OPEC Oil Prodcution Rises Most In 6 Months, Hits Highest Since December

Tyler Durden

Well, so much for OPEC's production cut Well, so much for OPEC's production cut

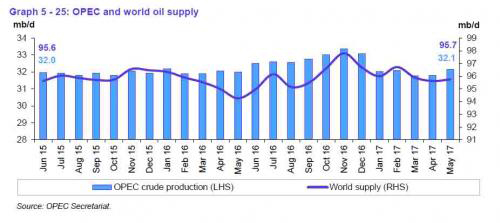

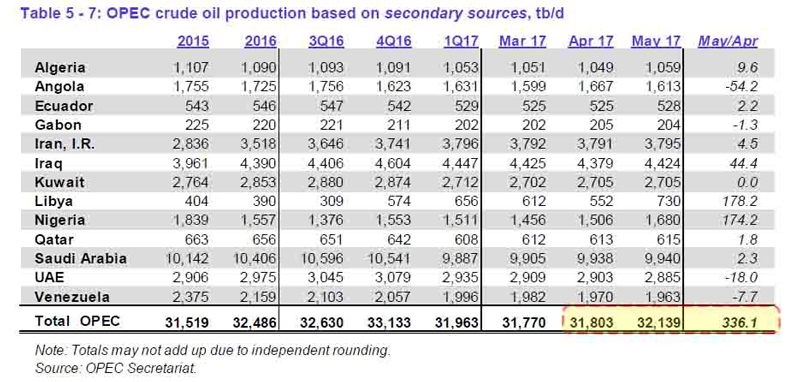

In OPEC's latest Monthly Oil Market Report, the oil producing cartel reported that in May - the same month OPEC met to extend its production cuts - crude output climbed the most in six month, since November 2016, rising by 336.1kb/d to 31.139 mmb/d, the highest monthly production of 2017, as members exempt from the original Vienna deal restored lost supply.

From the report:

Preliminary data indicates that global oil supply increased by 0.13 mb/d in May to average 95.74 mb/d, m-o-m. It also showed an increase of 1.48 mb/d, y-o-y. A decrease in non-OPEC supply, including OPEC NGLs represents a contraction of 0.21 mb/d m-o-m but an increase of 0.34 mb/d in OPEC crude oil production, not only offset the decline of non-OPEC supply but also increased overall global oil output in May. The share of OPEC crude oil in total global production stood at 33.6% in May, an increase of 0.3% from the month before. Estimates are based on preliminary data for non-OPEC supply, direct communication for OPEC NGLs and non-conventional liquids, and secondary sources for OPEC crude oil production

Specifically, Libya pumped 730k b/d in May, up 178kb/d from 552kb/d in April; Nigeria output jumped to 1.68m b/d vs 1.506m b/d, a 174kb/d increase, while even the biggest producer Saudi Arabia, saw its output grow by 2.3kb/d to 9.94mb/d vs 9.938m b/d in April.

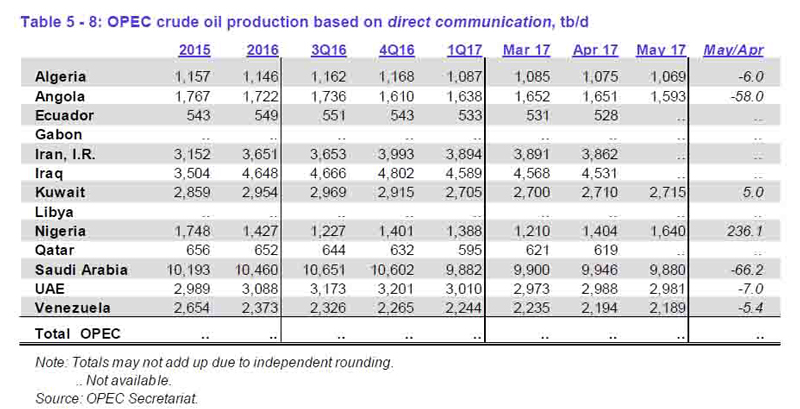

Not surprisngly, in an attempt to preserve the "reduction" narrative, in its self-reported figures, Saudi Arabia told OPEC via direct communication that it produced 9.88mb/d in May, down 66.2kb/d from April's 9.946mb/d, although these figures are looking increasingly suspect.

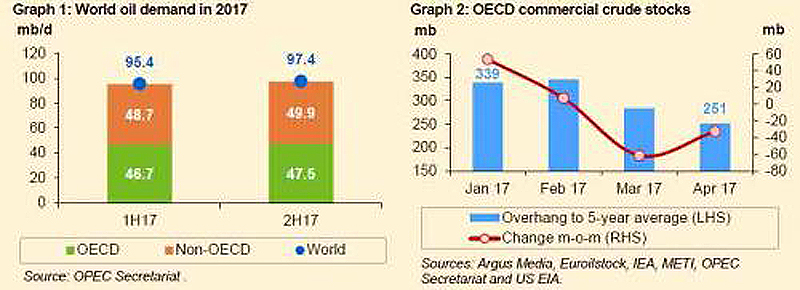

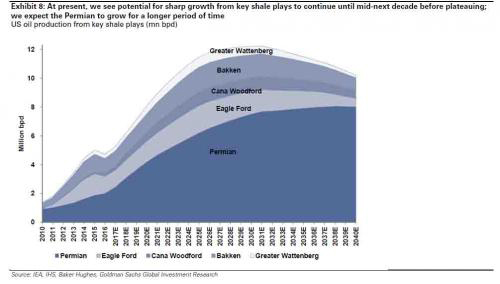

Perpetuating its existence of forced self-delusion, OPEC predicted that surplus oil inventories would continue to decline in 2H 2017 as their cuts (what cuts) take effect and demand picks up. “The re-balancing of the market is underway” OPEC wrote, conceding that it is taking place "at a slower pace" and adding that “the decline seen in the overhang” in developed-nation stockpiles “is expected to continue in the second half, supported by production adjustments by OPEC and participating non-OPEC producers." There was little discussion of the soaring US shale output, which as we wrote last night is expected to hit an all time high next month.

From the monthly report:

The decline seen in the overhang in OECD commercial oil inventories in the first four months of the year – from 339 mb to 251 mb compared to the five-year average (Graph 2) – is expected to continue in the second half, supported by production adjustments by OPEC and participating non-OPEC producers.

These trends along with the steady decline in oil in floating storage, indicate that the rebalancing of the market is underway, but at a slower pace, given the changes in fundamentals since December, especially the shift in US supply from an expected contraction to positive growth. In light of these developments, OPEC and the participating non-OPEC countries decided to extend production adjustments for a further period of nine months in recognition of the need for continuing cooperation among oil exporting countries in order to achieve a lasting stability in the oil market,

Additionally, OPEC lowered forecasts for Russia production in 2H by 200k b/d, while the overall outlook for non-OPEC supply in 2H was reduced by 200k b/d, vs pledge of total reduction of ~558k b/d. The surplus in oil inventories in developed nations relative to their five-year average -- OPEC’s main measure of the overhang -- is down to 251m bbl from 339m at end-2016.

The report kept 2017 global oil demand growth forecast unchanged from previous month’s estimate at 1.27m b/d y/y, while it cut full year non-OPEC supply growth estimate to 840k b/d y/y, a downward revision of 110k b/d. Which is, of course, wrong if Goldman's forecast for shale production is even remotely accurate.

our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|