Send this article to a friend:

February

18

2026

Send this article to a friend: February |

The Hidden Story Behind Gold's Sudden Spike (It's Not China)

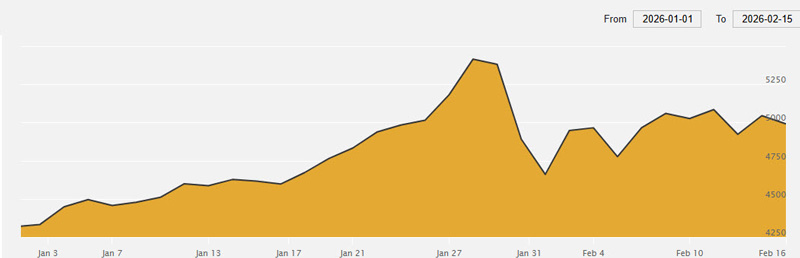

According to Reuters, the price of gold surged sharply before pulling back last week, triggering headlines about “crashes” and “billions wiped out.” CNBC similarly highlighted analysts attributing price swings to massive futures contracts and leverage. Treasury Secretary Scott Bessent suggested Chinese speculators played a role in this all-but-unprecedented gold price volatility. He's not alone. Bloomberg made similar claims a couple of weeks back. There’s some truth there. Gold investment has long played an important role in China's household savings. Here in the U.S., gold accounts for a miniscule fraction (0.17%-0.2%) of financial portfolios, according to Goldman Sachs. Chinese investors, on average, own five times as much gold (1% of total assets). Chinese exchanges have recently tightened oversight of gold trading, including scrutiny of margin activity, limiting leverage and restricting "synthetic" financial products like derivatives tied to gold price. Since the beginning of the month, I've seen so many headlines like $1.3 Trillion Wiped Out in 2 Hours and $10 Trillion Erased in 3 Days. Headlines like that are attention-grabbing, I'll grant you. But here’s what gets lost in the noise. Physical gold bullion owners didn’t see billions “wiped out.” A two-day price spike followed by a correction is not the same thing as a collapse in gold price or in gold demand. When we look at the last six weeks, we've seen volatility:

Zoom out even slightly, and gold remains significantly higher versus last month (+8.14%) and year-over-year (+72%). The farther you go back in time, the smarter gold owners look. What we’re really witnessing is something markets always do during structural repricing events. Leverage magnifies price moves. When an asset class catches attention, speculators pile in with borrowed money and hope like crazy to make a quick buck. But when a trade gets "crowded" like gold and silver have over the last few months, there's more and more leverage at work. Every price move gets bigger. And you can see it! CBOE has published a gold volatility index since 2008. Its long-term average from first report to present 18.6, and here's what it looks like today:

CBOE Gold Volatility Index (^GVZ) chart via Yahoo Finance Right now, gold prices are making nearly 2x bigger moves than normal (and earlier this year, 3x bigger moves). That's what leverage does. Remember housing in 2007? Or bitcoin in 2022? Same story, different assets. The key distinction – and this matters – is between credit-fueled commodity speculation and owning physical gold bullion. The vast majority of the volatility occurs in commodities contracts, not in gold coins and bars changing hands. When speculators get the dreaded margin call, unless they can add cash collateral they'll find their contracts liquidated automatically. (This is also called "deleveraging" among financial professionals.) These episodes are characterized by indiscriminate selling, just like we saw at the end of January. It's not about fundamentals or long-term value; just indiscriminate liquidation. When you see headlines like Gold and silver erased $7 trillion from global markets, I want you to understand one thing: That's not how markets work. That $7 trillion didn't suddenly disappear. It was a total based on mark-to-market pricing, and that pricing changed. Gold didn't vanish. Silver didn't evaporate. In fact, the only thing that vanished was leverage. The only thing that can legitimately melt away at that speed is credit-based exposure, paper positions built on borrowed money. But here's the important part: Historically, when that kind of leverage gets flushed out, it actually makes markets healthier, not weaker. It resets prices closer to their fundamental values. If anything, regulatory tightening in China reinforces a larger trend we’ve been discussing for years: global authorities are slowly trying to rein in paper gold trading after Basel III reforms redefined the rules around bank reserves. (That's a can of worms I'll not crack open right now.) Listen, blaming speculators in China is convenient. But leverage-driven volatility didn't originate in the Far East. It’s a structural feature of modern financial markets. We see it everywhere. But we only really notice when volatility spikes and headlines bray about trillions vanishing overnight. Nonsense. So what's the takeaway from this explainer on leverage and volatility? I'll let Ray Dalio answer. At the World Governments Summit in Dubai, he was asked: After all this volatility, is gold still the best place to store money? He gave a wise response:

