Send this article to a friend:

December

30

2023

Send this article to a friend: December |

Gold Is Now Definitely An Impulse Buy

Recently, Costo began selling gold bars on its website (see Did Gold Just Become An Impulse Buy?). The bars were a big hit, generating revenues of $100 million in the most recent quarter. Now Walmart has opened its own Precious Metals Shop:

Who’s next?

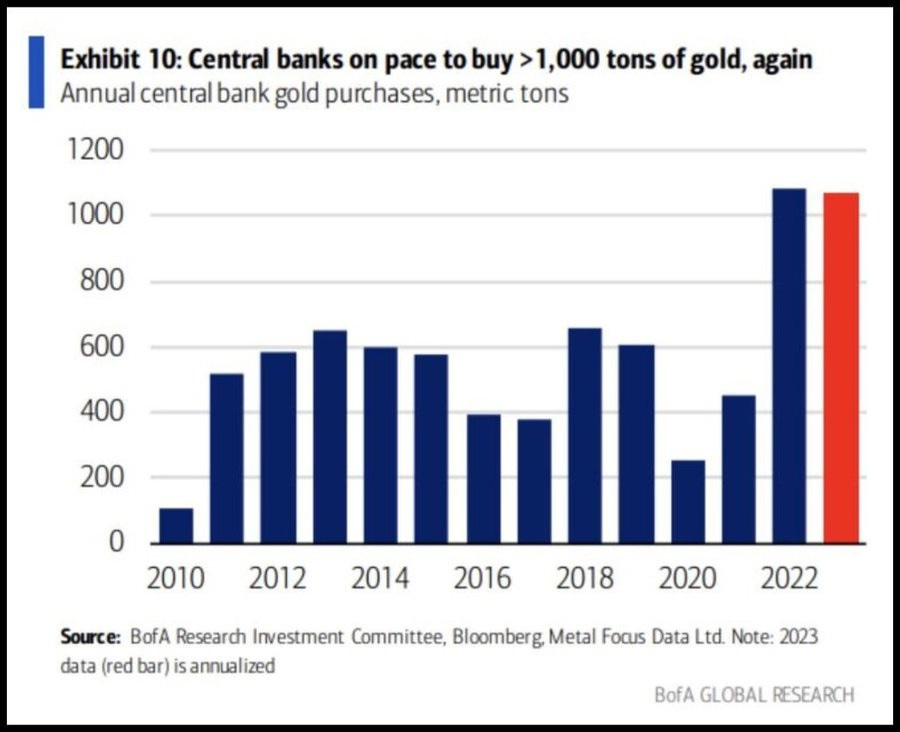

If gold works for the biggest-box retailers, expect Target and other similar chains to join in. The result might be a significant amount of gold being taken off the market and stashed in safe deposit boxes and home hiding places. Both ends of the buying spectrum This good retail news comes as central bank buying ramps up to record levels:

Not so long ago, central banks were net gold sellers, and individuals had to seek out dedicated dealers to buy precious metals. The times they are a-chaging… Good news on the legal front

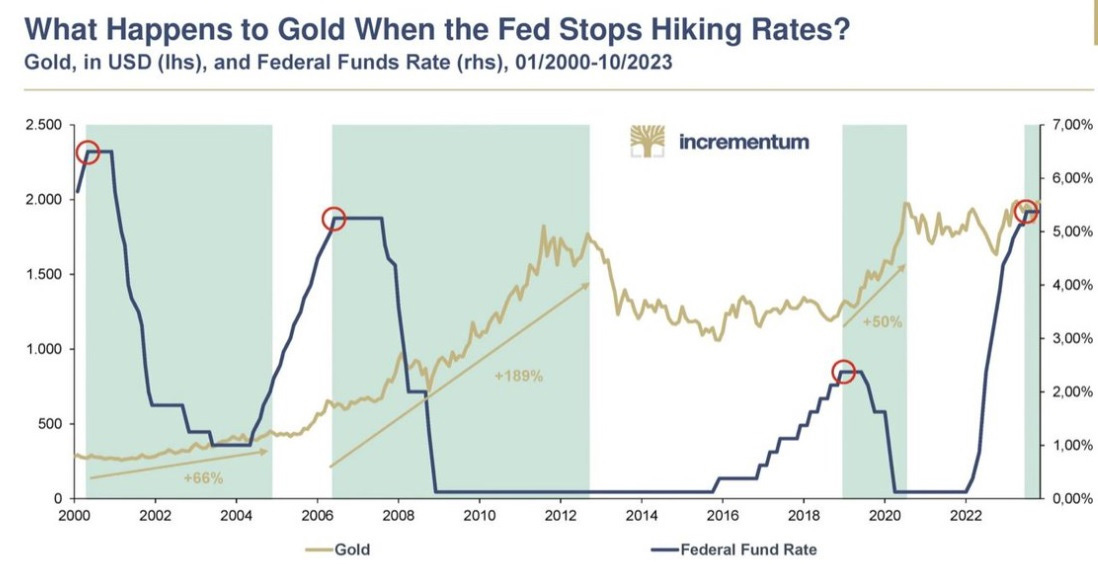

2024 might be a big year The above is happening in a monetary environment that, if past is still prologue, is already a great setup for precious metals. In the last few cycles, gold started major moves immediately after the Fed stopped raising interest rates — which seems to have just happened again.

Subscribe to John Rubino's Substack Thousands of paid subscribers Survive and Thrive in the Coming Crisis

DollarCollapse.com is managed by John Rubino, co-author, with James Turk, of The Money Bubble(DollarCollapse Press, 2014) and The Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He currently writes for CFA Magazine.

|

Send this article to a friend:

|

|

|