GoldFix: Wall Street Bets Silver Thesis in Full

Vince Lanci

Good Morning. Good Morning.

Gold Technical Comment

The following are excerpts from Moor Analytics Technical Reports posted here with permission. Charts andtutorial on how to read the work supplied by VBL daily

Gold (G) Sell against $1,859.3 (-1 tic per/hour starting at 8:20am); get long on a decent penetration and/or pullback above and look decent strength to come in. Get short on a decent penetration and/or pullback below $1,832.2 (-1 tic per/hour starting at 8:20am) and look for decent pressure—below which higher bear calls are OFF HOLD.

Go toMoorAnalytics.com for 2 weeks of his Gold and Energy reports free.

Silver Squeeze?

UPDATE: 9:11 AM

Even before the SLV open Silver, Gold, Oil and the PGMs all rocketed. This tells us that either shorts are spooked or the big players like JPM are positioning themselves to profit from the next wave of buying. For Silver watch the spreads. If they go into backwardation that is a sign that either someone on the bullion side is short OR a producer is overhedged. Bullion banks are very familiar with this adn will not be holding the bag if there is a squeeze.

Quick Education on Silver Squeeze Dynamics

GoldFix: open Q and A on $gme and $slvhttps://t.co/lb85AfbvpK — VBL (@VlanciPictures) January 28, 2021

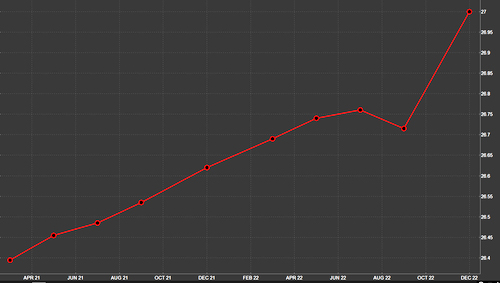

Silver Term Structure live mid markets

As to Gold, it is dangerous to play this game with something the Fed is desperate to keep out of the headlines

Thats all

After doing an interview With Daniela Cambone on GameStop in which we discussed the potential for a Silver squeeze I saw this:

Uh oh @DanielaCambone we have to revisit this? $slv pic.twitter.com/DIXT65a2Q8 — VBL (@VlanciPictures) January 27, 2021

So I started looking closer. here's what I found

The r/WallStreetBets SLV Due Dilligence Post

VBL Comment:

While staring mesmerized at the screen this morning watching GameStop tick in $10 increments; I surfed reddit to see if there was anything to this "lets get the silver shorts next" thing. Turns out there was. Here is the rationale and tactical apporach to what the short squeeze vigilantes are looking to possibly do next. This reads like an internal trading memo for a bank's prop desk.

Posting this is not in any way a recommendation to do anything other than watch and learn about market structure. While we do not have a position in SLV, Silver or any silver mine, we have traded options, precious metals, and commodities for over 30 years and will do so again.

Do not be stupid. It would be foolish to think you can handicap the outcome. For us the alarm bells say: close open interest as markets may move almost entirely based on liquidation events across all asset classes now. Valuation metrics are worthless to use when trying to explain correlations now.

As to the silver work here: The story is not new and traders have been called paranoid for years by the status quo for saying just this. Now you see the story circulating among a group of people who have stated that they "can remain retarded longer than you can remain solvent".

Good Luck

VBL

Here is the post in full

Here is the longer DD for the short squeeze case for SLV, a follow-up from my shorter post a few hours ago.

First things first, don't do this until the GME rise is done. Lets conquer one market at a time. I am long GME but am going long SLV immediately after. Then again each person is an individual and that needs to be made clear as well.

If you just want to know what to buy skip to the end

I present 2 investment DDs in this post, the short squeeze and the fundamentals. If you want to see what to buy

The short squeeze:

Buy SLV shares and call options to force physical delivery of silver to the SLV vaults.

The silver futures market has oscillated between having roughly 100-1 and 500-1 ratio of paper traded silver to physical silver, but lets call it 250-1 for now. This means that for every 250 ounces in open interest in the futures market, only 1 actually gets delivered. Most traders would rather settle with cash rather than take delivery of thousands of ounces of silver and have to figure out to store and transport it in the future.

