One Bank Predicts $3 Trillion In Quantitative Tightening Coming

Tyler Durden

Wall Street has officially jumped the shark: with the economy set to slow this year - even as supply-driven inflation refuses to relent - consensus now expects 3-4 rate hikes this year (with Jamie Dimon predicting as many as "6 or 7") - some are going so far as to predict how much shrinkage the Fed's balance sheet will see in the coming years once it begins any time between March and June. Wall Street has officially jumped the shark: with the economy set to slow this year - even as supply-driven inflation refuses to relent - consensus now expects 3-4 rate hikes this year (with Jamie Dimon predicting as many as "6 or 7") - some are going so far as to predict how much shrinkage the Fed's balance sheet will see in the coming years once it begins any time between March and June.

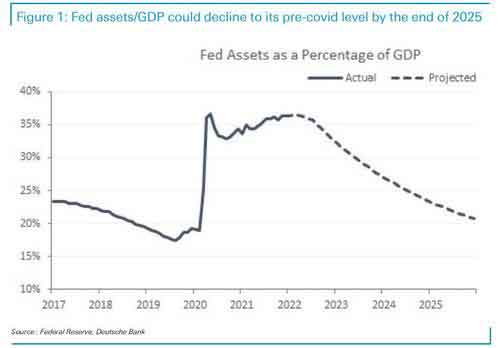

Enter Deutsche Bank, which forecasts that once QT begins, the Fed's balance sheet will shrink from $9 trillion currently to $6 trillion.

As DB's Jim Reid notes overnight, citing the bank's economist Matt Luzzetti and rate strategist Steven Zeng, project that the Fed balance sheet would peak just under $9tn after QE completes in March, before falling back to eventually approach 20% of GDP from over 35% today, and around a third smaller than this peak, at which point it will be around $6 trillion.

That, according to Kostin, is a level more consistent with the pre-covid experience and a potential target highlighted by Governor Waller. Under this projection, the balance sheet would reduce by $560bn this year and $1tn in 2023, and the balance in outer years.

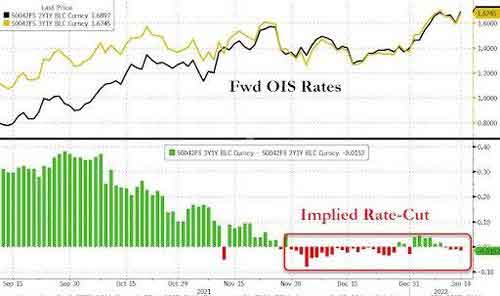

As an aside, there zero chance of that happening as by then the US will be in a recession and the Fed will be scrambling to ease as even the market now expects, projecting the next rate cut will take place between 2 and 3 years from today.

There is another reason why this will never happen: the market will implode long before the $3 trillion in QT is completed.

For context, Reid notes that between October 2017 and August 2019, QT reduced the balance sheet by around $700bn from c.$4.47tn to $3.76tn, at which point banks realized they dont have nearly enough reserves and we had the infamous repo crisis which ushered in "NOT QE."

The DB report approximates that a $650-700bn drawdown equates to around a 25bps hike so out to end 2023 they think the reduction will be equal to c.2.5 hikes.

Of course, this is all purely theoretical, and as even Reid notes, his personal view is that "the balance sheet will have to grow substantially again in the years ahead as the authorities are forced to use financial repression in order to make the growing public debt burden sustainable." We agree with this 100%. The only question is what crisis will catalyze the next explosion of the Fed's balance sheet.

Even so, the Fed is increasingly trapped because while it may have no choice but to pivot dovish soon, in 2018 the Fed had the luxury of a dovish pivot as inflation trended back down towards and below 2%. Or as Reid concludes, "will they have the option to be as flexible this time?"

Well, of course: all the Fed needs to do is inspire another global crash a la Lehman and reset the inflationary score. And this time a global pandemic won't cut it.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|