Send this article to a friend:

January

09

2019

Send this article to a friend: January |

|

The Fed IS the Ugly Truth

And instead of addressing that, and I’m not even talking about addressing fixing what is wrong, all I see is neverending stuff about Jay Powell using, or not using, terms such as “patient” or “accommodative”. Like any of it means anything coming from him and his ilk. Other than for making ‘investors’ a quick buck. Like a quick buck could ever trump the survival of entire market systems. People discussing whether Jay Powell is doing a good job all miss the point. Because Powell should not be doing that job in the first place. The Fed should not have the power to manipulate the US economy anywhere near as much as it does. Because that power is perverting America like nothing else, and the US economy will never recover as long as the Fed holds that power. Is that clear enough? Do we understand that at least? Powell apparently changed his tune Friday in order to let the mirage that the stock market has become, live another day. Almost literally a day, since it will come crumbling down no matter what he does, just a day or so later. It’s all some message hidden in his use of “patience” or “accommodative”. Nothing he does will have any effect in the medium or longer term, and he knows it. The entire US economy today is about the quick buck. It’s about tomorrow morning only because nobody has the guts to look at 10 years from now. That makes Jay Powell and his whole Federistas staff worse than useless. It makes no difference if perhaps jobs are doing well; the pre-Powell Fed launched a bubble and that bubble will burst one day, a whole series of them will. The only good thing he can do is get out of the way and let the markets be the markets, to let them discover prices by letting people interact with people. But who exactly in the US has the power to make the Fed go away? If you were one of the people who thought Jerome Powell was different from the rest of the Fed head honchos, the ones who preceded him, and I’m by no means just talking Greenspan, Bernanke and Yellen, you can now consider yourself corrected. Powell is not going to keep hiking rates if a bunch of zombie markets keep falling like they did in December 2018, even though that’s just what we should want zombies to do, and even if hiking is the only way to resurrect a degree of normality and functionality into the markets. Greenspan, Bernanke and Yellen, by the way, like Powell, just serve(d) to give the beast a human face, and one that the actual power brokers can hide behind. Over the past nigh 106 years since the blinded wagons rode to Jekyll island, the individual brokers may have died their natural deaths, but the institution they represented and served blindly, never did. Seen in that light, the Fed was/is a kind of a forerunner of the 2010 Citizens United legislation that granted corporations the same rights as individual citizens. The -perverse- sense, that is, in which citizens do die, but corporations do not. So they are much more, and much more powerful, than citizens. Citizens Limited should have set a time limit, like the ones all corporations used to have, and the Fed should have had the shortest and strictest limit of all. And you were worried about Brett Kavanaugh being named to the Supreme Court… Just as an example of how wrong we get these things these days, Let’s turn to Sven Henrich’s piece in MarketWatch this weekend. Henrich is the founder and lead market strategist of NorthmanTrader.com, and g-d bless him, I’m sure he means well, but he gets things so upside down it’s not funny. He writes about that quick buck only, and doesn’t see the future. It’s like Danielle DiMartino Booth writing on Twitter Friday: “In one word Powell CAVED to pressure 16 days after a taking hard line. The one thing he did do he should have done after last FOMC meeting was convey that the Fed would truly be data dependent going forward. “Gradual” needs to go. Winner: Stock Market. Loser: Powell’s Credibility”. Danielle is great, and probably much smarter than I am, but she’s also a former Fed employee, and that brings a shade of blindness with it. What are the odds that she will state anytime soon that the Fed can only, possibly, make things worse for the American economy? I don’t think those odds are good. Back to Sven Henrich. In essence, it’s ridiculous that a news outlet like MarketWatch still has the guts to publish a piece like his, or that someone like him has the guts to write it. Because it means there still are people, perhaps the author(s) and editors among them, who haven’t yet understood what has happened, even after 10 years and change. They are people who think the Fed can do right, that they can fix things if only they find the right policies. We have to get rid of this illusion because the Fed will not, can not, fix what is wrong with the economy, or the ‘markets for that matter. Quite the contrary, the Fed can only make things worse. We know this because the only way the markets can be fixed, brought back to life indeed, is to let them function, and the only way they can function is when they can discover what things, stocks, bonds, homes etc., are worth, without some unit with unlimited financial power interrupting. Central banks are founded for one reason only: to save banks from bankruptcy, invariably at the cost of society at large. They’ll bring down markets and societies just to make sure banks don’t go under. They’ll also, and even, do that when these banks have taken insane risks. It’s a battle societies can’t possibly win as long as central banks can raise unlimited amounts of ‘money’ and shove it into private banks. Ergo: societies can’t survive the existence of a central bank that serves the interests of its private banks. Henrich: Stock-Market Investors, It’s Time To Hear The Ugly Truth

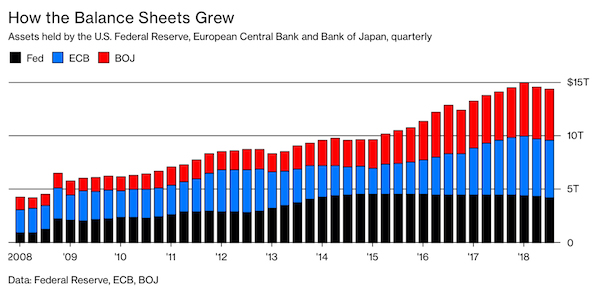

is it $15 trillion, or is it 20, or 30? How much did China add to the total? And for what? How much of it has been invested in productivity? I bet you it’s not even 10%. The rest has just been wasted on a facade of a functioning economy. Those facades tend to get terribly expensive. Western economies would have shrunk into negative GDP growth if not for the $15-20 trillion their central banks injected over the past decade. And that is seen, or rather presented, as something so terrible you got to do anything to prevent it from happening. As if it’s completely natural, and desirable, for an economy to grow forever. It isn’t and it won’t happen, but keeping the illusion alive serves to allow the rich to put their riches in a safe place, to increase inequality and to prepare those who need it least to save most to ride out the storm they themselves are creating and deepening. And everyone else can go stuff themselves. And sure, perhaps a central bank could have some function that benefits society. It’s just that none of them ever do, do they? Central banks benefit private banks, and since the latter have for some braindead reason been gifted with the power to issue our money, while we could have just as well done that ourselves, the circle is round and we ain’t in it. No, the Fed doesn’t hide the ugly truth. The Fed is that ugly truth. And if we don’t get rid of it, it will get a lot uglier still before the entire edifice falls to pieces. This is not complicated stuff, that’s just what you’re made to believe. Nobody needs the Fed who doesn’t want to pervert markets and society, it is that simple. Nicole M. Foss is co-editor of The Automatic Earth, where she writes under the name Stoneleigh. She and her writing partner, Raúl Ilargi Meijerhave been chronicling and interpreting the on-going credit crunch as the most pressing aspect of our current multi-faceted predicament. The site integrates finance, energy, environment, psychology, population and real politik in order to explain why we find ourselves in a state of crisis and what we can do about it. Prior to the establishment of TAE, she was previously editor of The Oil Drum Canada, where she wrote on peak oil and finance. Her academic qualifications include a BSc in biology from Carleton University in Canada (where she focused primarily on neuroscience and psychology), a post-graduate diploma in air and water pollution control, the common professional examination in law and an LLM in international law in development from the University of Warwick in the UK. She was granted the University Medal for the top science graduate in 1988 and the law school prize for the top law school graduate in 1997.

|

Send this article to a friend:

|

|

|