The people naked shorting silver via the futures markets are a couple of large banks and making them pay dearly for their over leveraged naked shorts would be incredible. It's not Melvin capital on the other side of this trade, its JP Morgan. Time to get some payback for the bailouts and manipulation they've done for decades (look up silver manipulation fines that JPM has paid over the years).

The way the squeeze could occur is by forcing a much higher percentage of the futures contracts to actually deliver physical silver. There is very little silver in the COMEX vaults or available to actually be use to deliver, and if they have to start buying en masse on the open market they will drive the price massively higher. There is no way to magically create more physical silver in the world that is ready to be delivered. With a stock you can eventually just issue more shares if the price rises too much, but this simply isn't the case here. The futures market is kind of the wild west of the financial world. Real commodities are being traded, and if you are short, you literally have to deliver thousands of ounces of silver per contract if the holder on the other side demands it. If you remember oil going negative back in May, that was possible because futures are allowed to trade to their true value. They aren't halted and that's what will make this so fun when the true squeeze happens.

The silver market is much larger than GME in terms of notional value, but there is very little physical silver actually readily available (think about the difference between total shares and the shares in the active float for a stock), and the paper silver trading hands in the futures market is hundreds of times larger than what is available. Thus when they are forced to actually deliver physical silver it will create a massive short squeeze where an absurd amount of silver will be sought after (to fulfill their contractually obligated delivery) with very little available to actually buy. They are naked shorting silver and will have to cover all at once and the float as a percentage of the total silver stock globally is truly miniscule.

The fundamentals:

The current gold to silver ratio is 73-1. Meaning the price of gold per ounce is 73 times the price of silver. Naturally occurring silver is only 18.75 times as common as gold, so this ratio of 73-1 is quite high. Until the early 20th century, silver prices were pegged at a 15-1 ratio to gold in the US because this ratio was relatively known even then. In terms of current production, the ratio is even lower at 8-1. Meaning the world is only producing 8 ounces of silver for each newly produced ounce of gold.

Global industry has been able to get away with producing so little new silver for so long because governments have dumped silver on the market for 80 years, but now their silver vaults are empty. At the end of WW2 government vaults globally contained 10 billion ounces of silver, but as we moved to fiat currency and away from precious metal backed currencies, the amount held by governments has decreased to only 0.24 billion ounces as they dumped their supply into the market. But this dumping is done now as their remaining supply is basically nil.

This 0.24 billion ounces represents only 8% of the total supply of only 3 billion ounces stored as investment globally. This means that 92% of that gold is held privately by institutions and by millions of boomer gold and silver bugs who have been sitting on meager gains for decades. These boomers aren't going to sell no matter what because they see their silver cache as part of their doomsday prepper supplies. It's locked away in bunkers they built 500 miles from their house. Also, with silver at $23 an ounce currently, this means all of the worlds investment grade silver only has a total market cap of $70 billion. For comparison the investment grade gold in the world is worth roughly $6 trillion. This is because most of the silver produced each year actually gets used, as I have mentioned. $70 billion sounds like a lot, but we don’t have to buy all that much for the price to go up a lot.

**If the squeeze happens, it would be like 40 years worth of their gains in 4 months **

The reason that only 8 ounces of silver are produced for every 1 ounce of gold in today's world is because there aren't really any good naturally occurring silver deposits left in the world. Silver is more common than gold in the earth's crust, but it is spread very thin. Thus nearly every ounce of silver produces is actually a byproduct of mining for other metals such as gold or copper. This means that even as the silver price skyrockets, it wont be easy to increase the supply of silver being produced. Even if new mines were to be constructed, it could take years to come online.

Finally, most of this newly created silver supply each year is used for productive purposes rather than kept for investment. It is used in electronics, solar panels, and jewelry for the most part. This demand wont go away if the silver price rises, so the short sellers will be trying to get their hands on a very small slice of newly minted silver. The solar market is also growing quickly and political pressure to increase solar and electric vehicles could provide more industrial demand.