Short-term price swings say nothing about gold’s long-term role as a "very effective diversifier" and a hedge against financial risk. The STREAMLINE Act: Less Conspiracy, More Reality Have you heard of the Bank Secrecy Act? Online commentary recently claimed the Federal Reserve would soon lower reporting thresholds for certain cash transactions involving precious metals from $10,000 to $3,000 or even $1,000. That claim circulated widely and panic spread on the fringes of the investment community. Being reported for buying a single ounce of gold? The reality is more nuanced. The STREAMLINE Act, introduced in Congress in late 2025, actually proposes raising certain reporting thresholds – from $10,000 all the way up to $30,000. Less surveillance, not more? That doesn't sound right... Why the change? Well, Congress was merely adjusting for inflation. Let that sink in for a moment. If $10,000 once represented a major transaction that required governmental reporting for suspicious activity... But today, as one of my colleagues put it, it's just two gold American eagles and maybe a pizza? That tells us something important about long-term currency erosion. I mean, we could see this as a sign of expanding economic freedom. But it's more of a self-defense move from regulators who don't want to be overwhelmed with millions of reports of so-called suspicious activity. Furthermore, it's a quiet acknowledgment that today's dollar buys dramatically less than it used to. In other words, the “conspiracy” narrative that flew around the world was backward. But the underlying economic reality is more sobering. This isn’t really about surveillance drama or financial privacy. It’s about math. And in a nation that currently owes $38.65 trillion, it's an admission that $10,000 just doesn't go as far as it used to. Central banks aren’t acting like gold is a bubble JPMorgan recently reiterated its longer-term gold forecasts, including projections as high as $6,300 by the end of 2026. More important than the forecast is the reasoning behind it: Central bank demand. According to the World Gold Council, central banks purchased:

This is a very clear pattern of historically elevated buying. This quarterly chart of central bank gold purchases puts things into perspective:

Gold line represents gold price per oz. Chart via World Gold Council. Here’s the critical point. Central banks bought heavily when gold was near $1,600. They bought heavily at $2,000. They have barely slowed down as gold rose above $4,000. Now, if gold were truly in a speculative bubble as some of the financial media would have you believe, wouldn't official-sector buyers take a step back? Wouldn't they wait for the inevitable correction, then add to their stockpiles at a much lower price? Of course they would! Instead, they’ve been among the most consistent buyers despite rising price. Are central banks price-sensitive like regular investors? Of course they are! Even though they operate at massive scales (a single metric ton costs about $161 million at today's price), central banks have budgets just like you and me. I believe the data suggest something else is at play. Central banks are making a strategic reallocation of their reserves. They view gold not as a trade, but as monetary insurance. (That's part of what The Great Repricing is all about.) That perspective aligns with history. In the early 2000s, gold rose quietly for years before broader financial instability became obvious. Watching short-term price fluctuations meant missing the structural shift underway... And, by the time the trend became easy to see, we were in the middle of the Great Financial Crisis. Here's what I want you to remember: Central banks don’t buy gold because it’s trendy. Or because its price went up (or down), unlike the speculators we were discussing earlier. Or because it's their only choice. Central banks buy physical gold because it is just about the only financial asset that has no counterparty risk and no default risk. And that’s a very different motivation than speculative leverage. They don't add gold to their reserves because they hope it will go up. They buy gold because they know it'll be there, safe and secure in their vaults, when they need it. What's the bigger picture?When headlines shout “volatility” and officials blame foreign speculation, it’s worth asking a different question: What are long-term institutional investors doing? They’re buying. They’re diversifying. And they’re making these decisions in terms of decades, not days. For individual investors – especially those of us thinking about the long term – that distinction matters. While it's true that short-term price spikes make headlines, long-term monetary trends make history.

|

Send this article to a friend:

|

|

|