The West, as Mao Tse-Tung once claimed, is not a paper tiger; unless, of course, you’re referring to its paper money.

In 1991, communism was, in fact, collapsing. But capitalism, unbeknownst to itself and others, was bankrupt after its costly decades-long struggle with communism. Today, the former communist super-powers, Russia and China, have re-emerged and are playing the high-hand of gold against England, the US and the West and their now vulnerable paper currencies.

England’s debt-based paper banknotes were the reason for the West’s three hundred year global hegemony. Because of its ability to wage war on credit and pass off its debt-based paper banknotes as money, England in the 18th and 19th centuries and, later, the US in the 20th achieved a level of world power not seen since the Roman Empire.

In the 1900s, Russia and China escaped the West’s capitalist dominion by adopting communism, an alternate economic paradigm, based on the theories of Karl Marx, Friedrich Engels and Vladimir Lenin. Communism was, in fact, a potent and dysfunctional amalgam of untested theories, unfounded hopes and totalitarian state oppression.

Ostensibly offering a more equitable distribution of wealth than the banker’s paradigm of credit and debt, Marxism/Leninism was, in fact, a bloody and costly trap into which Russia and China would both fall in their attempts to escape the West’s economic and political domination.

The West’s attempts to subjugate Russia and China would, however, ultimately cost the West its foundation of economic and political power, i.e. the ability to pass off debt-based paper banknotes as money.

In capitalist economies, debt-based paper money possessed intrinsic value because it was convertible to gold upon demand. Gold, in fact, was capitalism’s ‘secret sauce’, the essential ingredient that transformed the bankers’ debt-based banknotes into something other than government-issued IOUs.

Since 1971, however, the West’s paper banknotes are no longer convertible to gold. This is because after WWII, the US, in its attempts to militarily subjugate Russia and China overspent its massive gold reserves, forcing it to end the gold-convertibility of the US dollar. As a result, all currencies in the world formerly tied to the US dollar and hence to gold became fiat, i.e. currencies who have value only because of government fiat, i.e. command.

After 1971, it was only a matter of time until the bankers’ debt-based paper banknotes—without the convertibility to gold—would become increasingly unstable and ultimately worthless; and, today, in 2013, the former has happened and the latter is underway.

The value of today’s paper money is determined solely by currency speculators placing leveraged bets in the hopes of achieving short-term gains. Once the gold-convertibility of paper money ended, modern currencies became paper coupons with expiration dates written in invisible ink.

Today, the West and its bankers are desperately hoping that no one will notice, hoping thereby to prevent a hyperinflationary collapse of paper money should confidence in fiat paper money evaporate.

Russia and China, however, are preparing for that very day. Russia and China are stockpiling gold as fast as they can in anticipation of a coming currency crisis triggered by the West’s increasingly suspect paper money.

For the former communist powers, Russia and China, it’s payback time; but for England and the US, it’s blowback time

THE EAST IS GOLD WITH A RED TINGE

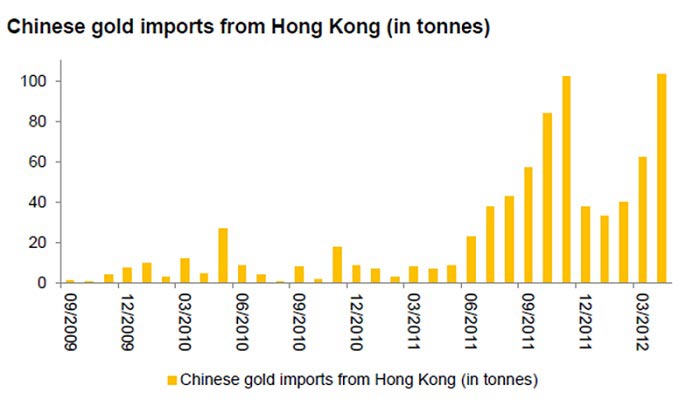

On February 6, 2013, in China Gold Imports from Hong Kong Climb to record on Wealth, Bloomberg New reported:

Exports of gold to Hong Kong from China more than tripled to 310,861 kilograms in 2012 from about 95,529 kilograms a year earlier, according to Bloomberg calculations. Shipments were 29,718 kilograms in December, up from 28,978 kilograms in November.