The other part of the story is the faster moving piece and that is the inflation and currency debasement fear portion. The government and the fed are printing money like crazy debasing the value of the dollar, so investors look for real assets like precious metals to hide out in, driving demand for silver. The $1.9 trillion stimulus passing in a month or two could be a good catalyst. All this money combined with the reopening of the economy could cause some solid inflation to occur, and once inflation starts it often feeds on itself.

What to buy:

I will be putting 50% directly into SLV shares, and 50% into the $35 strike SLV calls expiring 4/16. This way the SLV purchase creates a groundswell into silver immediately that then rockets through a gamma squeeze as SLV approaches $35. Price target of $75 for SLV by end of April if we pull this off.

Alternate options:

- buying physical silver; this also works but you pay a premium to buy and sell so its less efficient and you take fewer silver ounces off of the market because of the premium you pay

- going long futures for February or March; if you are a rich bastard and can actually take physical delivery of 1000s of ounces of silver by all means do so. But if you simply settle for cash you are actually part of the problem. We need actual physical delivery, which is what SLV demands and is why SLV is the way to go unless you are going to take delivery

- miners; I don’t recommend buying miners as part of this trade. Miners will absolutely go up if SLV goes up, but buying them doesn't create the squeeze in the actual silver market. Furthermore, most silver miners only derive 30-50% of their revenue from silver anyways, so eventually SLV will outperform them as it gets high enough (and each marginal SLV dollar only increases miner profits by a smaller and smaller percentage)

Details on SLV physical settlement:

When SLV issues shares, the custodian is forced to true up their vaults with the proportional amount of silver daily. From the SLV prospectus:

"An investment in Shares is: Backed by silver held by the Custodian on behalf of the Trust. The Shares are backed by the assets of the Trust. The Trustee’s arrangements with the Custodian contemplate that at the end of each business day there can be in the Trust account maintained by the Custodian no more than 1,100 ounces of silver in an unallocated form. The bulk of the Trust’s silver holdings is represented by physical silver, identified on the Custodian’s or, if applicable, sub-custodian's, books in allocated and unallocated accounts on behalf of the Trust and is held by the Custodian in London, New York and other locations that may be authorized in the future."

Join me brothers. Lets take silver to the moon and take on the biggest and baddest manipulators in the world. Please post rocket emojis in the comments as desired.

Disclaimer: do your own research, make your own decisions, everything here is a guess and hypothetical and nothing is guaranteed, not a financial advisor, I have ADHD and maybe other things too.

Bear case: silver does tend to sell off if the broader market plunges so it’s not immune to broad market sell off. It’s also the most manipulated market in the world so we are facing some tough competition on the short side

SOURCE

Final Comment: I have personally traded through many (most) commodity based crises, and even knowing what I do about what can happen- the Gamestop debacle is very scary because if they (whoever they are) let it go this far, then things are broken and/or their reaction to the next event may be even harsher than one can imagine. Markets as price discovery and valuation tools are worthless in a world where asset valuations absorb all inflationary forces and markets do not self clear. The market is resetting.

This is a serial problem and a reflection of market structure and policy, not assets or traders. It is not a silver squeeze or a GameStop squeeze. It is a market seeking the path of least resistance based on years of bad decisions by our leaders. That path might be asset hyperinflation to better reflect the money supply situation

That's it. Good Luck

VBL

Here's a Quick and Dirty explanation on Gamma from a marketmaker's perspective

GameFix: $GME Gamma squeeze explained. Part 1- marketmaker risks https://t.co/nSs86Q6TY1

— VBL (@VlanciPictures) January 26, 2021

Vincent Lanci embarked on his career in Commodity trading 20 years ago as a marketmaker on the floor of the Nymex and Comex and Nybot Exchanges. In 2004 he served as GP for for CiS Energy LLC, a commodity derivatives fund specializing in Energy Options.

After a successful run there, he formed Echobay Partners in 2007, a venture capital group specializing in Exchange Vertical investments, FMX|Connect and Cameron Hanover among them. He currently oversees company strategy in trading as well as investing and is also actively managing a portfolio in precious metals for echobay.

www.zerohedge.com

|