy.

BofA upgraded its rating on CCJ to Buy from Neutral, setting a $32 price target. The firm pointed to strength in uranium prices and a changing cultural attitude toward the space, highlighting the advantages of nuclear power as part of a push towards decarbonization, compared to options like renewables, hydro, and natural gas.

CCJ shares are now up 62.5% over the past 52 weeks, but its peers have done even better: Energy Fuels Inc. (NYSE:UUUU) is up 103.0% YTD, Uranium Energy Corp. (NYSE:UEC) has vaulted 87.1%, while NexGen Energy (NYSE:NXE) has jumped 58.7%.

Source: Bloomberg Green

China is the biggest emitter of greenhouse gases, but says its nuclear program will play a critical role in replacing its 2,990-coal-fired generators alongside wind and solar energy. Indeed, Beijing says its nuclear plans could prevent about 1.5 billion tons of annual carbon emissions, more than the annual emissions of the U.K., Germany, France and Spain combined.

Another key reason why nuclear energy in China makes sense: Low costs.

About 70% of the cost of Chinese reactors are covered by loans from state-backed banks, leading to dramatically lower costs. In fact, Francois Morin, China director at the World Nuclear Association, says China can generate nuclear power at just $42 per megawatt-hour, thanks to the low 1.4% interest rate on loans for infrastructure projects, making it far cheaper than coal and natural gas in many places. At the high end of the spectrum, in developed economies, a 10% interest rate means the cost of nuclear power shoots up to $97 per megawatt-hour, making it more expensive than everything else. The World Nuclear Association estimates that China can build nuclear plants for about $2,500 to $3,000 per kilowatt, about one-third the cost of the latest nuclear projects in the U.S. and France.

New uranium funds

But that's just part of the reason why uranium stocks are flying, the other being the launch of the world's first and largest physical uranium funds.

In July, Canadian investment fund Sprott Asset Management LP launched Sprott Physical Uranium Trust (OTC:SRUUF) after acquiring uranium holding company, Uranium Participation Corp. Since then, Sprott has gone on a uranium buying spree and currently holds ~33 million pounds of uranium, roughly equal to 76% of JSC National Atomic Co. Kazatomprom's sales last year. Republic of Kazakhstan state-owned miner Kazatomprom is the world's largest yellow cake producer.

The new fund says it has "no endgame," will not sell uranium to other entities, and will operate as a passive entity "in perpetuity" until investors lose interest in the fund. Investors are particularly enthusiastic about Sprott's modus operandi because it's effectively taking material off the market that will never come back.

Further, the uranium market has become so hot that Kazatomprom itself has announced plans to finance a separate fund for physical uranium purchases.

These new uranium-buying funds have been creating plenty of competition in the spot market and helped drive uranium prices up 55% over the past 52 weeks to trade at $45.50 per ounce.

By Alex Kimani for Oilprice.com

Alex Kimani is a veteran finance writer, investor, engineer and researcher for Safehaven.com.

oilprice.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)