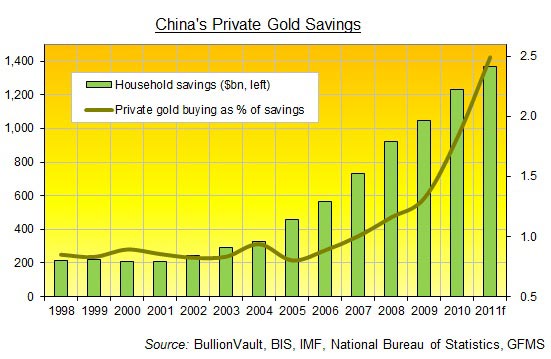

In the article, Bloomberg News also noted the growing relationship between China’s wealth and the ownership of gold:

China’s urban per capita disposable income rose 12.6 percent in nominal terms in 2012 to 24,565 yuan, the National Bureau of Statistics said on Jan. 18. Per capital rural net income increased 13.5 percent in nominal terms, and 10.7 percent in real terms…

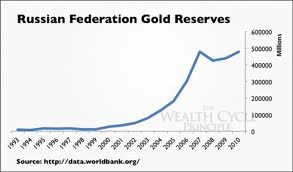

Not only is China buying record amounts of gold, Russia is buying even more. On February 11th in Putin Turns Black Gold Into Bullion as Russia Outbuys World, Bloomberg News reported that Russia’s President Putin is investing Russian’s oil income in gold bullion at a record rate:

When Vladimir Putin says the U.S. is endangering the global economy by abusing its dollar monopoly, he’s not just talking. He’s betting on it.... His central bank has added 570 metric tons of the metal in the past decade, a quarter more than runner-up China, according to IMF data compiled by Bloomberg. The added gold is also almost triple the weight of the Statue of Liberty.

China, the world’s number one producer of gold, and Russia, the world’s

fourth largest producer, also no longer allow domestically-mined gold to

be sold outside their countries. This means Russia and China are

accumulating gold both by buying and mining it in record amounts.

GEOPOLITICS AND THE PRICE OF GOLD

Money and power are two sides of the same coin and both are at the

center of today’s gold market. With growing demand for gold from both

China and Russia, it would be assumed that prices should be rising as

supplies of gold are becoming increasingly tight.

Sandeep Jaitly is the author of the Gold

Basis Service, a subscription-only commentary on developments in

the gold and silver bases and the ‘implications about future movements

for prices’. In his February newsletter, Jaitly referred to an earlier

statement from January 25th:

The bases/co-bases across all maturities for both gold and silver are

falling/rising indicating substantial demand for physical bullion that

is not being adequately accommodated. February gold has entered

backwardation as of last week. As a consequence of the fall/rise in

the bases/co-bases, volatility of bullion against fiat is likely to

increase. The opportunity to exchange gold for silver should be taken

if the gold/silver ratio rises substantially (above 55.)

Sandeep Jaitly’s observations about gold and silver have been remarkably

consistent over the past year. Demand for both gold and silver have been

constant while supplies of both metals have been pressured leading to

indications that an upswing movement in prices can be expected and the

accumulation of both metals is encouraged.

In the past year, however, gold and silver have not performed in

accordance with such expectations. I believe this temporary anomaly is

attributable to two factors: (1) the increasing determination of Western

central and bullion banks to prevent another almost-vertical price

movement in gold as happened in July/August of 2011 when gold rose 27%

in only 60 days; and (2) the current Chinese strategy to purchase gold

at the lowest price points possible.

On February 11th when gold collapsed to a low of $1642, Takoa de Silva

of Bull

Market Thinking asked a trader who runs a market-making desk in

London’s gold market to explain the drop in gold.

Commenting on today’s collapse he said,

“I’m not that worried about the sell-off today, it’s just the logical thing. I was surprised they waited so long [to take it down], because many opportunities to push it to that level existed before…and it finally happened, and that’s good for the market. This is actually a blessing. We are still not at the lows of January at $1625…but at the moment this is probably as far as it’s going to go [$1642]. There’s good support here.”

He further added that, “This is actually the typical reaction of the

Chinese New Year, because the shorts, they know there will be no

physical demand for a couple of days, there won’t be support there,

and so they are smart. This is smart money just pushing it to the

extremes. For me this is an opportunity to get something cheap in for

the mid-term. But you can’t fight the trend at the moment in terms of

what’s in the air for the Fed-speak etc., but the long-term money

stays and sits.”

The statement, the opportunity to get something cheap describes China’s

buying strategy perfectly. Both China and Russia want to buy the West’s

gold at the lowest possible price and they will do so accordingly. All

investors should do the same.

In my current youtube video, Bankers,

England and Israel, I explain the role of England and bankers in

the creation of the state of Israel. As stated previously, money and

power are two sides of the same coin. The creation of the state of

Israel is no exception.

Sandeep Jaitly’s observations about the gold and silver markets are

correct. The accumulation of both metals is encouraged. Regarding the

continuing struggle between gold and paper money, precious metal

investors have already put their money where their beliefs are—and they

should keep it there.

Buy gold, buy silver, have faith.