|

|

|

|---|

01.26.13- Opportunities always look bigger going than coming

As the editor of the Silver Bear Cafe, I spend most of my time researching current events. I explore the markets, the economic war that is being waged on the middle class, precious metals, the Federal Reserve and energy. In this weekly column I will attempt to condense the week's events and examine how the news might affect your pocketbook. JSB Financial Markets I was asked by a friend this week, how I thought the markets would perform this year. Well as Yogi Berra put it: "It's hard to make predictions, especially about the future". I'm going to go out on a limb and suggest that 2013 will be the year that the sheeple finally begin to lose confidence in the financial system and view the Central Banksters of the world for what they are; Bozos that are the cause and not the effect. This realization will be predicated by higher bond yields and a noticeable increase in the rate of inflation. Meanwhile the VIX (Volatility Index, a popular measure of the implied volatility of S&P 500 index) has fallen to new lows, trading at the lowest levels in the last five years. This expresses lackadaisical sentiment of the part of investors, which is a very strong contrarian indicator. Get ready 'cause here it comes.

On the Economic War Front If there is anyone out there that still believes the tripe that is spewed by the mainstream media, concerning the robust recovery we are all supposably experiencing, please take off your blinders and pull your head out of the sand. To suggest that the economic demise of America is being intentionally orchestrated by a bunch of megalomaniacal morons my seem a bit conspiratorial. But that is simply because it is.

Precious Metals If you ever contemplate if and when the gold market will go ballistic, please consider how many people remain completely unaware of the reality of the situation. In the following contribution from JS Kim, one realizes, without a doubt, that if investors were ever made aware of the following statistics, that they would exit the S&P 500 and pour into gold and gold stocks and thereby initiate the beginning of a new bubble in the precious metals sector. It could then last for several years. The gold rush is still in its infancy and far, far from over.

Energy There is nothing that the current administration is doing that will relieve the economic pressures that are about to become apparent in the global energy fiasco which is becoming more distressed by the minute. Israel is still planning to attack Iran, India is on the verge of going to (nuclear) war with Pakistan and North Korea has just threatened South Korea over UN sanctions that aim at deterring atomic weapons testing. This, coupled with the propaganda being spewed from the MSM that the U.S is on the verge of energy independence, ensures that the general population will remain "in the dark" when concerned with the level of volatility that currently exists.

The Fed Those of us who understand the immense value proffered by precious metals (and coal and oil and potash and fresh water...) as a hedge against the massive deflation which must eventually occur as the natural result of the massive inflation that has been going on for the last eleven years, are in financial survival mode as we stack gold and silver. The clueless felonious putzs (the Federal Reserve) who, through their infernal machinations have managed to steal most of everything, only at a cost that will prove to be unbearable, have presided over the creation of a a dysfunctional system that has no options other than to self destruct. The following assessment is provided by a former Central Banker.

Financial Survival How can the Fed keep buying treasury paper, which allows the Government to keep on borrowing? While I realize that keeping the bond market inflated is the primary aim of the Central Bankers, (the Fed), to what lengths will they go to do so? What new legislation will they dream up for their puppet politicians to pass? If it never occurred to you that the Federal Reserve, (a private corporation), owns the U.S. Government, please read the following statement made by Fed Governor Ben Bernanke.

What in blazes is positive inflation? And why would anyone, representing the people, want the price of goods and services to rise? Who, but a banker could benefit from inflation? Inflation equals rising prices. Rising prices equal more loans. More loans equal more interest. The natural evolution of man would have provided for a continuing improvement in the standard of life for all persons, if it wasn't for the heinous contrivance called inflation. Technology has provided new and improved ways to produce and deliver almost everything. Without inflation almost everything would be cheaper, or at least remain the same price. Let me restate that last part. If it wasn't for the Federal Reserve, everything would become cheaper, instead of more expensive. Most people believe that inflation is a natural economic occurrence. This is simply untrue.

You must first realize that there are, present in our lives, enemies. You must then know who those enemies are and act accordingly. Eliminate as much debt as possible, especially “variable rate” debt, such as credit cards and lines of credit. Interest rates will be rising, so the elimination of debt offers a “real return” of escaping rising rates by creditors. Get some control over some fresh water. If you are depending on Social Security, stop. Follow the course opposite to custom and you will almost always do well...

More next week... May the Great Spirit be with you always,

Johnny

Silver Bear Disclaimer All statements and expressions are the sole opinions of the editor and are subject to change without notice. A profile, description, or other mention of a company in the newsletter is neither an offer nor solicitation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable, in no way do we represent or guarantee the accuracy thereof, nor the statements made herein. The staff of Silver Bear Cafe are not registered investment advisors and do not purport to offer personalized investment related advice. The publisher, editor, staff, or anyone associated with, or associated to the Silver Bear Cafe may own securities mentioned in this newsletter and may buy or sell securities without notice. |

|---|

Archives

01.19.13- There's too much youth; how about a fountain of smart

01.12.13- Sixty-five-year-old, one owner, needs parts ...Make offer.

01.05.13- Lead me not into temptation, I can find it by myself

12.29.12- Never Underestimate the Power of Stupid People in Large Groups

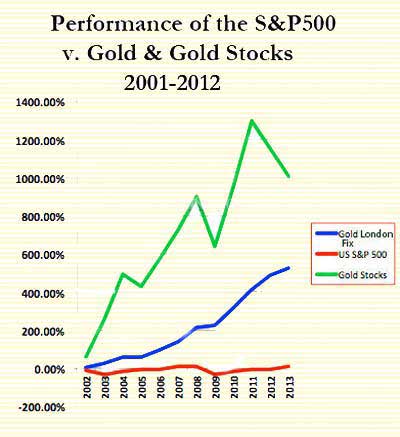

Viewing the chart to the right, a six-year old child could tell you that investing in physical gold and gold mining stocks (as indicated by the AMEX HUI gold bugs index) yielded returns from 2001 to 2012 far superior to the returns of the US S&P 500 Index over the same time period. In fact, the truth of this statement is so self-evident, that if this same child was asked what asset classes he should have been invested in over the past decade by viewing the above chart, the simplicity of that question might lead him to think that one is asking a trick question.

Viewing the chart to the right, a six-year old child could tell you that investing in physical gold and gold mining stocks (as indicated by the AMEX HUI gold bugs index) yielded returns from 2001 to 2012 far superior to the returns of the US S&P 500 Index over the same time period. In fact, the truth of this statement is so self-evident, that if this same child was asked what asset classes he should have been invested in over the past decade by viewing the above chart, the simplicity of that question might lead him to think that one is asking a trick question. For much of the twentieth century, the developed world saw a steady march upwards in wages and living standards, due primarily to huge quantities of cheap, high-yielding liquid hydrocarbon. As we find ourselves bumping along the plateau of Peak Oil's apex, suddenly we find that "growth" is a lot harder to come by.

For much of the twentieth century, the developed world saw a steady march upwards in wages and living standards, due primarily to huge quantities of cheap, high-yielding liquid hydrocarbon. As we find ourselves bumping along the plateau of Peak Oil's apex, suddenly we find that "growth" is a lot harder to come by.

Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.

Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.